Alibaba Group Holding Ltd. has seen its stock price strengthen, boosted by stronger-than-expected earnings and renewed investor confidence in its long-term strategy. The company’s environmental, social, and governance (ESG) efforts are also attracting investors. Its focus on net-zero emissions adds to its appeal. Investors now consider sustainability as important as profitability.

Let’s examine the Chinese tech giant’s recent stock and what causes it, and the company’s progress in its net-zero pledge.

Earnings Power: Alibaba Surprises Markets With Strong Q2 Growth

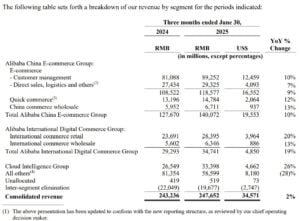

For the quarter ended June 30, 2025, Alibaba reported revenue of RMB 247.65 billion (US $34.57 billion), up 2% year-over-year, or +10% on a like-for-like basis excluding divested units.

Net income attributable to ordinary shareholders soared 76% to RMB 43.12 billion (US $6.02 billion). It is boosted by investment gains and the divestiture of its Trendyol business. Non-GAAP net income, which excludes one-off items, fell 18% to RMB 33.51 billion (US $4.68 billion).

Adjusted earnings, for underlying business performance, declined 14% to RMB 38.84 billion (US $5.42 billion). Meanwhile, income from operations dropped 3% to RMB 34.99 billion (US $4.88 billion). Operating margin slipped slightly from 15% to 14%.

Cloud and Consumption Drive Growth

Two segments stood out. Cloud Intelligence Group revenue grew 26% YoY to RMB 33.40 billion (US $4.66 billion), with adjusted earnings rising 26% to RMB 2.95 billion (US $412 million). For the eighth consecutive quarter, AI-related product revenue saw triple-digit growth.

Alibaba China Commerce Group—which bundles Taobao, Tmall, Cainiao logistics, and Instant Commerce—posted a 10% YoY revenue gain (~RMB 140.07 billion / US $19.55 billion). This is driven by a 12% rise in quick-commerce revenue to RMB 14.78 billion (US $2.06 billion) and a 10% increase in customer management fees. Its adjusted earnings decreased 21%, reflecting investment in Instant Commerce and technology.

International commerce (AIDC) grew 19% to RMB 34.74 billion (US $4.85 billion), and losses narrowed significantly from RMB 3.71 billion to just RMB 59 million.

AI Chip Strategy

To strengthen its competitive edge in AI, Alibaba has doubled down on its in-house chip design unit, T-Head. The company recently launched its new AI inference chips. These chips aim to boost performance for big language models and cloud AI tasks. These chips help cut reliance on foreign semiconductors. They also boost energy efficiency in Alibaba Cloud’s data centers.

Alibaba is combining custom AI chips with its cloud services. This move makes it a leader in technology and sustainability. More efficient chips can reduce power use in data-heavy tasks.

Market Response and Investor Sentiment

The earnings beat translated into stronger market sentiment. Alibaba’s stock, traded on the Hong Kong Stock Exchange (9988) and the New York Stock Exchange (BABA), jumped nearly 8% in August 2025. This rise outperformed many other Chinese tech companies.

The company’s market cap is now over US$190 billion. This increase shows that investors are more confident now. This comes after they faced regulatory pressure and slower growth in China’s e-commerce sector.

Analysts say Alibaba’s diversification in international e-commerce, logistics, and cloud computing helps it handle economic uncertainty. Its global platforms, like Lazada and AliExpress, saw double-digit order growth. This shows their strength beyond the home market.

From E-Commerce Giant to Green Pioneer: Alibaba’s Net-Zero Drive

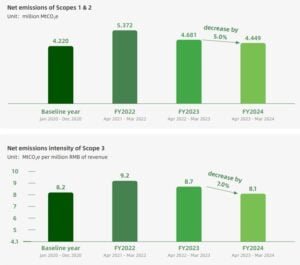

Alibaba has also leaned heavily into sustainability. It has set ambitious climate goals that align with China’s 2060 carbon neutrality pledge. In 2021, the company committed to achieving carbon neutrality by 2030 for its own operations (Scope 1 and 2 emissions).

More notably, it promised to cut Scope 3 emissions, which make up most of its footprint, by 1.5 gigatons of CO2e by 2035. This goal applies to its merchants, customers, and partners.

The company has already reported progress. In 2024, Alibaba cut its operational emissions by 12% compared to the previous year. This was helped by using more renewable energy. More than 50% of its data center energy is now sourced from renewable power, including wind and solar.

Key sustainability initiatives include:

-

Green Cloud Infrastructure:

Alibaba Cloud has launched energy-efficient data centers. Some of these facilities have a PUE (power usage effectiveness) ratio as low as 1.09. This is one of the lowest in the industry. This enables 9.88 Mt CO₂e emission reductions for customers.

-

Circular Economy Projects:

Through its logistics arm, Cainiao, the company recycled 1.5 billion packaging materials in 2024, cutting emissions and reducing plastic waste. Taobao/Tmall greening tools helped consumers cut over 10 Mt CO₂e.

-

Sustainable Finance:

In 2023, Alibaba issued US$1 billion in sustainability-linked bonds. These bonds are linked to the company’s goals for renewable energy use and cutting emissions.

Concrete Climate Action: Alibaba’s Green Projects in Motion

Alibaba has made visible progress in aligning business operations with ESG priorities. The company has cut its emissions intensity in recent years. This change comes from using more renewable energy and low-carbon technologies.

Alibaba Cloud uses advanced cooling systems and clean energy to cut energy use in its big data centers. Cainiao is testing smart warehouses at its logistics hubs. These warehouses use renewable energy systems. This helps cut costs and lower emissions.

The company also introduced “green shopping” options on Taobao and Tmall, nudging consumers toward more sustainable products. This reflects an effort to influence consumer behavior as much as internal operations.

Alibaba is boosting transparency in ESG reporting. This is becoming more important for international investors. Sustainability reports now include detailed carbon accounting, energy usage, and progress toward milestones.

Roadblocks Ahead: Tackling Scope 3 and Renewable Gaps

While the company’s climate commitments are ambitious, execution remains complex. Scope 3 emissions—largely tied to suppliers, logistics, and consumer use—account for over 95% of Alibaba’s total carbon footprint. Coordinating across such a vast ecosystem is a significant challenge.

Moreover, China’s slower rollout of renewable energy in certain regions poses risks for meeting 2030 neutrality targets. Industry watchers say the company must speed up investment in green projects at home and abroad to stay on course.

Why Investors Care About Alibaba’s ESG

Alibaba’s financial performance is a major attraction for investors. However, ESG factors are becoming more important, too. Global institutional investors, especially in Europe and North America, are adding sustainability to their portfolio choices.

There are several reasons why investors are paying attention:

-

Resilience: Companies with clear sustainability roadmaps are seen as better prepared for regulatory shifts and market transitions.

-

Market Demand: Consumer preference for greener products aligns with Alibaba’s efforts to feature sustainable goods.

-

Global Standards: Compliance with ESG reporting makes Alibaba more accessible to foreign funds that prioritize sustainability metrics.

Outlook: Blending Growth and Sustainability

Looking ahead, Alibaba’s dual narrative of financial resilience and ESG progress could be a decisive factor for investors. Analysts expect the company’s revenue to grow by 7–8% each year until 2026. This growth will be driven by e-commerce recovery, cloud expansion, and international efforts.

Alibaba’s stock gains reflect more than a short-term earnings rebound. They underscore the company’s broader evolution into a diversified, disciplined, and sustainability-driven enterprise.

The company is showing strong financial results. It focuses on efficiency and is making real progress toward net-zero. This positions the company as a tech leader and a responsible corporate actor in a changing low-carbon economy.

The post Alibaba Stock Climbs as Earnings Beat and Net-Zero Goals Win Over Investors appeared first on Carbon Credits.