Disseminated on behalf of Surge Battery Metals Inc.

Electric vehicles (EVs), energy storage systems (BESS), and clean energy technologies depend heavily on lithium. Yet even with fast-rising demand, the United States still produces far less lithium than it needs.

In 2024, U.S. production reached only about 25,000 tonnes of lithium carbonate equivalent (LCE) – roughly 2% of global supply, which totaled around 1.2 million tonnes. That output is enough for only about 158,000 Tesla Model 3 battery packs per year.

The gap between national demand and domestic production keeps widening. Most lithium used in the U.S. comes from imports, mainly from Chile, Australia, and China. This dependency exposes the country to supply disruptions, trade restrictions, and price volatility. If imports are interrupted, the U.S. battery and EV industries could face serious setbacks.

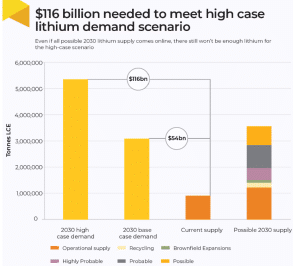

Growing Demand Creates a Structural Deficit

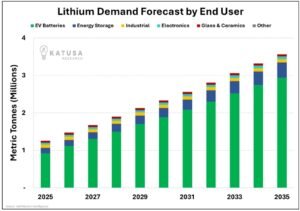

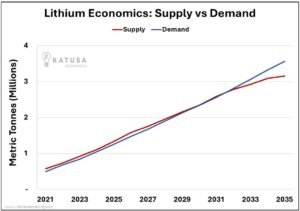

Global demand for lithium is growing quickly. Analysts expect it to quadruple by 2030 as more countries adopt EVs and build large-scale battery storage.

According to Katusa Research (2025), global lithium demand is projected to climb from 1.04 million tonnes in 2024 to 3.56 million tonnes by 2035 — a 3.5× increase. About 83% of that demand will come from EV batteries, while energy storage will account for another 11%.

Per the International Energy Agency, the U.S. alone may need over 625,000 tonnes of LCE per year by 2030, compared with only a small fraction produced domestically today.

Building new mines takes time – often 10 to 15 years from exploration to commercial production. This long timeline makes it difficult to ramp up supply fast enough to meet demand. Therefore, a lasting shortage is forming. If the U.S. does not accelerate new projects soon, it may depend on imports for decades.

Each EV battery pack uses large amounts of lithium. On average, an EV requires about 60 kilograms of LCE – or 8 to 10 kilograms per kilowatt-hour (kWh) of battery capacity. As automakers build more gigafactories, that adds up quickly.

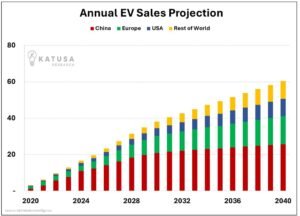

Katusa’s data also shows that global EV sales jumped from 2 million in 2020 to 11 million in 2024, a 450% surge — and could exceed 60 million units per year by 2040, more than half of all cars sold globally.

The U.S. is expected to have 440 gigawatt-hours (GWh) of battery manufacturing capacity by 2025 and more than 1,000 GWh by 2030. That growth alone could double or triple national lithium demand.

Introducing the Nevada North Lithium Project

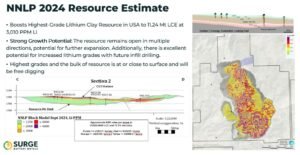

One company aiming to help close this gap is Surge Battery Metals. Its flagship asset, the Nevada North Lithium Project (NNLP) in Elko County, Nevada, is one of the few high-grade lithium clay deposits in the United States.

The project has an inferred resource of 11.24 million tonnes of LCE, grading about 3,010 ppm lithium, making it the highest-grade lithium clay resource in the country.

Surge’s Preliminary Economic Assessment (PEA) shows strong project fundamentals:

- Post-tax NPV (8%) of US$9.21 billion

- IRR of 22.8%

- Operating cost ≈ US$5,243/t LCE

- Mine life of 42 years

The project benefits from ideal logistics. NNLP is only 13 kilometers from major power lines and close to all-season roads. The Bureau of Land Management (BLM) has issued a Record of Decision and a Finding of No Significant Impact (FONSI), allowing expanded exploration over 250 acres. These factors make NNLP a leading U.S. candidate for large-scale lithium development.

How NNLP Helps Close the Supply Gap

Surge Battery Metals’ Nevada North project has features that position it well to help close America’s lithium gap. Its high grade and large resource size suggest it could deliver significant output once in production. Higher-grade deposits typically allow lower extraction costs and shorter payback periods.

Because NNLP already has key permits and environmental clearance, it may reach production faster than many early-stage peers. That speed is critical as EV demand accelerates and the U.S. targets more domestic battery manufacturing.

Just as important, NNLP supports U.S. policy goals for supply chain security. Producing lithium domestically reduces reliance on imports, helping stabilize supply and pricing for American automakers. It also supports the Inflation Reduction Act, which requires that most EV battery minerals come from North America or allied countries by 2027.

In March 2025, the U.S. government took direct equity stakes in several lithium ventures, including Lithium Americas’ Thacker Pass, signaling a strong federal commitment to reshoring critical mineral production. This policy backdrop reinforces projects like NNLP as part of a national security priority.

- RELATED: U.S. Lithium Push: How Washington’s Bet on Lithium Americas Could Reshape the Global Market

Lithium Market Volatility and Project Risks

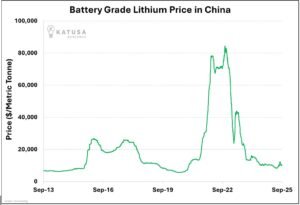

Like any mining venture, NNLP faces challenges. Lithium prices fell nearly 90% from their 2022 peak, but from June to September 2025, they rebounded 24%, showing early signs of recovery.

This cyclical pattern reflects Katusa’s “cost floor” concept — production costs in China and Australia now average around $5,000–6,000 per tonne LCE, while South American and U.S. projects need about $8,000/t to stay profitable. If prices fall near those levels, high-cost mines pause output, tightening supply again and stabilizing prices.

Another factor is resource expansion. NNLP’s current resource is inferred, but the company expects to complete its current drilling program at NNLP by the end of October 2025. Once the results are released, the lithium resource will be upgraded from Inferred to Indicated and Measured categories. This step will strengthen confidence in the deposit’s scale and quality, supporting the upcoming Pre-Feasibility Study (PFS).

Permitting and community engagement also remain important; even in a mining-friendly state like Nevada, water use and land reclamation practices must meet strict environmental standards.

Surge Battery Metals has emphasized sustainable practices, including water recycling and progressive site reclamation, as part of its exploration and development plan.

Competition is growing, too. Lithium projects across South America, Australia, and Canada are advancing quickly. Still, Nevada’s combination of stable governance, established mining laws, and proximity to major battery plants gives U.S. projects like NNLP a strong advantage.

- RELATED: Live Lithium Price today

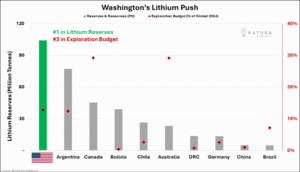

A National View: U.S. Lithium Resources and Reserves

The U.S. is home to some of the world’s largest lithium reserves, but it still underdevelops them. According to the U.S. Geological Survey, global lithium reserves total around 21 million tonnes, with the U.S. holding roughly 12%. Nevada alone hosts the country’s biggest lithium resources, concentrated in the Thacker Pass region and the northern claystone belts – where NNLP is located.

Unlocking these resources is vital. Every new project that moves forward strengthens the domestic supply chain and supports national goals to lead in clean energy technology.

MUST READ: Every Lithium Stock Just Woke Up From a 3-Year Coma

What to Watch in 2025 and Beyond

Surge Battery Metals plans to continue advancing NNLP through new drilling campaigns and metallurgical studies in 2025. These programs aim to expand and upgrade resources, optimize extraction processes, and confirm the potential to produce battery-grade lithium carbonate with 99.9% purity. The company is also evaluating potential offtake partnerships with battery and automotive manufacturers.

Analysts and investors will be watching for:

- Updated resource estimates and grade expansion

- Progress toward pre-feasibility studies

- Partnerships or funding deals with strategic investors

- Regulatory updates supporting U.S. critical mineral development

Positive results in these areas could accelerate NNLP’s move toward construction and help it become one of the first next-generation lithium clay projects to enter U.S. production.

Powering the U.S. Energy Future

The U.S. faces a widening gap between lithium supply and demand that could slow its clean-energy transition. Katusa Research projects a 400,000-tonne global supply shortfall by 2035, roughly the world’s entire 2020 output – a deficit that could keep prices elevated long term.

Surge Battery Metals’ Nevada North Lithium Project provides a realistic and timely opportunity to help close that divide. With its high-grade resource, strong economics, strategic location, and environmental focus, NNLP could play a central role in building a stable, self-sufficient lithium supply for the United States.

As the nation races to electrify transportation and decarbonize energy, projects like NNLP will be critical. They are not only about producing lithium – they are about powering the next chapter of American industry and ensuring that the clean-energy future is built on secure, sustainable ground.

DISCLAIMER

New Era Publishing Inc. and/or CarbonCredits.com (“We” or “Us”) are not securities dealers or brokers, investment advisers, or financial advisers, and you should not rely on the information herein as investment advice. Surge Battery Metals Inc. (“Company”) made a one-time payment of $50,000 to provide marketing services for a term of two months. None of the owners, members, directors, or employees of New Era Publishing Inc. and/or CarbonCredits.com currently hold, or have any beneficial ownership in, any shares, stocks, or options of the companies mentioned.

This article is informational only and is solely for use by prospective investors in determining whether to seek additional information. It does not constitute an offer to sell or a solicitation of an offer to buy any securities. Examples that we provide of share price increases pertaining to a particular issuer from one referenced date to another represent arbitrarily chosen time periods and are no indication whatsoever of future stock prices for that issuer and are of no predictive value.

Our stock profiles are intended to highlight certain companies for your further investigation; they are not stock recommendations or an offer or sale of the referenced securities. The securities issued by the companies we profile should be considered high-risk; if you do invest despite these warnings, you may lose your entire investment. Please do your own research before investing, including reviewing the companies’ SEDAR+ and SEC filings, press releases, and risk disclosures.

It is our policy that information contained in this profile was provided by the company, extracted from SEDAR+ and SEC filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee them.

CAUTIONARY STATEMENT AND FORWARD-LOOKING INFORMATION

Certain statements contained in this news release may constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information generally can be identified by words such as “anticipate,” “expect,” “estimate,” “forecast,” “plan,” and similar expressions suggesting future outcomes or events. Forward-looking information is based on current expectations of management; however, it is subject to known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those anticipated.

These factors include, without limitation, statements relating to the Company’s exploration and development plans, the potential of its mineral projects, financing activities, regulatory approvals, market conditions, and future objectives. Forward-looking information involves numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking information. These risks and uncertainties include, among other things, market volatility, the state of financial markets for the Company’s securities, fluctuations in commodity prices, operational challenges, and changes in business plans.

Forward-looking information is based on several key expectations and assumptions, including, without limitation, that the Company will continue with its stated business objectives and will be able to raise additional capital as required. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, or intended.

There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially. Accordingly, readers should not place undue reliance on forward-looking information. Additional information about risks and uncertainties is contained in the Company’s management’s discussion and analysis and annual information form for the year ended December 31, 2024, copies of which are available on SEDAR+ at www.sedarplus.ca.

The forward-looking information contained herein is expressly qualified in its entirety by this cautionary statement. Forward-looking information reflects management’s current beliefs and is based on information currently available to the Company. The forward-looking information is made as of the date of this news release, and the Company assumes no obligation to update or revise such information to reflect new events or circumstances except as may be required by applicable law.

For more information on the Company, investors should review the Company’s continuous disclosure filings available on SEDAR+ at www.sedarplus.ca.

Disclosure: Owners, members, directors, and employees of carboncredits.com have/may have stock or option positions in any of the companies mentioned: None.

Carboncredits.com receives compensation for this publication and has a business relationship with any company whose stock(s) is/are mentioned in this article.

Additional disclosure: This communication serves the sole purpose of adding value to the research process and is for information only. Please do your own due diligence. Every investment in securities mentioned in publications of carboncredits.com involves risks that could lead to a total loss of the invested capital.

Please read our Full RISKS and DISCLOSURE here.

The post America’s Lithium Gap: How Surge Battery Metals Could Bridge the Supply Shortfall appeared first on Carbon Credits.