Cameco and Brookfield have joined a major partnership with the U.S. government to build a large fleet of new nuclear reactors. The plan centers on Westinghouse reactor technology. It aims to boost the U.S. power supply and speed up the use of low-carbon electricity for industry and data centers. The agreement is worth at least $80 billion in aggregate project value.

A Historic $80B Bet on Nuclear Power

The partnership commits to mobilizing at least $80 billion to build new Westinghouse reactors across the United States. The U.S. government agreed to help arrange financing and to speed permitting and approvals.

The companies say the program will fund both large reactors (AP1000 class) and smaller designs, such as the AP300 small modular reactor (SMR). The aim is repeatable construction and faster delivery.

Officials said the plan includes near-term purchases of long-lead parts and financing to make projects bankable. The government may also take a financial stake or use profit-sharing mechanisms tied to future project cash flows. That is meant to cut investor risk and attract private capital into long lead-time nuclear projects.

Chris Wright, Secretary for the United States Department of Energy, remarked:

“This historic partnership with America’s leading nuclear company will help unleash President Trump’s grand vision to fully energize America and win the global AI race. President Trump promised a renaissance of nuclear power, and now he is delivering.”

Powerful Partners: Who’s Behind the Deal

Westinghouse provides reactor designs, engineering, and project know-how. Brookfield Asset Management brings large-scale project finance and infrastructure experience.

Cameco, a major uranium producer, supplies fuel expertise and helps secure nuclear fuel supply chains. Together, they combine technology, capital, and raw material access.

The U.S. government acts as a facilitator. It will help line up financing, speed regulatory approvals, and coordinate federal support. The public role aims to reduce early-stage risk so private investors will commit to multi-billion-dollar projects. This public-private model is central to the deal.

What $80 Billion Buys: Scale and Impact

The $80 billion figure is an aggregate investment target. Industry analysts estimate this sum could support about 6 to 10 large reactors. This is based on using 1 GW-class AP1000 units and costs close to current U.S. estimates. The final mix could include several large units plus a set of SMRs, depending on site choices and supply costs.

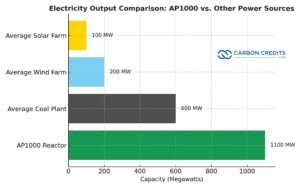

If the program builds multiple 1 GW reactors, the added capacity could total several thousand megawatts. Each AP1000 unit can produce about 1,100 MW of electricity.

The chart shows how powerful a single AP1000 reactor is compared with other common energy sources. Each unit generates about 1,100 megawatts (MW) of electricity. That’s similar to the output of 2 modern coal plants, 5 large wind farms, or about 11 utility-scale solar farms.

Data from the U.S. Energy Information Administration, the International Energy Agency, and the National Renewable Energy Laboratory show that:

- A typical coal plant generates about 600 MW.

- Wind projects average around 200 MW.

- Solar projects average about 100 MW.

Nuclear power stands out for its ability to provide steady, large-scale electricity from one site. This supports industrial growth and helps meet clean energy goals.

Multiple units would offer steady, low-carbon power. Grid operators and large users, like data centers and manufacturing hubs, can count on this power all day and night.

Timing will depend on permitting, supply chain ramp-up, and financing. The partners said they will focus on repeatable designs to shorten schedules.

Still, observers warn that multi-year lead times are likely for most projects. The deal does include near-term actions to buy long-lead items now, which can help start work sooner.

Rebuilding America’s Energy Workforce

Backers say the program will revive large parts of the U.S. industrial base. Reactor builds need heavy forgings, turbines, valves, control systems, and large concrete works. They also need skilled trades such as welders, pipefitters, and nuclear operators.

Estimates show that there will be tens of thousands of construction jobs in peak years. Each completed plant will create thousands of long-term operations jobs.

The plan could also spur investment in domestic component manufacturing. That includes forging mills, heat exchanger factories, and specialized machining facilities.

Allied countries can also supply parts. Local content rules and incentives may boost U.S. production. Proponents say a revived supply chain will reduce cost risks and shorten delivery times over the long run.

Cameco’s shares jumped sharply when the announcement arrived. Investors expect that uranium demand will rise and prices will strengthen if a multi-reactor program moves forward.

Brookfield’s shares also rose, reflecting the firm’s role as a project owner and financier. Market moves show investor appetite for nuclear-related assets when backed by government support.

Fueling the AI Boom With Clean Power

Data centers and AI systems draw increasing electricity. International energy agencies predict that global data center electricity use may more than double by 2030. Large, always-on power sources, such as nuclear, help avoid the output variability of some renewables.

Tech firms looking to scale AI often seek firm, low-carbon power to run data centers reliably. This deal links clean power planning to industrial and digital growth goals.

- SEE MORE: After $102B Quarter Revenue and Record Stock, Google Turns to Nuclear to Power the AI Boom

Policymakers see nuclear as a way to add “firm” low-carbon capacity. The U.S. plans discussed this year aim to boost nuclear capacity significantly by mid-century. This increase will help support electrification and heavy industry. The new agreement positions Westinghouse and its owners to play a major role if the national policy push continues.

But at What Cost?

Large nuclear projects can run into delays and cost overruns. Past builds worldwide show that permitting complexity, supply chain bottlenecks, and labor shortages raise budgets and push schedules.

Critics say that scaling too quickly might cause past issues to reappear. They stress the need for tight control over management, standards, and procurement.

Cost control will matter. Industry watchers note that standardized, repeatable designs and cleared regulatory paths can reduce per-unit costs over time. The deal’s advocates point to near-term purchases of long-lead items and government risk sharing as tools to keep costs down. But the real test will come during project execution and the first wave of concrete pours and module deliveries.

On policy, the partnership came alongside broader international trade and investment talks. Some reports say allied countries, including Japan, may support financing or procurement as part of wider industrial cooperation. That could give projects added capital and technology depth, but it also means geopolitics will shape parts of the supply chain.

A Turning Point for U.S. Nuclear Energy

This $80 billion partnership is a major step toward a new U.S. nuclear building program. It pairs private capital and industry know-how with government support.

If done right, the plan could boost low-carbon electricity, create jobs, and strengthen fuel and component supply chains. If it faces delays or cost overruns, the program could strain public budgets and investor patience.

The coming months will show if the partners can turn headlines into real projects. This means getting to operating reactors that will support a low-carbon, AI-driven economy.

- READ MORE: Project Matador: America’s $90B Nuclear Power Solution for AI, Semiconductors, and Data Centers

The post Big American Nuclear Revival! Cameco, Brookfield, and Washington’s $80B Reactor Deal appeared first on Carbon Credits.