Booking Holdings closed 2025 with solid financial growth, supported by strong global travel demand. The global travel platform reported solid increases in revenue, bookings, and cash flow during the year.

At the same time, it made further progress toward its net-zero target by 2040. Operational emissions remain sharply lower than pre-pandemic levels, supported by renewable electricity and efficiency gains. As travel demand expands, the company is working to balance business growth with long-term emissions reduction commitments across its value chain.

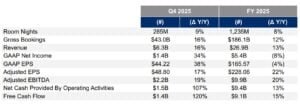

Booking Holdings reported $26.9 billion in revenue for full-year 2025, up 13% year over year. Gross bookings reached $186.1 billion, a 12% increase compared with 2024. Room nights booked totaled 1.235 billion, rising 8% year over year.

Profitability remained strong. Adjusted EBITDA reached $9.9 billion, up 20%, while the adjusted EBITDA margin improved to 36.9%, compared with 35.0% in 2024. Free cash flow increased 15% to $9.1 billion.

However, net income declined to $5.4 billion, down 8% year over year, reflecting higher expenses and investment costs. Net income margin stood at 20.1%, compared with 24.8% in 2024.

In the fourth quarter alone, Booking generated $6.3 billion in revenue, up 16% year over year. Gross bookings for the quarter reached $43.0 billion, also up 16%. Room nights rose 9% to 285 million.

The results show continued strength in leisure travel and alternative accommodations across major markets.

Diversified Business Drives Growth

Booking Holdings operates several major travel platforms, including Booking.com, Priceline, Agoda, KAYAK, and OpenTable. Its growth in 2025 came from multiple segments. Alternative accommodation options grew. Also, flight bookings and attraction services became more popular.

The company’s global footprint across more than 200 countries provides geographic diversification. This helps reduce exposure to single-market disruptions.

Booking continues to invest in technology and artificial intelligence to improve the user experience. The company is integrating AI tools to personalize travel planning and enhance partner services.

At the same time, cost discipline helped lift margins. The company balanced investments with efficiency measures, supporting its improved adjusted EBITDA margin.

Science-Based Targets Shape the 2040 Roadmap

Alongside financial growth, Booking Holdings continues to advance its climate goals. The company has committed to reaching net-zero greenhouse gas emissions by 2040. Its climate targets have been validated by the Science Based Targets initiative (SBTi).

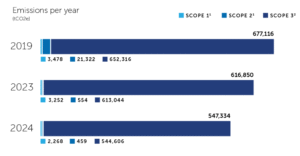

Booking aims to reduce Scope 1 and Scope 2 emissions by 95% by 2030, compared with a 2019 baseline. These emissions come mainly from office energy use and direct operations.

The company has already made major progress. Operational emissions (Scope 1 and 2) have declined by approximately 85% compared with 2019 levels. This reduction mainly came from using 100% renewable electricity for office operations. It has also improved energy efficiency.

Scope 1 and 2 emissions represent only about 1% of Booking’s total emissions footprint.

The 99% Challenge: Decarbonizing the Value Chain

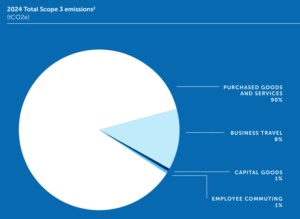

The vast majority of Booking Holdings’ emissions fall under Scope 3, which includes indirect emissions from its value chain. Scope 3 emissions account for roughly 99% of the company’s total greenhouse gas emissions.

These emissions come from areas such as:

- Purchased goods and services

- Business travel

- Employee commuting

- Capital goods

Reducing Scope 3 emissions is more complex because they depend on third parties. However, Booking has committed to cutting Scope 3 emissions by 50% by 2030 and 90% by 2040, compared with 2019 levels.

The company continues to refine its emissions accounting methods to improve data quality and reporting accuracy. Better data helps identify the largest sources of emissions and target reduction strategies.

Scope 3 reductions will depend on collaboration with partners, suppliers, and travel service providers.

Expanding Sustainable Travel Options

Booking Holdings has also focused on helping travelers make more sustainable choices. Through its platforms, the company highlights accommodations with recognized sustainability certifications. This allows customers to see properties with verified environmental practices.

The company works with partners to improve sustainability standards and reporting transparency. It also collaborates with external organizations to align with global frameworks.

In previous years, Booking set a target for a large share of bookings to come from properties with sustainability certifications. The company keeps adding sustainability to product design and customer info, even as targets change.

These initiatives aim to support lower-carbon travel behavior while maintaining business growth.

Travel and tourism contribute significantly to climate change. Latest estimates show the global travel and tourism sector made up about 7.3% of total greenhouse gas emissions in 2024, down from 8.3% in 2019.

Managing Climate Risks

Booking recognizes that climate change presents operational and financial risks. Extreme weather events, rising temperatures, and water scarcity can affect travel demand and infrastructure. Destinations vulnerable to climate impacts may face disruptions.

The company evaluates physical and transitional climate risks in its long-term planning. It looks at how policy changes, carbon pricing, and sustainability rules might impact operations and partners.

Booking wants to boost resilience by adding climate risk assessments to its strategy. This will help meet global sustainability expectations.

Profit Expansion Meets Emissions Reduction

Booking Holdings’ 2025 results show that strong travel demand can coexist with advancing climate commitments.

Revenue growth of 13% and adjusted EBITDA growth of 20% demonstrate financial strength. At the same time, the company has significantly reduced operational emissions and set bold long-term reduction goals.

Operational emissions are already down sharply. The next phase will focus on value chain decarbonization. This area represents the largest share of its footprint.

Reaching net-zero by 2040 will require continued collaboration with travel suppliers, property owners, airlines, and technology providers.

As global travel rebounds and expands, emissions management will remain a key challenge for the sector.

Can Travel Growth Align With Net-Zero Goals?

Heading into 2026, Booking Holdings appears financially stable and operationally strong, as stated in its guidance. Solid cash flow and margin expansion provide resources for investment and innovation.

Sustainability will likely remain central to the company’s long-term strategy. Meeting Scope 3 targets and maintaining renewable electricity sourcing will be critical milestones.

The company’s performance in 2025 shows that growth and climate strategy are increasingly linked. Investors and customers alike are paying closer attention to both financial returns and environmental responsibility.

If Booking continues to align revenue expansion with emissions reduction, it could strengthen its position as both a leading travel platform and a climate-conscious global company.

- READ MORE: Greening the Aviation: Lufthansa and Airbus Team Up to Cut Business Travel Emissions Using SAF

The post Booking Holdings Posts $26.9B Revenue While Advancing 2040 Net-Zero Goals appeared first on Carbon Credits.