Tesla’s (TSLA) dominance in Europe is fading fast. In July 2025, its sales in France plunged nearly 27%—one of its steepest monthly declines yet. Once an EV frontrunner, Tesla is now clearly struggling to keep up. Chinese competitors like BYD (BYDDY) are racing ahead, and local automakers are also pushing back hard.

What once felt like unstoppable momentum, Musk’s Tesla has turned into a scramble to retain market share. Europe’s EV market is now the most competitive in the world, and Tesla is feeling the heat.

A CNBC report highlighted that,

“Data published by the U.K.’s Society of Motor Manufacturers and Traders (SMMT) showed Tesla’s new car sales dropped by nearly 60% to 987 units last month, down from 2,462 a year ago.”

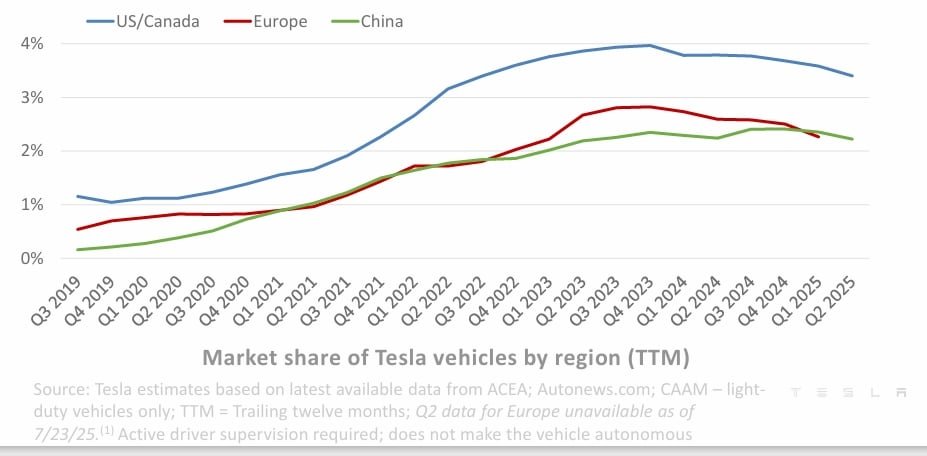

Tesla’s European Market Share Continues to Shrink

According to the European Automobile Manufacturers Association, Tesla’s market share in the EU, U.K., and EFTA dropped to 2.8% in June, down from 3.4% the previous year.

The company sold 34,781 vehicles across the region that month, which is a 22.9% year-on-year drop. Also in July, its sales in France plunged by nearly 27%, marking one of its steepest monthly drops yet.

The above data tells that Tesla is facing severe headwinds across Europe, with sales falling in most major markets despite the launch of an updated Model Y. According to Reuters, Tesla’s new car registrations in:

-

Sweden fell 86%

-

Denmark dropped 52%

-

Netherlands sank 62%

-

Belgium declined 58%

-

Italy slipped 5%

-

Portugal slid 49%

The only bright spots were Norway and Spain, where Tesla saw gains of 83% and 27%, respectively. Norway’s spike followed the rollout of 0% interest loans on Tesla models, while Spain’s surge coincided with a 155% jump in sales of all electrified cars.

The chart below also tells us that Tesla is losing ground in Europe.

Model Y Revamp Fails to Lift Sales

Tesla had pinned hopes on its refreshed Model Y, which began selling in March 2025 in Europe. However, the update has failed to spark meaningful growth. According to analyst Felipe Munoz from JATO Dynamics, the updated Model Y “has so far failed to provide the expected sales boost.”

Even in Tesla-stronghold Sweden, Model Y registrations fell 88% in July. In Denmark, they dropped 49%. By contrast, Norway saw a resurgence, with Model Y registrations jumping fourfold to 715 units due to financing incentives.

Here’s how Tesla (TSLA) performed in Q2 2025.

- SEE DETAILS: TSLA Stock Drops on Weak Q2 2025 Earnings: Tesla Faces Carbon Credit, Margin, and Political Risks

Pricing Strategy and Margins Under Pressure

To stay competitive, Tesla has slashed prices across Europe, often undercutting its margins. In France, the company’s market share fell from 1.6% in 2024 to just 0.9% in 2025, with buyers turning to local brands like Renault, which outsold Tesla’s Model Y with its new Renault 5 model in June.

Aggressive discounting might stimulate demand in the short term, but it signals waning pricing power, a worrying trend for a brand that once commanded premium status.

Tight Rules Stall Tesla’s Self-Driving Push in Europe

Another pain point for Tesla in Europe is the region’s strict autonomous driving regulations. While Tesla’s supervised self-driving feature is a major selling point in the U.S., it’s not fully available in many European countries due to tighter rules.

Musk acknowledged in July that the company could have “a few rough quarters” ahead as it waits for approvals and ramps up production of a new, more affordable EV model.

Tesla’s efforts to diversify include a trial robotaxi service in Austin, Texas, using autonomous Model Y vehicles. However, this program is not yet authorized for widespread deployment in Europe.

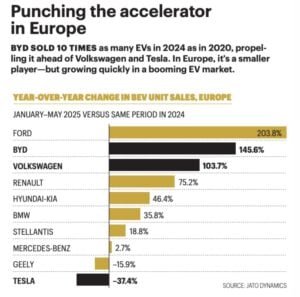

BYD Steals the Spotlight in Major European Markets

While Tesla stumbled, Chinese EV giant BYD roared ahead. In Spain, BYD sold 2,158 cars in July, nearly 8X more than the same month last year.

- In the UK, BYD registered 3,184 vehicles, quadrupling its year-over-year numbers. And in Germany, BYD posted a 390% increase in July sales.

BYD’s affordability, growing dealership network, and product variety have helped it attract European buyers seeking alternatives to Tesla.

- Notably, BYD overtook Tesla in overall European EV sales as early as April 2025, a trend that now looks firmly established.

Smart Pricing, Sharp Growth

BYD’s strategy of affordable pricing and rapid expansion is paying off. Models like the Dolphin Surf (globally known as the Seagull) and the Seal U are leading the charge. The Seal U tied as Europe’s best-selling PHEV in June.

Looking ahead, BYD plans to expand into 12 more European countries by the end of 2025. The company is also preparing to launch local production in Hungary, helping it reduce costs, navigate EU tariffs, and better compete with local and global rivals.

Chinese Brands Make Their Mark

The impact goes beyond BYD. Chinese EV makers, led by BYD, have nearly doubled their collective market share in Europe — from 2.7% in early 2024 to 5.1% in the first half of 2025. This surge reflects the growing influence of Chinese automakers across the European auto market.

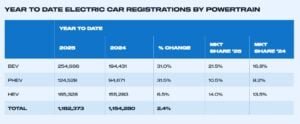

Broader EV Market Still Growing—But Tesla Lags Behind

It’s important to note that Tesla’s slump comes at a time when overall EV demand in Europe is still rising. In July:

-

Denmark’s overall car sales rose 20%

-

Sweden was up 6%

-

Norway surged 48%

-

Spain grew 17%

-

Portugal jumped 21%

This makes Tesla’s performance look even worse in comparison. The EV pioneer is not suffering from market decline, but rather losing ground to faster-moving rivals like BYD, Volkswagen, and Renault.

Elon Musk’s Controversies Add Fuel to the Fire

Aside from market dynamics, Tesla is battling reputational damage, much of it tied to CEO Elon Musk. His endorsement of Germany’s far-right AfD party and anti-union comments sparked protests at Tesla showrooms across Europe.

The backlash has been especially strong in Germany, where labor unions and political parties wield significant influence. Tesla’s sales in the country dropped 55% in July, with only 1,110 units sold compared to 2,469 a year ago. From January to July, Tesla’s total German sales plunged 57.8% to just 10,000 units.

In Britain, Tesla’s July sales fell 60%, while BYD’s more than quadrupled.

Legacy Automakers Also Feel the Heat

Tesla isn’t the only automaker feeling the squeeze. European giants like Volkswagen, BMW, Mercedes-Benz, Stellantis, and Renault all posted weak Q2 results, citing falling demand and concerns over U.S. import tariffs.

However, these companies are still expanding their EV offerings and investing in local supply chains, unlike Tesla, which continues to rely heavily on exports and centralized production.

What Lies Ahead?

Tesla’s roadmap includes a more affordable EV model and the potential expansion of its Berlin Gigafactory’s output. But until production ramps up and autonomous features are approved in Europe, Tesla may continue to struggle.

In contrast, BYD and other Chinese players are gaining speed, price advantage, and regulatory momentum, making them serious threats to Tesla’s European ambitions.

Tesla’s 27% sales crash in France shows that the much-touted EV leader is on the defensive in a region once crucial to its global strategy. Concisely, unless Tesla adjusts its pricing, updates its lineup more frequently, and repairs its brand reputation, it may continue to lose ground to BYD and others.

The post BYD (BYDDY) Beats Tesla (TSLA) in Europe: The EV Shift No One Saw Coming appeared first on Carbon Credits.