Crop markets looked weak in late 2025. Can they put on some muscle in 2026?

Let’s check their status.

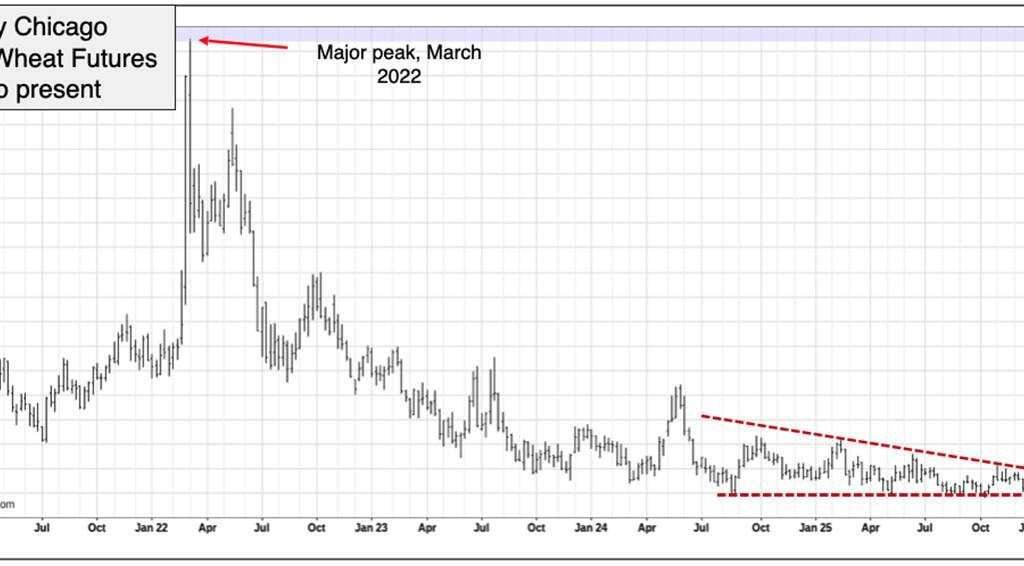

Wheat

Wheat futures were quiet in 2025. All three U.S. markets stayed trapped in low-level trading ranges.

I have noted previously that they appear to be slowly forging major cyclic lows. This theory remains valid.

Wheat popped higher the first two days of 2026, which could be a good omen. Odds are, in 2026, wheat futures will hold within their narrow ranges — at the very least. Indeed, the wheat markets are likely to eventually burst to the upside, out of their low-level channels.

That burst might happen later this year or it could be delayed. Either way, when the breakout happens, it could be sharp — a game changer.

Corn

The corn market did a great job in holding above its 2024 lows this past year, despite rising supplies in the U.S.

More recently, corn entered 2026 with solid action. This could be a sign of more upside in the first few weeks of January.

The big clouds hanging over this market are the hefty 2025 U.S. crop, projected solid output in South America and another anticipated large-acreage year in the U.S. Without weather problems in South America soon (or the U.S. later), corn futures run the risk of eventually setting new lows, below those of 2024.

Like wheat, this market has seen the worst of its long-running bear market. Where corn differs is the lack of convincing bottoming action on the long-term charts. For corn, we don’t see a sideways trading range at a low level of historic support.

Attention, growers! If March or May futures reach about US$5, sell some corn to protect against the possibility of an eventual break below $3.50.

Soybeans

Soybean futures did well in 2025. This was not surprising, considering a smaller U.S. crop than the previous year. The high for the year was in November.

After a setback in December, futures posted bullish reversals on the daily charts the first couple days of 2026. This could signal a strong performance ahead in the first month or two of the new year.

However, getting above last November’s high would require weather problems in Brazil. Don’t forget that seasonal odds point down for March due to Brazilian harvest pressure. Late March/early April is a common time for a low for this market. At press time in early January, the outlook is for a heavy Brazilian crop, auguring for the normal seasonal weakness ahead.

Bottom line: This market may have posted a major low in 2024, but we can’t rule out new lows in 2026. All will be determined by South American and U.S. production.

Meal could be the strongest member of the soybean complex in 2026. A previous column suggested that meal users could see a buying opportunity in December. That happened, as the market retraced about 75 per cent of its October/November run-up. Be alert for another price dip in March.

Strategy to consider: If beans and meal take a hit in late March/early April, avoid sales of soybeans. If you’re a feed user, book some meal.

Canola

Canola began 2026 with upward energy but faces a tough road ahead.

If beans can rally on South American weather nervousness, canola will ride that market’s coattails. However, as of press time on Jan. 7, most of Brazil’s crop seems to be well-watered. Canola will, at best, follow any bean rallies with reluctance. Canadian canola supply estimates are rising after the huge 2025 harvest and slow exports due to China’s duty. There is an increasing risk of falling below the 2024 low.

The last notable rally (and good selling opportunity) was in May and June of 2025. An old rule of thumb is that, if the market is rallying in April and early May, farmers should get some sold by the last week of May or the early days of June. That worked in 2025.

Now, prices are lower. Going forward, one suggested strategy is to sell incrementally into $20 to $30 rallies. You might get bigger rallies than that, but it would take a major soybean surge or spring weather problem in Canada to generate significant strength. If China was to eliminate its temporary countervailing duties, that would also help. All are possible, but not probable.

In summary

The major crop markets began 2026 with encouraging vigour. For farmers, that’s good to see. It could set up some rallies, and selling opportunities, soon.

The bear markets that began in 2022 are now in their late stages. Wheat has a good chance of getting through 2026 without faltering to new lows. Corn and beans also might, but crop problems would be needed for this to happen. Canola is vulnerable to setting new lows without weather problems or a pickup in exports.

This year is bound to usher in some new, unforeseen forces and jarring political gamesmanship. Some may be extremely bullish; others immensely bearish. Keep your eye on the long-term perspective and be careful to avoid overreaction.

The post Can crop markets strengthen in upcoming year? appeared first on Farmtario.