The voluntary carbon market made great strides in early 2025. strong growth. This is fueled by record credit retirements, a focus on integrity, and increased interest in carbon removals compared to traditional avoidance credits.

We have studied newly published reports from two credible research agencies, namely Sylvera and CEEZER. Both say that organizations are now willing to invest more in credits that deliver real climate impact. Thus, the market is shifting from quantity to quality, and the numbers support this. Let’s deep dive.

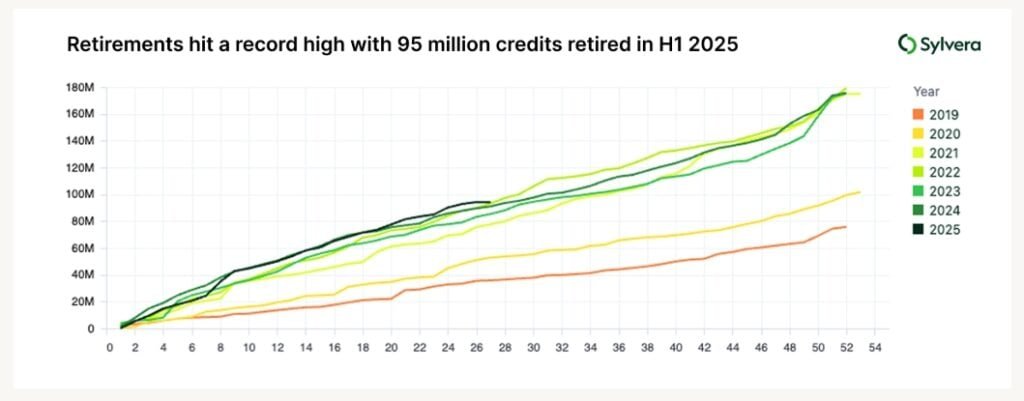

Carbon Credit Retirements Reach a New Peak

Carbon credit retirements hit 95 million in the first six months of 2025, the highest total ever recorded for a half-year. This marks a 9% increase compared to H1 2024. More importantly, total retirement value jumped by 32%, indicating that buyers are not just retiring more credits—they’re paying more for the right ones.

This increase reflects a clear preference for verified high-quality credits. Buyers are becoming more selective and placing climate integrity at the forefront.

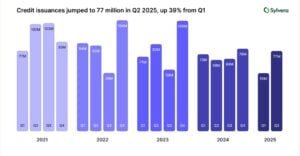

Supply is Growing, But Demand Is Growing Faster

On the supply side, carbon credit issuances rose to 77 million in Q2 2025, a 39% increase from the previous quarter. This represents a 14% boost compared to Q2 2024.

Yet even with more credits available, retirements continue to outpace issuances. If this trend holds, this year could see negative net issuance for the first time. However, this imbalance can inevitably put pressure on developers to meet demand for high-integrity credits. As companies pursue long-term climate targets, they seek more than low-cost offsets.

Quality Becomes a Core Priority

Data shows buyers are moving up the quality ladder. In H1 2025, 57% of Sylvera-rated credits retired had BB ratings or higher, up from 52% in all of 2024. This shift is driven by better due diligence tools, clearer carbon credit ratings, and initiatives like the ICVCM’s Core Carbon Principles.

Market participants are becoming more informed and aligning purchases with ESG goals, climate science, and regulations. Buyers now choose credits with intention instead of blindly purchasing.

CORSIA Spurs Growth in Compliance-Eligible Credits

The Sylvera report further emphasizes that more than 37% of credits issued in Q2 2025 could be eligible under Phase 1 of CORSIA, the global offsetting scheme for international aviation.

- This is a notable increase from 28% in the same period of 2024. This alignment with international standards is closing the gap between voluntary and compliance markets.

Full CORSIA eligibility depends on host country authorizations under Article 6 of the Paris Agreement. The cancellation deadline for Phase 1 is January 2028, and developers are closely watching national authorities’ responses.

The Market Shifts Toward Durable Carbon Removals

One key trend of 2025 is the strong shift toward carbon removals. CEEZER data shows a 102% increase in the share of removal credits transacted compared to last year. Buyers are prioritizing long-term impact over short-term avoidance.

Spending patterns reflect this shift. The average spend per ton across all credit types has more than doubled, rising 2.2 times year-on-year. For removals specifically, prices have increased by 3.2 times. This premium reflects interest in projects with lasting impact, such as biochar, mineralization, and reforestation.

Companies are now focusing on credits in Oxford Category 5, representing durable removals with low reversal risk, rather than Category 4 credits, which carry higher long-term uncertainties.

Nature-Based Credits in Demand, But Supply and Standards Remain a Challenge

Nature-based projects like ARR (Afforestation, Reforestation, and Revegetation) are attracting premium prices. On average, ARR credits are selling for $24 per ton in the primary market. For credits with BBB+ ratings, prices can reach up to $27. However, these credits only make up 3.7% of total retirements, indicating high demand but limited supply.

This supply-demand gap is prompting developers to increase high-quality nature-based removal projects. However, challenges like land access, cost, and long verification timelines still hinder expansion.

Moving on, REDD+ projects, aimed at reducing deforestation and forest degradation, rebounded in Q2 2025. Their share rose from 3% in Q1 to 16%, the highest since Q2 2023. Still, scrutiny remains over outdated REDD+ methodologies, many of which may not meet ICVCM’s integrity standards.

This uncertainty is pushing buyers to explore alternatives like waste management, biogas, and improved forest management, where credibility and transparency are easier to achieve.

North America Leads Issuance Growth

Significantly, North America has become a major player in carbon markets, doubling its share of new issuances to 43% in Q2 2025. This growth propelled the American Carbon Registry (ACR) to the top spot among registries, holding a 33% share. Gold Standard followed at 25%, and Verra at 21%.

This surge reflects stronger project pipelines, clearer regulations, and confidence in the U.S. market’s ability to meet both voluntary and compliance criteria.

Industrial and Commercial Credits Gain Market Share

Carbon credit projects from industrial and commercial sectors are quickly gaining traction. In H1 2025, these projects accounted for 19% of new issuances, up from just 7.9% during the same time in 2024. These include initiatives like refrigerant recovery, methane capture, and energy efficiency upgrades.

These scalable, technology-driven projects are becoming popular alternatives to traditional forestry and land use projects. As demand grows, industrial credits are expected to capture a larger share of the market.

Tech and Services Drive Up Carbon Removal Demand

The CEEZER report also highlighted that professional services and tech sectors are emerging as key players in carbon removal. Professional services firms now account for 24% of the total retirement value in 2025. The tech and IT sector has seen a 61% jump in retirement value for removals, the highest growth rate of any sector this year.

These industries align decarbonization with business values, helping shape the next phase of the market.

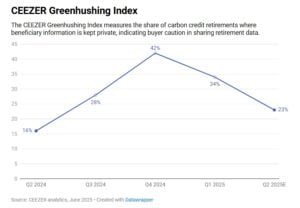

Greenhushing Begins to Decline

Many companies used to quietly retire credits. This trend is known as “greenhushing.” However, things are changing. CEEZER’s Greenhushing Index tracks these anonymous retirements. It peaked at 42% during the 2024 U.S. elections. By Q1 2025, it fell to 35% and then to 23% in Q2.

This decline indicates growing buyer confidence. Companies are becoming more transparent, using credit retirements to showcase their climate leadership.

So, Is Integrity the New Standard for the Carbon Market?

Data from H1 2025 shows the carbon market is growing. Buyers are now focusing on credits that offer long-term benefits instead of offsets. With PACM credits coming later this year and high-integrity standards becoming standard, 2025 could establish new benchmarks for credibility and performance.

As demand and quality expectations increase, developers and registries will feel more pressure to deliver. The voluntary carbon market is aligning more with compliance markets. It is becoming a key tool for global climate action.

Allister Furey, CEO at Sylvera, summarized:

“Demand for credits and, in particular, high-quality credits is at an all-time high. At the same time, increasing use of project-based credits in compliance schemes is narrowing the gap between voluntary and compliance markets. Meeting both higher climate integrity standards, as evidenced by ratings, and eligibility criteria for schemes, like CORSIA, is being seen as essential for new projects in development. Market alignment with both integrity and regulatory expectations is starting to unlock the potential of carbon markets to deliver genuine climate impact at lower economic costs.”

If this trend continues, 2025 won’t just break records; it could redefine how the world values the carbon removal market.

The post Carbon Removal in 2025: Are You Investing in the Right Climate Credits? appeared first on Carbon Credits.