Chevron (NYSE: CVX) delivered better-than-expected earnings in the second quarter of 2025 despite falling oil prices and weaker refining margins. Profits fell year-over-year. However, strong production in the Permian Basin and careful capital management allowed the company to generate solid cash flow. This also helped maintain returns for shareholders.

Alongside its financial results, Chevron reaffirmed its climate goals. This includes net-zero Scope 1 and 2 emissions by 2050. It also involves ongoing investments in carbon capture, hydrogen, and renewable fuels. These efforts support a wider energy transition strategy.

Chevron’s Q2 Delivers Amid Oil Price Drops

Chevron Corporation shared its financial results for the second quarter of 2025. The results show pressure from lower oil prices but also show progress in its long-term strategy.

For the quarter ending June 30, 2025, the company posted net income of $2.49 billion, or $1.45 per share. After adjusting for special items, earnings came in at $1.77 per share, slightly higher than what Wall Street expected.

Total revenue came in at $44.82 billion, a decline of about 12% compared to the same quarter last year. This marks Chevron’s lowest quarterly profit in four years, largely due to weaker oil prices and refining margins.

Even so, the company’s earnings still exceeded analyst expectations on an adjusted basis.

Chevron’s earnings followed a similar trend seen across the oil and gas sector. Other major energy firms also reported lower profits, driven by high production levels and flat global demand.

In particular, weaker natural gas prices and reduced margins in fuels and chemicals impacted Chevron’s bottom line.

Strong Oil Production and Cash Flow Help Offset Weak Prices

Despite the decline in profits, Chevron maintained a strong operating performance. The company increased production in the Permian Basin, reaching over 1 million barrels of oil equivalent per day. This is the highest output the company has reported from that region since mid-2024.

Chevron generated $4.9 billion in free cash flow during the quarter, a 15% increase compared to the first quarter of the year. The company also returned $5.5 billion to shareholders through a mix of dividends and share buybacks.

Notably, Chevron continued its stock buyback program temporarily in the second quarter. The oil major’s ongoing efforts to acquire Hess Corporation will boost its access to oil reserves in Guyana.

Overall, Chevron’s operational strength and disciplined capital management helped it weather the effects of falling oil prices.

- INTERESTING READ: Big Oil’s Showdown: How Shell, Chevron & ExxonMobil Balance Big Profits with Net Zero?

Cleaner Barrels Ahead: Chevron’s Climate and Net Zero Plan

Chevron continues to work toward reducing its greenhouse gas emissions while meeting global energy demand. The company has a long-term goal of reaching net-zero emissions for its upstream Scope 1 and Scope 2 operations by 2050.

Scope 1 includes direct emissions from Chevron’s operations. Scope 2 covers indirect emissions from electricity and heat that Chevron buys.

Chevron measures emissions with a full value chain approach. This includes Scope 3 emissions. These emissions cover the use of sold products, such as gasoline and diesel. Although the company has not committed to a full Scope 3 net-zero goal, it reports these figures for transparency and to track progress.

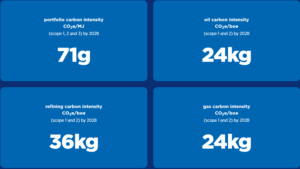

In addition to these goals, Chevron has introduced a carbon intensity reduction target, aiming to cut emissions per unit of energy produced. The company’s target is to reduce its Portfolio Carbon Intensity by more than 5% by 2028, using a 2022 baseline.

Chevron’s reported greenhouse gas (GHG) emissions for 2024 are approximately:

-

Scope 1: 53 to 54 million tonnes CO2 equivalent (Mt CO2e)

-

Scope 2 (market-based indirect emissions): about 3 to 4 million tonnes CO2e

-

Scope 3 (mainly from use of sold products): between 416 million and 717 million tonnes CO2e, depending on calculation method (production, throughput, or sales method).

Chevron’s portfolio carbon intensity is at around 70.7 grams CO2e per megajoule energy produced. The oil giant’s upstream carbon intensity is about 23.9 kg CO2e per barrel of oil equivalent.

Investing in Lower-Carbon Solutions

Beyond reducing emissions from its own operations, Chevron is building a portfolio of low-carbon businesses. The company is investing in carbon capture and storage (CCS), hydrogen, and renewable fuels.

According to its 2024 Corporate Sustainability Highlights, Chevron invested over $600 million in over 100 emissions abatement projects in 2024, which will grow to $1.5 billion this year. These projects aim to cut around 1.2 million tonnes of CO2 equivalent each year. These include:

-

methane emission reductions through facility retrofits,

-

electrification of natural gas compression stations, and

-

efficiency improvements at refineries and LNG plants.

Moreover, Chevron has invested over $1 billion in carbon capture and storage projects. These efforts aim to cut emissions by around 5 million tonnes of CO2 each year. The company is growing its range of abatement technologies and low-carbon investments. This shows a big increase from previous years.

These efforts aim to reduce the company’s upstream carbon intensity to around 24 kilograms of CO₂ equivalent per barrel of oil. Chevron’s decarbonization plan includes energy efficiency upgrades, equipment changes, and the use of renewable electricity at production sites.

Chevron has partnerships with multiple firms focused on carbon removal, including projects that store CO₂ underground or use advanced technologies to capture emissions at industrial sites. These investments are intended to grow over time as demand for clean energy increases.

The company is also looking into hydrogen storage solutions. It has also invested early in fusion energy technologies. These ventures are still in development but represent Chevron’s effort to stay ahead of long-term changes in the energy system.

Chevron’s total planned investment in low-carbon businesses is projected to reach $10 billion through 2028. The company has made it clear that it wants to be part of the energy transition, even while continuing to supply traditional oil and gas.

Eyes on 2026: Risks, Rewards, and What’s Next for Chevron

Still, Chevron faces criticism from some investors and environmental groups. Concerns include how fast things are changing. There’s also a need for total emissions cuts, not just reducing intensity.

Plus, the company keeps investing in oil and gas production. Chevron responds by saying it must balance energy reliability, affordability, and sustainability. It also supports carbon markets, carbon pricing, and efforts to scale up verified carbon credits.

Though the amount or figure wasn’t disclosed, Chevron has bought millions of carbon credits. Between 2022 and 2024, Chevron’s Colombian subsidiary purchased around 3 million carbon credits. These credits support Indigenous community conservation projects in the Colombian Amazon through the REDD+ program.

Chevron also bought 1.8 million carbon credits from the Cotuhé Putumayo project. This purchase helped offset regional emissions. These credits mainly reflect avoided deforestation and conservation efforts.

Chevron believes oil and gas will remain important for decades. Their strategy focuses on cutting emissions from this supply. At the same time, they are developing new energy solutions.

The company’s Q2 results show the pressure facing oil producers in a lower-price environment. Even though revenue and profits fell from last year, Chevron posted solid operating results.

Whether Chevron can meet its 2050 net-zero goals while maintaining shareholder value and energy supply will depend on policy changes, market demand, and technological progress. But for now, the company is signaling that it plans to be part of both today’s energy system and tomorrow’s clean energy transition.

The post Chevron (CVX Stock) Powers Through Q2 With $5.5B Payout, Permian Growth, and Net-Zero Push appeared first on Carbon Credits.