China’s carbon prices jumped after regulators announced that the national emissions trading system (ETS) would include big industries like steel, aluminum, and cement. The announcement signaled a major expansion of the market and pushed demand for carbon allowances higher.

Prices changed fast as traders responded to the new scope and the expected rise in compliance needs in China’s carbon-heavy sectors. This development marks one of the most significant steps in China’s climate policy since the ETS began. It expands the system beyond the power sector, which includes a stronger focus on heavy industry. It also raises hopes for tighter markets in the long run.

China ETS Expansion Sparks Price Surge

Regulators confirmed that metals and cement producers will join the national ETS. This move quickly raised the number of firms that need to give up allowances for their emissions.

Steel, aluminum, and cement release a lot of carbon. So, traders viewed the expansion as a clear sign that demand for allowances would increase. Prices jumped to 66.9 Chinese yuan per ton as buyers entered the market to secure supply ahead of the next compliance cycle.

The quick reaction showed both short-term trading habits and long-term views on how the ETS will change. Until now, the market has focused mainly on power plants. Investors believe that including heavy industry will affect more parts of the economy. They think it will also play a bigger role in guiding China’s carbon market and climate goals.

Companies also saw the expansion as a sign of growing policy certainty. Many have been preparing for broader coverage, but the timing remains unclear. With this announcement, firms now know they must take part in the market, improve monitoring, and plan for future carbon costs.

Big Carbon Emitters Entering the Market

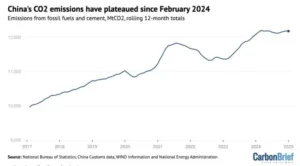

Steel, cement, and aluminium are among the largest industrial sources of greenhouse gases in China. Together, they produce around 3 billion tonnes of CO₂ each year, according to China’s Ministry of Ecology and Environment.

The total emissions figure represents more than 20% of China’s total CO₂ emissions. Adding these industries brings a major share of China’s industrial emissions into the market for the first time.

The inclusion expands the ETS beyond just electricity. It helps impact sectors with fewer low-carbon choices now. Some facilities can lower emissions by improving efficiency. However, others have tougher technical challenges.

Many steel and cement plants rely on processes that inherently release CO₂. Transitioning away from these methods will take time, new technology, and often higher investment.

The expansion means more companies need to track emissions closely. They must also adjust operations to stay within their limits.

How China’s ETS Works: Cap, Trade, and Compliance

China’s ETS uses a “cap-and-trade” model. Firms get allowances and must submit enough to cover their actual emissions each year. If they emit more than they hold, they must buy extra carbon allowances or carbon credits. If they emit less, they can sell any surplus.

The system began with the power sector because monitoring was simpler and data systems were more mature. Now, with heavy industry joining, rules must adapt to more complex processes and a wider range of emission sources.

For the new sectors, most carbon allowances will still be given for free, based on industry benchmarks. Free allocation helps ease the first years of compliance and reduces sudden cost shocks.

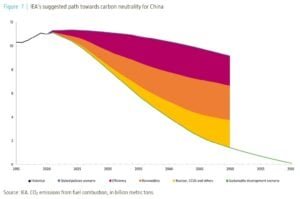

Regulators have indicated that partial auctioning might start later. This will happen after the market stabilizes and reporting gets better. Auctioning would increase cost pressure and send a stronger price signal.

The Chinese government also plans long-term reforms. Officials have outlined steps toward absolute emissions caps for certain sectors by 2027. This would move the system from intensity-based rules and would set clearer limits on total emissions. This change would also let the market have more say in long-term planning.

Price Trends, Volumes, and How the Market Is Changing

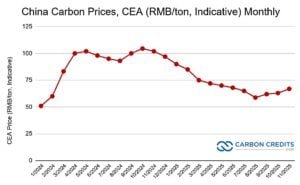

Before the expansion, China’s carbon prices usually traded within a band of 40 to 70 yuan per tonne. This moderate range showed the market’s early stage.

The dominance of free allowances also kept liquidity low. Daily trading volumes were often under 1 million tonnes. Prices tended to rise during compliance periods when firms needed to settle their accounts.

By adding heavy industries, the market now covers a much larger emissions base. This changes the balance of supply and demand and could increase both liquidity and volatility in the short term.

More companies will trade allowances. They will adjust their operations, estimate compliance needs, and see how their emissions stack up against benchmarks.

For context, the EU Emissions Trading System (EU ETS), the world’s largest and most established, trades around €70–€80 per tonne. China’s lower price level reduces immediate costs for domestic firms, but it also shows that the market has room to tighten. As China moves toward stricter caps, prices could trend upward over time.

The rise in carbon prices after the expansion announcement shows that policy clarity can drive strong reactions. It also reflects growing confidence that China intends to use the ETS as a central tool of climate policy, not only as a data-gathering exercise. All these will help the country move toward its carbon-neutral goal by 2060.

Industry Impact: Costs, Efficiency, and New Opportunities

Adding steel, aluminum, and cement will increase costs for many companies. This is especially true for those with older or less efficient plants.

Some companies may face higher expenses if they rely heavily on coal or run outdated equipment. Others might need to quicken energy-efficiency upgrades or invest in new production methods. This helps them avoid buying too many allowances.

To support the transition, a number of programs are available. These include government-backed loans for efficiency improvements, funding for carbon capture pilots, and grants for electrifying industrial processes.

The expansion also creates new business opportunities. Firms that reduce emissions faster than required can sell excess credits.

Consulting and verification service providers are likely to grow as more companies need accurate monitoring. Financial institutions may also increase their presence as the market becomes larger and more liquid.

Looking Ahead: Global Effects and Market Evolution

China’s wider ETS will influence not only domestic policy but also global trade. Europe’s Carbon Border Adjustment Mechanism (CBAM) adds fees to imports that have high carbon emissions. This includes products like steel, aluminum, and cement.

A stronger, clearer ETS helps Chinese exporters show their carbon costs better when selling to Europe. This makes coordination between China’s rules and international reporting requirements even more important.

The next few years will shape how effective the expanded ETS becomes. Economic conditions, production levels, and the pace of technological adoption will all play roles in the market’s development.

The move to absolute caps and possible auctioning shows a stronger commitment to long-term emissions control. If these reforms continue, the ETS could play a major role in helping China peak emissions before 2030 and move toward carbon neutrality by 2060.

- READ MORE: Tencent to Form Carbon Credit Buyers’ Alliance: How Could it Transform China’s Carbon Market?

The post China Carbon Prices Rise as Metals and Cement Enter the National Trading Scheme appeared first on Carbon Credits.