Chile has just entered a new phase of its lithium journey. State-owned Codelco and global lithium producer SQM have formed NovaAndino Litio SpA, a significant public-private joint venture that will oversee lithium development in the Salar de Atacama through 2060. This move strengthens Chile’s control over one of the world’s richest lithium resources. At the same time, it supports the world’s fast shift toward electric vehicles and clean energy.

The agreement merges Codelco’s Minera Tarar SpA with SQM Salar SpA. All assets, technology, people, and know-how now sit under one company. NovaAndino Litio will handle everything from exploration to production to sales. It will also guide long-term growth in the Atacama Salt Flat. With majority state participation and modern governance, the partnership shows Chile wants leadership, transparency, and sustainable value creation.

Máximo Pacheco, Chairman of the Board of Codelco, said:

“Codelco is taking a strategic step today to actively participate in lithium production, a key resource for the global energy and digital transition. This partnership with SQM fills us with pride and reflects a new form of public-private collaboration: transparent, professional, and long-term.”

Strong State Role, Steady Operations, and Smooth Transition

This joint venture was formally announced through Chile’s Financial Market Commission. It followed reviews from many national and international institutions. It also included a wide Indigenous consultation process. Now, the planning stage is over. The project moves into real action as the new board begins shaping the future of Chile’s lithium industry.

Additionally, NovaAndino Litio brings together the government’s strategic leadership and SQM’s strong operational experience. It gathers all necessary permits, subsidiaries, and international offices in one place. As a result, current Atacama operations can continue without disruption.

And at the same time, the partnership prepares for new contracts after 2031, ensuring stability for customers, investors, and communities.

There is also another major win. SQM transferred its Maricunga Salt Flat concessions to Codelco. This move strengthens Chile’s control over another key lithium reserve. It opens the door for future projects and reinforces national authority over critical minerals.

- READ MORE: SQM Bets Big With $2.7 Billion Expansion as Lithium Prices Rebound and Demand Surges

- CHECK: LIVE LITHUM PRICES

Lithium Demand Surges as Electric Mobility Grows

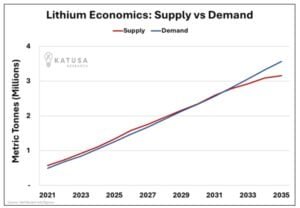

This partnership matters even more because of what is happening globally. Electric vehicles are growing fast across the world. So, lithium demand is rising sharply. Chile already supplies more than a quarter of global lithium. It mainly comes from brine extraction in the Salar de Atacama, which generally produces lower greenhouse gas emissions than hard-rock mining in other regions.

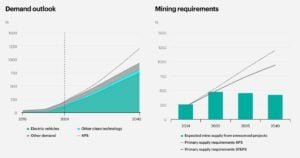

According to research from the International Council on Clean Transportation (ICCT) and the Centro de Movilidad Sostenible, battery demand in Chile is expected to jump dramatically. It could rise from 0.5 GWh in 2024 to up to 18 GWh by 2030, and even reach 38 GWh by 2035. Because of this, lithium demand from vehicles could surge from just 44 tonnes in 2024 to more than 3,000 tonnes by 2035. So, NovaAndino’s timing is not just important—it is essential.

Boosting Chile’s Lithium Production, Revenues, and Economy

Chile’s lithium production capacity is already set to expand. Announced capacity could rise from 42,000 tonnes in 2024 to 64,000 tonnes in 2030, and nearly 79,000 tonnes in 2035. Most of this will come from existing, proven operations. That means less risk and stronger reliability.

Financial benefits are also big. Lithium brought Chile about $2.7 billion in 2024. By 2030, revenues could reach $7.3 billion. By 2035, they could climb close to $9 billion, depending on prices and project success. Meanwhile, Codelco says the merger will have a strong positive effect on its financial results, which should show up in its 2025 reports.

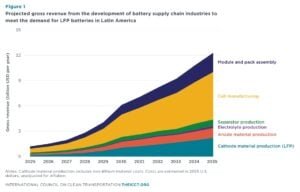

The country wants to move higher up the value chain for raw materials export. Today, almost all lithium mined in Chile is already refined locally. The next step is producing cathode materials. Making LFP cathodes for Latin American markets alone could generate $1.1 billion each year by 2030 and up to $2.2 billion by 2035. This would be almost double the income from exporting lithium carbonate. Even better, it would also create thousands of skilled jobs.

If Chile goes even further and builds full battery manufacturing, the impact becomes massive. Developing full LFP battery supply chains could generate up to $6.1 billion by 2030 and $12.3 billion by 2035, while creating as many as 32,000 direct jobs. So, NovaAndino Litio is not just a mining venture. It is a path to full industrial transformation.

Balancing Growth with Environment and Community

However, growth must remain responsible. The Atacama Desert is fragile. Water use and environmental protection remain critical. Indigenous communities and local stakeholders also need to stay involved. So, consultation and shared benefits must continue. Thankfully, this partnership was built with oversight, community discussion, and environmental awareness in mind.

Looking ahead, recycling will also become important. As more EV batteries reach the end of their life, recovering materials will reduce environmental pressure and help keep more value inside Chile’s economy.

A Defining Moment for Chile and the Global EV Shift

In the end, NovaAndino Litio marks a defining moment. Chile is protecting national interests while staying competitive in a rapidly changing world. With strong governance, advanced technology, and plans to expand downstream, Chile is moving from just supplying resources to creating long-term value.

As electric vehicles grow, renewables expand, and climate goals tighten, lithium will stay essential. Chile’s decision to build this state-led but globally competitive partnership shows confidence and direction. With NovaAndino Litio now in motion, Chile is ready to power the next generation of batteries—and help drive a cleaner, more sustainable energy future worldwide.

The post Codelco and SQM Unite to Boost Chile’s Lithium Future Through 2060 appeared first on Carbon Credits.