Copper prices climbed to new record highs this week. The jump came from two major forces: China’s shift toward stronger economic support and growing expectations that the U.S. Federal Reserve will soon cut interest rates. Together, they pushed investors toward the metal and highlighted rising fears of a supply shortage in 2026.

On the London Metal Exchange, benchmark three-month copper briefly reached $11,771 per ton. Shanghai futures also hit a peak near 93,300 yuan per ton. New York and Mumbai contracts followed the same direction, showing how broad the rally has become.

China’s Growth Push Sparks Copper Surge

The latest copper price surge began after a key meeting in Beijing. China’s leaders said economic growth would be their top goal in 2026. They promised a “more proactive” fiscal policy and “moderately loose” monetary policy. Markets view this as clear support for new stimulus.

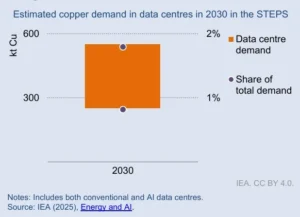

Much of this spending will flow into power-grid upgrades, renewable energy, and large computing and data center systems. These projects use a lot of copper.

Stronger Chinese trade data added support. Exports rose in November, pushing China’s yearly trade surplus to more than $1 trillion for the first time. Shanghai copper futures ended the day up about 1.5%, setting a new record close.

Long-term trends are also boosting demand. The International Energy Agency says clean-energy technologies could raise refined copper use to 33 million tons by 2035 and 37 million tons by 2050. This is up from about 27 million tons in 2024, showing how tight the market could become.

Rate-Cut Speculation Adds Fuel to the Rally

Financial markets are also helping copper rise. Investors expect the U.S. Federal Reserve to cut interest rates by 25 basis points this week. CME FedWatch shows an 85–90% chance of that happening.

Rate cuts usually weaken the U.S. dollar. When the dollar falls, dollar-priced metals like copper become cheaper for global buyers. There are also growing worries about possible U.S. tariffs on refined copper. These fears have led to aggressive stockpiling by American buyers.

LME warehouse withdrawals are rising, and U.S. Comex inventories have reached record levels. At the same time, supplies in other regions are tightening.

China’s smelters plan to cut refined copper output by around 10% because of low treatment charges and limited concentrate supply. Analysts at GF Futures and Citic Securities warn that the market may face a refined copper deficit of about 450,000 tons by 2026. Citic also says prices may need to average above $12,000 per ton in 2026 to support new mine investment.

Supply Shortages in Chile and Peru Intensify Tension

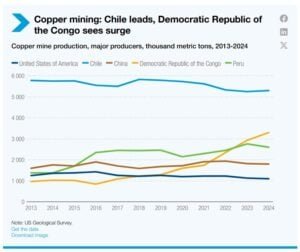

Copper supplies remain tight. Production issues in Chile and Peru—two countries that supply almost 40% of the world’s mined copper—are slowing output. Some mines are dealing with lower ore grades, water shortages, or delays in government approvals.

The International Copper Study Group reports that the global supply of refined copper grew by just 1% in 2024. Meanwhile, mine supply went up by less than 2%. This shows how slowly the new supply is growing.

These tight conditions are drawing more attention to future projects, including early-stage miners. Junior companies such as Filo Corp. In Argentina, Ivanhoe Electric in the U.S., and Hudbay’s Copper World project in Arizona are assets that might ease supply pressure later. They are still several years away from full production, but remain part of the long-term supply outlook.

Market Outlook: Volatility Ahead for 2026

Copper markets are preparing for a period of sharp and frequent price swings. Even though prices are at record highs, conditions behind the rally remain fragile.

Inventories on the London Metal Exchange have dropped to very low levels compared to the past ten years, while demand from major sectors continues to rise. This creates a market where small changes in supply or demand can move prices quickly.

Analysts warn that 2026 may bring even tighter conditions. Electric vehicles, renewable energy systems, power lines, and data centers all require large amounts of copper. For example, a single electric car can use up to 4x more copper than a gasoline vehicle.

New solar and wind projects also need copper-heavy cabling and transformers. Data centers for AI and cloud computing are now becoming another fast-growing source of demand.

Meanwhile, supply is not growing fast enough to match this rise. Many large copper mines in Chile and Peru are dealing with lower ore grades, which means they must move more rock to produce the same amount of metal.

Some projects have also faced delays due to environmental rules, community approvals, or limited water resources. These issues make it harder for miners to respond quickly when demand surges.

Financial factors may add more instability. If the U.S. Federal Reserve cuts rates further or the dollar weakens more, investors could pour additional money into copper. But if the global economy slows or if Chinese demand weakens, prices could fall sharply.

Many analysts believe that copper will be one of the most volatile major commodities until 2026. This is due to strong long-term demand, but also fragile short-term conditions.

Some forecasts from major research groups show the refined copper market staying in deficit for several years.

J.P. Morgan sees a tight copper market heading into 2026, projecting a global refined‑copper deficit of around 330,000 metric tons. They forecast copper prices to rise to about $12,500 per ton in Q2 2026, with an average price of roughly $12,075 per ton for the full year.

The analyst also sees rising demand, especially from data centers, electrification, and grid upgrades, as a key upside risk. However, supply issues and tight inventory might maintain upward price pressure.

Meanwhile, the International Copper Study Group notes only slight growth in mine and refined supply. These trends suggest copper may remain tight even if prices pull back from recent highs.

Copper Enters a New Phase

Copper’s move to record highs is not just a short-term story. China’s new stimulus plans, a likely U.S. rate cut, and supply problems in major producing countries are all pushing the market upward at the same time. With inventories low and new projects developing slowly, the market is entering a period of lasting tension.

Copper’s importance to clean energy, electrification, and digital infrastructure means demand will keep rising. As a result, the tight market conditions seen today could continue well into 2026 and beyond.

The post Copper Prices Hit New Record at $11,771/Ton: What Ignites the Rally? appeared first on Carbon Credits.