Happy Monday!

As the year winds down and the holiday break kicks in, we’re putting on our reflection glasses and taking a look back. If you read us this year, these were the stories and themes you saw again and again. Here's a little present before the holidays – dive into your CTVC wrapped below 🎁!

In deals, $523m for sustainable home solutions financing, $400m for micro nuclear reactor development across two deals and $300m for EV development.

In other news, Ford’s pivot from EVs to grid-scale batteries, the Trump Media and fusion company TAE Technologies merger, and a spate of SMR deals.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at hello@ctvc.co.

💼 Find or share roles on our job board here.

CTVC is powered by Sightline, the tactical market intelligence platform for energy and investment decision-makers.

🎁 2025, wrapped

It’s the end of the year, and you know what that means … a recap of your listening, we mean, reading habits! That’s right: it’s CTVC wrapped.

We’ve run the numbers and found out what resonated with you the most. Through all the policy twists and messy market moves, a few things grabbed your attention this year. These were the stories you came back to most.

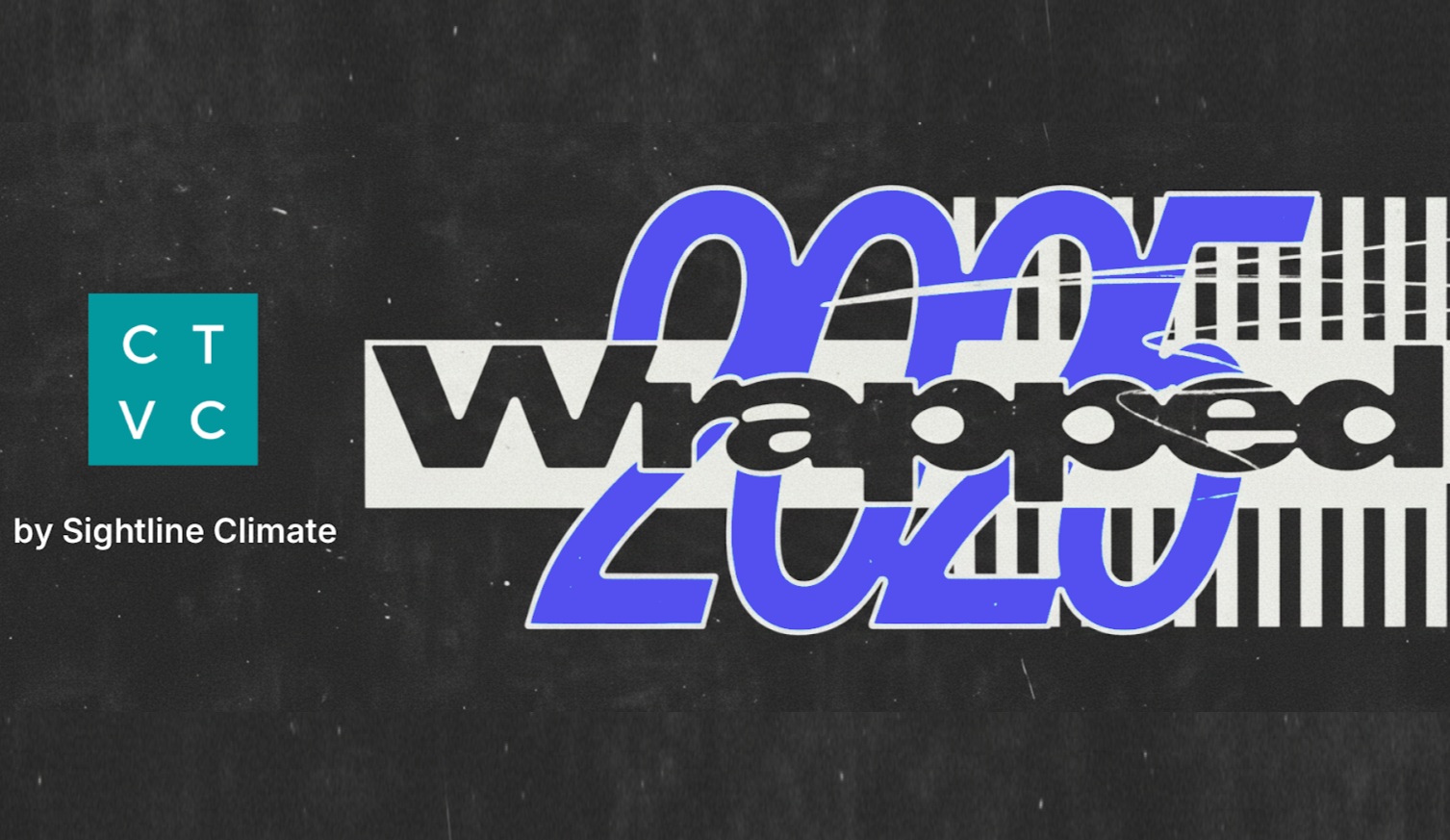

This was the one you couldn’t put down. Your top read: Funding freeze fallout at the DOE, from February. This was our The Times They Are A-Changin:’ exploring some of the first big changes that the Trump 2.0 administration made after inauguration. We dove into what the $145bn in federal loans and grants were for, and where they were. Of course, it was a bit of a harbinger: Washington uncertainty dominated throughout the year.

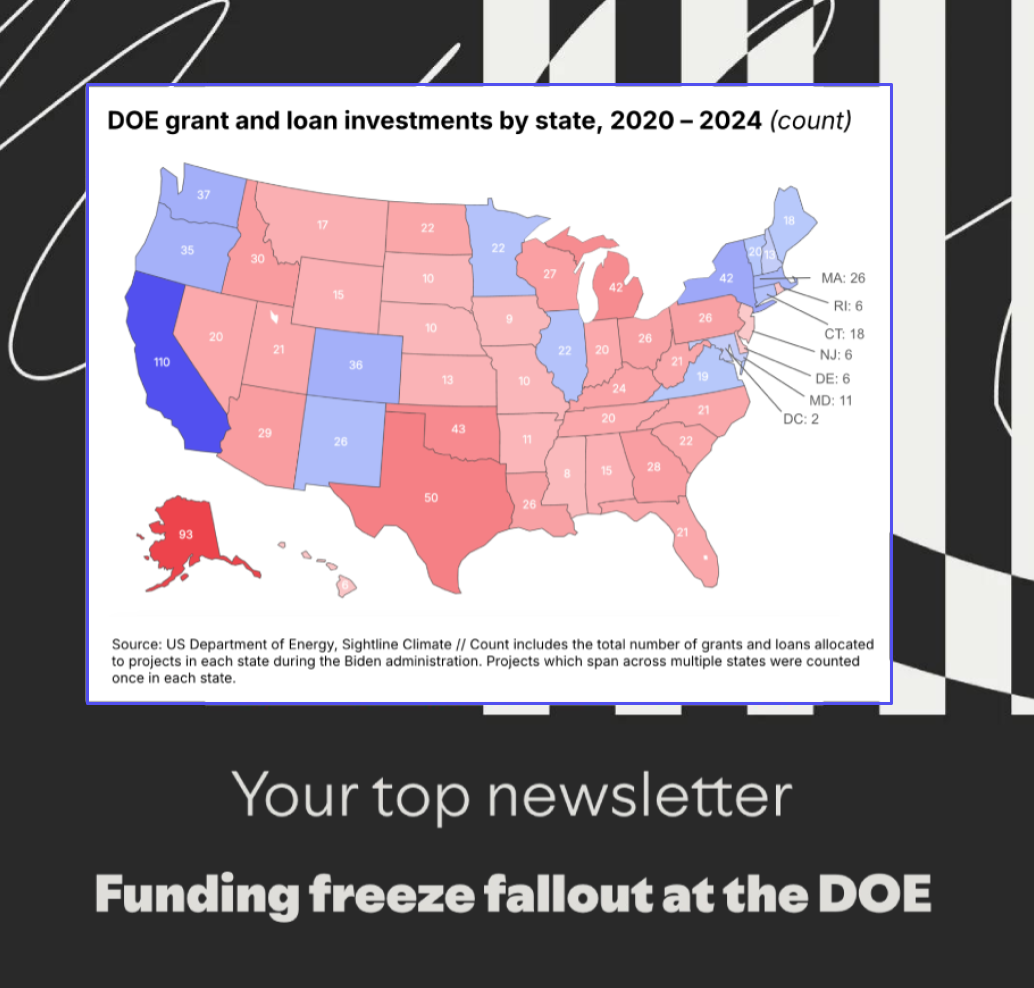

But it wasn’t the only newsletter you returned to. Your top 5 most read:

Your top newsletters demonstrated your excellent taste 😉. You bounced between tax codes and cap tables, with a playlist that mixed policy deep cuts and market reality checks.

Coming in number 2, Taxing times for CCUS from July, explored Trump 2.0’s OBBB’s new tax credits and their impact on CCUS.

And from January, under the Biden administration, the Final hydrogen tax credits get greenlight hit home. After months of waiting, hydrogen tax credits finally got some guidance…but they now face an accelerated phaseout under the OBBB passed over the summer.

Across the pond, you were interested in the UK’s cap-and-trade carbon markets (the ETS), which in July, brought engineered carbon removals into the scheme. You read it for what it means for BECCS, DAC, and whether removals can move beyond pilots and into compliance markets in UK ETS opens floor to carbon removal.

Last but not least, our annual investment trends newsletter, $30bn and a 14% fall as the market finds a new normal in ’24, This story stuck because it showed the data behind the new normal, as climate markets adjusted to higher rates, tougher diligence, and fewer free passes. Keep your eyes peeled for when we release our 2025 updated version at the beginning of January.

Looking back at the year, a few genres dominated our coverage. Of course, these weren’t the isolated stories so much as themes that kept resurfacing in markets, policy, and technology. The themes we touched on the most were:

- AI-driven power demand and the policies around them. That includes data centers, interconnection constraints, and debates over how grid upgrade costs get allocated.

Read more: DeepSeek hype vs. the hyperscalers; OpenAI’s shopping spree; Bearing the (large) load (tariffs).

- The US government funding pullback, from shifting DOE priorities to the OBBBA, and its knock-on effects for project finance, deployment timelines, and investor risk appetite.

Read more: OCED's not-so-clean break; Tariffs, trade wars, and climate tech; Bright spots and sunsets in the OBBB.

- Corporate clean firm offtake, especially in nuclear and geothermal, as large buyers stepped in to anchor projects in the absence of stronger policy certainty.

Read more: SMRs for GPTs; Fervo goes hotter, deeper, faster, cheaper; Nuclear fleet week

- China’s electro-state readiness, spanning manufacturing scale, grid expansion, and industrial coordination, and how that position is reshaping global competition in energy and clean industry.

Read more: 🌏 A tour of China's electrostate

- The race to scale deployment, from long-duration energy storage and grid-enhancing technologies to advanced nuclear and carbon projects (CCUS, carbon removal, BECCS). We tracked the projects and the tools they use, as companies move from pilot to build-ready and bankable.

Read more: Europe extends runtime for Li-ion LDES; The hope and hype of fusion; New tools for a complex capital stack; The working capital playbook for climate startups

Beyond the singles, these were the albums you actually listened to all the way through: our reports. (Thanks for downloading, reading, and giving us all the great feedback!)

- Climate Tech Investment Trends: 2024 was the one you kept on repeat. It’s a classic, we get it!

- You also spent time with Data Center Powering Models 2025, our electronic mix this year. Everyone talks about AI, but this report got into how it actually gets powered, where the bottlenecks are, and why firm power and grid access are becoming the real constraints.

- Our international hit, our own Rosalia’s Lux, if you will: Globalization in Climate Tech was another favorite. In partnership with HSBC, it looked at how climate tech is spreading out across regions, with supply chains, manufacturing, and capital getting more fragmented and more local at the same time.

- By midyear, Climate Tech Investment Trends: H12025 checked back in. A high-energy report, showing just how much money was flowing into the energy sector as energy security and resilience came into focus.

- And Climate Investor Market Sentiment: 2025 rounded out the list. Our sentimental ballad report, asking investors their feelings about the sector, in partnership with Elemental. And it wasn’t all downers, there were some upbeat notes too.

We’re calling this one 19. This year marked a shift into the “new normal,” as the sector moved further away from the conditions that defined its early growth, like interest rates and subsidies. Without them, and with more uneven policy signals and tighter capital, we’ve seen a lot of fits and starts. There’s been heartbreak and angst and plenty of big feelings.

But that’s typical and even expected in climate tech’s maturing phase. Beyond the shakeouts and market consolidations, clearer winners are starting to emerge. These companies can operate under real constraints and still make progress. They’re growing up, moving out of the house, and the real world’s hitting, just as the hype and the hormones start to stabilize.

We’ll be off next week for the holidays, and we’re excited to see you in 2026!

🔮 And don’t forget to submit your predictions for 2026 in our prediction bets survey here for the chance to win a $50 gift card and to tell us what you expect to be on this list for next year.

Deals of the Week (12/15-12/21)

Late-Stage / Growth

⚡ Radiant Nuclear, an El Segundo, CA-based micro nuclear reactor developer, raised $300m in Series D funding from DCVC, a16z, Chevron Technology Ventures, ARK Invest, and Boost VC.

⚡ Last Energy, a Washington DC-based modular nuclear reactor developer, raised $100m in Series C funding from AE Ventures, Ultranative, Gigafund, Astera Institute, and Woori Technology.

♻️ XSD International Paper, a Kulim, Malaysia-based sustainable paper and packaging manufacturer, raised $70m in Growth funding funding from IFC.

⚡ Fuse Energy, a London, England-based clean energy supplier and grid platform developer, raised $70m in Series B funding from Lowercarbon Capital and Balderton.

⚡ Blykalla, a Stockholm, Sweden-based advanced SMR producer, raised $50m in Growth funding from Nucleation Capital, Oklo, CoreWeave, ARMADA Investment AG, and Pitango VC.

📦 Manna, a Dublin, Ireland-based drone delivery services provider, raised $33m in Growth funding from Coca Cola, Molten Ventures, Tapestry VC, Dynamo, and Radius Capital.

⚡ Sharing Energy, a Tokyo, Japan-based distributed solar energy provider, raised $20m in Series C funding from Energy & Environment Investment, JAFCO Group, JIC Venture Growth Investments, and Sumitomo Mitsui Trust Bank.

🚢 Pyxis, a Singapore, Singapore-based sustainable IT solutions developer, raised $10m in Growth funding from MOL PLUS, Motion Ventures, SG Growth Capital, OCBC, and Shift4Good.

Early-Stage

⚡ IND Technology, a Richmond, Australia-based grid fault detection software, raised $50m in Series A funding from Energy Impact Partners, Edison International, Virescent Ventures, and Angeleno Group.

⚡ Skye, a Stockholm, Sweden-based industrial energy optimization software, raised $11m in Seed funding from Transition VC, Emblem, Hawktail, and byFounders.

🛵 Oben Electric, a Bangalore, India-based electric two-wheeler manufacturer, raised $9m in Series A funding.

🌡 Cordulus, an Aarhus, Denmark-based weather data analytics provider, raised $8m in Series A funding from Delphinus Venture Capital, Danish Agro, Pajbjergfonden, and Rockstart.

🥩 Those Vegan Cowboys, a Belgium, WI-based animal-free milk protein producer, raised $7m in Seed funding from Westland Kaas.

🐄 Symbrosia, a Kailua-Kona, HI-based seaweed-based methane‑reducing feed additive, raised $6m in Series A funding from Idemitsu Australia and One Small Planet.

Other

⚡ GoodLeap, a Roseville, CA-based sustainable home solutions financing platform, raised $523m in Debt funding from Bank of America, CIBC, Citi, and Goldman Sachs.

🚗 Polestar, a Gothenburg, Sweden‑based EV manufacturer, raised $300m in Debt funding from Geely.

⚡ Soltage, a Jersey City, NJ-based solar asset developer and operator, raised $80m in PF Debt funding from First Citizens Bank and East West Bank.

🛵 Cowboy, a Brussels, Belgium-based electric bike maker, raised $18m in Corporate Strategic funding from ReBirth.

⚡ Next Hydrogen, a Mississauga, Canada-based electrolyzer manufacturer, raised $15m in Post-IPO Equity funding from Smoothwater.

Exits

♻️ Innovative Recycling, a New Prague, MN-based sustainable waste management, was acquired by Arcwood Environmental for an undisclosed amount.

⚡ Baywa-re Japan, a Tokyo, Japan-based BayWa re’s Japan solar developer, was acquired by Virya Energy for an undisclosed amount.

💥 Luminar, an Orlando, FL-based vehicle sensor and software developer, filed for Bankruptcy.

This is a sample of deals available for Sightline clients. Can’t get enough deals?

In the News

Ford Motor is retreating from its EV push while pivoting toward grid-scale battery storage, repurposing an underused Kentucky EV battery plant to produce lithium iron phosphate batteries. The move follows roughly $19.5bn in EV-related write-downs and reflects surging US demand for stationary storage, driven by data centers and grid constraints, as shifting market forces mean grid-scale storage has a more resilient near-term growth market than passenger EVs.

Trump Media, owner of Truth Social, merges with fusion company TAE Technologies. Though TAE is one of the oldest fusion startups and respected in the fusion community, its approach, known as Field Reversed Configurations, still faces significant engineering and physics risk and lags other leading designs in technological maturity. Trump Media plans to start building the first fusion power plant in 2026. This follows recent pressure for the US government to do more to support US fusion companies to match the Chinese Government's recent billions, and the establishment of the DOE Fusion Office last month.

Meanwhile, advanced nuclear startups secured a wave of new financing this week, with $100m for Last Energy, $300m for Radiant, and $50m by Sweden’s Blykalla. The deals signal strong investor appetite for SMRs and microreactors, but most projects still face long development timelines, regulatory uncertainty, and first-of-a-kind deployment risks that could delay commercial operation into the 2030s.

The Trump administration said it will dismantle the National Center for Atmospheric Research (NCAR) in Boulder, Colorado, accusing the federally funded center of promoting “climate alarmism” and moving or shutting down key operations, amid broader efforts to cut climate science funding. The move threatens a critical source of atmospheric data, modeling, and supercomputing that underpins weather forecasting, renewable integration, grid planning, risk analytics, and climate resilience tools, disaster preparedness and public safety

California regulators approved a $115m, first-of-its-kind program to boost demand for plug-in heat pumps and battery-equipped induction stoves, aiming to cut installation costs and speed home electrification. The six-year effort targets manufacturers, retailers and consumers, with a focus on renters and low-income households, and is designed to overcome high upfront costs and limited availability as federal efficiency incentives are rolled back.

Pop-up

Elemental CEO Dawn Lippert’s new op-ed: Environmentalism meets its builder era.

A year in review of Trump 2.0’s DOE.

Meanwhile, DOE alums’ new Substack just dropped.

The leading women in climate and sustainable finance, goes to…Fin-Earths awardees.

From solar to storage, this Australia climate tech report shows the future is looking bright down under.

BP drills for new leadership with a new CEO (again).

The world’s last flock of whooping cranes gets a new lease on life.

Opportunities & Events

📅 Minneapolis Climate Week: Join climate leaders, innovators, and communities in Minneapolis, Minnesota, USA from February 3–6, 2026 for a series of climate‑focused events and activities as part of the global Climate Week Network

📅 Cross‑Campus Innovation Exchange: Join faculty, researchers, grad and undergrad student leaders advancing climate tech on Friday, January 23, 2026, 1:00 PM – 5:30 PM EST in Midtown Manhattan, New York, NY, USA for panels, industry pitches, workshops, research presentations, and networking with startups and investors.

💡 The Climatebase Fellowship: Apply by January 12, 2026 for priority consideration to join Cohort 9 of this career accelerator that helps mission‑driven professionals supercharge their climate careers, land their next climate job, or launch projects and ventures in the sector.

Jobs

Investment Associate, @Zero Infinity Partners

Electrical Project Engineer, @Planted Solar

Civil Project Engineer, @Planted Solar

Solution Engineer, @Planted Solar

Senior Full-Stack Engineer, @Coral

Full Stack Engineer, @Möbius Industries

Part-Time Inside Sales Representative, @Composer

Software Engineer, Fullstack, @Eagle

Senior Software Engineer, Marketing Lead, Platform Engineer @Sightline Climate

📩 Feel free to send us deals, announcements, or anything else at hello@ctvc.co. Have a great week ahead!