[Disclosure: AgFunderNews’ parent company is AgFunder.]

Investment into Brazilian agrifoodtech has steadily increased over the years as more and more VC dollars flow into sectors like Ag Marketplaces, agrifintech, and bio-based crop protections—all areas brimming with startup activity in the country.

According to AgFunder data, Brazil ranked third in the Americas (behind the US and Canada) and 11th globally for venture capital investment in agrifoodtech in 2024, with startups raising $249 million across 49 deals.

Brazil remains the top-funded country in Latin America and the Caribbean for agrifoodtech investments, and second behind India among developing markets globally. (AgFunder considers China a developed country for investment data analysis.)

Sector analysts have recently recognized Brazil as a key player in the global agrifoodtech landscape.

However, as with other markets, investments have suffered from the global shortage of capital in the post-covid scenario: The $249 million raised in 2024 was a 24% drop from the previous year; dealcount was also down 43%, to 44 rounds.

By comparison 2024 global agrifoodtech funding dropped only 3% year on year, while deal count fell 21%.

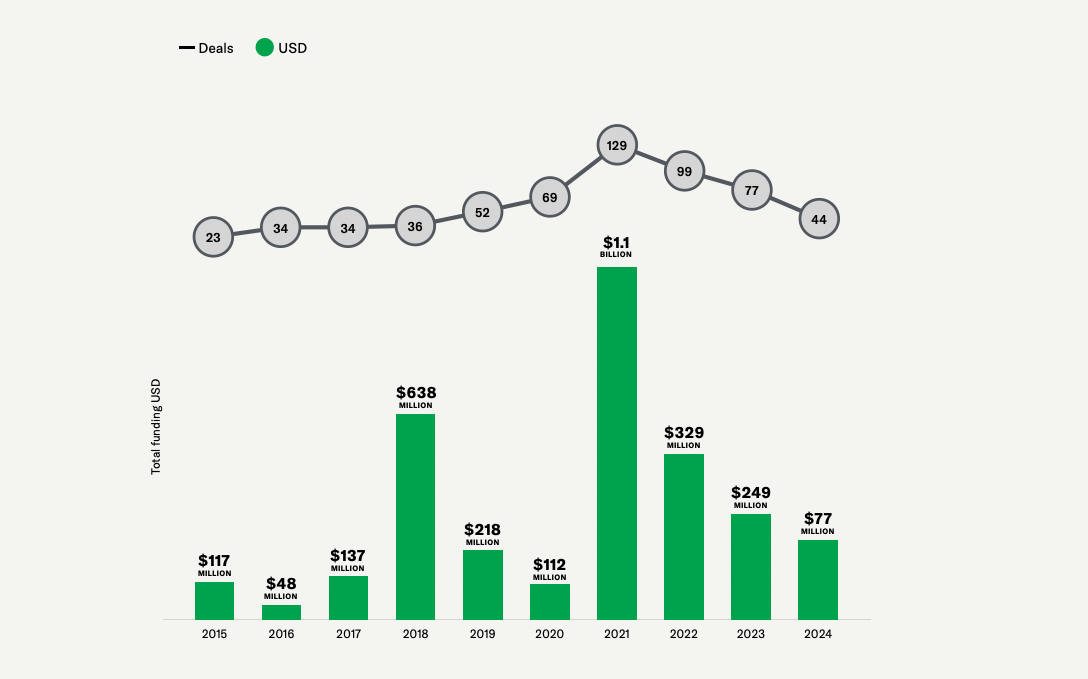

10 years of agrifoodtech investment in Brazil

Despite the post-2021 slump, recent investment volumes have remained well above pre-covid levels, excluding 2018, where $500 million went to a single round scored by food delivery platform iFood. It was, and remains, the largest deal in the history of Brazilian agrifoodtech startups.

Minus that outlier, pre-pandemic funding levels are well below those that took place after 2021, which shows some resilience on the part of Brazil and hopes for future growth.

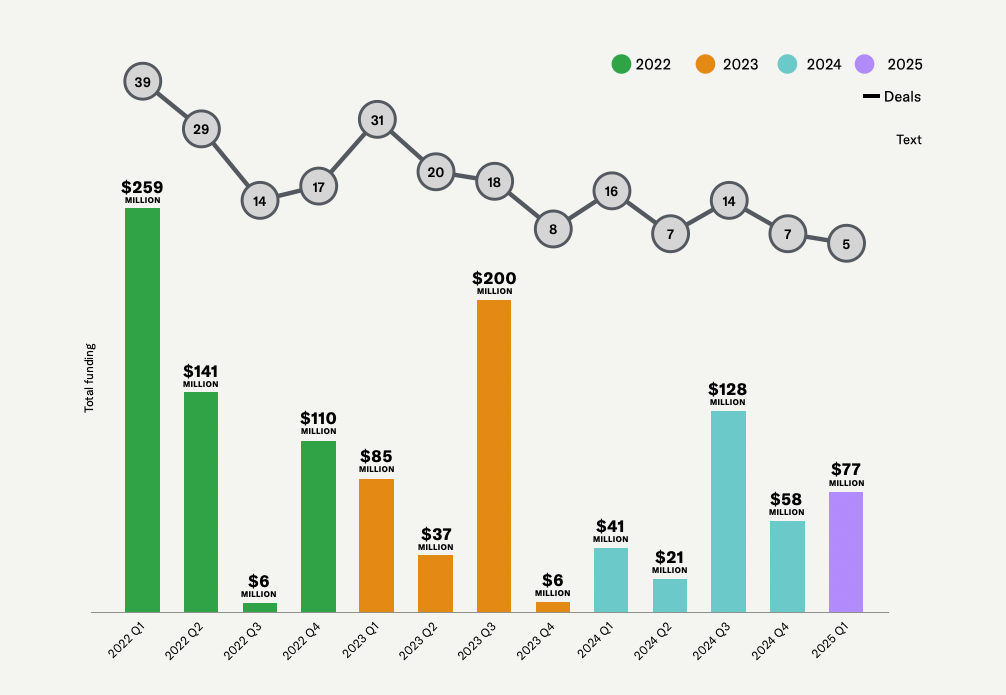

Agrifoodtech investment by quarter since 2022

Along those lines, a more granular look at quarterly activity shows small signs of recovery.

With a total of $76.8 million, Q1 2025 posted a 32% growth over the previous quarter, and 85% over the same period in 2024. The amount increase was achieved with just five deals, the largest of which was a $60 million Series D for Solinftec. [Disclosure: AgFunderNews’ parent company AgFunder is an investor in Solinftec.]

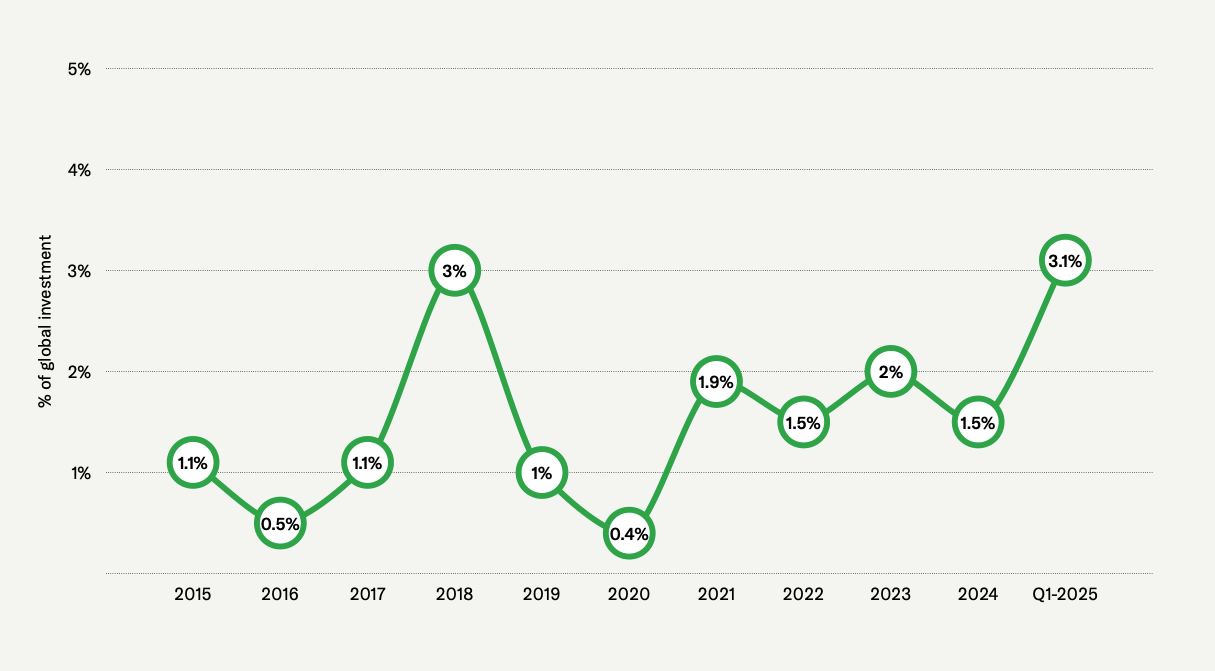

Agrifoodtech investment in Brazil as a 5 of global

While throughout 2024 Brazil represented 1.5% of global agrifoodtech investment, in the first quarter of 2025 it reached a 3.1% share, thanks in most part to Solinftec’s large deal. In 2024 Brazil also represented nearly 55% of all agrifoodtech investment in Latam the Caribbean.

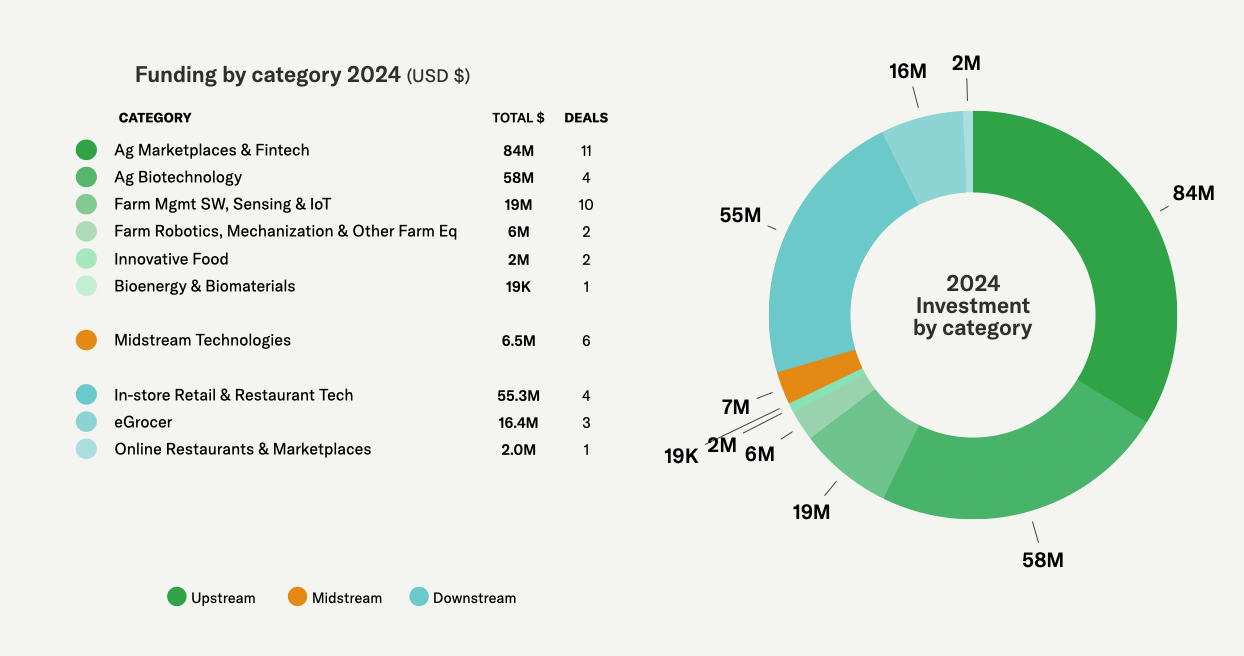

Breakdown by category

The top two categories in 2024 were upstream. Ag Marketplaces & Fintech garnered $84.3 million, with a 29% year over year increase. As the deal count was only up one unit from 2023, the increase in amount was achieved mainly thanks to larger deals, in particular the $52.7 million round raised by Agrolend, and the $20 million secured by Traive.

With four deals collectively worth $58.4 million, Ag Biotechnology was the second-best-funded category despite a 9% drop in total amount and 43% decrease in deal count. Downstream, In-store Retail & Restaurant Tech raised $55.3 million, thanks to a YoY 129% increase in total funding, in spite of a 60% drop in number of deals.

E-Grocery, Brazil’s best-funded category in 2023 with $104.7 million, fell fifth position with just three deals in 2024, posting a 57% drop in deal count from the previous year and falling 84% in total funding.

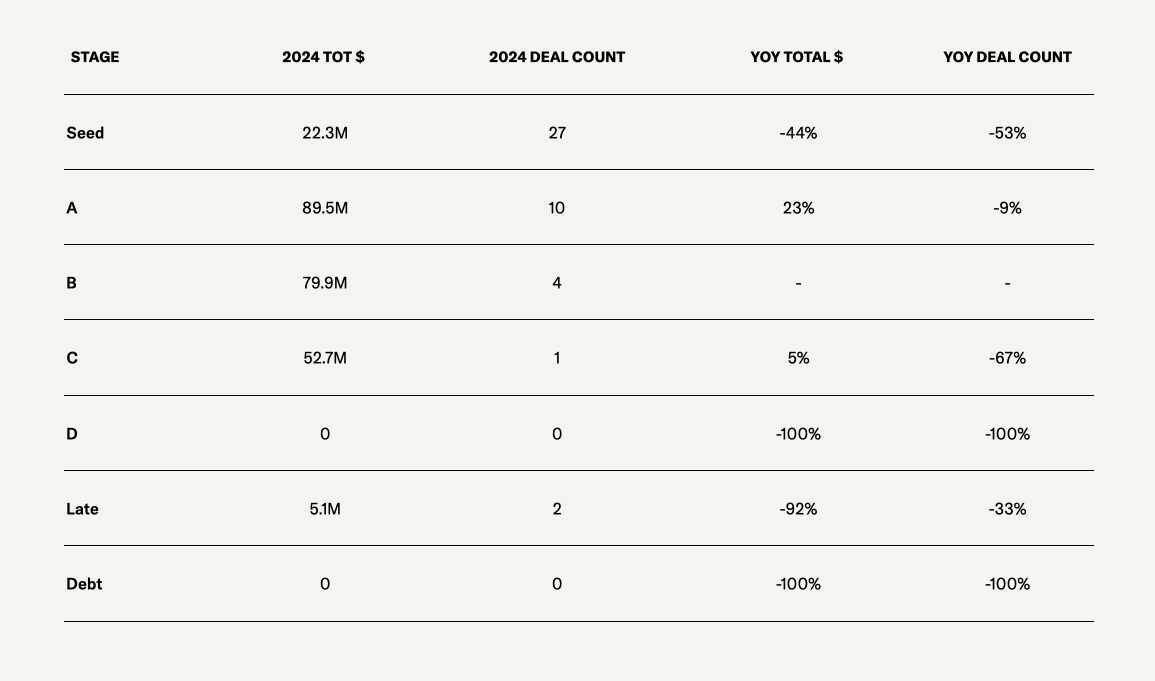

Stage analysis

Seed stage activity for Brazilian agrifoodtech saw a sharp drop in 2024, with funding volumes down 44% to $22.3 million, and deal activity down 53% to 27 rounds. The average deal size for seed stage remained unchanged at around $1.1 million.

Series A stage witnessed a 23% growth in total funding to $89.5 million, despite deals dropping slightly from 11 to 10 units., with median deal size rising from $6.6 million to 9.9 million.

Series B deals went from zero to four units, for a total of almost $80 million, and volumes for C stage rose 5%, despite being represented by a single deal. Late stage funding dropped significantly, and no debt financing was allocated in 2024.

Top 5 deals since 2024

Solinftec, an ag robotics company offering solutions for real-time monitoring, optimization and traceability of agricultural operations, raised $60 million with a D stage round closed In February 2025.

Cayena, a B2B marketplace connecting food suppliers with restaurants, bars, hotels, and other food service businesses, secured $55 million in July 2024 via a series B round.

Agrolend, a digital bank that provides credit for the agribusiness sector, closed a C round worth $52.7 million in October 2024.

Agrion Agrisolutions, an ag biotech firm producing gradual release organic mineral fertilizer, closed a $46.2 million Series A deal in August 2024.

AI-powered agricultural risk insurer and loan provider Traive raised $20 million in February 2024 via a Series B round.

Further reading:

Uruguay firm The Land Group expands its regen ag-focused asset management model to Brazil

The post <H6>Data Dive: AFN’s insights</H6><BR> <H1>Brazil’s agrifoodtech funding grows 32% in Q1 2025 after meagre 2024 performance</H1> appeared first on AgFunderNews.