India’s maritime sector is beginning a major shift toward cleaner operations. The Ministry of Ports, Shipping and Waterways (MoPSW) has launched the Harit Sagar Green Port Guidelines, which set a goal for 50 percent of all port equipment and vehicles to be electric by 2030. This goal provides an opportunity to modernize logistics, reduce costs and emissions, and make India’s ports more competitive and cleaner in a changing global market.

RMI’s latest report lays the foundation for large-scale electric truck deployment at ports, improving air quality in port regions, reducing operating costs for fleet operators, and positioning India as a global leader in sustainable port logistics.

Early ZET deployments show promise, but costs remain a hurdle

Today, about 24,000 diesel trucks operate within and around India’s 12 government owned Major Ports. These trucks are essential for moving goods but also add to local air pollution and greenhouse gas emissions. Replacing them with zero-emission trucks (ZETs), such as battery-electric or fuel-cell trucks, is an important step toward meeting the Harit Sagar goals.

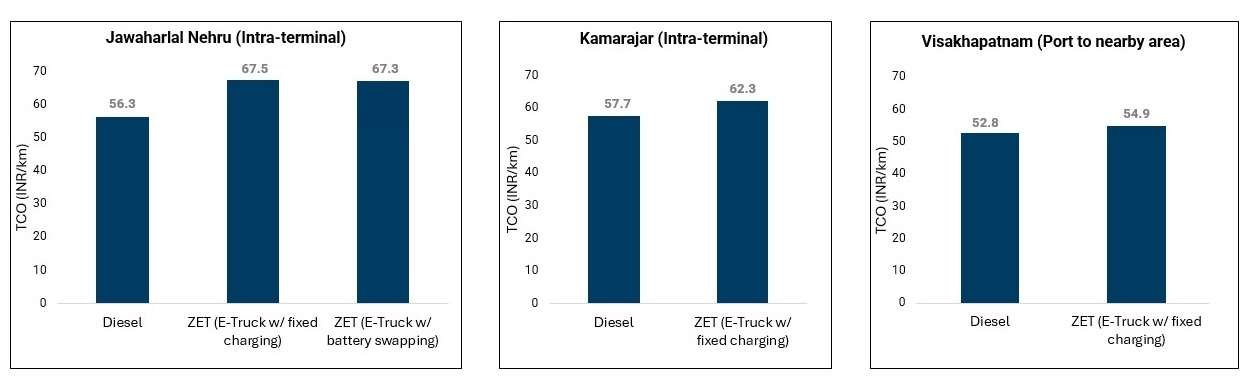

Some ports have already begun this journey. Pilot projects at Jawaharlal Nehru Port, Kamarajar Port, and Visakhapatnam Port have tested ZETs across various use cases. Early results indicate that ZETs can match diesel trucks in performance and payload, offering comparable range and operational efficiency. Drivers also report smoother, more comfortable and quieter operations. However, when considering economics, ZETs currently show a 4–20 percent higher total cost of ownership (TCO) compared than diesel trucks (Exhibit 1). This is driven largely by high up-front vehicle costs, elevated electricity tariffs (INR 9.7–16/kWh), and the cost of battery-swapping infrastructure.

Exhibit 1

Total cost of ownership of ZETs vs. diesel trucks for differing ports and use cases

Note: The results are inclusive of PM E-DRIVE E-truck incentives. Daily distance traveled (km) for Jawaharlal Nehru, Kamarajar, and Visakhapatnam ports is 125 km, 120 km, and 150 km, respectively.

Source: RMI Analysis

Despite the TCO gap, major ports are demonstrating a strong intent towards ZET adoption by indicating demand for approximately 800 ZETs to be deployed by 2030. While this represents only about 3 percent of the total truck fleet at ports, it marks a promising start that can build confidence, operational experience, and economies of scale.

The need for a policy framework

To move from small pilots to large-scale deployment, bridge the TCO gap, and align adoption with Harit Sagar targets, there is an urgent need for a dedicated policy framework specifically for ZETs at Major Ports. Such a framework (Exhibit 2), including strategic planning, fiscal and non-fiscal measures, infrastructure development and capacity building, would help align efforts across ports and provide consistent direction to both public and private stakeholders.

Exhibit 2

Policy framework for ZET adoption at ports

Source: Policy Framework for Zero-Emission Truck Adoption at Major Ports in India, RMI, 2025, https://rmi.org/insight/ policy-framework-for-zero-emission-trucks-adoption-at-major-ports-in-india.

It’s critical to prioritize the implementation of these solutions in a phased manner. In the near term (0–1 years), the focus should be on ensuring that each port develops a ZET transition plan to signal its intent to decarbonize logistics and build industry confidence. This can be complemented by aggregating demand across ports through a nodal agency to reduce costs for early adoption.

Additionally, fiscal measures such as up-front incentives can help lower the TCO and spur short-term adoption. These can be accompanied with nonfiscal measures, including the creation of green entry and exit channels for ZETs and the introduction of longer-term logistics service contracts favoring ZET operations. Finally, ports can also explore leveraging state EV tariffs and PM E-Drive charging infrastructure incentives to reduce charging-related costs. Capacity-building and workforce training programs should be prioritized to ensure drivers are equipped to operate ZETs efficiently.

In the medium term (beyond 1 year), more binding measures can be introduced. These may include embedding ZET adoption requirements for terminal operators in new or renewed concession agreements and imposing additional surcharges on the operation of diesel fleets at ports. At the same time, it is important to strengthen upstream infrastructure to accommodate higher charging demand, and to institutionalize continuous documentation, data collection, and monitoring of deployments and key learnings.

Overall, this represents a significant opportunity for India’s major ports to demonstrate leadership in ZET adoption on the global stage. With coordinated action between the public and private sector, and a dedicated policy framework, India can anchor a more sustainable, resilient, and competitive maritime future.

The post Driving the Adoption of Zero-Emissions Trucks at Major Ports in India appeared first on RMI.