European electricity markets saw a sharp rise in negative power prices in 2025. In many parts of the continent, wholesale electricity prices fell below zero for many hours. In these periods, power generators effectively paid buyers to take electricity because supply far exceeded demand. This trend hit record levels in 2025 and highlighted key shifts in Europe’s electricity system.

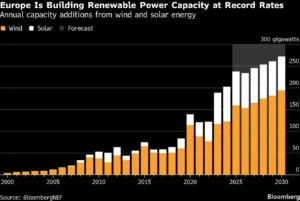

Negative power prices are linked to rising renewable energy output. Europe added large amounts of solar and wind power capacity. At the same time, grid systems and storage infrastructure struggled to keep up. The resulting oversupply pushed prices down in many markets, especially at times of low demand or very strong generation.

Let’s learn why negative prices rose, where they were most common, and what the trend means for Europe’s energy future.

When Power Becomes a Liability: What Are Negative Power Prices?

A negative power price means the wholesale cost of electricity drops below zero. In simple terms, it means generators pay others to take their power. This happens when supply is much greater than demand.

Oversupply can occur when renewable generation runs at full capacity. It can also happen when weather conditions push wind or solar output high while demand remains low.

Electricity markets typically set prices based on supply and demand. When supply exceeds demand by a large margin, prices fall. If this oversupply is sustained, wholesale prices can enter negative territory. This situation is not common in most electricity markets, but it became more frequent in Europe in 2025 as renewable output grew much faster than grid flexibility and demand response systems.

How Often Did Negative Prices Occur in 2025?

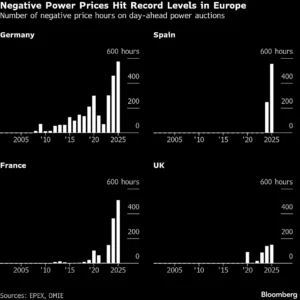

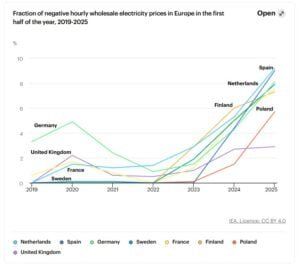

European markets logged record levels of negative price hours in 2025. Countries including Sweden, the Netherlands, Germany, Spain, Belgium, and France each recorded more than 500 hours of negative electricity prices.

In some cases, the number of hours with negative or zero prices increased sharply compared with previous years. These figures reflect a growing mismatch between generation and demand at certain times of day and in specific regions.

In Germany, for example, negative price hours rose significantly in 2025. Reports showed more than 570 hours of negative pricing, a 25% increase from 2024. Spain also saw a large increase in such hours, with totals doubling year-on-year as renewable generation expanded.

Some regions experienced negative pricing for long streaks. In parts of the Spanish market, over 500 hours of zero or negative prices were recorded in 2025, even as electric demand grew. Renewable power contributed more than 55% of generation in Spain at times, helping push prices lower.

Where Europe’s Power Glut Hit Hardest

Negative electricity prices did not affect Europe evenly. Some countries saw far higher counts than others.

Northern European markets with strong wind and hydro generation, like Sweden, recorded high numbers of negative price hours. The Swedish SE2 price zone logged over 500 hours of negative prices in just the first half of 2025.

Central Europe also saw many negative pricing periods. Germany and the Netherlands typically logged large totals. Germany’s high renewable capacity and limited transmission expansion contributed to frequent oversupply.

Southern European markets such as Spain also posted very high negative price hours. In Spain, renewables made up more than half of total generation at times, and the market saw over 500 hours of negative or zero prices in 2025.

Spain’s installed solar capacity surged from 9 GW in early 2020 to 32 GW by end-2025. This is driven by €1.2B+ subsidies, record permitting, and utility-scale projects.

Some markets still restrict negative prices by rule. Italy historically did not allow negative pricing, though reforms in 2025 changed some market rules.

What Caused the Negative Prices?

Several key factors led to the rise in negative electricity prices:

- Rapid growth in renewable energy supply. Solar and wind farms across Europe generated large volumes of power. When this output exceeded demand, prices fell.

- High solar output. European solar generation hit record levels, especially in spring and summer. At times, solar output alone exceeded local demand, creating oversupply conditions.

- Grid bottlenecks. Some transmission networks struggled to move electricity from high-generation areas to centers of demand. This reduced the ability to balance supply and demand efficiently and trapped excess generation locally.

- Low demand periods. Negative prices often occurred when demand was weak, such as weekends or mild weather days, while renewables continued to run at full capacity.

Together, these conditions created frequent periods where supply far exceeded demand. In some markets, this forced wholesale prices below zero much more often than in past years.

Winners, Losers, and the Cost of Oversupply

Record instances of sub-zero prices in Europe (4,838 negative or zero price hours in 2024, nearly double the prior year) have helped lower average wholesale costs during oversupply periods. This has mixed effects on the region’s power markets.

For consumers and industrial buyers, negative price hours can lower average wholesale costs. When prices fall below zero, buyers pay less for electricity or even receive credits under some pricing schemes.

For generators, negative prices can reduce revenues. Renewable developers may see lower average returns when prices often fall. This can affect project finance and investor confidence if markets do not provide adequate compensation mechanisms.

- For example, German solar captured ~€71.55/MWh in October 2025 versus an average market price of €84.40/MWh.

Negative pricing may also pressure long-term power purchase agreements (PPAs). Some PPA models assume positive wholesale prices. When prices frequently drop below zero, PPAs may deliver less predictable returns, pushing buyers and sellers to reconsider contract terms.

Negative price hours now make up a growing share of total hours, up to ~9% in some markets. As such, PPA revenue assumptions based on positive prices are under greater pressure.

- Despite negative episodes, average wholesale prices remain positive: e.g., EU electricity prices averaged around US$90/MWh in the first half of 2025.

On the positive side, frequent negative prices highlight the value of energy storage and demand response solutions. Storage systems like batteries can absorb excess generation and release it later. Demand response programs that shift load to times of oversupply can also reduce negative pricing frequency. These tools help balance supply and demand and may become more common as markets adapt.

Outlook for Europe’s Electricity System: Can Europe Fix Its Power Imbalance?

The trend of negative electricity prices in Europe is expected to continue as renewable capacity keeps growing. In 2025, Europe is set to add a record 89 GW of new renewable power, mostly from solar and wind, to meet climate targets and reduce reliance on fossil fuels.

However, grid expansion has not kept up with this growth. About 1,700 GW of renewable and hybrid projects are stuck in grid connection queues, more than three times the capacity needed to reach the EU’s 2030 energy goals.

Another 500 GW of ready-to-connect projects remain idle because transmission and distribution networks are not yet upgraded. These constraints have already caused around €7.2 billion of curtailed clean energy in 2024.

In some regions, developers may wait four to seven years or more to get grid access. Analysts estimate that roughly €1.2 trillion in grid investments will be needed by 2040 to modernize networks, reduce bottlenecks, and support the clean energy transition.

Experts point to the need for better market design and flexibility mechanisms. Negative pricing reflects a system under stress from rapid change. Improvements such as faster grid upgrades, expanded storage deployment, smarter demand planning, and updated pricing rules can help markets absorb more renewable electricity without as much volatility. How European markets adapt to these trends will shape the continent’s energy transition in the years ahead.

- READ MORE: Apple (AAPL) Expands Renewable Energy Projects Across Europe to Power Its 2030 Carbon-Neutral Vision

The post Europe’s Power Paradox: Why Electricity Prices Went Below Zero in 2025 appeared first on Carbon Credits.