Happy Tuesday!

We’re back in your inbox after taking Presidents’ Day off. Speaking of the federal government, we’ve got a deep dive into the new tax guidance that dropped last week on what exactly constitutes “foreign control” and how it affects tax credits.

In deals, $450m for commercial fusion energy development, $431m for energy storage development, and $355m for solar and battery storage development.

In other news, the endangerment finding is extinct, the Pentagon’s procurement order for coal, and the EU’s carbon market shakes.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at hello@ctvc.co.

💼 Find or share roles on our job board here.

CTVC is powered by Sightline Climate, the tactical market intelligence platform for energy and investment decision-makers.

What the FEOC?

What happened

Last year, we had cautious hopes that Trump 2.0’s first major bill, the One Big Beautiful Bill Act, would take a scalpel, not a sledgehammer, to the Inflation Reduction Act’s clean energy incentives. When it passed in July, all it brought was more uncertainty: the administration was clear that it would bring down that sledgehammer on foreign supply chains, but didn’t get too into specifics on implementation.

Now, guidance has started to arrive. Last week, the Treasury and the IRS released the first major Foreign Entity of Concern implementation rules. They outline the new stricter foreign ownership and sourcing requirements and tighter project deadlines that companies and projects must hit to access clean energy tax credits.

Why it matters

The IRA leveraged tax credits to unlock unprecedented clean energy deployment, covering new sectors and simplifying their use through mechanisms like direct pay and transferability. But times have changed, and with security in the spotlight (paired with antagonism towards clean energy), Trump’s OBBBA expanded restrictions, bringing fresh uncertainty for the developers and lenders behind these projects. It amended eligibility for the tech-neutral 45Y Clean Electricity Production Credit and the 48E Clean Electricity Investment Credit, plus the 45X Advanced Manufacturing Production Credit, if the facilities, investments, technologies, or components received “material assistance” from a prohibited foreign entity (companies tied to China, Russia, Iran, or North Korea) for tax years after July 4, 2025.

This is the first real guidance explaining how the new prohibited foreign entity (PFE) rules will work in practice. Here’s a quick breakdown of what’s included:

1. How to determine “material assistance” from a PFE

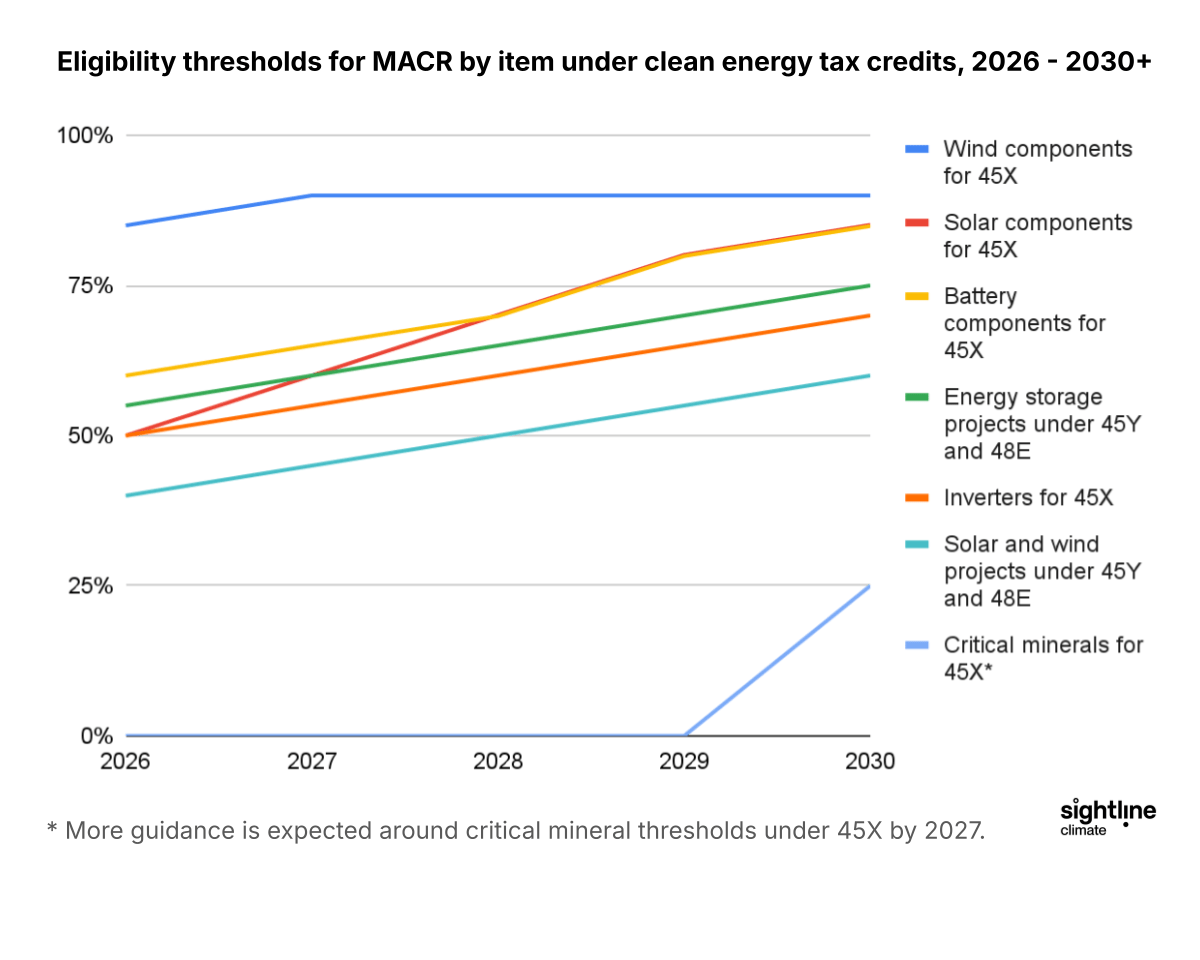

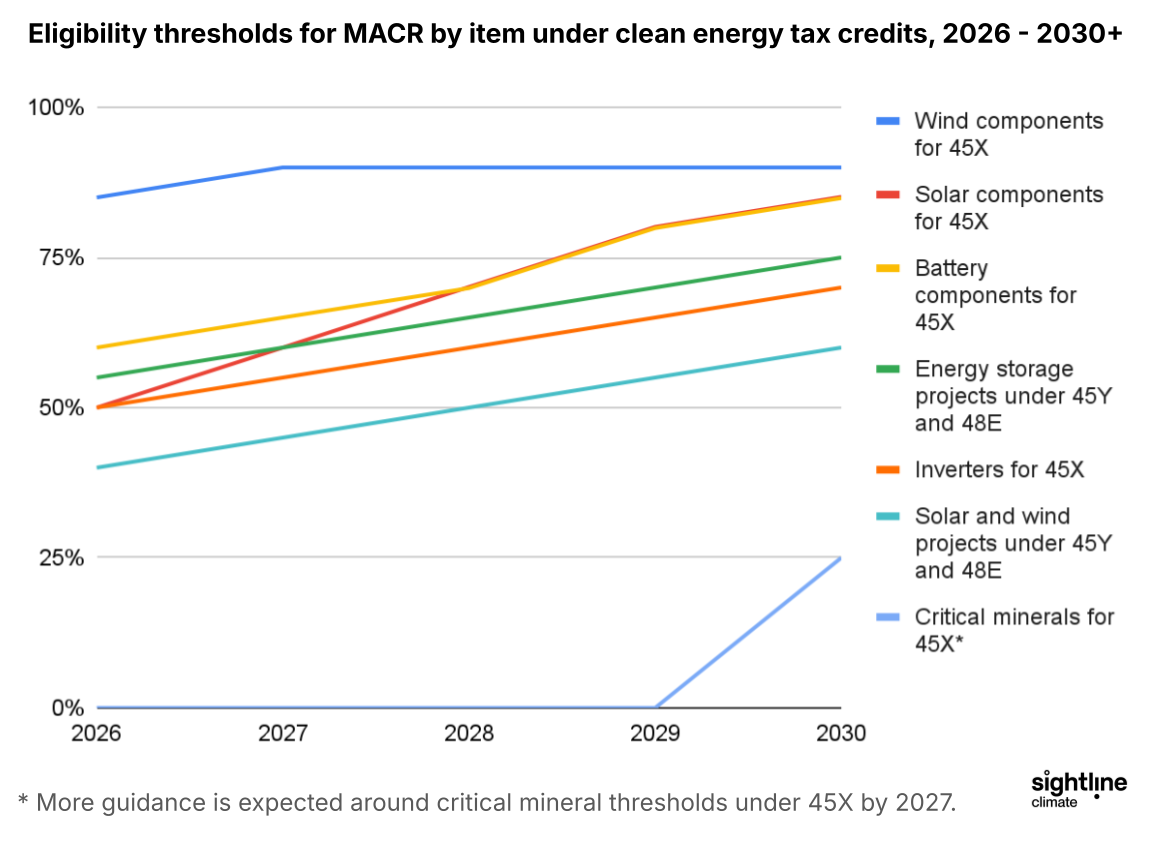

This provision is designed to push clean energy projects away from Chinese supply chains. China is the dominant producer of solar and battery components and systems, and processes the majority of most of the world’s critical minerals. However, supply chains can’t turn on a dime. Wind projects have the most non-PFE options, and therefore the highest MACR. Similarly, critical minerals are intensely reliant on Chinese processors and are given the most grace, though the IRS is planning to release new percentages in 2027 that will replace these.

Impact: While a ramp is helpful to the industry, these are still tight timelines. Factories can take years to be built, especially if companies with the most experience in manufacturing the components (usually Chinese producers) are excluded. Non-PFE manufacturers need to start ramping up capacity now in order to meet demand. The most likely result of this rapid ramp is that it pushes FIDs to post-2030, or kills the least competitive projects altogether. However, it will be a boon for domestic manufacturers with empty order books.

2. Allows use of “safe harbors” for compliance

Safe harbors protects the near-term clean power project pipeline, and the provisions have brought some welcome simplicity to the process. Lists of covered components, assigned percentages, and the ability to rely on supplier certifications reduce the administrative burden on projects. According to LevelTen’s Q4 2025 survey of developers, representing more than 233GW of planned capacity, over 75% of wind and solar projects with commercial operation dates (COD) through the end of 2028 have already been safe-harbored.

The outlook shifts for projects coming online in 2029 and beyond. These projects are far less likely to qualify for safe harbor and will instead need to actively meet rising MACR sourcing thresholds. As requirements increase toward 60%+ for electricity projects and 75%+ for storage by 2030, compliance becomes more complex just as a larger share of the pipeline enters this higher-risk window.

Impact: Avoids the need to trace every upstream subcomponent or raw material, and reduces the due diligence burden (for now). This is good for development timelines, but potentially bad for all the ESG reporting startups that were planning to pivot to bringing clarity to complex supply chain disclosures. But still a small consolation for developers trying to re-format their entire supply chain in four years.

3. Gives preliminary guidance on ownership and control

This provision provides some clarity but leaves key ownership-tracing and financing structure questions unresolved, mostly about what specifically a “foreign influenced entity” is. That leaves some legal risk for developers and investors, although the IRS noted it will provide more information soon.

Still, the guidance listed penalties for noncompliance: a 6-year audit period (rather than 3 years), and a 20% penalty if a miscalculation causes the taxpayer to underpay by more than 1% of the correct tax amount.

Impact: This reinforces the effort to isolate any and all influence of PFEs, but will make a lot of developers shy about making any decisions at all, with the threat of changes and severe penalties if they get it wrong. More wait and see.

Key takeaways

- More workable than feared. The guidance shifts the market from a de facto “avoid China entirely” posture to a cost-weighted compliance model. By allowing reliance on table-listed components and structured certifications, rather than tracing every upstream subcomponent, the Treasury made compliance painful but workable.

- Financing remains cautious. While MACR calculations are now more workable, uncertainty around “effective control,” ownership tracing, and future anti-circumvention rules continues to create lender hesitation, which will stunt new project finance. Credit buyers and tax equity providers are highly sensitive to recapture and audit risk, particularly given the 6-year audit window and potential penalty exposure.

- Key ownership and influence questions are still open. The notice previews how contractual control and licensing arrangements may be treated but stops short of comprehensive rules on foreign influence, constructive ownership, and complex financing structures. Until those definitions are finalized, a lot more FIDs will remain on hold.

Special thanks to Hasan Nazar from Crux for helping unpack these tax implications.

Deals of the Week (2/9-2/16)

VC / Growth

⚡ Inertia, a Livermore, CA-based laser-based commercial fusion energy developer, raised $450m in Series A funding from Bessemer Venture Partners, GV, Modern Capital, and Threshold.

✈️ Skyryse, an El Segundo, CA-based aviation automation developer, raised $300m in Series C funding from Autopilot, ArrowMark Partners, Atreides Management, BAM Elevate, Baron Capital, and other investors.

⚡ Tem, a London, England-based renewable energy marketplace, raised $75m in Series B funding from Lightspeed Venture Partners, AlbionVC, Allianz, Atomico, Hitachi Ventures, Revent, and other investors.

⚡ Neara, a Sydney, Australia-based critical infrastructure digital twin modeling software, raised $64m in Series D funding from TCV, EQT, Partners Group, Skip Capital, and Square Peg Capital.

🏠 metiundo, a Berlin, Germany-based smart metering developer, raised $48m in Series A funding from Octopus Energy Generation.

⚡ Alva Energy, a Cambridge, MA-based nuclear project developer, raised $33m in Series A funding from Playground Global, 8VC, Alumni Ventures, Mercator Partners, Logos, and other investors

⚒️ Hades Mining, a Munich, Germany-based sustainable mining technology developer, raised $18m in Seed funding from HV Capital, Headline, FounderLake, Founders Factory, Interface Capital, and other investors.

♻️ Hauler Hero, a New York, NY-based AI-powered waste management software, raised $16m in Series A funding from Frontier Growth, K5 Global, and Somersault Ventures.

⚡ Mitra EV, a Los Angeles, CA-based commercial fleet electrification platform, raised $14m in Series A funding from Ultra Capital and $14m in Debt funding from S2G Investments.

⚡ Capalo AI, a Helsinki, Finland-based battery trading and optimization platform, raised $13m in Series A funding from Heartcore Capital, Innovestor, Inventure, PROfounders, Tesi, and other investors.

🥩 Green Rebel, a Kota Tangerang Selatan, Indonesia-based plant-based meat alternatives producer, raised $13m in Seed funding from AgFunder, Teja Ventures, and Unovis.

⚡ WTenergy, a Barcelona, Spain-based plastic pyrolysis recycling provider, raised $12m in Seed funding from Suma Capital, Cemex Ventures, and Shell Ventures.

🛰 Apeiron Labs, a Cambridge, MA-based autonomous ocean monitoring software for carbon emission, raised $10m in Series A funding from DYNE Ventures, RA Capital Management, S2G Investments, Assembly Ventures, Bay Bridge Ventures, and other investors.

♻️ Uplift360, an Esch-sur-Alzette, Luxembourg-based advanced materials recycling service provider, raised $9m in Seed funding from Extantia, Fund F, NATO Innovation Fund (NIF), and Promus Ventures.

🧪 Dionymer, a Pessac, France-based biodegradable polymers developer, raised $8m in Seed funding from UI Investissement, AFI Ventures, AQUITI Gestion, BNP Paribas Développement, Bpifrance, and other investors.

⚡ HAMR Energy, a Melbourne, Australia-based low-carbon fuels developer, raised $7m in Series A funding from Airbus, Qantas Climate Fund, and Thyssenkrupp Uhde.

💨 Geolinks Services, a Paris, France-based geophysical monitoring platform, raised $7m in Seed funding from Calderion, BRGM Invest, Bpifrance, and EIT InnoEnergy.

⚡ Powerline, a San Francisco, CA-based energy assets monitoring and operation platform, raised $7m in Seed funding from MaC Venture Capital, LG Technology Ventures, J-Impact Fund, Alumni Ventures, CLAI Ventures and other investors.

⚡ Derapi, a Jackson, WY-based distributed energy platform, raised $7m in Seed funding from Earthshot Ventures, Aurora, Breakthrough Venture Capital, GreenSky Capital, M1C, and other investors.

🥩 Evergreen Connect, a Thousand Oaks, CA-based cultivated meat developer, raised $6m in Series A funding from Bold Capital Partners, Good Startup, and S2G Investments.

🏠 Gorlem, a Chiyoda-ku, Japan-based AI-driven construction and building optimization service provider, raised $5m in Seed funding from ANRI, Hankyu Hanshin Real Estate, MIRAITRONC, Shimizu Corporation, and Takenaka Corporation.

🤖 Upside Robotics, a Waterloo, Canada-based agtech robot developer, raised $5m in Seed funding from Plural and Garage Capital.

Project Finance / Debt

🔋 NineDot Energy, a New York, NY-based energy storage developer, raised $431m in PF Debt funding from Natixis Corporate & Investment Banking.

☀️ Grenergy, a Madrid, Spain-based renewable energy developer and independent power producer, raised $355m in Project Finance Debt from BNP Paribas, Banco Santander and Rabobank.

⚡ Revera Energy, a London, England-based renewable energy developer, raised $150m in Debt funding from Nomura.

🚗 Drivn, a Gurgaon, India-based electric vehicle leasing platform, raised $80m in Debt funding from Nomura.

💰 Enfinity Global, a Miami, FL-based renewable energy developer and independent power producer, raised $65m in Debt Funding from Eiffel Investment Group.

🔋 TWAICE, a Munich, Germany-based battery analytics software, raised $28m in Debt funding from the European Investment Bank (EIB).

Exits

🏠 LiquidStack, a Carrollton, TX-based liquid cooling solutions developer, was acquired by Trane Technologies for an undisclosed amount.

💨 Eion Carbon, a Princeton, NJ-based enhanced rock weathering carbon removal service provider, was acquired by Terradot for an undisclosed amount.

♻️ Allwood Recycling Solutions, a Warwick, England-based waste management service provider, was acquired by Papilo for an undisclosed amount.

🌳 Inflor, an Orlando, FL-based forest management software, was acquired by Remsoft for an undisclosed amount.

⚡ FM Conway, a Sevenoaks, England-based infrastructure service provider, was acquired by ubitricity for an undisclosed amount.

This is a sample of deals available for Sightline clients. Can’t get enough deals?

In the News

The EPA repealed the landmark 2009 “endangerment finding”, the scientific and legal basis that greenhouse gases threaten public health, one of the EPA’s most powerful tools to regulate climate change. The administration calls the rollback the biggest deregulation in US history, while scientists and policy makers warn it will increase pollution, weaken climate protections, and prompt court challenges.

The administration also directed the Pentagon to sign long-term contracts for coal power, allocating $175m to keep aging plants online, while framing the move as essential for grid reliability and national security. The intervention seeks to slow coal’s decline, even as market forces continue to favor cheaper natural gas and renewables.

In the EU, carbon prices fell sharply to their lowest levels since late 2025, after German Chancellor Friedrich Merz suggested revising or delaying the bloc’s carbon market. The slide reflects rising political and industry pressure on the EU carbon market and potential policy shifts that could weaken its climate policy.

Responding to this sentiment, hydrogen industry groups warn that a proposed suspension of CBAM could slow clean hydrogen and ammonia projects, undermining price stability and long‑term market predictability. They argue maintaining a clear, consistent CBAM is key to attracting decarbonization investment.

In other European news, ArcelorMittal confirmed a $1.5bn plan to build a large electric arc furnace (EAF) at its Dunkirk steelworks, aimed at producing much lower-carbon “green steel.” Up to 50% of the project’s capex will be covered by French government energy-efficiency support, key to help decarbonize heavy industry.

The Port of Immingham launched the UK’s first commercial biomethanol bunkering service, enabling ships to refuel with low-carbon methanol. It’s a significant step for maritime decarbonization, as operators see biomethanol as a practical fuel alternative to cut emissions in shipping’s hard-to-abate segments.

In automaker news, Ford is pivoting its Kentucky battery plant from EV production to stationary storage. The shift comes as policy uncertainty, including FEOC restrictions, complicates incentives for both EVs and grid-scale batteries.

Pop-up

Fervo just turned up the heat, literally.

The Patriots and EVs, the Super Bowl's big losers.

The world wants more power, and cleaner power, too, per the IEA/

In the race for rare earths, Japan goes with deep sea mud.

A lost satellite turns up the heat on invisible emissions.

Bad Bunny shines a spotlight on Puerto Rico’s fragile grid.

Prime Coalition's investor-grade climate data just went open access.

World’s first 400 megawatt-hour storage station powers up grid storage.

Opportunities & Events

📅 CFF & NY Climate Tech Meetup: On Febuary 17th from 6-8pm @ OCabanon in New York City connect with climate professionals and filmmakers from the Climate Film Festival (CFF) and Climate Tech Cities. Celebrating the launch of the CFF’s third open call meet new friends, collaborators and colleagues.

💡 Brainforest Venture Program: Apply by March 9th to participate in a 10 week hands-on acceleration program for forest & biodiversity solutions, work 1on1 with mentors, connect with their network of industry professionals, and pitch your venture in Zurich from June 1-12 for the chance at funding.

📅 Climatebase Fellowship: The Climatebase Fellowship is a 12-week accelerator for ambitious professionals ready to level up their careers climate, energy and sustainability. Find your next role, expand your network and knowledge, or build something new. RSVP for the Cohort 9 info session on February 18.

Jobs

Junior Account Executive, @3V Infrastructure

Associate, @Foundry-Logic, Inc.

Summer Research Intern, Senior Associate – Clean Fuels, Principal Analyst – Data Centers and Power Markets, Data Analyst – Late-Stage Finance, @Sightline Climate

Associate, @Prelude Ventures

US Program Director, UK Programme Manager, Operations Manager, @Constructive

📩 Feel free to send us deals, announcements, or anything else at hello@ctvc.co. Have a great week ahead!