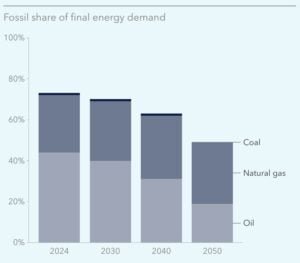

According to DNV’s 2025 Energy Transition Outlook, North America is on a slow but steady path toward a low-carbon future. The forecast shows fossil fuels will fall from 72% of final energy demand in 2024 to 45% by 2050, and further to 31% by 2060.

While the U.S. has seen policy shifts and slower progress due to changing political priorities, Canada’s energy policies remain relatively stable. Together, the two nations continue to move toward decarbonization, driven by clean technology investments and rising public support for sustainable energy.

U.S. Faces Fuel Security and Supply Chain Hurdles

The U.S. nuclear sector faces a different challenge — fuel dependency. As of 2023, the U.S. imported 99% of its uranium, with nearly one-third sourced from Russia, Uzbekistan, and Kazakhstan — countries with complicated diplomatic relations.

Developing a domestic nuclear fuel production capability has become a priority. The DOE is investing in research to expand uranium mining, enrichment, and HALEU production. These efforts are crucial for the future success of the SMR program and national energy security.

Until SMRs become commercially viable in the early 2030s, U.S. nuclear capacity growth will primarily come from reactor life extensions and the reopening of mothballed plants, such as Three Mile Island in Pennsylvania.

Nuclear Power Boost and Support Across the Continent

In this backdrop, nuclear power is enjoying its strongest public and political backing in a decade. In both the U.S. and Canada, nuclear energy is being recognized for its reliability and role in achieving net-zero targets.

In Canada, nuclear is the second-largest source of non-emitting electricity and contributes significantly to reducing carbon emissions. Ontario leads the way, with nuclear supplying nearly 60% of its total electricity. The province continues to invest in maintaining and extending reactor lifespans to ensure energy security and meet climate goals.

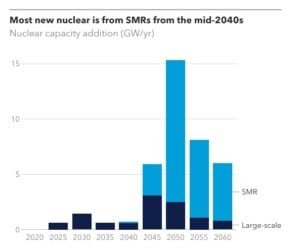

Despite this renewed interest, DNV notes that nuclear power’s near-term growth will be modest. However, its long-term outlook is strong, with nuclear capacity projected to increase from 115 gigawatts (GW) today to 232 GW by 2060. Most of this growth will come after 2045, primarily from Small Modular Reactors (SMRs).

SMRs: The Future of North American Nuclear Energy

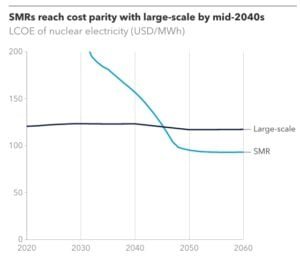

Large-scale nuclear projects have struggled in recent decades with cost overruns, construction delays, and public opposition. Even with continued policy incentives under the Inflation Reduction Act and Bipartisan Infrastructure Law, big reactors are costly, slow to build, and difficult to integrate with flexible renewable grids. These challenges make new large-scale reactors (LSNs) impractical for the short term.

Modern energy systems increasingly require power sources that can ramp up and down quickly to complement solar and wind. Large reactors lack this agility. SMRs, by contrast, can operate flexibly, be built faster, and support grid stability in renewable-heavy systems.

- Each SMR unit typically produces around 100 MW, making financing and construction more manageable than billion-dollar LSN projects.

DNV forecasts that SMRs will reach cost parity with large reactors by around 2045. Their modular design reduces construction risks, while their operational flexibility allows them to ramp up or down quickly — a crucial feature for grids with high solar and wind penetration.

Though still in the development phase, SMRs are advancing rapidly. Strong backing from the U.S. Department of Energy (DOE) and the Canadian government is accelerating research and demonstration projects.

Canada’s SMR Leadership and the Darlington Advantage

Canada is emerging as the North American frontrunner in SMR technology. The Darlington SMR project in Ontario, led by Ontario Power Generation (OPG) and funded partly by the Canada Infrastructure Bank, is on track to become the first grid-scale SMR in North America by 2030.

- Once built, the SMR will reduce carbon emissions by an average of 740 kilotonnes annually between 2029 and 2050.

This milestone could position Canada as a global leader in modular nuclear deployment. However, challenges remain. Canada currently lacks the facilities to produce HALEU (High-Assay Low-Enriched Uranium), the fuel needed for most SMR designs.

While Canada has strong uranium reserves and manufactures fuel for its traditional CANDU reactors, it must still develop a domestic HALEU supply chain to maintain its early-mover advantage in SMR deployment.

Key Projects and Timelines

Maritime Nuclear: A New Frontier for Clean Energy

Beyond the grid, DNV forecasts that nuclear energy could power up to 10% of North America’s maritime and near-shore energy demand by 2060 — up from an estimated 3.5% by 2050.

The maritime sector faces mounting pressure to decarbonize under the International Maritime Organization’s Net Zero by 2050 goals. SMRs could provide a solution, offering a zero-emission, high-density energy source for shipping and port operations.

Some developers are exploring floating SMR concepts capable of supplying clean power to docked vessels, reducing local air pollution, and protecting coastal ecosystems.

However, nuclear adoption in maritime transport faces high capital costs, complex financing models, and regulatory barriers. Nuclear-powered ships would require new rules and safety frameworks, particularly in countries with stringent oversight like the U.S. and Canada.

Still, advocates argue that the combination of energy density, low emissions, and efficiency makes nuclear an attractive option for a future low-carbon shipping industry.

Policy, Regulation, and Competitiveness

Regulatory complexity remains a major obstacle for both land-based and maritime nuclear expansion. Compared to countries like China, North America’s safety and environmental regulations add significant costs and time to nuclear construction.

A recent bipartisan push in the U.S. to revitalize domestic shipbuilding for national defense could help reduce barriers and provide incentives for SMR integration into shipyards. Yet, to compete globally, U.S. manufacturers will need to improve both shipbuilding capacity and SMR cost efficiency — a difficult combination to achieve in the near term.

The Long Road to 2060

DNV’s analysis paints a realistic, not overly optimistic, picture. The energy transition is happening, but slowly. Fossil fuels remain dominant in the near term, but nuclear, renewables, and clean fuels will take an expanding share of the mix.

By 2060, North America could see a fully integrated clean energy system, with flexible SMRs supporting renewables, new fuels decarbonizing industry and transport, and fossil fuels pushed to the margins.

The message is clear: the energy transition is inevitable but uneven. Governments, investors, and innovators that act early on SMRs and clean technologies will define the region’s next industrial wave.

- FURTHER READING: Canada’s Nuclear Boom: Big Investments in CANDU and SMRs

The post From Now to 2060: How Canada’s SMRs and Maritime Nuclear Power Will Drive a Net-Zero Future appeared first on Carbon Credits.