Google Cloud and NextEra Energy have expanded their long partnership with a major new deal. They plan to build several gigawatt-scale data center campuses across the United States. Each campus will have its own power generation and energy storage. This setup is meant to keep up with fast-growing artificial intelligence (AI) and cloud demand while making energy use cleaner and more reliable.

Google Cloud will also use NextEra’s power systems to support its enterprise AI and digital transformation services. The companies said the partnership links large new data centers with modern grid tools. They aim to produce cleaner electricity and use AI to manage it more efficiently.

The agreement reflects a wider trend: large tech firms now shape where new power plants, storage, and grid upgrades are built.

Inside the Google–NextEra Power Buildout

The partnership included several new details. NextEra and Google will co-develop multiple U.S. data center campuses at a gigawatt scale. Each site will have dedicated generation and storage, which means the campuses can match their own high electricity demand without adding stress to local grids.

Google Cloud will use NextEra’s solutions for its data centers and enterprise AI services. These tools help businesses run AI systems while using clean energy. Thomas Kurian, Google Cloud CEO, said:

“By infusing NextEra Energy’s deep domain expertise with Google Cloud’s AI infrastructure, platform, and models, we can together support the digital future of energy infrastructure.”

A major part of the deal is a new AI grid-management tool. The companies plan to launch it on the Google Cloud Marketplace by mid-2026. The tool will help grid operators predict equipment failures and improve power-system performance. It will also help forecast electricity demand, which is rising fast due to AI workloads.

The announcement did not share full financial details. However, it confirmed that the work involves new renewable power, large batteries, and grid services that fit the size of Google’s expanding data center fleet.

Why Gigawatt Campuses Could Reshape Grids and Communities

Data centers use a lot of electricity. AI systems need even more power to run large models and process data. Building gigawatt-scale campuses with their own generation and storage helps meet these needs. It also reduces the chance of shortages or strain on local grids.

Sites of this size can bring jobs and tax revenue to nearby communities. Construction brings thousands of temporary roles, and ongoing operations create long-term technical and support jobs. Local businesses often see new demand for services.

These large campuses may also require transmission upgrades. While upgrades can help the wider grid, they also require planning, permitting, and more investment from utilities and regulators.

What Surging AI Demand Means for U.S. Energy Markets

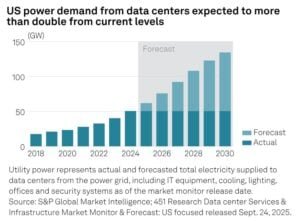

The new deal comes at a time when U.S. data center power demand is rising at historic rates. S&P Global projects that U.S. datacenter grid demand will climb 22% to 61.8 GW by the end of 2025. By 2030, demand is expected to more than double to 134.4 GW.

Certain states are seeing sharp growth:

- Virginia may reach 12.1 GW in data center demand in 2025, a 30% jump from last year.

- Texas may reach 9.7 GW over the same period.

Utilities also expect “hyperscalers” such as Google to add a major new load. In American Electric Power (AEP) territory alone, new demand from these firms may reach 18 GW by 2030.

NextEra said this demand surge has already helped it raise its earnings guidance. The company updated its 2025 adjusted EPS forecast to $3.62–$3.70, up from $3.45–$3.70. It also raised its 2026 adjusted EPS forecast to $3.92–$4.02, up from $3.63–$4.00. Management linked these increases directly to the growth of AI and data center electricity needs.

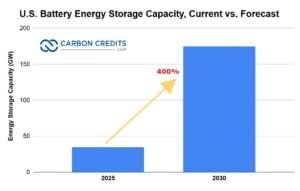

Battery storage also plays a major role. It helps smooth out peaks in demand and supports grids as more renewable power comes online. Forecasts now show U.S. battery capacity could reach 140–175 GW by 2030. Current capacity is around 35 GW.

Some regions may add large amounts on their own: ERCOT in Texas and CAISO in California may each reach 40 GW, while PJM could reach 30 GW.

SEIA recommends around 700 GWh, equal to roughly 140 GW of 5-hour battery systems. Wood Mackenzie projects 450 GWh under a baseline case and 600+ GWh under an aggressive case. These numbers show how fast energy systems are expanding to keep up with tech growth.

Still, the sector faces risks. Higher interest rates raise borrowing costs. Transmission bottlenecks slow project timelines. Policy changes and tax-credit updates can also affect financing. Even large partnerships do not remove these risks.

How Google Is Scaling Clean Power to Hit Its 2030 Goals

Google has been one of the world’s largest corporate renewable energy buyers for more than a decade. From 2010 to 2025, the company signed more than 170 clean energy agreements totaling over 22 GW. Recent deals include a large solar power purchase in Ohio that will deliver 1.5 TWh of energy from TotalEnergies.

- READ MORE: Google and TotalEnergies Unlock Carbon-Free Future for Ohio Data Centers with 15-Year Solar Deal

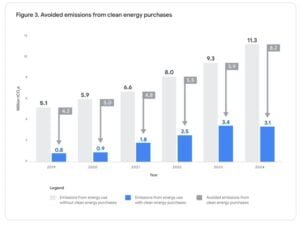

Google aims to reach net-zero emissions by 2030 across its operations and value chain. It also has a “24/7 clean energy” goal. This means the company wants every data center to run on carbon-free electricity at all hours of the day. Its clean energy purchases avoided over 8 million metric tons of CO2e.

Google’s 2025 sustainability update reported a 12% drop in data center emissions in 2024, even as compute demand rose. The company uses efficiency upgrades, long-term clean-energy contracts, and carbon removal credits.

Yet, total emissions have still grown since 2019 because the business expanded, and AI needs have increased. Google says it plans to lower overall emissions and rely on removals only for residual amounts.

A New Blueprint for Tech–Utility Energy Deals

The partnership shows how the energy and tech sectors are starting to work together in new ways. It mixes power development with AI-based grid tools. If the companies’ mid-2026 AI product performs well, it could help utilities reduce outages, speed repairs, and plan power flows more accurately.

This model may shape future corporate energy deals. Companies may prefer integrated solutions that combine generation, storage, transmission support, and software. Such models aim to match energy supply with high data center demand from the start, but success will depend on cost, local approvals, and regulatory support.

What This Partnership Signals for the Future of AI Power Demand

NextEra and Google Cloud have expanded their partnership at a time of rising AI and data center demand. The plan includes gigawatt-scale campuses, new clean energy generation, and a coming AI tool to support samarter grids.

Strong electricity demand and new battery storage forecasts suggest the sector will continue to scale quickly. In a separate deal, NextEra Energy also worked with Meta to secure 2.5 GW of solar and battery storage across ERCOT, SPP, MISO, and New Mexico.

Their long-term agreements will power Meta’s data centers, support U.S. grid reliability, and expand Meta’s renewable energy portfolio, with projects starting in 2026–2028.

If the companies meet their targets, this partnership may become a model for how tech firms and energy developers build the next generation of clean, high-power data centers.

The post Google and NextEra Team Up to Build Gigawatt-Scale AI Data Centers Powered by Clean Energy appeared first on Carbon Credits.