Mark S. Brooks is a venture investor, entrepreneur, and climatologist who’s backed transformative agtech and climate innovations. As former Managing Director of FMC Ventures and an investor at Syngenta Ventures, he now explores new leadership opportunities at the intersection of risk capital and planetary health innovation.

The views expressed in this article are the author’s own and do not necessarily represent those of AgFunderNews.

Our time’s greatest challenge is often said to be climate change, but an even deeper challenge exists: how we allocate risk capital that turns climate ambition into reality.

This article traced the evolution of agtech from the “Caloricene” to the “Holoagricene,” suggesting that breakthrough innovation demands not only new technologies but a complete rethinking of how it gets funded.

Compounding the issue is the fact that innovation at the major ag companies is falling behind. Some are cutting their R&D budgets, while even those with steady spending see their real investment in innovation decline as inflation erodes purchasing power.

A yawning innovation gap is widening as patent expirations outpace new discoveries and generics gain market share. This further exacerbates the shortage of M&A transactions and startup exits—vital mechanisms for attracting risk capital and entrepreneurs.

Agtech isn’t alone; other climate-facing sectors, including food and energy, face the same bottleneck.

The trillion-dollar opportunities of our time lie in these sectors. Yet, explosive growth, high valuations, and generational impact remain elusive. Traditional venture capital, designed for rapid exits and short-term returns, is misaligned with the patient, long-term capital these sectors require.

Reengineered funding models are needed in order to enable long-term, generational impact. Imagine models that mirror the long gestation periods and positive impacts of the innovations they fund.

So how do we unlock trillion-dollar opportunities in ag, food, energy, and climate within our lifetime?

Consider the these options.

Evergreen funds: Patient capital for lasting impact

Evergreen funds represent a departure from traditional, time-bound venture capital. Instead of operating on fixed 10-year cycles with forced exits, evergreen funds are designed to be perpetual. They recycle returns over decades, compounding the impact. This patient capital model aligns with the long development cycles required for breakthrough innovations in ag, food, energy, and climate.

Open-ended structure:

Evergreen funds have a 20- or 30-year horizon; some may not even have a predetermined lifespan. Investors can access liquidity through periodic windows, secondary markets, dividends, or revenue share from portfolio companies. This open-ended structure allows companies to mature naturally without forced exits, which is essential for sectors where transformational impact unfolds over generations.

Reinvestment for compound impact:

As returns are realized, they are continuously reinvested for future growth. This continuously compounds impact, nurturing an ecosystem of companies that collectively drive systemic change.

Long-Term Alignment:

Value creation over the long-term is recognized as being more important than quick wins. Evergreen funds incentivize both investors and founders to pursue strategies that deliver lasting financial returns alongside positive impact on the planet.

Early-stage consolidation & rollups: building ecosystem champions

Traditional venture funding scatters capital across individual startups, leading to fragmented solutions and duplicated efforts. Instead of funding isolated companies, early-stage consolidation and rollups offer a powerful alternative by surgically merging complementary startups into unified platforms.

This creates scale, operational synergies, and the potential to birth category-defining companies. This isn’t just about combining balance sheets—it’s about optimizing entrepreneurial energy within a well-defined opportunity space.

Ecosystem approach:

Instead of betting on single, standalone companies, this model unites startups that address different facets of a shared challenge. For instance, merging a bioinformatics startup with a trait discovery company and a peptide innovation startup can create an integrated solution with enhanced unit economics and competitive strength.

Accelerated scale:

By pooling resources and expertise early on, consolidated platforms can scale more rapidly than their individual counterparts. This integration not only reduces overhead but also fosters innovation through cross-pollination of ideas and technologies.

Why it works for investors and entrepreneurs:

For entrepreneurs, this provides access to shared resources, expertise, and faster market entry by combining assets, scaling efficiently, and improving economics. For investors, early-stage rollups offer diversified exposure to a consolidated high-growth platform, reducing the risks associated with fragmented investments and delivering greater potential returns.

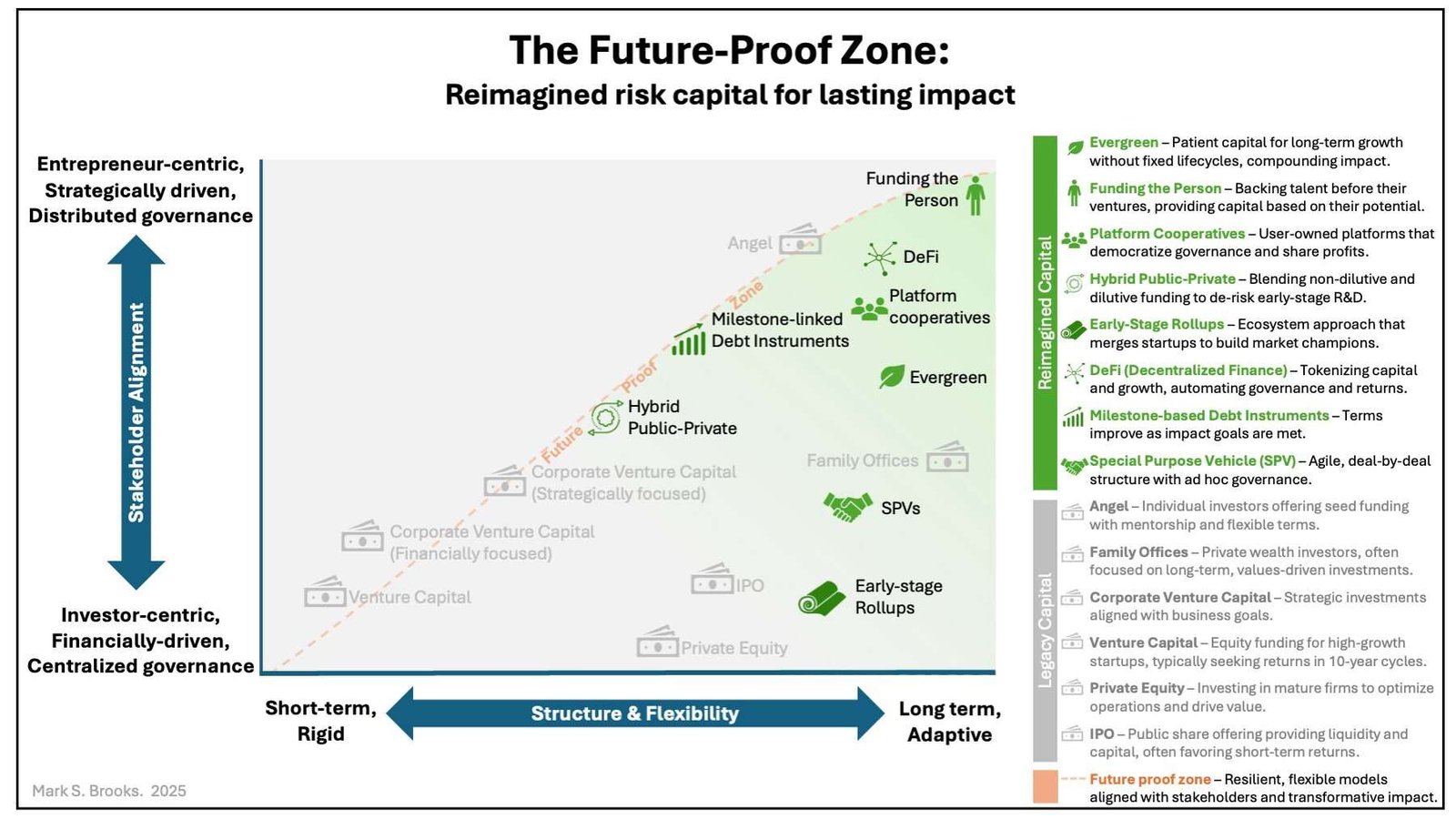

The Future-Proof Zone unlocks financial and generational impact

Emerging funding models can offer the necessary flexibility for the profile of innovations that we need while aligning stakeholder interests.

The challenge lies in striking the right balance between structure and adaptability. The Future-Proof Zone maps where various capital models fall on the spectrum of flexibility, governance, and stakeholder alignment—helping investors and entrepreneurs identify approaches that deliver both financial returns and long-term impact.

Framework to reimagine capital models

Investors, entrepreneurs, and policymakers can adapt these and other models for their unique circumstances. Specific elements to consider include:

1. Time Horizon and flexibility: short-term versus long term, rigid versus adaptive

- This dimension captures whether a model operates on quick exits or extended timelines, and how readily it can adjust to changing conditions. Models further right on the x-axis allow for more patient investment and agile adaptation. Models like Evergreen Funds align better with these extended timelines.

- Key question: How long does the innovation need to mature?

- Considerations: Determine the right balance between commitment and agility. Special Purpose Vehicles (SPVs), for example, offer a flexible, deal-by-deal investment approach, while evergreen funds recycle capital continuously.

2. Stakeholder alignment: investor-centric versus entrepreneur/community-centric

- This dimension focuses on who holds power and reaps the benefits. Models higher on the y-axis (e.g., platform cooperatives, DeFi) allow for more democratized power, while traditional VC generally prioritizes investors’ interests.

- Key question: Who should have control over decision-making, and how are interests aligned?

- Considerations: Funding models vary from investor-centric (traditional funds) to more distributed or community-driven (platform cooperatives or DeFi). Aligning the incentives of founders, investors, and broader stakeholders is crucial for long-term impact.

3. Impact Integration: financial-only versus mission-driven returns

- This dimension measures how strongly financial returns are tied to social and environmental outcomes. Some instruments (e.g., impact-linked convertibles) reward sustainability milestones, while others focus solely on ROI.

- Key question: How is impact built into the financial incentives?

- Considerations: Impact-linked instruments and blended funds tie returns to measurable milestones, ensuring that financial rewards are directly linked to real-world outcomes.

4. Governance & Accountability: centralized versus distributed decision-making

- This dimension addresses how decisions are made and enforced. Governance can range from top-down (traditional funds) to more democratic or algorithmic (platform cooperatives, DeFi). Strong accountability mechanisms help mitigate risk and build stakeholder trust.

- Key Question: Who sets strategy, and how is decision-making power shared or delegated?

- Considerations: Are there clear processes for oversight and conflict resolution? Does the governance model encourage transparency and collaboration, or is it primarily controlled by a few key players?

The path forward

By adopting these reimagined funding models, we can realign our financial ecosystem with the true pace and potential of breakthrough innovation in ag, food, energy, and overall climate. Evergreen funds offer the patient, long-term commitment needed to nurture transformative ideas, while early-stage consolidation and rollups create operational synergies that build scalable market champions.

In rethinking how we finance progress, we aren’t just plugging a funding gap—we’re creating a new framework for growth. This is how we transform the promise of ag, food, energy, and climate innovations into the trillion-dollar opportunities of our time.

Early adopters won’t just drive change—they’ll define markets. The opportunity is clear, the time is now. Will you be one of the pioneers?

The post Guest article: how to unlock trillion-dollar opportunities in agrifood and climate within our lifetime appeared first on AgFunderNews.