[Disclosure: AgFunderNews’ parent company is AgFunder.]

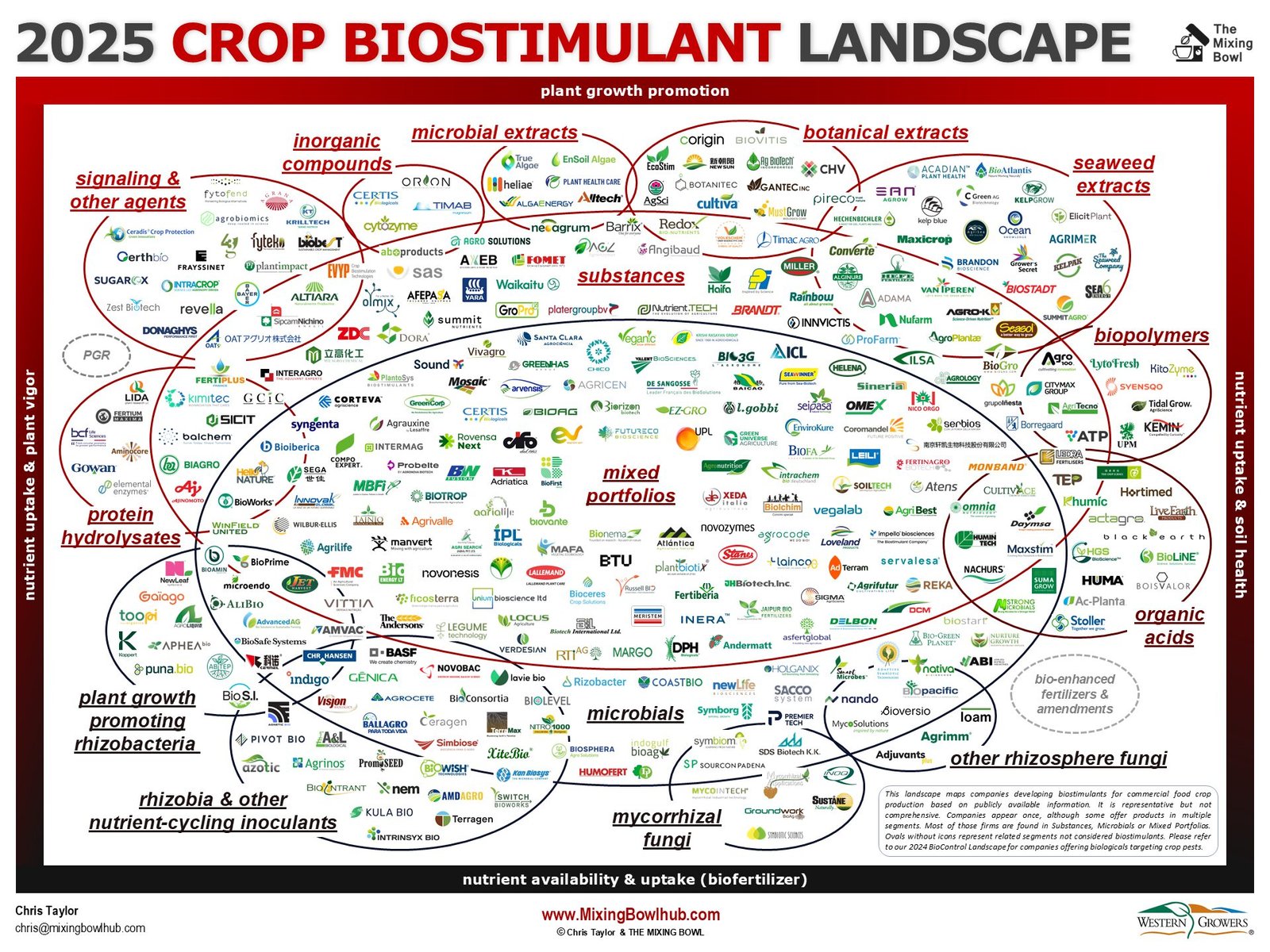

One thing that’s clear from The Mixing Bowl’s latest market map: the crop biostimulant space is incredibly crowded.

Unveiled at the 2025 Salinas Biological Summit this past June, the 2025 Crop Biostimulant Landscape crams 350 companies into 12 “active ingredient” categories to offer a high-level view of who’s doing what in this area of ag biologicals.

The entire ag biologicals market is expected to be worth $19.6 billion by 2027, with biostimulants accounting for about $7.6 billion of that, according to Dunham-Trimmer data shared during the Salinas conference.

Biostimulants are substances or microorganisms used to boost productivity and resiliency in crops. Whereas biofertilizers supply nutrients directly to the plant, and biocontrols target pests, biostimulants activate processes already naturally present in the plant to improve nutrient uptake and efficiency, stress tolerance, and yield, among other things.

These products are increasingly seen as potential alternatives at a time when regulations have tightened on traditional chemicals, which are also linked to environmental degradation and problems with human health.

Chris Taylor, a partner at The Mixing Bowl, says interest in biostimulants has been “extraordinary,” though the space continues to be “a challenging one to navigate for everyone.”

“While we try to be representative, the landscape is far from exhaustive,” he says of the new biostimulants map. “The sheer number of offerings, combined with loose terminology, lagging regulation, and multi-functional ingredients and products make it a complex sector for manufacturers, retailers, advisors and producers alike.”

A fluctuating funding environment

Funding for ag biologicals has also been a challenge of late.

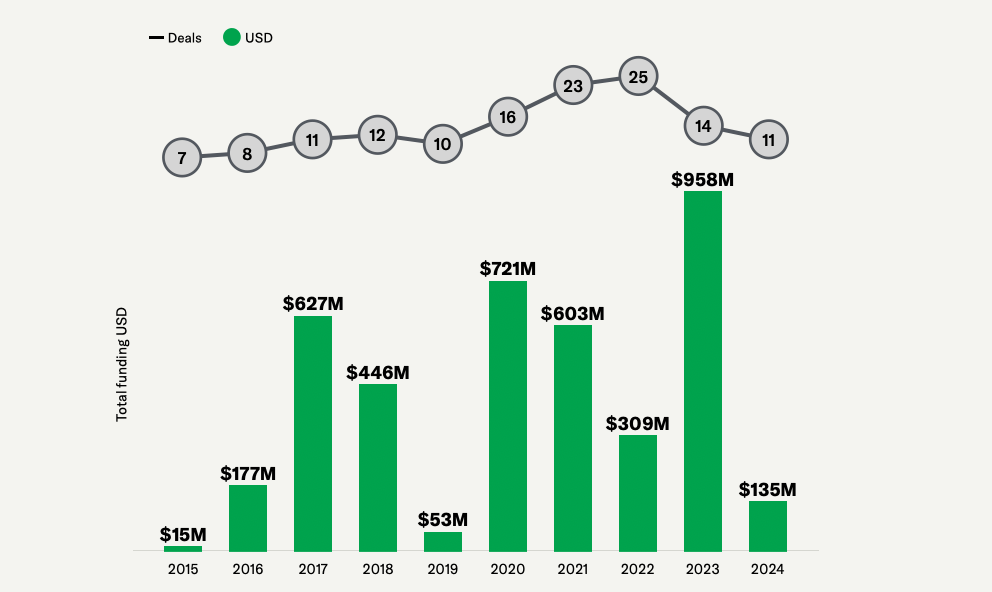

According to AgFunder data, VC funding to biostimulants dropped 86% in 2024 to just $135 million. The decline reflects broader trends not just in agtech but across multiple industries, and is no doubt partially due to ongoing uncertainties in trade and the political arena.

That said, consolidation and partnerships are ongoing, as established agricultural companies invest in innovation and try to expand their biological product portfolios, and startups seek partnerships to accelerate development and expand market access.

A decade of investment in biostimulants

Since 2015, startups listed on The Mixing Bowl’s biostimulants map have jointly raised a total of $4.2 billion. Of the 350 companies, 50 presented funding information for a total of 159 rounds.

Investment into biostimulants has fluctuated over the years, due in no small part to the weight of large deals over the total. In 2021, for example, Pivot Bio’s $430 million Series D accounted for a huge chunk of the total raised that year. Total funding peaked at $958 million in 2023, thanks mostly to two large late rounds: 391 million raised by Biobest and a $270 million deal closed by Indigo.

Between 2015 and 2024, deal activity grew steadily for eight years, with a slight inflection in 2019. After peaking at 25 deals in 2022, it dropped again to pre-covid levels, and has so far not shown signs of recovery.

Biostimulants by geography (since 2012)

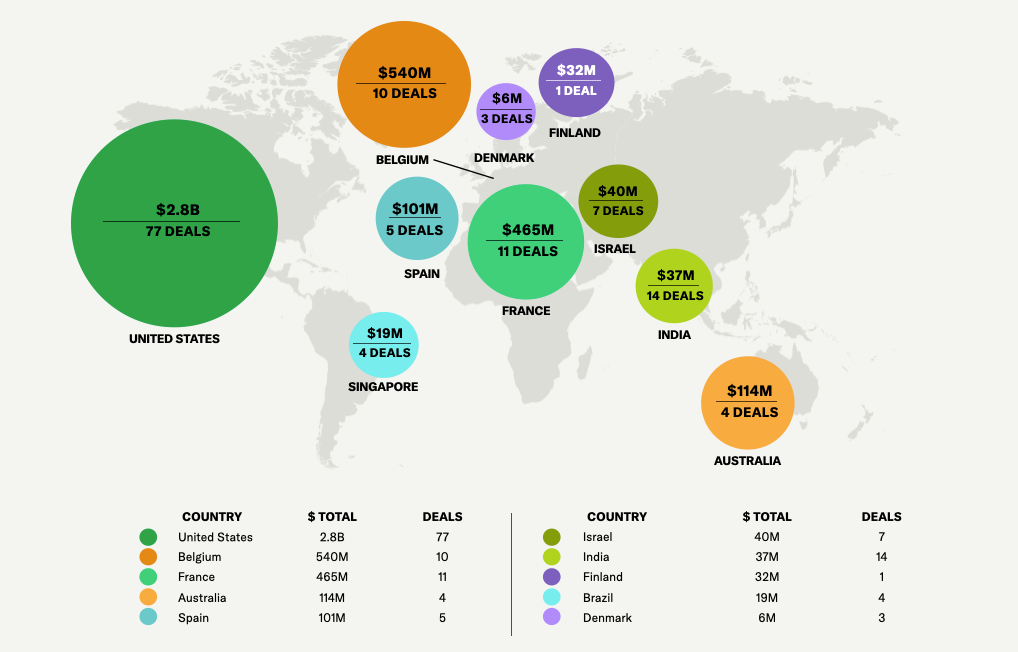

Three countries, the United States, Belgium, and France, dominate the landscape in terms of total funding amounts, with the US alone accounting for over 67% of all investment since 2012.

In terms of deal count, India comes second after the US, despite reaching only seventh place in terms of total amounts. France follows with 11 deals, then Belgium with 10.

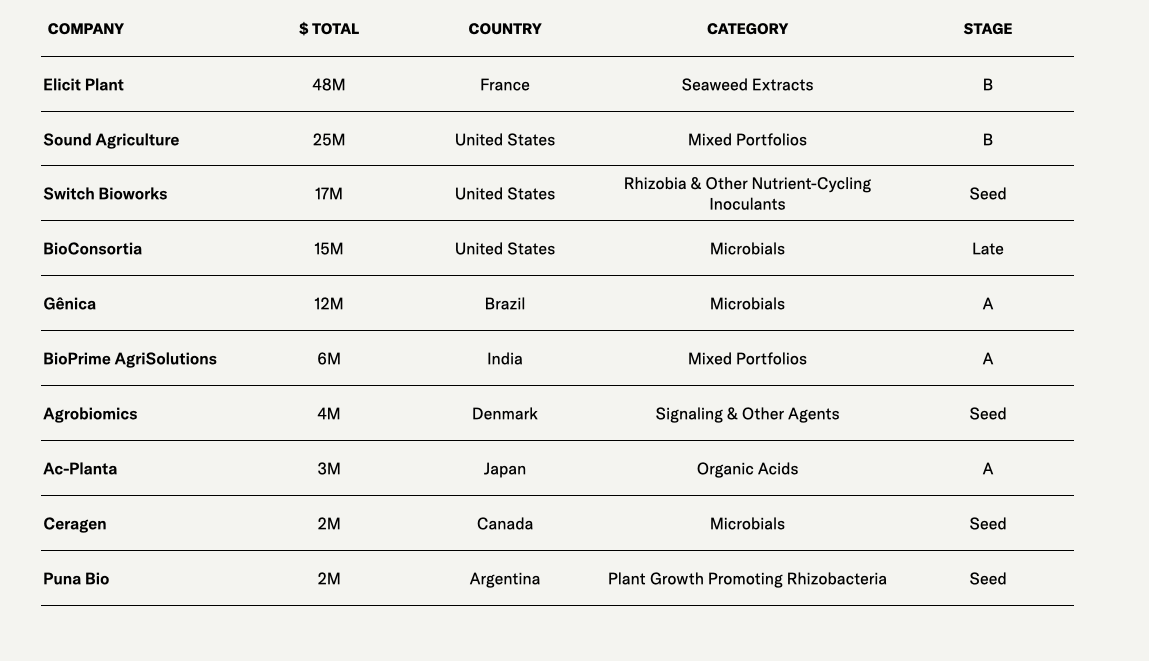

Top 10 biostimulant deals of 2024

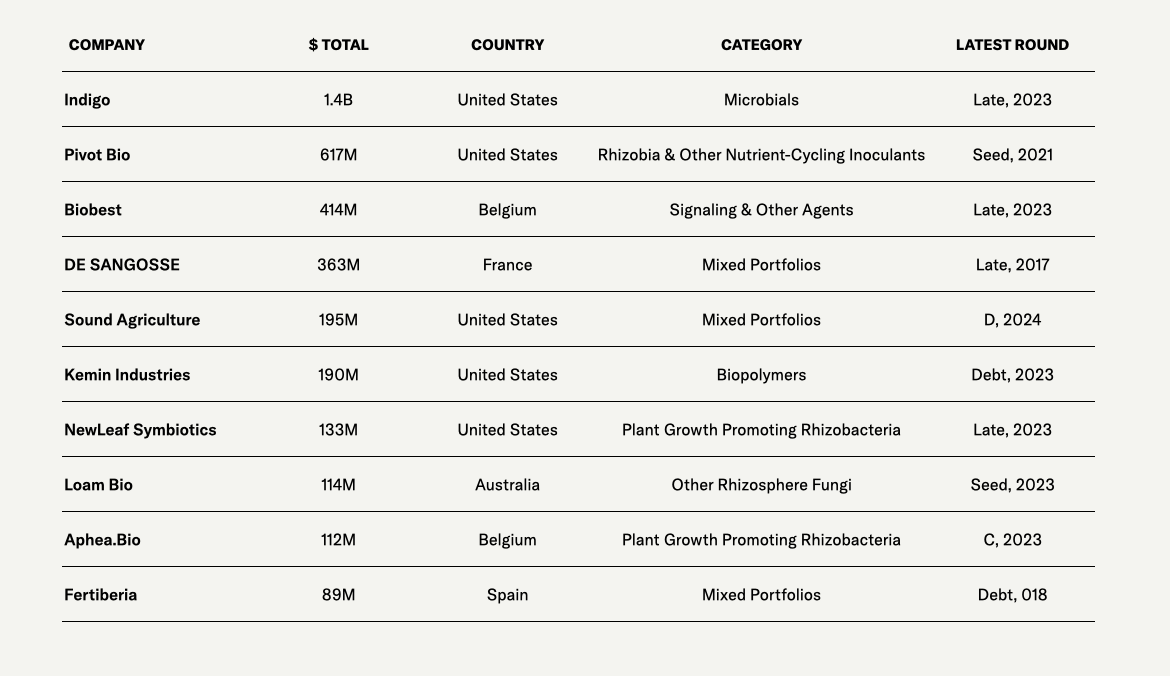

Top-funded biostimulant startups since 2012

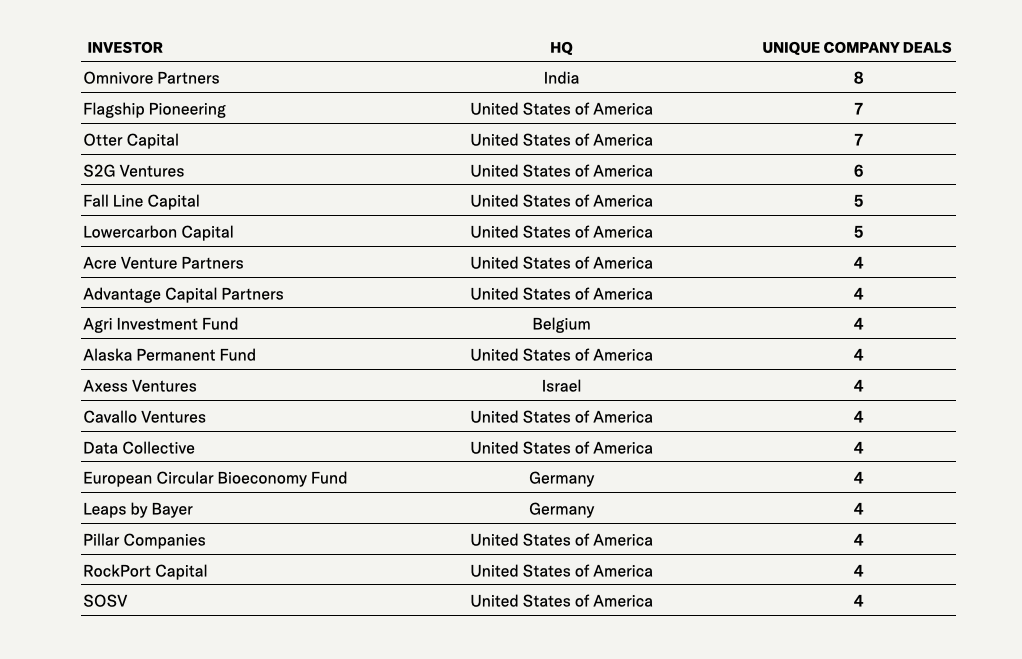

Top investors into biostimulant startups since 2012

Mapping the biostimulants landscape

Product differentiation, unified frameworks a focus going forward

As Taylor notes above, the number of startups claiming the “biostimulant” label—a word that has historically been open to interpretation in the industry—along with vague regulations and terminology make this area a tough one to classify.

Some regions have made steps to address this terminology issue. The EU has its own definition, as does Brazil.

As Dr. Pam Marrone pointed out during the Salinas summit, the US has yet to establish a definition and/or framework for biostimulants, although the Plant Biostimulant Act was recently reintroduced to address this. The legislation would create “a uniform, federal definition” of biostimulants and seek to streamline the approval process for products.

Currently, there are 29 US states that “accept or may initiate legislation/rulemaking in 2025” around biostimulants. Additionally, California signed senate bill 1522 last year that defines plant biostimulants as “a substance or microorganism, or mixtures thereof, that, when applied to seeds, plants, the rhizosphere, soil, or other growth media, act to support a plant’s natural nutrition processes independently of the biostimulant’s nutrient content.”

Product differentiation is also a major challenge right now. Biostumulant manufacturers use a relatively limited set of ingredients: seaweed extracts, organic acids, protein hydrolysates, and select microbial species. Formulations often combine various ingredients, making their modes of action hard to segment.

“I still think it’s very hard to differentiate between many biostimulant products,” says Taylor. “There are a relatively limited number of active ingredients being utilized, and they are often multi-functional or used in combination. Regulation can help, but so can more straightforward messaging from manufacturers and retailers.

“Let’s not forget that the producers also have to consider their specific crops, practices, location, risk tolerance and more,” he adds. “In lieu of clarity, I can see producers retreating to what they know, either existing practices or biological products from manufacturers and retailers they trust, and that favors established players and distribution.”

Despite these challenges, Taylor and his team expect continued progress for biostimulants, including continued innovation in new actives and formulations (possibly RNAi-based options in the longer term), and “the more mundane, but critical aspects like efficacy, shelf life, and ease of application.”

“We also see continued investment, partnership and M&A activity as this crowded market seeks equilibrium in the number of companies it can support,” says Taylor. “Regardless, the underlying forces driving increasing biostimulant adoption globally aren’t going away.”

This article was produced in collaboration with The Mixing Bowl and Western Growers.

The post Interest in biostimulants ‘extraordinary’ despite 86% funding drop to category appeared first on AgFunderNews.