Disseminated on behalf of Surge Battery Metals Inc.

The race for North America’s lithium supply is about more than size. It’s about efficiency and economics. In this contest, Surge Battery Metals (TSXV: NILI) shines. Its Nevada North Lithium Project (NNLP) combines strong geology with solid financial metrics. This junior company could build one of the most profitable lithium operations in the U.S.

The latest preliminary economic assessment (PEA) shows Nevada North ranks among the top lithium claystone projects in the Western Hemisphere. It hosts an Inferred Resource of 11.24 Mt LCE at 3,010 ppm Li, the highest grade in the U.S.

Nevada North Lithium Project (NNLP) is the highest-grade U.S. lithium clay asset

The U.S. Lithium Imperative

As the U.S. aims for energy independence, a domestic lithium supply chain is essential. Demand for lithium carbonate equivalent (LCE) is set to grow fivefold by 2035. Battery gigafactories need a steady, low-cost supply.

Nevada is at the center of this change. It’s home to Tesla’s Gigafactory and has strong mining infrastructure. Surge Battery Metals’ Nevada North Project benefits from easy access to highways, water, and skilled workers. This reduces capital risk and environmental impact.

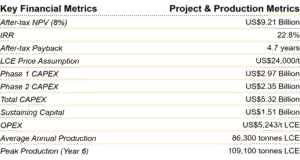

Breaking Down the Economics

-

Evolution Mining JV Strengthens NNLP’s Tier 1 Potential

In September, Surge signed a JV LOI with Evolution Mining (ASX: EVN) for the Nevada North Lithium Project. Under the deal, Surge holds 77% and Evolution 23%, with Evolution funding up to C$10 million for the Preliminary Feasibility Study to earn up to 32.5%.

Following this, on December 9, the company announced receiving C$3 million in initial funding. The payment was made under NNL’s updated operating agreement. As a result, Evolution’s stake in the joint venture rose to 25.85%, up by 2.85%. And Surge Battery Metals USA Inc. now holds the remaining 74.15%.

Evolution adds 880 acres of private land and 21,000 acres of high-potential ground, expanding NNLP’s footprint. The JV will now focus on advancing the Pre-Feasibility Study, building on the strong 2025 PEA results.

-

Exceptional Profitability Profile

The Preliminary Economic Assessment (PEA) confirmed NNLP’s strong potential with a 42-year mine life, 82% recovery rate, and average annual output of 86,000 t/y LCE, peaking at 109,000 t/y. The project’s after-tax NPV₈ reached about US$9.2 billion with a 23% IRR — impressive for an early-stage asset.

Even at lower prices of US$20,000/t LCE, it stays profitable. The 22.8% IRR shows efficient capital use and a quick payback for investors.

Surge also secured an expanded BLM exploration permit, increasing its allowable disturbance from 5 to 250 acres. This approval enables its largest drill program yet, targeting an upgrade of most resources to measured and indicated by mid-2026.

These figures highlight the project’s resilience, even with conservative pricing. Simply put, it competes well with established lithium producers.

The low operating cost of US$5,097/t LCE sets NILI apart. Most North American peers operate at US$8,000–10,000/t due to higher energy costs. Also, another significant advantage comes from its mineralogy and process design. Its lithium-bearing clays allow high recoveries with simple leaching, cutting reagent use, and waste.

-

Long-Life Asset

Preliminary models suggest a mine life spanning decades based on only part of the drilled area. Further exploration could expand the resource, boosting longevity and cash flow. Long-life assets are valuable in a volatile market. A project that keeps low costs for years can deliver value through price cycles.

-

Capital Efficiency

Unlike expensive spodumene or brine projects needing billions upfront, NILI’s Nevada North benefits from its U.S. location and modular setup. With easy transport access and favorable permitting, capital needs are lower.

Capital expenditures are expected to stay below US$2 billion. This eases financing through partnerships, grants, or U.S. Department of Energy incentives for domestic lithium production.

Why Economics Matter More Than Ever

The lithium market is maturing. Not every discovery will become a mine. Investors now seek projects that thrive in weak markets. And Nevada North meets this demand.

- By 2035, global lithium demand is expected to hit 3.56 million metric tonnes, while supply will reach only 3.16 million tonnes.

Its strong economics show that Surge Battery Metals aims to build a profitable, sustainable operation—not chase hype. Pilot testing and metallurgical studies confirm scalable processing methods. These programs help turn PEA numbers into reality and reduce project risk.

Sustainability and Strategic Value

NILI aligns with ESG goals. The company plans to use renewable energy for processing and recycle water to limit environmental impact. Unlike South American brine mines facing water issues, or hard-rock projects relying on carbon-heavy crushing, Nevada North uses a low-impact clay-based process. This supports U.S. sustainability and clean energy goals.

Clean Chemistry, High Potential

NNLP sits in an ancient volcanic basin similar to the McDermitt Caldera that hosts Thacker Pass. Over time, rhyolitic ash settled into a lake, forming lithium-rich clay beds now preserved near the surface, ideal for low-cost open-pit mining.

Crucially, NNLP’s clean chemistry sets it apart. Its clays contain low magnesium (2–4%) and less hectorite, making acid leaching easier, reagent use lower, and processing simpler. Early tests already produced battery-grade lithium carbonate without complex steps, proving strong scalability.

With grades topping 3,000 ppm, well above most clay projects, NNLP naturally fits into the lowest-cost tier once in production.

- CLICK TO SEE: LIVE LITHIUM PRICES

- ALSO READ: Lithium Prices Surge Amid Strong Demand Forecasts, Could Reach Up to $28,000/Ton by 2026

Driving Real Shareholder Value

Surge Battery Metals offers investors a U.S.-based Tier 1 lithium project with great potential. By 2030, global lithium demand is expected to hit 2.4 million tonnes of LCE, nearly four times the current amount. As electric vehicles, grid storage, and clean infrastructure grow, more lithium projects will be needed to meet this demand.

As Government policies reshape the landscape quickly, U.S.-backed projects like Nevada North are all set for gains.

Share Structure

For Surge Battery Metals, Nevada North is more than a mine – it’s a value engine. Surge is debt-free and had approximately C$6–7 million in cash as of October 2025, providing a 12-month runway at its current burn rate of around C$300,000 per month.

Investors in lithium often face two extremes: overpriced speculations and undervalued strong assets. NILI falls into the second group. Nevada North may be key to America’s lithium independence. If it keeps growing and uses U.S. critical mineral policies, its impact could be significant.

Looking Ahead

The next few months are crucial. Surge Battery Metals will drill more to expand high-grade zones, update its resource, and start prefeasibility studies. Each step will enhance the project’s world-class potential.

Surge Battery Metals stands out among lithium juniors. While many face weak prices, its economics are strong now and will remain so in the future.

For investors seeking clean energy opportunities, the Nevada North Lithium Project stands out. It offers strong economics and sustainable design. This project isn’t just another venture; it’s a blueprint for the future of lithium mining.

DISCLAIMER

New Era Publishing Inc. and/or CarbonCredits.com (“We” or “Us”) are not securities dealers or brokers, investment advisers, or financial advisers, and you should not rely on the information herein as investment advice. Surge Battery Metals Inc. (“Company”) made a one-time payment of $50,000 to provide marketing services for a term of two months. None of the owners, members, directors, or employees of New Era Publishing Inc. and/or CarbonCredits.com currently hold, or have any beneficial ownership in, any shares, stocks, or options of the companies mentioned.

This article is informational only and is solely for use by prospective investors in determining whether to seek additional information. It does not constitute an offer to sell or a solicitation of an offer to buy any securities. Examples that we provide of share price increases pertaining to a particular issuer from one referenced date to another represent arbitrarily chosen time periods and are no indication whatsoever of future stock prices for that issuer and are of no predictive value.

Our stock profiles are intended to highlight certain companies for your further investigation; they are not stock recommendations or an offer or sale of the referenced securities. The securities issued by the companies we profile should be considered high-risk; if you do invest despite these warnings, you may lose your entire investment. Please do your own research before investing, including reviewing the companies’ SEDAR+ and SEC filings, press releases, and risk disclosures.

It is our policy that information contained in this profile was provided by the company, extracted from SEDAR+ and SEC filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee them.

CAUTIONARY STATEMENT AND FORWARD-LOOKING INFORMATION

Certain statements contained in this news release may constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information generally can be identified by words such as “anticipate,” “expect,” “estimate,” “forecast,” “plan,” and similar expressions suggesting future outcomes or events. Forward-looking information is based on current expectations of management; however, it is subject to known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those anticipated.

These factors include, without limitation, statements relating to the Company’s exploration and development plans, the potential of its mineral projects, financing activities, regulatory approvals, market conditions, and future objectives. Forward-looking information involves numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking information. These risks and uncertainties include, among other things, market volatility, the state of financial markets for the Company’s securities, fluctuations in commodity prices, operational challenges, and changes in business plans.

Forward-looking information is based on several key expectations and assumptions, including, without limitation, that the Company will continue with its stated business objectives and will be able to raise additional capital as required. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, or intended.

There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially. Accordingly, readers should not place undue reliance on forward-looking information. Additional information about risks and uncertainties is contained in the Company’s management’s discussion and analysis and annual information form for the year ended December 31, 2024, copies of which are available on SEDAR+ at www.sedarplus.ca.

The forward-looking information contained herein is expressly qualified in its entirety by this cautionary statement. Forward-looking information reflects management’s current beliefs and is based on information currently available to the Company. The forward-looking information is made as of the date of this news release, and the Company assumes no obligation to update or revise such information to reflect new events or circumstances except as may be required by applicable law.

The post Lithium Economics: Why Surge Battery Metals’ Nevada Project Stands Out appeared first on Carbon Credits.