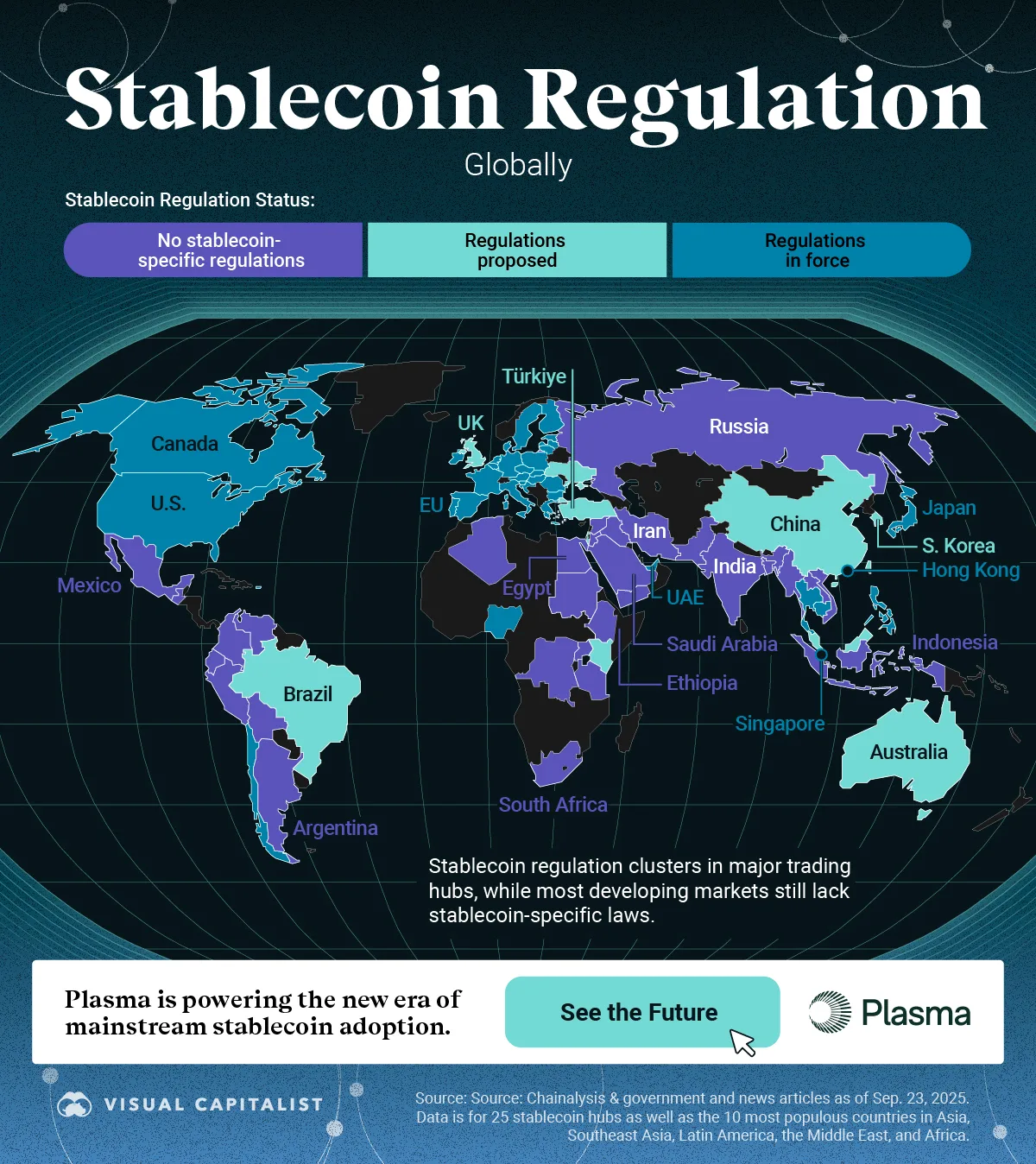

Mapped: Stablecoin Regulation Globally

Key Takeaways

- Many developed hubs that receive high stablecoin trading activity, like the U.S. and Europe, have put some form of stablecoin regulation in place.

- In contrast, many developing countries have yet to introduce any stablecoin-specific legislation.

The global stablecoin landscape is in flux, with regulatory regimes increasingly becoming a key differentiator in where stablecoin activity can scale with confidence. While some major jurisdictions now have stablecoin regulation in force, many countries still lack any tailored laws.

This graphic, created in partnership with Plasma, is part of Stablecoin Week and highlights the global state of regulations specific to stablecoin.

Breaking Down Stablecoin Regulation Status

In our analysis, we’ve used three categories:

- No stablecoin-specific regulation: There is no evidence of the country or jurisdiction announcing any regulation specific to stablecoin. Note that our map does not include regulation on cryptocurrency overall.

- Regulations proposed: The jurisdiction has proposed or had discussions about introducing stablecoin-specific laws.

- Regulation in force: The jurisdiction has passed any amount of legislation or has active regulation that directly addresses stablecoin.

With those criteria in mind, here’s how regulation breaks down around the world.

| Jurisdiction | Stablecoin regulation status |

|---|---|

U.S. U.S. |

Regulations in force |

Canada Canada |

Regulations in force |

Chile Chile |

Regulations in force |

Japan Japan |

Regulations in force |

Hong Kong Hong Kong |

Regulations in force |

Philippines Philippines |

Regulations in force |

Thailand Thailand |

Regulations in force |

Singapore Singapore |

Regulations in force |

Cambodia Cambodia |

Regulations in force |

European Union European Union |

Regulations in force |

UAE UAE |

Regulations in force |

Nigeria Nigeria |

Regulations in force |

China China |

Regulations proposed |

South Korea South Korea |

Regulations proposed |

Australia Australia |

Regulations proposed |

UK UK |

Regulations proposed |

Ukraine Ukraine |

Regulations proposed |

Brazil Brazil |

Regulations proposed |

Türkiye Türkiye |

Regulations proposed |

Malaysia Malaysia |

Regulations proposed |

Israel Israel |

Regulations proposed |

Kenya Kenya |

Regulations proposed |

Mexico Mexico |

No stablecoin-specific regulations |

Peru Peru |

No stablecoin-specific regulations |

Colombia Colombia |

No stablecoin-specific regulations |

Argentina Argentina |

No stablecoin-specific regulations |

Venezuela Venezuela |

No stablecoin-specific regulations |

Guatemala Guatemala |

No stablecoin-specific regulations |

Ecuador Ecuador |

No stablecoin-specific regulations |

Bolivia Bolivia |

No stablecoin-specific regulations |

India India |

No stablecoin-specific regulations |

Pakistan Pakistan |

No stablecoin-specific regulations |

Bangladesh Bangladesh |

No stablecoin-specific regulations |

Iran Iran |

No stablecoin-specific regulations |

Indonesia Indonesia |

No stablecoin-specific regulations |

Vietnam Vietnam |

No stablecoin-specific regulations |

Myanmar Myanmar |

No stablecoin-specific regulations |

Laos Laos |

No stablecoin-specific regulations |

Timor-Leste Timor-Leste |

No stablecoin-specific regulations |

Russia Russia |

No stablecoin-specific regulations |

Iraq Iraq |

No stablecoin-specific regulations |

Yemen Yemen |

No stablecoin-specific regulations |

Saudi Arabia Saudi Arabia |

No stablecoin-specific regulations |

Syria Syria |

No stablecoin-specific regulations |

Jordan Jordan |

No stablecoin-specific regulations |

Egypt Egypt |

No stablecoin-specific regulations |

Ethiopia Ethiopia |

No stablecoin-specific regulations |

Democratic Republic of the Congo Democratic Republic of the Congo |

No stablecoin-specific regulations |

Tanzania Tanzania |

No stablecoin-specific regulations |

Sudan Sudan |

No stablecoin-specific regulations |

Uganda Uganda |

No stablecoin-specific regulations |

Algeria Algeria |

No stablecoin-specific regulations |

South Africa South Africa |

No stablecoin-specific regulations |

Source: Chainalysis, government and news articles as of September 23, 2025. Data is for 25 stablecoin hubs as well as the 10 most populous countries in Asia, Southeast Asia, Latin America, the Middle East, and Africa.

Many developed countries that have received high stablecoin value have regulations in place.

For instance, the U.S. passed the Genius Act in July 2025, a significant milestone in stablecoin’s evolution. Among the stipulations, stablecoin issuers are required to have 100% reserve backing with liquid assets like U.S. dollars or short-term treasuries and must implement anti-money laundering programs.

The State of Regulations in Developing Countries

Stablecoin regulation is much less common in developing countries and, in some cases, stablecoins are outright banned. Namely, cryptocurrencies in general are banned in Iraq, Algeria, and Bangladesh.

Meanwhile, some countries that allow stablecoin activity are taking steps to put laws in place. Türkiye recently proposed measures that will create daily and monthly limits on stablecoin transfers with the goal of preventing the rapid outflow of illicit funds.

In an example of more openness, Thailand announced in March 2025 that stablecoins USDT and USDC would be included in its list of approved cryptocurrencies for digital asset transactions. Traders are now able to directly trade one cryptocurrency for another without first needing to liquidate into Thai baht.

How Regulations Help Unlock Adoption

Regulation matters not just for reducing risk, but as a way to signal legitimacy. Clear stablecoin laws reduce legal uncertainty and enable institutional adoption. Regulatory clarity also supports smooth transactions across borders, a vital trait as stablecoins become embedded in cross‑border payments networks.

While many developing jurisdictions have not yet taken action, the clustering of regulation in major financial hubs is an important step. Notably, these frameworks may serve as blueprints for other regions still formulating their approach. For instance, the Deputy Secretary-General of the Hong Kong 3.0 Association recently offered to help Laos with stablecoin compliance solutions.

As regulation gains ground, Plasma is powering the new era of mainstream stablecoin adoption.

-

Technology2 months ago

Technology2 months agoStablecoin Evolution: Milestones of the New Payment Rail

The GENIUS Act marks a turning point for stablecoin. Explore 8 key milestones in the digital dollar’s rise to mainstream finance.

-

Technology3 months ago

Technology3 months agoIs the U.S. Dollar Primed for a Digital Rebound?

U.S. dollar influence is shrinking in some spaces, but stablecoins could give the currency a new chapter of global dominance.

-

Money3 months ago

Money3 months agoRanked: The Biggest Currency Drops So Far in 2025

In the first half of 2025, one currency dropped over 50% against the U.S. dollar. What led to the decline?

-

Technology4 months ago

Technology4 months agoRanked: Countries With the Highest Remittance Costs

To send money across borders, workers can be charged high remittance fees—over 50% of the amount transferred in some cases.