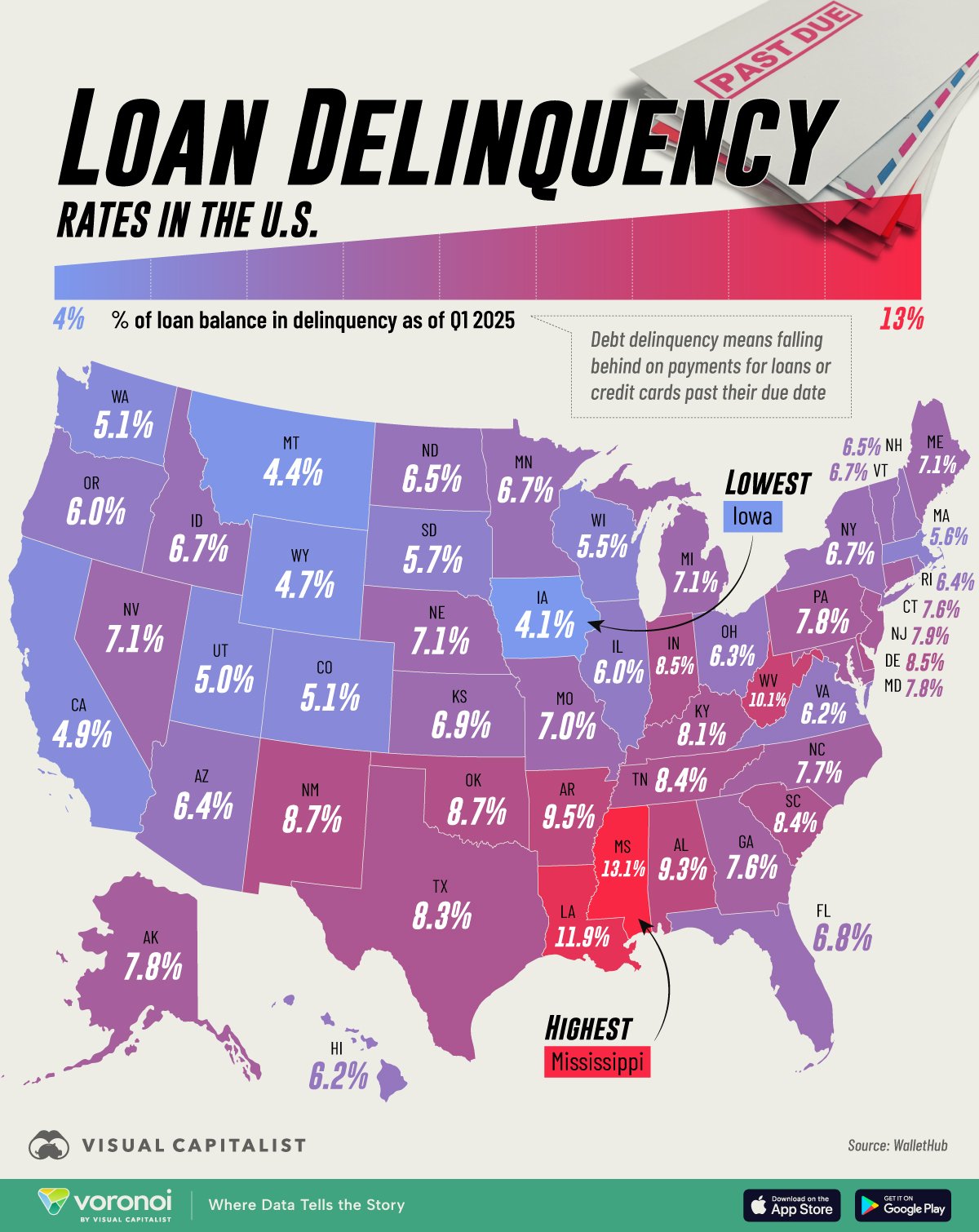

Mapped: Which States Are Most Behind on Debt?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- Debt delinquency refers to falling behind on payments for loans or credit cards past their due date.

- Delinquency can have consequences for your credit, including late fees, and higher rates.

In the U.S., many households carry multiple forms of debt—credit cards, student loans, auto loans, and more. But falling behind on those payments can lead to long-term financial stress.

In this visualization, we rank which states are the most behind on their debt obligations, based on their loan delinquency rate in the first quarter of 2025.

Data & Discussion

The data for this visualization comes from WalletHub. It highlights the loan delinquency rate in each state, which refers to the percentage of payments that are overdue.

| Rank | State | Percentage of Loan Balance Delinquent (Q1 2025) |

|---|---|---|

| 1 | Mississippi | 13.09% |

| 2 | Louisiana | 11.93% |

| 3 | West Virginia | 10.13% |

| 4 | Arkansas | 9.46% |

| 5 | Alabama | 9.34% |

| 6 | New Mexico | 8.74% |

| 7 | Oklahoma | 8.69% |

| 8 | Delaware | 8.50% |

| 9 | Indiana | 8.47% |

| 10 | South Carolina | 8.41% |

| 11 | Tennessee | 8.39% |

| 12 | Texas | 8.32% |

| 13 | Kentucky | 8.14% |

| 14 | New Jersey | 7.94% |

| 15 | Pennsylvania | 7.83% |

| 16 | Maryland | 7.82% |

| 17 | Alaska | 7.79% |

| 18 | North Carolina | 7.65% |

| 19 | Georgia | 7.59% |

| 20 | Connecticut | 7.58% |

| 21 | Michigan | 7.12% |

| 22 | Maine | 7.09% |

| 23 | Nevada | 7.08% |

| 24 | Nebraska | 7.05% |

| 25 | Missouri | 7.04% |

| 26 | Kansas | 6.93% |

| 27 | Florida | 6.77% |

| 28 | New York | 6.73% |

| 29 | Vermont | 6.73% |

| 30 | Minnesota | 6.69% |

| 31 | Idaho | 6.68% |

| 32 | New Hampshire | 6.49% |

| 33 | North Dakota | 6.47% |

| 34 | Rhode Island | 6.42% |

| 35 | Arizona | 6.41% |

| 36 | Ohio | 6.27% |

| 37 | Hawaii | 6.21% |

| 38 | Virginia | 6.20% |

| 39 | Oregon | 6.04% |

| 40 | Illinois | 5.97% |

| 41 | South Dakota | 5.67% |

| 42 | Massachusetts | 5.62% |

| 43 | Wisconsin | 5.50% |

| 44 | Colorado | 5.10% |

| 45 | Washington | 5.05% |

| 46 | Utah | 5.03% |

| 47 | California | 4.93% |

| 48 | Wyoming | 4.66% |

| 49 | Montana | 4.35% |

| 50 | Iowa | 4.08% |

Southern States Are Struggling Most

Mississippi tops the list, with a loan delinquency rate of 13% as of Q1 2025. Louisiana follows close behind at nearly 12%. Other high-delinquency states like West Virginia, Arkansas, and Alabama round out a trend: the South faces higher levels of financial strain.

Many of these states have lower average incomes and higher poverty rates, factors that often contribute to increased debt delinquency.

Coastal and Western States Fare Better

At the opposite end, states like Iowa (4.08%), Montana (4.35%), and Wyoming (4.66%) had the lowest delinquency rates. California, despite its high cost of living, also saw a relatively low rate at just under 5%. These lower figures may reflect stronger job markets, higher wages, or broader access to financial services.

Learn More on the Voronoi App

If you enjoyed today’s post, check out Annual Retirement Costs by State on Voronoi, the new app from Visual Capitalist.