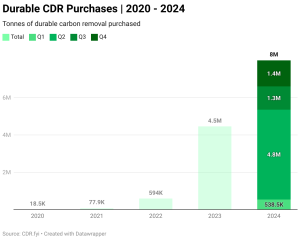

Carbon removal credits are becoming a key tool for tackling climate change. The report from CDR.fyi shows that the carbon dioxide removal (CDR) market grew significantly in 2024. Carbon removal credits rose 78% to 8 million tonnes. This big rise shows more interest in carbon removal solutions for global climate action.

Carbon removal credits are different from regular carbon offsets. Instead of balancing emissions, they help fund projects that take CO₂ out of the air. This article explores the key trends, challenges, and outlook for the CDR market based on the latest findings from CDR.fyi.

Big Tech Fuels CDR Market Boom

Total CDR purchases reached nearly 8 million tonnes in 2024, a 78% increase over 2023, per CDR.fyi analysis. However, the number of unique purchasing companies grew by only 7%, from 202 to 216.

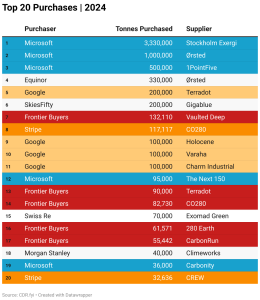

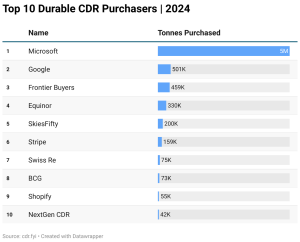

The growth was primarily driven by repeat buyers such as Microsoft, Google, and Stripe. These big tech companies, along with other Frontier buyers accounted for about 80% of 2024 purchases. Their purchases highlight a high concentration of CDR demand.

These companies lead in carbon removal investments, backing projects that grow new technologies. Their ongoing support is crucial. However, the few new players in the market raise worries about long-term stability.

- Microsoft led the market with 5.1 million tonnes, making up 63% of the total volume. This is a small drop from its 70% share in 2023.

Microsoft, Google, Meta, and Salesforce created the Symbiosis Coalition. They promised to purchase 20 million tonnes of nature-based CDR by 2030.

CDR Supply Struggles to Keep Up

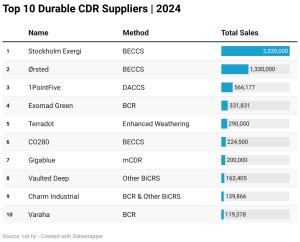

While the market is growing, demand remains insufficient to support the increasing number of suppliers. Only 36% of CDR suppliers listed on CDR.fyi registered a sale in 2024. Many suppliers might struggle to get funding without new buyers. This could lead to consolidations and bankruptcies in 2025 and 2026.

A few buyers dominate the market. If their priorities or financial plans change, progress could slow. Getting more industries on board is key for future growth. This includes manufacturing, transportation, and retail.

Microsoft and Frontier accounted for 12 of the top 20 purchases in 2024. Google increased its direct purchases, totaling 500,000 tonnes. Meta pledged to buy $35 million in carbon credits over the next year. The tech giant is still unsure how much to allocate to durable CDR or nature-based solutions.

Among suppliers, Stockholm Exergi’s 3.3 million-tonne sale to Microsoft set a new record. Ørsted expanded its relationship with Microsoft with an additional 1 million-tonne sale. Meanwhile, CO280, Terradot, and Gigablue made significant market entries with first-time sales.

Meanwhile, venture investments in the CDR sector dropped 30% year-over-year in 2024 as investors exercised caution. Many are waiting to see which suppliers secure sales before committing additional funding. Suppliers who can’t make enough money might struggle financially. This can slow down innovation and reduce market variety.

Price Wars: Cheap vs. Costly CDR

The price of CDR credits remains a critical factor influencing market growth. The weighted average price per tonne decreased from $490 in 2023 to $320 in 2024.

Remarkably, credit prices varied significantly based on removal technology. Biochar-based removal credits were cheaper. In contrast, direct air capture (DAC) credits stayed costly because of high tech and operation expenses.

Biochar, which converts waste into carbon that can be stored in soil, has prices ranging from $50 – $150 per tonne. In contrast, DAC, which extracts CO₂ from the air and stores it underground, remains costly, with prices going beyond $600 per tonne.

The big cost difference slows down the use of DAC. It’s a great option for permanent carbon removal, but it’s still not widely adopted.

Biochar and Mineralization saw price increases, while other methods experienced declines. Most notably, mineralization saw a whopping 123% price increase, from $370 to $827 per tonne.

The cost reductions indicate a narrowing gap between supplier and purchaser expectations. However, high-cost durable CDR methods may struggle to compete without additional buyer incentives.

The high price of high-quality CDR solutions continues to be a barrier to wider corporate adoption. To make CDR more accessible, costs must come down. This can be done through technological advances and economies of scale. This will help a wider range of companies and industries use CDR in their climate goals.

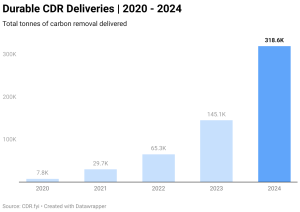

Durable CDR deliveries hit 318.6K tonnes in 2024. This is a 120% rise from 2023. However, the delivery-to-booked volume ratio was just 4.4%. Many companies are still increasing production. Biochar accounted for 86% of total deliveries. As other methods mature, the overall delivery rate is expected to rise.

Policy Push and Tech Breakthroughs

Government policies and incentives are critical to sustaining growth in the CDR market. Some governments have taken proactive steps to integrate CDR into their climate strategies. The United States has increased funding for CDR projects with initiatives like the US 45Q tax credit. Meanwhile, the European Union is creating a certification framework for carbon removal.

Denmark and Sweden’s BECCS subsidies have helped build expensive facilities. But, the absence of global standards makes it hard for companies to deal with regulations.

Better policy clarity and uniform regulations may enhance corporate confidence and promote broader adoption.

Technology is also making carbon removal solutions more efficient and affordable. In 2024, DAC cut costs. Biochar and ocean-based CDR projects also gained traction.

In addition, ocean-based carbon removal has gained interest due to its potential for large-scale impact. Techniques like ocean alkalinity enhancement boost the ocean’s ability to absorb CO₂. They’re currently being explored.

However, scalability remains an issue. Deploying these technologies on a large scale needs a big investment. Many companies hesitate to invest without better financial incentives. If costs keep falling because of new technology, more companies may invest in CDR solutions. This could speed up market growth.

What’s Next for CDR? Challenges and Opportunities

Despite strong growth, the CDR market faces key challenges:

- Dependence on a Few Buyers: The market needs new participants to ensure long-term stability.

- High Costs: Prices must come down for broader adoption.

- Regulatory Uncertainty: Standardized policies could provide clearer incentives for companies to invest.

- Technological Barriers: Further advancements are needed to improve scalability and affordability.

However, there are also opportunities, namely:

- Government Support: Increased funding and policy incentives could drive growth.

- Innovation: Technological improvements could lower costs and enhance effectiveness.

- New Market Entrants: Demand could expand significantly if more companies commit to CDR.

The carbon removal credits market in 2024 saw impressive growth, but it still faces hurdles. More companies should enter the market; costs must fall, and rules must change. With continued investment, innovation, and policy support, CDR could become a key component of global climate action, helping meet net-zero goals more effectively.

The post Microsoft Leads as Carbon Removal Credits Hit 8 Million Tonnes in 2024 appeared first on Carbon Credits.