Microsoft has signed a 10-year carbon removal agreement with Arca, a Canadian startup that turns mine waste into carbon storage. The partnership backs Microsoft’s goal to be carbon negative by 2030. It also helps Arca grow its natural mineralization technology.

The deal came just before Microsoft reported $77.7 billion in revenue for the first quarter of fiscal 2026, an 18% increase from a year earlier. Operating income also rose 24% and net income increased by 12%.

Despite the strong results, Microsoft’s stock fell about 3% after the earnings release. Investors are becoming cautious about spending more on data centers, AI infrastructure, and OpenAI costs.

Yet, Microsoft’s financial strength allows it to support big climate and energy projects, like the Arca deal. This shows how the company connects AI growth with long-term sustainability goals.

Turning Mine Waste into Carbon Storage

Arca uses a process called mineralization, which captures CO₂ by reacting it with magnesium-rich mine waste. This reaction forms stable carbonates, permanently locking carbon in solid rock.

The company works with mining firms that produce waste materials such as nickel, cobalt, and platinum tailings. These minerals naturally react with CO₂, but Arca speeds up the process using technology developed in Canada.

The captured carbon can stay stored for thousands of years, making it one of the most durable forms of carbon removal. The process also helps mining sites lower emissions and improve environmental performance.

Arca’s CEO, Paul Needham, said the Microsoft deal gives the company long-term stability to grow and reach more industrial partners. It also strengthens Arca’s position as a global leader in geology-based carbon storage, noting:

“This agreement with Microsoft validates Industrial Mineralization as a viable pathway for durable carbon removal with the potential to scale and meaningfully contribute to global climate goals.”

Microsoft’s Path to Carbon Negativity

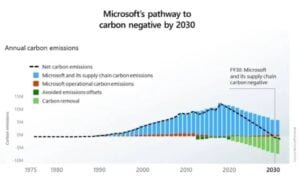

Microsoft first pledged in 2020 to become carbon negative by 2030, meaning it will remove more carbon from the air than it emits. By 2050, it aims to erase all historical emissions since its founding in 1975.

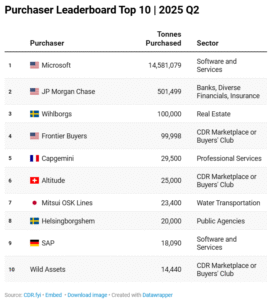

The company is one of the largest corporate buyers of carbon removal. It has signed contracts with companies like Heirloom, Climeworks, and Running Tide. They use a mix of direct air capture (DAC), biomass, and ocean-based methods.

As of 2024, Microsoft reported cutting its Scope 1 and 2 emissions by 22% from 2020 levels. However, Scope 3 emissions — those from supply chains and product use — still make up over 95% of its total footprint.

To meet its targets, Microsoft is combining renewable energy investments with durable carbon removal projects such as Arca’s. Following this deal, the tech giant reported its Q1 2026 financial results.

Microsoft’s Latest Earnings: Strong Results, But Shares Slip

Microsoft reported strong first-quarter fiscal 2026 results. Revenue rose 18% to $77.7 billion. Operating income grew 24% to $38.0 billion. Net income was $27.7 billion, up 12%. Profit also climbed to $30.8 billion, up 22%.

Microsoft Cloud revenue hit $49.1 billion, up 26%, and Azure and other cloud services grew 40%. The company returned $10.7 billion to shareholders through buybacks and dividends.

Despite the beats, Microsoft’s shares dropped roughly 3% in extended trading. Traders flagged three main worries.

- First, Microsoft raised its investment profile — management signalled higher capital spending to build more data centers and AI infrastructure.

- Second, the company disclosed a $3.1 billion hit related to its OpenAI investments that lowered reported earnings.

- Third, investors flagged margin pressure and possible capacity limits as cloud demand keeps rising.

These factors tempered the market’s initial enthusiasm, even as core business metrics beat expectations.

Meeting AI’s Growing Energy Demands

Microsoft’s AI and cloud services require large amounts of energy. As its Azure platform and data centers expand, electricity demand keeps climbing.

Global data centers used about 415 terawatt-hours (TWh) of power in 2024, equal to roughly 1.5% of total global use. By 2030, that number could rise to 945 TWh, more than double current levels. AI computing will likely drive much of that growth.

To balance this, Microsoft is investing in clean and firm power sources such as nuclear, wind, solar, and geothermal. The company is also studying small modular reactors (SMRs) to power future data centers.

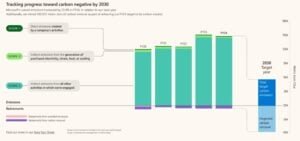

The deal with Arca adds another tool to help offset emissions from AI expansion. Microsoft is expanding its climate strategy. It’s now focusing on permanent carbon removal, not just renewables. It remains the top buyer of durable carbon removal in the second quarter of this year.

SEE MORE: Microsoft (MSFT Stock) Tops Q2 2025 Record-Breaking Surge in Durable Carbon Removal Credit Purchases

Arca’s Role in the Growing Carbon Removal Market

The global carbon removal market remains small but is growing fast. Experts say that by 2030, companies will need to remove at least 1 billion tonnes of CO₂ each year to meet climate goals. Today, only about 5 million tonnes of verified removals exist globally — meaning the market must expand hundreds of times.

Arca’s mineralization process is highly scalable. It uses abundant mining waste instead of new raw materials. Pilot projects in British Columbia and Ontario have shown good results. So, new facilities are planned all over North America.

The Microsoft deal gives Arca both credibility and financial backing to grow faster. Funds will help build larger operations, improve carbon measurement, and expand partnerships with mining companies globally.

Economic and Environmental Impact

For Arca, this deal marks a major step in scaling a once experimental process. It proves that natural mineralization can attract big corporate buyers and investors. It also highlights Canada’s leadership in carbon management and clean mining innovation.

The Honourable Tim Hodgson, Minister of Energy and Natural Resources, commented:

“The next generation of clean growth will be built by Canada’s first-class innovation ecosystem – companies like Arca, which are turning Canadian ingenuity into global leadership. Carbon removal technologies are not only strategic tools we can use to tackle climate change, they create good jobs and position Canada at the forefront of the global opportunity of a low-carbon economy.”

The deal helps Microsoft balance the environmental costs of its AI and cloud growth. It also supports its carbon removal efforts. Every tonne of CO₂ removed will be verified and stored permanently. This follows the Science Based Targets initiative (SBTi) standards.

A Broader Shift Toward Permanent Carbon Removal

Tech giants like Google, Meta, and Shopify have signed similar long-term deals with carbon removal startups. These contracts give small companies predictable income, helping them scale and lower costs over time.

Analysts think the carbon removal market might reach $50–100 billion a year by 2030. This growth will depend on policy support and corporate buyer demand.

Both companies see this partnership as a model for combining technology, industry, and nature to fight climate change. For Microsoft, it is a key step in cleaning up emissions from its fast-growing AI business. For Arca, it provides a launchpad for global expansion and further innovation.

As more companies race toward net-zero goals, the demand for reliable and permanent carbon removal will keep rising. The Microsoft–Arca deal shows that tackling climate change can also drive new business opportunities where sustainability and growth can work hand in hand.

The post Microsoft Seals 10-Year Arca Carbon Deal Ahead of Earnings Beat and Record Profits appeared first on Carbon Credits.