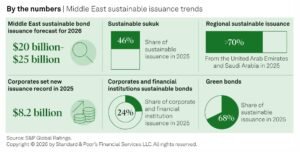

Sustainable bond issuance in the Middle East is expected to remain strong in 2026. S&P Global Ratings projects regional issuance will reach between $20 billion and $25 billion next year. This outlook comes after a year marked by trade volatility and global uncertainty. Despite those pressures, investor appetite in the region remained resilient.

In 2025, conventional bond issuance by corporates and financial institutions in the Middle East grew by 10%–15%, reaching $81.2 billion. At the same time, sustainable bond issuance in the region increased by about 3%.

This contrasts sharply with global trends. Worldwide sustainable bond issuance declined by 21% in 2025. The Middle East, therefore, outperformed the broader global market.

Growth in 2025 was largely supported by the Gulf Cooperation Council (GCC) countries. Saudi Arabia and the United Arab Emirates (UAE) were especially important. Their strong activity offset a slowdown in Turkiye.

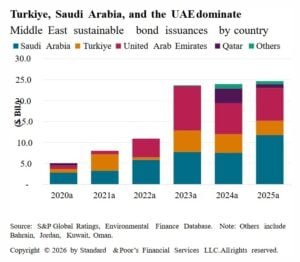

Issuance Concentrated in Three Countries

Sustainable bond activity in the Middle East remains highly concentrated. Turkiye, Saudi Arabia, and the UAE captured more than 90% of the sustainable bond market in the region.

The bond market itself is mainly driven by Saudi Arabia and the UAE. Together, they accounted for a combined 80% of sustainable bond issuance by value in 2025.

Turkiye plays a different role. Sustainable loans dominate the market in that country rather than bonds. In fact, sustainable loan issuance in Turkiye represented about 60%–65% of the regional market by value, and 70%–75% by volume.

In 2025, labeled bond issuance slowed sharply in Turkiye. Banks reduced their activity in the bond market. However, renewable energy projects increased in both bond and loan markets. Wind and solar capacity growth could support issuance again in 2026.

In Saudi Arabia and the UAE, issuance remained resilient across markets. Volume stayed strong even during periods of volatility.

Sustainable Sukuk Breaks Records

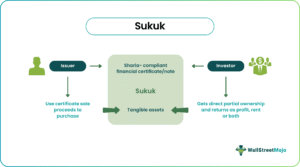

One of the most notable trends is the rapid growth of sustainable sukuk. Sustainable sukuk are designed to fund projects that have environmental or social benefits, while complying with Shariah principles.

Total sustainable sukuk issuance in the Middle East reached a new record of $11.4 billion in 2025, compared with $7.9 billion in 2024. This type of financing now accounts for more than 45% of regional sustainable bond issuance by value and more than 40% by number of issuances in 2025.

This represents a major increase from the end of 2024, when sustainable sukuk made up 33% of value and 24% by number. Saudi Arabia and the UAE continue to lead sukuk issuance.

Guidance published by the International Capital Market Association (ICMA) in April 2024 on green, social, and sustainability sukuk has helped improve transparency. Regulatory and government initiatives may further support growth in 2026.

Sukuk structures are particularly important in the GCC, where Islamic finance plays a central role in capital markets.

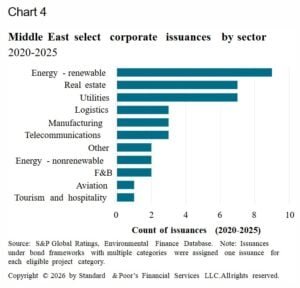

Renewable Energy Drives Issuance

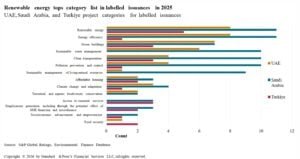

Renewable energy remains the main use of proceeds in the region’s sustainable bond market. Solar energy is especially popular in GCC countries because of high solar irradiance. Large-scale renewable projects require significant capital. And green bonds and sukuk help finance these investments.

Energy companies such as Masdar in the UAE are expected to continue issuing green bonds to expand renewable portfolios.

Saudi Arabia is preparing to commission the world’s largest utility-scale green hydrogen project in Neom in 2026. The project will use solar, wind, and energy storage systems. It forms part of Saudi Vision initiatives aimed at diversifying the economy and reducing reliance on hydrocarbons.

Other common project categories include:

- Energy efficiency

- Green buildings

- Sustainable water management

- Clean transportation

Climate adaptation projects are still limited but growing. In Saudi Arabia, the sovereign has included climate adaptation in its green bond framework. Banks in the UAE and Saudi Arabia have also started financing adaptation projects.

New Bond Types Emerging

The Middle East sustainable finance market is evolving beyond traditional green bonds.

Transition finance is expected to grow in 2026. This is particularly relevant for hydrocarbon-linked economies. Issuers with credible transition strategies may use transition bonds or transition loans. These can finance emissions reductions and methane abatement projects.

Guidelines for sustainability-linked loan financing bonds (SLLBs) were introduced in June 2024. These instruments allow issuers to finance portfolios of sustainability-linked loans aligned with international principles.

In 2025, Emirates Islamic issued the first SLLB sukuk in the region. This may encourage more banks to follow.

Blue bonds are also gaining attention. The UAE has positioned itself as a leader in this segment, in line with its UAE Water Agenda 2036.

In August 2025, First Abu Dhabi Bank issued the region’s first blue bond by a financial institution. In January 2026, Emirates NBD raised $1 billion through a dual-tranche issuance, including $300 million in blue bonds and $700 million in green bonds.

Eligible blue projects include:

- Offshore wind

- Wetland and coral reef conservation

- Flood and drought-resilient infrastructure

- Sustainable water and wastewater management

Digital bonds may also emerge. In January 2026, Emirates NBD issued the largest UAE dirham-denominated digital bond listed on Nasdaq Dubai. Although not labeled sustainable, digital issuance could improve liquidity and attract foreign investors.

Stronger Rules Lay the Foundation for Growth

Finally, regulation is gradually strengthening across the region. In April 2025, Saudi Arabia’s Capital Markets Authority published guidelines for issuing labeled debt instruments. These align closely with ICMA standards.

In the UAE, Federal Decree Law No. 11 (2024) requires all entities to measure, report, and reduce greenhouse gas emissions by May 2026. The law supports the country’s Net Zero 2050 strategy. Also, Turkiye is developing its own Green Taxonomy, largely based on the European Union framework.

Although there are currently no fully implemented local taxonomies in the region, policymakers are considering classification systems similar to Singapore’s “traffic light” approach. This system classifies activities as Green, Amber (transition), or Red (ineligible).

Such frameworks may help clarify which activities qualify for sustainable financing and could boost investor confidence.

What Will Power the $25B Forecast?

S&P Global expects issuance between $20 billion and $25 billion in 2026. The key drivers include:

- Continued renewable energy expansion

- Growing sustainable sukuk issuance

- Increased transition finance activity

- Regulatory developments and disclosure requirements

- Rising attention to climate adaptation and water resilience

However, sustainable finance volumes remain below what is needed to meet the region’s environmental challenges. Climate adaptation and water scarcity are still underfinanced. Private and blended finance may play a larger role in closing this funding gap.

Despite global volatility, the Middle East sustainable bond market has shown resilience. Strong issuance from Saudi Arabia and the UAE, combined with innovation in sukuk and new bond types, positions the region for continued growth in 2026.

If projections hold, the region could surpass $25 billion in sustainable bond issuance next year, reinforcing its expanding role in global sustainable finance.

The post Middle East Sustainable Bonds Set to Hit $25B in 2026 as Sukuk Surge appeared first on Carbon Credits.