Nickel—a vital component for stainless steel and electric vehicle (EV) batteries—is facing a challenging period in 2025. Supply-demand imbalances, shifting policies, and economic uncertainty are shaping the market, which is further impacting its price.

Notably, Indonesia holds significant influence over prices and supply, being the world’s largest nickel producer. Let’s explore the current state of the nickel market, the forces shaping it, and what lies ahead in the pricing trend.

Key Factors Behind the Ongoing Nickel Price Slump

Nickel prices have been falling steadily for two years. In 2024, the London Metal Exchange (LME) recorded an average price of $15,328 per metric ton, down 7.7% from 2023. By early 2025, prices dipped even further to $15,078 per metric ton—the lowest since 2020.

- However, analysts predict average prices are expected to be around $15,700 per metric ton—a level insufficient to attract significant new investments.

Several factors are driving the price slump and some of them are starkly evident.

Strong US Dollar

A stronger US dollar has made nickel more expensive for international buyers, reducing demand. When the dollar strengthens, commodities like nickel become less affordable for those using other currencies.

Robust US labor market data in early 2025 also impacted prices, pushing nickel to its lowest levels in five years.

US-China Tariff War

Additionally, ongoing geopolitical tensions, like US-China trade disputes post Trump took over the presidency have created uncertainty.

For instance, in January 2025, the announcement of potential 10% tariffs on Chinese goods added more pressure on base metals, including nickel.

Persisting Oversupply

At the same time, nickel production has consistently outpaced demand. Indonesia’s aggressive output expansion is a significant factor. With the country accounting for nearly half of the world’s nickel supply, its policies directly influence market dynamics.

Nickel Prices in 2025: Where Are They Headed?

While nickel prices briefly surged to $16,168 per metric ton in December 2024 due to speculation about output cuts in Indonesia, it was short-lived. Prices quickly fell back to $15,113 per metric ton, highlighting the market’s fragility.

Despite this, Russian producer Norilsk Nickel (Nornickel) expressed confidence, announcing plans to sell all its metal production in 2025. However, market experts believe Indonesia’s policies and global environmental regulations will continue to dictate price movements.

Additionally, environmental concerns will continue reshaping the nickel industry. Stricter regulations could limit production, creating uncertainty for producers and investors.

For instance, companies failing to meet green standards might face production cuts. This has prompted some producers to look for alternative sources of nickel ore. Sustainability is no longer just an option; it’s becoming essential for the industry’s future.

Short-Term Spike, Long-Term Lows

The outlook for nickel in 2025 remains challenging, with S&P Global predicting an oversupply that will continue to outpace demand. With a forecast of an average of $15,700 per metric ton, this year indicates ongoing significant market pressures.

Analysts also predict that global nickel stocks may reach 17.4 weeks of consumption by 2028. This increase could further pressure prices.

In the short term, price recoveries seem unlikely. Still, nickel’s role in key industries like EVs and renewable energy keeps it significant. Companies need to innovate, prioritize sustainability, and adjust to new dynamics to thrive in this changing market.

Indonesia’s Nickel Power: A Market Shaper

Indonesia controls almost half of the world’s nickel production. This solidifies its role as a major market influencer. Therefore, its policies and strategies can shape the global nickel landscape.

In late 2024, optimism grew when talks of cutting mining quotas emerged.

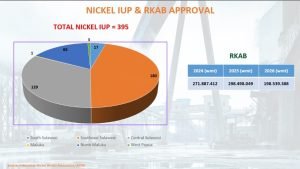

Credible media agencies reported that the Indonesian Nickel Miners Association (APNI) shared data in a recent hearing with the House of Representatives. It revealed Indonesia’s nickel production is set at 298.5 million wet metric tons, exceeding 2024’s 272 million tons.

This move shows a strong commitment to high output, keeping the market once again oversupplied.

Despite being the top nickel producer Indonesia faces a tough balancing act. The government wants to boost economic gains from nickel exports. At the same time, it needs to tackle rising environmental issues. Producers failing to meet sustainability standards could face stricter regulations or production cuts.

Some Indonesian companies are looking to import nickel ore from the Philippines. This unusual step shows the tough regulations producers will have to deal with.

China’s Grip on Refining Raises Concerns

China’s dominance in nickel refining further complicates the scenario. Chinese firms control 75% of Indonesia’s refining capacity. This gives them a major hold on this key part of the supply chain. By 2030, Indonesia will likely produce 44% of the world’s refined nickel.

This could increase supply chain risks for EV makers that depend on this resource.

This dependency has raised concerns. Disruptions in Indonesia’s nickel output or China’s refining could impact global EV production. Automakers and battery makers might need to change their supply chains soon.

Nickel Price Forecast 2030 and Beyond

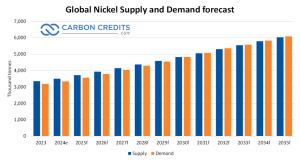

The analysis for the supply vs. demand chart emphasizes that demand is growing at a faster rate than supply. Over the period from 2023 to 2035, the compound annual growth rate (CAGR) for supply is 4.6%, while demand is projected to grow at 5.1%.

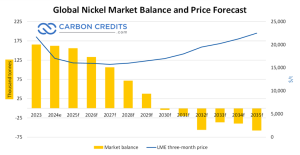

Building on the supply and demand forecast, the current nickel oversupply and low-price environment are expected to shift. With a declining market balance and reduced oversupply, nickel prices are forecasted to rise. By 2030 and beyond, demand is projected to exceed supply, leading to a further price increase.

In conclusion, the nickel market is currently facing persistent challenges of oversupply, slower demand growth, and stricter environmental regulations. These factors consistently drive prices downward. However nickel prices for 2030 and beyond show optimism for industry growth and mining.

The post Nickel Prices Plunge in 2025: Can Demand Revive the Market by 2030? appeared first on Carbon Credits.