The U.S. offshore wind sector has been thrown into uncertainty after the Trump administration announced an immediate pause on all large-scale offshore wind projects already under construction. The Interior Department said the decision stems from “national security risks” flagged by recently completed classified reports from the Department of War. Officials argue the pause gives time to reassess whether these risks can be reduced through mitigation measures.

However, the move has triggered intense pushback from states, developers, utilities, grid operators, and industry groups. Many warn that the decision could raise electricity prices, delay clean energy deployment, threaten investments, hurt reliability, and undermine years of planning and regulatory approvals.

Secretary of the Interior Doug Burgum said:

“The prime duty of the United States government is to protect the American people. Today’s action addresses emerging national security risks, including the rapid evolution of the relevant adversary technologies, and the vulnerabilities created by large-scale offshore wind projects with proximity near our east coast population centers. The Trump administration will always prioritize the security of the American people.”

National Security Concerns Take Center Stage

According to the Interior Department, the pause affects major U.S. offshore wind projects, including:

The following leases are paused:

- Vineyard Wind 1 (OCS-A 0501)

- Revolution Wind (OCS-A 0486)

- CVOW – Commercial (OCS-A 0483)

- Sunrise Wind (OCS-A 0487)

- Empire Wind 1 (OCS-A 0512)

Officials claim large offshore wind turbines can interfere with national defense radar systems. Their rotating blades and reflective towers can create what’s called “radar clutter,” which may obscure real targets or generate false signals — a concern highlighted in earlier U.S. government assessments. A 2024 Department of Energy report noted that raising radar thresholds to reduce this clutter could also mean missing actual threats.

Interior Secretary Doug Burgum framed the pause as a security-first decision, saying the administration must prioritize protecting Americans amid evolving adversary capabilities.

Industry Pushes Back: “We’ve Already Cleared Defense Reviews”

The BBC reported that developers and energy leaders strongly dispute the need for the pause. Dominion Energy, developer of the major Virginia offshore wind project, stressed that its site is far offshore and has not caused security issues. The company noted its two pilot turbines have operated for five years without any national security concerns. Still, Dominion’s stock fell over 3% following the announcement, while Danish developer Ørsted sank 12%, and turbine maker Vestas dropped 2.6%.

Similarly, S&P Global also highlighted that the National Ocean Industries Association (NOIA) called the action unnecessary. President Erik Milito said all projects under construction had already passed Department of Defense coordination and clearance through rigorous legal processes. He urged the administration to end the pause quickly and highlighted that defense officials were engaged at every permitting stage.

The same S&P Global report also cited that the Oceantic Network, representing the offshore wind industry, called the decision a “veiled attempt” to derail offshore wind progress, arguing it contradicts years of multi-agency review and previous Pentagon approvals. The network warned the pause could delay nearly 6 GW of new power capacity — at a time of rapidly rising electricity demand — while driving prices higher and discouraging investment.

Political and Legal Fallout Intensifies

Governors and state leaders are sounding alarm bells. Connecticut Governor Ned Lamont criticized the decision as “erratic,” saying it will raise electricity costs and disrupt jobs and predictability for businesses. Many of these projects are nearing completion or already supplying power, and states argue that sudden federal reversals undermine economic confidence.

The pause also arrives after the administration has suffered multiple legal defeats. Earlier in December, a federal judge rejected a broader wind project ban, calling it “arbitrary and capricious.” Courts also blocked attempts to halt Revolution Wind and overturned the January permitting freeze. Analysts at ClearView Energy Partners suggested the timing of the new pause may be a strategic response — a “counterpunch” to recent judicial losses.

Meanwhile, 17 states led by New York are already challenging earlier wind restrictions, calling them an “existential threat” to the U.S. wind industry. That broader political and legal confrontation is now expected to deepen.

Grid Reliability Concerns: “We Need Every Electron”

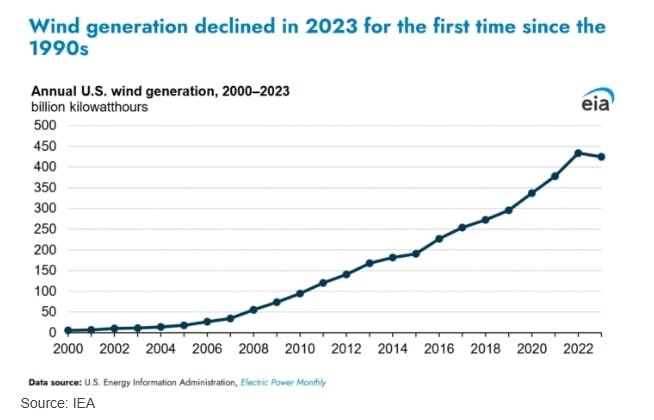

Energy security isn’t just about defense — it’s also about keeping the lights on. Former FERC Chairman Neil Chatterjee sharply criticized the pause, calling it reckless at a time when the U.S. needs every available power source. With electricity demand projected to surge — especially from artificial intelligence data centers — offshore wind plays a growing role in supporting grid reliability.

ISO New England echoed the concern. Vineyard Wind is already feeding power to the grid, while Revolution Wind is expected to be online by 2026. Both are built into regional power planning and winter reliability strategies, when offshore wind often performs strongest while other energy supplies tighten. Pausing or canceling them, ISO warned, would raise costs and increase reliability risks.

- READ MORE: Renewables 2025: How China, the US, Europe, and India Are Leading the World’s Clean Energy Growth

Offshore Wind Was Finally Gaining Momentum: Wood Mackenzie

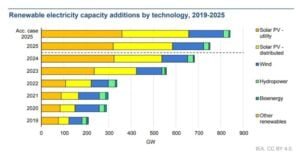

Before the pause, the U.S. offshore wind market was finally building traction after years of delays, inflation pressures, supply chain constraints, and permitting battles. Wood Mackenzie projected strong growth ahead, forecasting 46 GW of new U.S. wind capacity from 2025 to 2029 across onshore and offshore projects combined.

The U.S. offshore sector had begun recovering from cost overruns and contract cancellations. Near-term projects targeting 2026 commercial operation were advancing, even though post-2027 developments still faced hurdles like limited installation vessel capacity and tariff uncertainty. Major players like Ørsted and Equinor were restructuring finances and navigating policy headwinds, but momentum was slowly returning.

Wood Mackenzie expected total national wind capacity to reach nearly 197 GW by the end of the decade — including 6 GW of offshore wind. A peak year of 12 GW or more installations was forecast for 2027. This new federal pause now threatens to disrupt that trajectory.

A High-Stakes Crossroads for U.S. Clean Energy

Energy markets also feel the shock. S&P Global reported growing concern within the sector that halting projects could tighten power supply and worsen price pressures, especially in high-demand regions like the Northeast. Many experts warn that the U.S. can’t afford to pull back on clean energy just as consumption is projected to surge.

The post Offshore Wind Shock: Trump Administration Hits Pause Citing National Security Risks appeared first on Carbon Credits.