Advanced nuclear energy is moving from concept to execution in the United States. Oklo Inc. (NYSE: OKLO), a next-generation nuclear technology company, has reached a major milestone after signing an Other Transaction Agreement (OTA) with the U.S. Department of Energy (DOE). The agreement supports the design, construction, and operation of a radioisotope pilot plant under the DOE’s Reactor Pilot Program (RPP).

This step marks Oklo’s transition from planning to active deployment under formal DOE authorization. It also signals growing federal confidence in private-sector nuclear innovation, especially as energy demand rises alongside AI-driven infrastructure growth.

DOE Agreement Pushes Oklo into Active Execution Phase

The OTA allows Oklo to move forward with its Radioisotope Pilot Facility, a project designed to demonstrate domestic production of critical medical and research isotopes. Unlike traditional federal contracts, OTAs provide flexibility, speed, and fewer administrative constraints. This framework is increasingly favored for advanced reactor development.

With the agreement now in place, Oklo’s subsidiary Atomic Alchemy Inc. will focus its near-term efforts entirely on building and operating the pilot facility. As part of this “learn first, then scale” approach, the company has withdrawn its earlier Nuclear Regulatory Commission (NRC) permit application for the Meitner-1 commercial facility. Instead, Oklo plans to use insights from the pilot plant to support future commercial-scale deployments.

Jacob DeWitte, co-founder and CEO of Oklo, said:

“This OTA establishes a framework for execution and risk reduction. By building and operating a pilot reactor, we generate the data and experience to streamline future commercial deployments, improve regulatory efficiency, and deliver long-term value”

Why Domestic Radioisotope Production Matters

Radioisotopes play a critical role across healthcare, research, and national security. They are used to diagnose and treat cancer, support medical imaging, power scientific research, and enable space and defense applications. Yet many of these isotopes are still produced overseas or at aging facilities.

Oklo aims to change that. By establishing a pilot plant in the U.S., Atomic Alchemy is laying the foundation for reliable, domestic isotope supply chains. This shift could reduce dependence on foreign sources while improving long-term availability for hospitals and research institutions.

Moreover, Oklo’s technology allows the recycling of used nuclear fuel to extract valuable isotopes. Some materials, such as Strontium-90, can be used directly in applications like space power systems without additional processing. This approach improves efficiency while reducing waste, offering both economic and strategic benefits.

Oklo Stock Gains Strong Investor Confidence

Investors responded quickly to Oklo’s DOE milestone. As of January 9, 2026, OKLO shares closed at $105.31, rising nearly 8% in a single session. It traded between $104.03 and $115.72, with after-hours activity pushing prices even higher.

Trading volume surged to 33.8 million shares, more than double the average, signaling heightened market interest. Oklo’s market capitalization now stands at roughly $16.45 billion.

Zooming out, the performance is even more striking. The stock is up 30% year-to-date in 2026 and more than 260% over the past year. Strategic partnerships, including power supply agreements linked to major technology companies, have helped position Oklo as a leading nuclear play in a rapidly evolving energy market.

- READ MORE: Project Matador: America’s $90B Nuclear Power Solution for AI, Semiconductors, and Data Centers

More Developments: Terrestrial Energy Joins the DOE Pilot Program

This week, Terrestrial Energy, a Generation IV small modular reactor (SMR) developer, also signed an OTA with the DOE for Project Tetra.

Project Tetra will support the development of Terrestrial Energy’s Integral Molten Salt Reactor (IMSR), a design intended to deliver clean, flexible power to industrial users, data centers, and electric grids. The IMSR’s molten salt technology allows for high-temperature operation, enabling efficient electricity generation as well as direct heat supply for industrial processes.

Notably, the IMSR relies on standard low-enriched uranium (LEU), avoiding the supply constraints associated with HALEU fuel. This design choice could accelerate commercialization at a time when fuel availability has become a key bottleneck for advanced nuclear projects.

As of January 10–11, 2026, the Terrestrial Energy stock (IMSR) hovered between $9.37 and $9.80, posting recent gains amid renewed enthusiasm for nuclear technologies.

Trading volumes exceeded averages, and the company’s market cap reached approximately $768 million. While the stock remains volatile—common for pre-commercial SMR developers—investor interest reflects broader optimism around molten salt reactors and advanced nuclear designs.

OTAs Create a Faster Path From Pilot to Commercial Scale

Both Oklo and Terrestrial Energy are operating under the DOE’s Advanced Reactor Pilot Program, which allows privately built reactors to operate outside national laboratories. This program can bridge the gap between early system testing and full commercial licensing.

By using OTAs, the DOE enables companies to test reactors, gather operational data, and refine designs without the delays of traditional procurement frameworks. As a result, advanced nuclear technologies can reach the market more quickly.

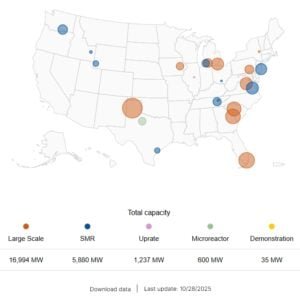

In conclusion, recent U.S. executive actions aim to expand nuclear capacity from 100 gigawatts to 400 gigawatts by 2050. The plan includes upgrading existing reactors, restarting idle plants, and launching new large-scale reactor projects by 2030.

The post Oklo Stock Rises as DOE Approves Radioisotope Pilot Using Recycled Nuclear Fuel appeared first on Carbon Credits.