Artificial intelligence is expanding at a breathtaking pace, and its growing energy needs are creating a new problem for the tech world. This week, the discussion took a dramatic turn after Nvidia (NASDAQ: NVDA) CEO Jensen Huang backed nuclear power as the key to powering the next generation of AI. His comments immediately sent ripples through the market—especially for SMR companies Oklo (NYSE: OKLO).

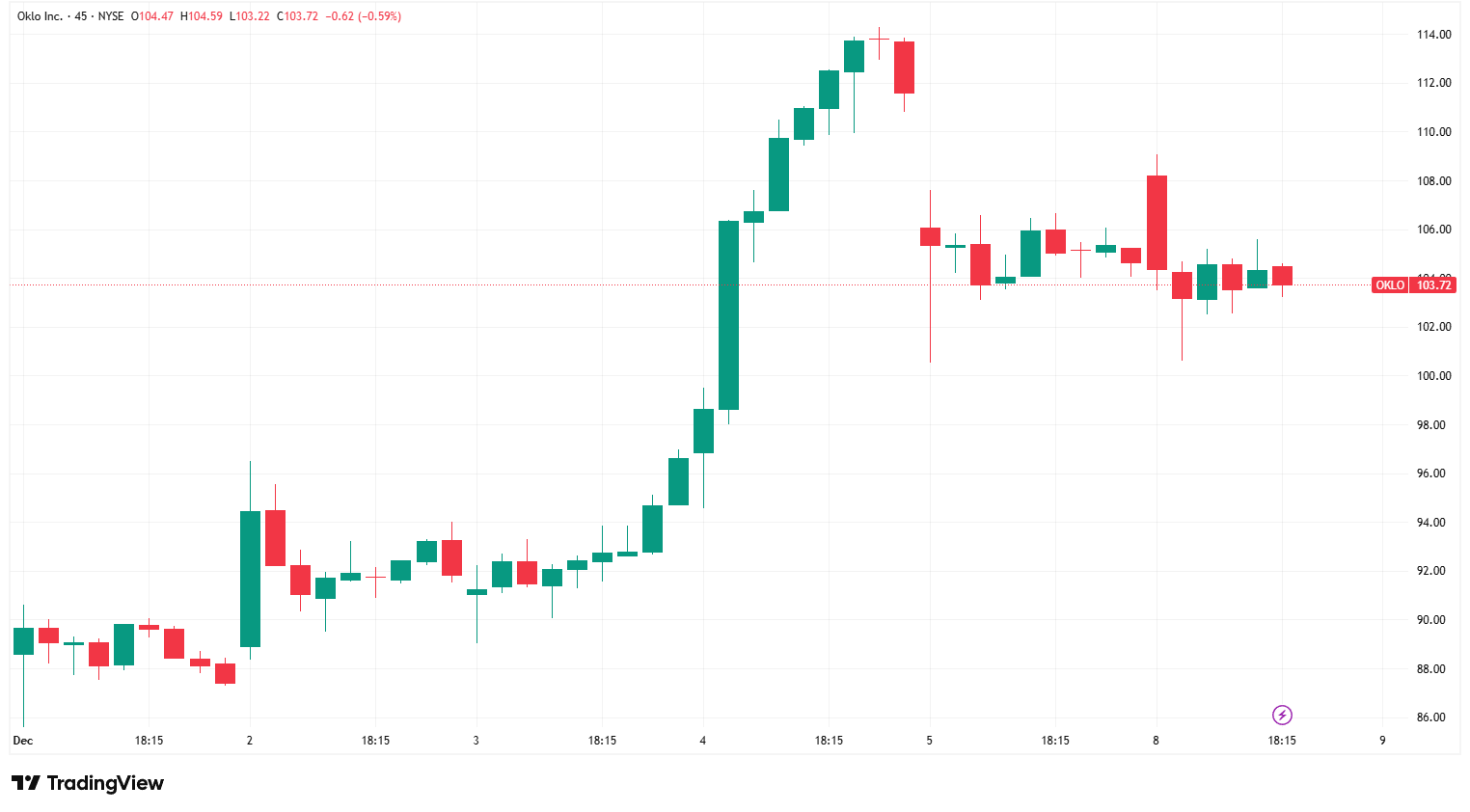

Oklo shares surged almost 24% after Huang predicted that advanced reactors would become essential within six to seven years. The move added to Oklo’s already unbelievable 1,000% gain over the past year. Investors took Huang’s view seriously, and nuclear energy stocks suddenly looked like the next beneficiaries of the AI boom.

The One Comment That Made Oklo an AI Stock Sensation

Huang didn’t comment lightly. As per media reports, during his appearance on The Joe Rogan Experience, he warned that energy is becoming “the bottleneck” for AI. Data centers, he said, are turning into “gigawatt factories,” and the current grid simply cannot handle the pressure.

- His message was clear: AI will need stable, round-the-clock, carbon-free power—and nuclear checks every box.

Oklo’s momentum reflects this shift. The California company is developing fast-neutron microreactors called Aurora powerhouses, which deliver 15–75 MW of clean energy using recycled nuclear waste. These reactors can run up to 10 years without refueling, making them ideal for remote areas or power-hungry AI campuses.

This year, Oklo struck a historic deal with data-center giant Switch. Under what the companies call the “Master Power Agreement,” Switch plans to deploy 12 gigawatts of Oklo’s reactors through 2044. It is one of the largest corporate clean-power agreements ever signed and places Oklo at the center of the AI energy transition.

Oklo’s market cap has now reached about $16.35, driven by both investor enthusiasm and the belief that nuclear microreactors will become standard infrastructure for AI-ready data centers. Wedbush analyst Daniel Ives even raised his price target to $150, saying the demand for reliable new energy sources is overwhelming.

Regulators Still Stand in the Way

Despite the excitement, Oklo remains a pre-revenue company. It is still navigating the lengthy U.S. Nuclear Regulatory Commission (NRC) approval process, which has hindered the advancement of nuclear technology for years. The company aims to deploy its first reactors by 2027 or early 2028; however, timelines in the nuclear industry are rarely straightforward.

Even so, Oklo is making progress. It received clearance from the DOE and Idaho National Laboratory (INL) to begin site characterization for its first commercial plant. It also received a permit to access fuel material from INL and submitted the first custom combined license application for an advanced fission plant.

NuScale Power also rallied after Huang’s comments. However, NuScale remains a speculative investment, though, because it does not generate meaningful revenue and has struggled with costs. Analysts note that investors who want nuclear exposure without company-specific risks may prefer nuclear energy ETFs.

- READ MORE: IAEA Predicts Doubling Nuclear Capacity by 2050—SMRs and Reactor Life Extensions Lead the Way

DOE Plans a Nuclear Boom to Feed Exploding AI Demand

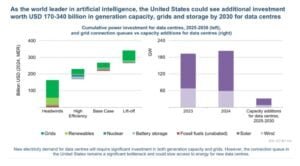

The nuclear momentum isn’t just coming from Silicon Valley. The Department of Energy and the National Nuclear Security Administration (NNSA) are turning to nuclear power as the backbone for future AI growth.

Federal agencies are preparing major sites—Savannah River Site, Oak Ridge Reservation, Idaho National Laboratory, and the Paducah Gaseous Diffusion Plant—to host AI data centers powered by advanced reactors. This signals a major shift in how the U.S. plans to fuel digital infrastructure.

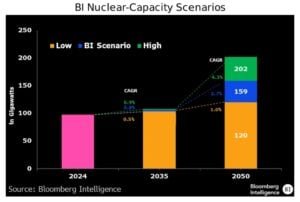

A key DOE study called for tripling U.S. nuclear capacity from today’s 100 GW to 300 GW by 2050. The report identified 190 potential coal and retired nuclear sites that could host up to 269 GW of new reactors.

Bloomberg Intelligence projects U.S. nuclear capacity could rise 63% to 159 GW by 2050, requiring around $350 billion in investment—much of it driven by AI.

Only Nuclear Fits the Bill

The numbers reveal the urgency. According to the U.S. Department of Energy (DOE):

-

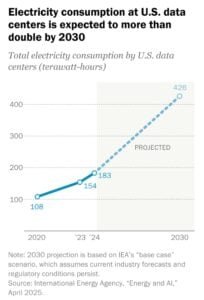

U.S. data centers consumed 176 TWh of electricity in 2023, equal to around 4.4% of all U.S. power use.

-

By 2028, this could reach 325–580 TWh, mainly because of AI servers.

-

By 2035, AI data centers alone could double total U.S. data-center demand to about 9% of the national grid.

Globally, data centers could consume over 4% of electricity by 2035, making them one of the world’s biggest power users.

As AI models grow, so does the energy intensity. Next-generation chips generate more heat, require more cooling, and most importantly, need nonstop power. Solar and wind can contribute, but their intermittent nature makes them difficult to rely on 24/7. Nuclear, in contrast, offers constant, carbon-free electricity that fits perfectly with AI’s nonstop compute cycles.

Tech Giants Secure Nuclear Deals

Big Tech doesn’t want to wait for grid upgrades. Companies are directly partnering with nuclear operators to secure decades of stable power:

-

Microsoft signed a 20-year agreement with Constellation to restart the Three Mile Island Unit 1 reactor, bringing 837 MW of power to its data centers.

-

Meta signed a long-term deal with Constellation to expand an Illinois nuclear plant by 30 MW, protecting local jobs and boosting the grid.

-

Amazon Web Services secured a 10-year contract for several hundred MW from Talen Energy’s Susquehanna nuclear plant.

These deals show that nuclear power is becoming a competitive advantage in the AI race. Companies that secure clean, steady electricity today will scale faster than those stuck waiting for the next power line.

Is Oklo Ready to Fuel the AI Era

Huang’s endorsement gave Oklo a huge confidence boost. The company sits at the intersection of AI, clean energy, and next-gen nuclear technology. If its Aurora powerhouses reach commercial deployment on schedule, Oklo could become one of the most important energy suppliers for the AI era.

Still, it faces years of regulatory review, technical testing, and construction challenges. NuScale has similar hurdles and remains a high-risk bet.

Yet the broader trend is undeniable: AI needs nuclear power to grow, and nuclear companies are finally receiving the attention and investment they long waited for. And with Nvidia’s CEO putting the spotlight on advanced reactors, Oklo may be stepping into its most important chapter yet.

- ALSO READ: Nuclear Stocks, Oklo, NuScale, Centrus Energy, Rise as U.S. Army Pushes for Microreactors

The post Oklo Stock Rockets After Nvidia CEO Jensen Huang Backs Nuclear for AI Data Centers appeared first on Carbon Credits.