Orbital data centers are a radical rethinking of where and how we process the world’s data. Companies are moving away from building bigger campuses on Earth. Instead, they are designing computing facilities to operate in low Earth orbit and beyond. These systems provide constant solar power and cool naturally to reject heat. Plus, they can process satellite data right on-site. This could tackle some major challenges that terrestrial data centers face today.

The idea has moved quickly from theory to concrete plans. Axiom Space, for example, is planning to deploy orbital data center (ODC) nodes to the International Space Station by 2027. Google has joined the race with Project Suncatcher. This initiative aims to create solar-powered AI data centers in orbit.

Google’s plan includes launching prototype satellites around 2027 equipped with Tensor Processing Units (TPUs). They will run on continuous sunlight and use laser-based communication systems.

The company says orbital solar panels could produce up to 8x more energy than those on Earth. They also believe costs may match those of land-based data centers by the mid-2030s.

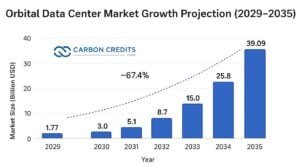

Market analysts expect fast growth. The orbital data center market will rise to tens of billions of dollars by 2035. This shows a compound annual growth rate of about 67%. This surge comes from high demand for AI computing, new satellite data, and the push to lower the data center’s environmental impact.

The next sections will explore the technical, environmental, commercial, and geopolitical factors driving this change. They will explain why the decade ahead might determine whether orbital data centers stay niche or become key global infrastructure.

The Rise of Orbital Data Centers

The digital world is expanding at a pace never seen before. Every day, businesses, governments, and individuals generate massive volumes of data. The demand for data processing and storage is skyrocketing. This is driven by AI training models needing a lot of computational power and satellite networks sending terabytes of images back to Earth.

Traditional terrestrial data centers have carried the load so far, but they are reaching their limits. The sheer scale of energy consumption, cooling requirements, and land use is making it harder to sustain growth. This pressure has given rise to a bold alternative: orbital data centers.

The Limits of Earth-Based Data Centers

On Earth, data centers are already among the most energy-intensive types of infrastructure. In the U.S. alone, power demand from these facilities is projected to climb from 17 gigawatts in 2022 to 35 gigawatts by 2030.

The industry could see $2 trillion in global capital spending in the next five years. Half of that will be in the United States. Data centers use more than just electricity. They consume millions of gallons of water each year for cooling. They also take up large areas of land and release a lot of carbon dioxide. This environmental footprint clashes with global climate goals. Many areas are facing water scarcity and grid issues.

The physical expansion of Earth-based data centers also creates tensions with local communities. In parts of the U.S. and Europe, new projects face pushback. This is due to land use issues, water stress, and rising electricity costs tied to large-scale digital infrastructure. As demand continues to rise, these conflicts are expected to grow sharper.

Enter Space-Based Computing

Orbital data centers want to solve these problems by placing processing power in space. These systems use solar energy from space. They don’t rely on power grids on Earth. So, they can work without interruptions from weather or day-night changes.

Orbital centers could cut the environmental impact by eliminating the need for land and water resources. This is a major advantage over Earth-based centers.

The concept is not entirely new. Experiments have already proven that computers can operate reliably in space. Hewlett-Packard Enterprise (HPE) grabbed attention with its Spaceborne Computer project. This project showed that regular hardware can work well on the International Space Station (ISS). This early step showed that data centers could scale to orbital operations. They would need radiation protection, heat dissipation systems, and reliable networking.

Market Potential

What was once science fiction is now a market on the cusp of rapid growth. Analysts expect the orbital data center industry to grow from $1.77 billion in 2029 to $39.09 billion by 2035. This shows a remarkable compound annual growth rate (CAGR) of 67.4%.

Notes: Shows rapid industry expansion with a CAGR of 57.4% driven by AI demands and sustainability

This surge is fueled by multiple drivers:

- The insatiable demand for AI and machine learning workloads.

- The explosion of satellite constellations is generating enormous amounts of data.

- The urgent need for more sustainable, climate-conscious computing.

- Advances in reusable rockets and space-based solar power systems are making orbital deployment increasingly feasible.

Cost Comparison

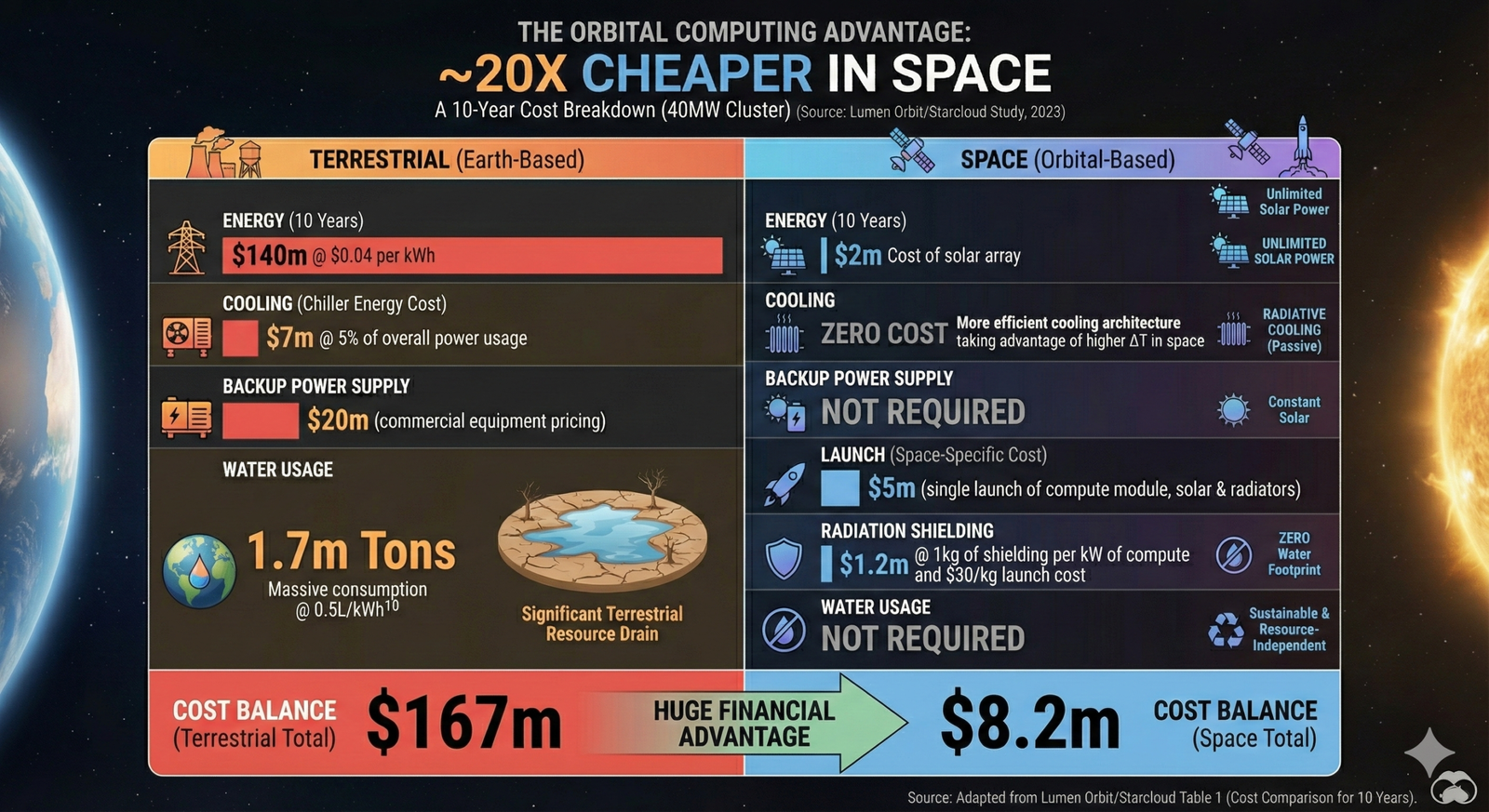

Based on the Lumen Orbit white paper, the cost comparison between orbital and terrestrial data centers is dramatic:

Over a 10‑year span, a 40 MW terrestrial data center would cost about US$167 million, covering energy (~$140 m), cooling ($7 m), water use, backup power ($20 m), etc. Meanwhile, an equivalent orbital setup would cost only ~US$8.2 million, factoring in $5 m for launch, $2 m for a solar array, and $1.2 m for radiation shielding.

This implies space‑based data centers could be roughly 20× cheaper to operate over that timeframe.

Cost Comparison for a 10-year Cycle: Terrestrial vs. Orbital Data Centers

From Vision to Reality

The next few years will be critical in proving the viability of orbital data centers. Companies such as Axiom Space, Google, Starcloud, and China’s ADA Space are already preparing demonstration missions and initial deployments. These projects aim to test hardware. They also show investors and customers that orbital facilities offer real performance benefits.

Axiom Space plans to send an orbital data center module to the ISS by 2027. They aim to grow this with their commercial space station platform. Starcloud plans to launch a GPU-powered satellite in 2025 to test high-performance computing in orbit. ADA Space is launching a bold plan for a 2,800-satellite constellation. This shows how quickly orbital infrastructure can grow.

These efforts mark a shift from theoretical feasibility studies to practical implementation. If they succeed, they could change global digital infrastructure. This would lead to a future where computing isn’t just on Earth, but spread across land and space.

Environmental Promise and Sustainability Benefits

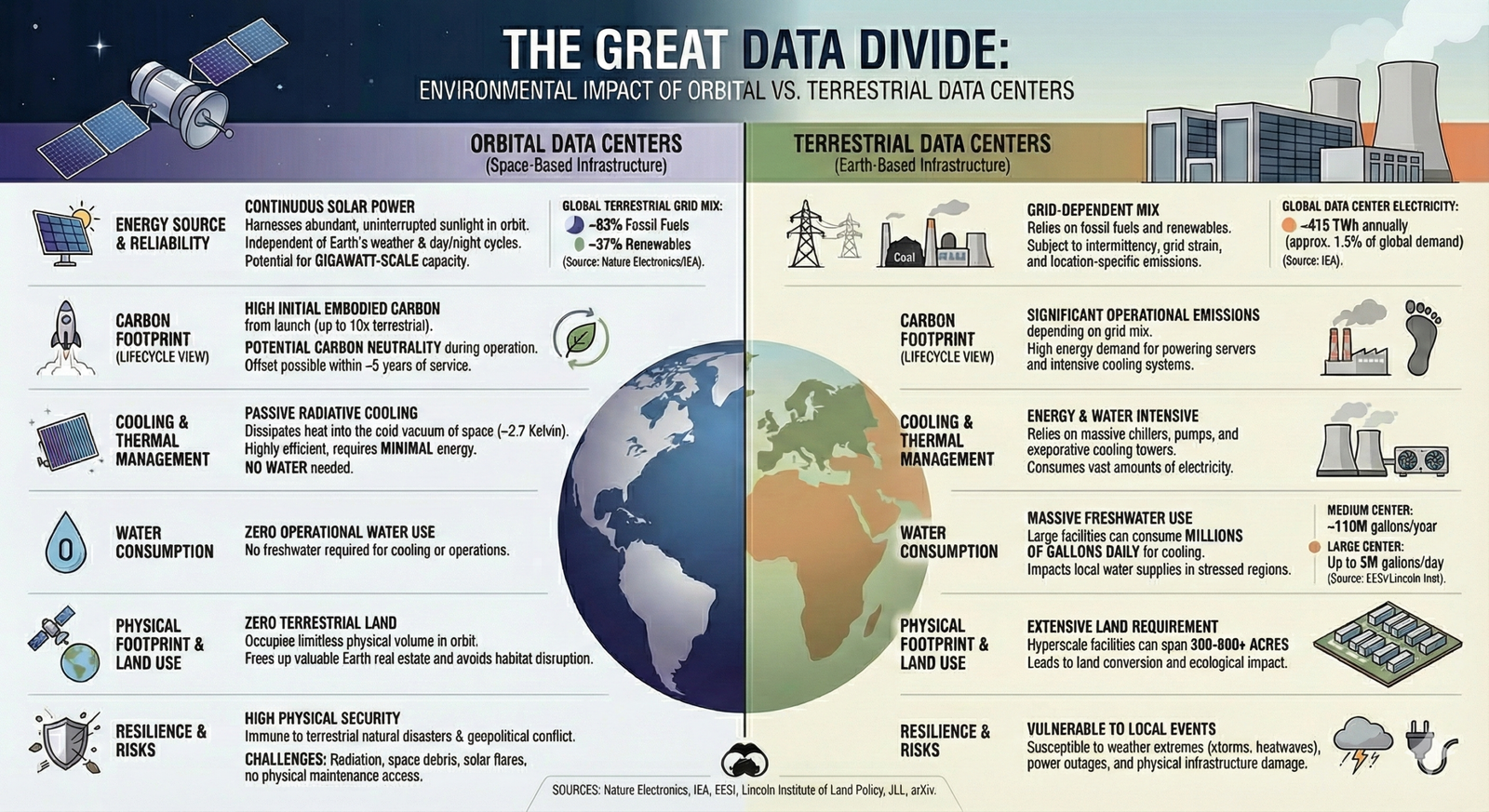

One of the strongest arguments for orbital data centers is their potential to ease the environmental strain created by traditional facilities. Terrestrial data centers use about 1–2% of the world’s electricity. This percentage is rising as more people adopt AI. Cooling systems alone can consume up to 40% of a facility’s power needs.

In addition, many data centers require hundreds of acres of land and millions of gallons of water each year for heat management. These pressures have made the sector a target of regulatory scrutiny and community pushback. Companies think they can greatly reduce these impacts by moving some computing infrastructure into orbit.

Unlimited Access to Solar Power

The most obvious advantage of orbital data centers is access to continuous solar energy. Orbital solar arrays don’t have interruptions from weather or night. Unlike solar farms on Earth, they operate continuously. This means they can deliver a constant and highly efficient power supply. Starcloud and others are planning large solar grids. These grids could stretch up to 2.5 miles and aim to power big orbital data facilities.

For high-performance computing, like AI training, this power source offers faster, cheaper, and more sustainable processing than what we can achieve on Earth.

Cooling in the Vacuum of Space

Cooling is one of the biggest sources of energy waste in terrestrial facilities. Conventional centers use fans, air conditioning, or liquid systems. These can make up almost half of their electricity use.

In orbit, space creates a unique environment. Traditional convection cooling doesn’t work here, so heat must leave through radiation.

Engineers are creating unique radiator panels, heat pipes, and phase-change materials. These tools help control thermal loads in orbital data centers. These systems are complex, but they lack energy-hungry water and air cooling. This could lead to big efficiency gains when scaled up.

Reduced Land and Water Use

Space-based facilities free up land on Earth. This helps avoid conflicts with farming, city growth, or conservation. This is especially important in places like Northern Virginia and Dublin. Data center growth there has led to community pushback about land use and strain on infrastructure.

Orbital centers also sidestep water usage, a growing concern in drought-prone regions such as the American West. By comparison, large data centers use millions of gallons of water each year for cooling. This puts pressure on local water supplies.

Carbon Footprint Reduction

Orbital data centers could reduce dependence on fossil fuel-based electricity by tapping directly into abundant solar power in space. They also eliminate the carbon emissions tied to land clearing and cooling infrastructure.

Research backed by the European Commission shows that orbital data centers may be environmentally friendly. They could offer computing power with a lower carbon footprint than data centers on Earth.

The Trade-Off: Launches and Space Debris

The sustainability equation is not without complications. Rocket launches needed for orbital infrastructure still release a lot of emissions. This includes black carbon particles, which can build up in the upper atmosphere.

Large-scale deployment might increase this footprint. However, reusable launch systems like SpaceX’s Falcon 9 are lowering the cost and emissions for sending hardware to orbit.

Another concern is space debris. With tens of thousands of new satellites projected for launch by 2030, orbital traffic is experiencing significant congestion. Large solar arrays and data hubs represent big targets for collisions with debris traveling at speeds of up to 28,000 kilometers per hour.

Mitigation strategies are key. Debris shields, active cleanup missions, and smart orbital slot management will help. These steps ensure that sustainability gains aren’t lost to new environmental hazards in orbit.

Environmental Impact Comparison: Terrestrial vs. Orbital Data Centers

A Net Positive, if Challenges Are Managed

Taken together, orbital data centers promise major environmental benefits by reducing energy demand, land use, and water consumption on Earth. Launch emissions and orbital debris are concerns, but technology and smart rules can create a positive outcome. If these facilities can scale well, they could be a major innovation in sustainability for digital infrastructure.

Market Landscape and Key Players

The orbital data center market is new, but companies and partnerships are paving the way. These players include space station developers, satellite operators, cloud and hardware firms, and telecom companies. They all compete for a share of a potential multibillion-dollar industry by the mid-2030s.

Their strategies vary, but all aim to address the same challenges while providing real benefits compared to land-based options:

- powering,

- cooling, and

- protecting computing infrastructure in the harsh conditions of space.

Axiom Space: Building the First Orbital Data Hub

Axiom Space is among the most prominent U.S. firms advancing orbital data center capabilities. The company is best known for Axiom Station, which will replace the International Space Station. It also plans to integrate orbital data center (ODC) modules into its future projects. Axiom has received funding to boost its research and development. This includes $5.5 million from the Texas Space Commission.

The company focuses on “Earth independence”, which means data can be stored and processed in orbit. It doesn’t need any ground-based cloud systems.

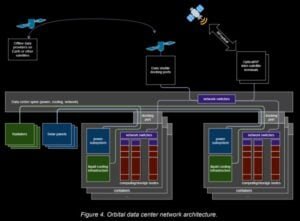

Axiom teamed up with Kepler Communications and Skyloom Global. Together, they added optical inter-satellite links (OISLs). This upgrade allows fast data transfers between orbit and ground. The first ODC nodes will launch on the ISS by 2027. This will be one of the earliest real-world tests of orbital computing.

Starcloud: Scaling Solar-Powered Computing

Another key innovator is Starcloud, which used to be called Lumen Orbit. This startup has raised over $21 million in seed funding: one of the biggest early investment rounds for a Y Combinator graduate. The company’s vision is bold: solar panel grids up to 2.5 miles wide powering megawatt-scale data centers in orbit.

Starcloud’s first demo mission successfully launched in November 2025 on a SpaceX Falcon 9. It carried a 132-pound (60-kilogram) satellite with an NVIDIA data-center-grade GPU. This mission is designed to prove that space can handle demanding computing tasks such as AI inference and training.

If they succeed, the company thinks orbital facilities could be cheaper than Earth-based data centers. This is especially true for processing satellite data and AI tasks that work better near the source.

Google’s Project Suncatcher: Sustainable AI Computing

Google announced this project, which represents the first major move by a global tech giant into orbital computing. The company will launch solar-powered satellites. These satellites have custom TPUs and use laser communication to connect orbital clusters to Earth.

Google’s research shows that solar collection in orbit could be up to eight times more efficient than on Earth. This could provide sustainable AI computing on a large scale. If the prototypes succeed, Google expects to expand toward operational orbital nodes in the early 2030s.

China’s ADA Space: An Ambitious Constellation

China has emerged as a powerful competitor through ADA Space (Guoxing Aerospace). In May 2025, the company launched 12 AI-enabled satellites. This is the first step in a plan for 2,800 satellites. Each satellite has 744 tera operations per second (TOPS) of computing power. They use 8 billion-parameter AI models and feature 100 Gbps laser inter-satellite links.

This project highlights China’s strategic intent to dominate orbital computing. ADA Space processes data in orbit, especially for astronomy and remote sensing. This helps reduce bandwidth issues and speeds up response times. The constellation is more than just a business. It also helps China with its national security and space goals.

PowerBank: A Strategic Contributor

PowerBank Corporation, in partnership with Orbit AI, is developing the Orbital Cloud, a network of AI-enabled orbital data centers. The system combines satellite communication, on-orbit AI computing, and blockchain verification, providing resilient, censorship-resistant services independent of ground networks.

PowerBank supplies advanced solar energy systems, adaptive energy management, and thermal control technologies to power and maintain these orbital compute nodes. The first satellite, DeStarlink Genesis‑1, launched in December 2025, marking the start of the network, with additional nodes planned through 2026 and beyond.

This initiative positions PowerBank at the intersection of renewable energy, AI, and space infrastructure. Analysts estimate the combined market for orbital infrastructure, in-orbit computing, and satellite services could exceed USD 700 billion over the next decade.

OrbitsEdge + HPE: Modular Racks in Orbit

OrbitsEdge has partnered with Hewlett Packard Enterprise (HPE) to design modular, satellite-based data centers. Their SatFrame satellite bus can hold standard 19-inch server racks. It can also scale to support larger hardware.

HPE’s Edgeline Converged Edge Systems show how traditional IT hardware companies are adjusting ground technology for space. This modular approach could allow incremental scaling. This has lower risks compared to large, one-time deployments.

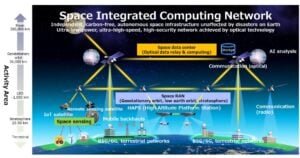

NTT/JSAT Space Compass: Beyond-5G Integration

Japan’s NTT Corporation and Sky Perfect JSAT have teamed up in the Space Compass joint venture. This shows how telecom companies see orbital computing as key to future networks. Their plan connects land, air, and space communication systems. This will support Beyond-5G and 6G connectivity.

The venture plans to use high-speed optical transmission to connect these layers. This will provide seamless global cloud services. As such, orbital data centers will serve as the backbone for low-latency processing.

European Efforts: Feasibility and Sustainability

Europe is also exploring orbital data centers, though it is earlier in the process. Thales Alenia Space, with help from the European Commission, studied the technology and environmental impact of these systems.

Europe may be behind the U.S. and China in commercial deployments. But its focus on sustainability and regulation might set global standards.

Funding and Strategic Backing

Behind these companies is a growing web of investors and government support. Venture firms like Y Combinator, NFX, FUSE, and Soma Capital are backing startups such as Starcloud. Also, major tech investors like Sequoia and Andreessen Horowitz are interested in orbital computing ventures.

Even the CIA’s venture capital arm, In-Q-Tel, has backed projects in this space. This shows how important orbital data centers are for defense and intelligence.

These investments show confidence that orbital computing will evolve from experimental missions into commercial infrastructure. As demonstration projects show their worth, the sector may attract bigger funding rounds. We could also see more partnerships among aerospace, telecom, and cloud computing giants.

Technical and Operational Challenges

While orbital data centers promise enormous benefits, turning the concept into reality requires solving a set of tough technical and operational problems. Space is a harsh and unforgiving place. Radiation, extreme temperatures, and micrometeoroids constantly threaten electronic systems.

Also, the costs of starting, running, and growing orbital infrastructure create challenges that land-based competitors don’t encounter.

Radiation: The Need for Hardened Components

One of the most critical issues is radiation. Electronic components in space face cosmic rays and charged particles. These can lead to single-event effects (SEEs), memory corruption, and system failures. Commercial off-the-shelf (COTS) hardware, while cheaper and more advanced, is highly vulnerable in orbit.

Radiation-hardened (rad-hard) electronics are tougher. However, they cost more, offer less power, and are often years behind the newest commercial chips.

Google’s Project Suncatcher acknowledges that radiation hardening is key to long-term reliability. This is especially true when using large arrays of TPUs in orbit. The company is testing AI chips that can handle faults. They are also using adaptive software like RedNet AI’s error-correction model, which aims to reduce radiation damage.

Thermal management is equally vital. Google’s research shows that using solar power constantly still faces a big problem. Radiating waste heat in a vacuum is tough to manage. Their proposed solution involves kilometer-scale radiator panels and phase-change systems — technologies also being studied by Starcloud and ADA Space.

Innovative approaches are emerging. Researchers created methods like RedNet. This system is made for deep neural networks. RedNet doesn’t just depend on rad-hard hardware. It also uses the varying sensitivity of AI model layers to manage radiation-induced errors.

Correcting errors in the model’s weak spots leads to nearly zero error rates. This also speeds up inference by 33% compared to traditional methods. Such hybrid strategies could allow orbital data centers to balance cost, reliability, and performance.

Thermal Management in the Vacuum of Space

Cooling is another major hurdle. On Earth, data centers rely on air and liquid cooling systems to dissipate heat. In space, convection does not work in a vacuum — all heat must be radiated away. This is much less efficient and needs special systems, such as large radiator panels, heat pipes, and phase-change materials.

As data centers scale to megawatt power levels, the challenge becomes more extreme. Companies like Starcloud envision orbital facilities with cooling systems stretching kilometers across to shed excess heat.

Designing these systems to run reliably for years without maintenance makes them more complex and expensive. Before orbital data centers can manage workloads like Earth’s biggest facilities, solving thermal management is key.

Space Debris and the Kessler Risk

The growing density of satellites and debris in low Earth orbit (LEO) poses a serious risk. NASA scientist Donald Kessler first described Kessler Syndrome in 1978. It’s a chain reaction in which collisions create more debris, causing even more collisions.

Large orbital data centers, with expansive solar panels and radiator arrays, would be particularly vulnerable. Even tiny fragments, less than a centimeter, can travel up to 28,000 kilometers per hour. They can destroy sensitive equipment.

Operators will need to incorporate shields, redundant systems, and debris-avoidance maneuvers. Still, the risk of serious damage is a big concern for long-term orbital infrastructure.

Launch Economics and In-Space Assembly

Getting heavy, complex systems into orbit is expensive. Current launch costs range from about $7.5 million to $67 million per mission, depending on payload size and orbit. Reusable rockets, like SpaceX’s Falcon 9 and Starship, are cutting costs. However, setting up gigawatt-scale facilities may still need hundreds of tons of hardware.

One solution is in-space assembly and modular construction. Companies could use smaller modules instead of a full facility. They can then piece these modules together in orbit. This incremental approach spreads costs across multiple missions and reduces risk. Longer term, in-space manufacturing could further cut costs by using materials sourced from the Moon or asteroids.

Maintenance Hurdles and Redundancy Needs

Unlike Earth-based facilities, orbital data centers cannot rely on technicians to swap out failing components. Repairs need robotic missions or astronauts. Both options are expensive and complicated. To mitigate this, orbital facilities will need high levels of redundancy and fault tolerance.

This means creating systems that can handle component failures while still operating. This approach adds weight, cost, and complexity. Maintenance challenges will stay a major hurdle for commercial success until autonomous repair systems improve.

Applications and Use Cases

For orbital data centers to thrive, they need to show clear benefits compared to land-based facilities. Building in space has high costs and risks. However, some applications could benefit so much from orbital infrastructure that using it will become necessary. These early use cases, powering artificial intelligence and securing defense systems. show how the market might grow.

AI Training with Continuous Solar Energy

One of the most promising applications is training large AI models, including large language models (LLMs). These workloads need a lot of computing power and constant energy. They often test the limits of Earth’s grids.

Orbital data centers can use constant solar energy in space. They don’t face day-night cycles or weather issues. This enables uninterrupted operations, potentially lowering costs and accelerating model development.

Starcloud’s 2025 mission will test AI training and inference using NVIDIA GPUs in space. This will provide 100 times more computing power than past space demos. In the long run, gigawatt-scale orbital clusters might serve as special platforms for training large AI systems. They could take on the energy-heavy tasks that currently happen on Earth.

Earth Observation and Satellite Data Processing

Today, satellite constellations produce terabytes of data every day. A lot of this data needs to be sent to ground stations for processing. This creates bandwidth bottlenecks and latency issues that limit real-time applications. Orbital data centers solve this problem by processing data in space. They send only useful insights back to Earth.

Research from Tsinghua University shows that using inter-satellite links for data processing can boost system capacity significantly. This is much more effective than traditional downlink methods. This could lead to quicker wildfire detection, better disaster response, and improved environmental monitoring. Plus, it would lower transmission costs.

Defense and National Security

Defense is another high-value use case. Orbital data centers can support missile defense systems, autonomous weapons, and intelligence gathering. Here, even a fraction of a second can make a big difference. Processing data in orbit offers ultra-low latency and global coverage. These benefits aren’t achievable with just terrestrial infrastructure.

Security is also enhanced. Orbital centers are naturally isolated from many physical and cyber threats. Axiom Space has pointed out “Earth independence” as a key feature of its orbital cloud services. This means defense applications stay functional even if ground networks fail.

Disaster Recovery and Data Backup

Orbital and lunar data centers also hold potential for disaster recovery. Lonestar Data Holdings has already shown a lunar payload that can store and retrieve encrypted data. This makes the Moon an ideal backup site. Storing important information in orbit can help protect against natural disasters, political issues, or cyberattacks that could harm data centers on Earth.

This concept echoes the “Library of Alexandria” concern — the idea that without off-world backups, humanity risks losing irreplaceable knowledge in a catastrophe. Orbital data centers may become the ultimate safeguard for digital civilization.

Hybrid Cloud Models

In the near term, orbital facilities are unlikely to replace terrestrial data centers. Instead, they are expected to operate in hybrid systems, where workloads are distributed between Earth and orbit. Advanced optical communication networks will let data flow easily between the two. Placement will be optimized for speed, cost, and security needs.

For instance, AI training could happen in orbit, but customer-facing apps stay on Earth. Satellite data can be processed in orbit. Then, it can be added to cloud platforms on Earth. This hybrid model may prove the most commercially viable, offering the best of both worlds.

Regulatory, Political, and Security Landscape

As orbital data centers move closer to reality, questions of governance, law, and security loom large. Orbital data centers don’t fit neatly under national laws. Instead, they exist in a complex mix of international treaties, national rules, and global competition. Companies venturing into this space must navigate overlapping — and often unclear — legal frameworks.

- Data Privacy in Orbit

One of the most pressing issues is data privacy. There is no treaty that specifically governs personal data protection in space. Current laws like the EU’s General Data Protection Regulation (GDPR) apply to any company handling data from EU citizens, no matter where they are located.

U.S. laws also apply to orbital operations. These include HIPAA for health data, the Gramm-Leach-Bliley Act for financial data, and state laws like California’s Consumer Privacy Act (CCPA). Companies must comply with several regulatory rules at the same time, even when in orbit.

- Export Controls and Security Restrictions

Orbital data centers must follow rules from the International Traffic in Arms Regulations (ITAR) and the Export Administration Regulations (EAR). Advanced computing systems, radiation-hardened electronics, and satellite technologies are often seen as dual-use or defense-related. This limits international collaboration and may prevent certain partnerships or data-sharing arrangements.

Governments are likely to impose further restrictions as orbital computing becomes strategically significant, particularly for defense and intelligence applications.

- Orbital Debris, Licensing, and Traffic Management

The growth of orbital infrastructure adds to existing concerns about space debris. Regulators like the U.S. Federal Communications Commission (FCC) and the International Telecommunication Union (ITU) require companies to develop end-of-life disposal and collision avoidance plans.

Large orbital data centers, with their big solar panels and radiator arrays, will have strict requirements. Licensing rules, debris control, and orbital slot allocation will increase costs and make operations more complex.

Geopolitical Competition

Finally, geopolitics is shaping the orbital data center race. The United States leads in space through companies like Axiom Space, Google, and Starcloud. NASA, the Department of Defense, and venture funding support them.

China, however, is also making big investments in ADA Space’s planned 2,800-satellite constellation. This shows how important orbital computing is for both business and military use.

This rivalry could speed up innovation, but it might also lead to fragmented systems. The U.S. and Chinese orbital clouds may operate side by side.

If governments see orbital computing as a key asset, national security might become more important than working together commercially. This could widen the gap between competitors.

Global Competition Growing: China, Elon Musk, and Amazon Enter the Race

The race to build orbital data centers and AI supercomputers in space is expanding fast. Major tech companies and national programs are now pursuing high-performance computing in orbit.

China is moving quickly. Companies like Zhongke Tiansuan (Comospace) have run space computers on Jilin‑1 satellites for over 1,000 days. Research groups, including the Three-Body Computing Constellation, have launched satellite clusters performing multi-trillion operations per second. The country plans a centralized space data center in dawn-dusk orbit with over one gigawatt of power, rolling out in phases toward a full-scale orbital megacenter by 2035.

Elon Musk’s xAI and SpaceX are exploring AI payloads on Starlink satellites, which could enable distributed orbital computing. Reusable rockets help lower costs and speed deployment. Blue Origin is also developing related technology.

Amazon also aims to extend AWS cloud and AI services into space. Its “Leo” satellite initiative seeks to integrate orbital computing with Earth-based networks, positioning Amazon against both traditional cloud providers and new orbital competitors.

This global competition now includes both state-backed programs and private companies. China’s rapid satellite deployment, Musk’s launch advantages, and Amazon’s cloud ecosystem give each player unique strengths.

As these systems move from prototypes to operational networks, the race will drive innovation, influence regulations, and reshape global computing infrastructure over the next decade. Here is what we can expect in the coming years.

Future Outlook

Orbital data centers are just starting. However, the future looks clearer as technology improves and pilot missions get ready to launch. If costs and risks can be contained, the sector could move from proof-of-concept to mainstream adoption within the next decade.

2025–2030: Demonstrations to Early Operations

The late 2020s will mark a turning point for orbital computing. Axiom’s ISS deployment and Starcloud’s 2025 GPU mission are leading the way. Also, Google’s Project Suncatcher brings strong commercial support. China’s ADA Space constellation is also rolling out in phases, beginning with AI-enabled satellites that can process data directly in space.

Between 2025 and 2030, these demonstrations will test whether AI training and continuous solar power can coexist in orbit. By 2030, the first orbital data centers should be handling some commercial tasks. They will show their worth for AI, Earth observation, and defense uses.

2030–2035: Scaling to Gigawatt-Class Facilities

In the early 2030s, orbital data centers are expected to grow a lot. They’ll shift from small demo payloads to large gigawatt-class clusters. These large facilities will use huge solar arrays that stretch for kilometers. They will also have advanced thermal management systems.

At this stage, orbital computing could play key roles in AI training, global cloud services, and secure government operations. The massive market growth will make orbital infrastructure a key part of the global data economy.

Google’s modeling shows that the cost per kilowatt-year might match Earth-based centers soon. This could be a tipping point for broad adoption. Beyond that, lunar storage projects like Lonestar’s may expand humanity’s computing footprint even further.

Beyond 2035: Lunar Storage and Off-World Infrastructure

After the mid-2030s, orbital data centers may expand to the Moon and deep space. Companies are looking into lunar data centers. They see the Moon as a top choice for storing and backing up digital assets. These lunar outposts could be disaster recovery sites, research hubs, and steps toward interplanetary computing.

As the sector matures, consolidation around successful players is likely. Startups like Starcloud can grow by partnering with or buying established aerospace and cloud computing companies.

Meanwhile, Hybrid Earth-orbit cloud models will likely become the norm. Orbital nodes will work alongside ground data centers. This setup suits energy-heavy or time-sensitive tasks.

The Future of Orbital Computing

Orbital data centers represent one of the boldest ideas in digital infrastructure. By moving computing power into space, they offer solutions to the pressing limitations of terrestrial facilities — from soaring energy consumption and water use to the physical constraints of land and grid capacity.

Orbital data centers could change how and where we process data. They can use continuous solar power, advanced thermal management, and easily integrate with satellites.

If successful, the first orbital data center launch aboard the ISS in 2027 could be remembered as the start of a new era. What once sounded like science fiction is now on the threshold of becoming mainstream — with the potential to transform not only the digital economy but also the environmental footprint of global computing.

The post Orbital Data Center Guide: Everything You Need to Know About This Next-Gen Space Computing Technology appeared first on Carbon Credits.