Petrobras and the Brazilian Development Bank (BNDES) opened a public call for proposals under the ProFloresta+ program to buy 5 million high-integrity carbon credits tied to Amazon restoration. The move seeks to boost forest restoration in the Amazon. It will also set a clear price benchmark for restoration credits and aims to create jobs and attract finance in the restoration sector.

What Petrobras and BNDES Want from Developers

The public notice covers five contracts of 1 million carbon credits each. Each contract must be backed by ecological restoration on at least 3,000 hectares. Contracts will last for 25 years. They will focus on areas within the Amazon biome. This includes both private land and public land with forest concessions.

Key facts in brief:

- Five contracts × 1 million credits.

- Minimum 3,000 hectares per contract, restored and verified.

- 25-year crediting and monitoring horizon.

The tender comes at a time when Brazil’s voluntary carbon market is growing. According to market surveys, Brazil issued about 14–16 million voluntary credits per year from 2021 to 2023. ARR (Afforestation, Reforestation, and Revegetation) credits accounted for about 10–15% of these total issuances.

The ProFloresta+ purchase of 5 million credits is a large amount. It’s much larger than the current supply of restoration credits.

Financing the Forest: How ProFloresta+ Unlocks Capital

Petrobras will buy the carbon credits through public tenders. Winning project developers may then get low-interest loans or financing from BNDES to cover upfront costs.

The Brazilian bank created tools to reduce financial risk for restoration companies and landowners. This pairing of long-term offtake and concessional finance is meant to make restoration projects bankable.

Over the past decade, carbon markets have shown that early funding is a barrier for landowners who want to begin restoration. BNDES’ model tries to fix this by offering credit lines with longer repayment periods and by supporting milestone-based contracts. Payments for credits are expected to follow a schedule tied to planting, survival rates, and verified carbon removals.

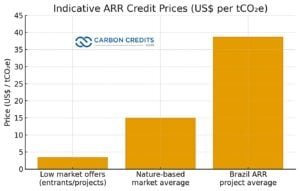

ProFloresta+ enters a market where ARR credits from the Amazon have sold for US$8 to US$18 per tonne. Prices vary based on quality, verification standards, and project risks. Petrobras hasn’t revealed its expected clearing price yet. However, the public tender sets a reference point for buyers and sellers to see.

The chart shows an indicative low, a broad nature-based market average, and an observed Brazil ARR average (USD per tCO₂e).

The Road to 50,000 Hectares

ProFloresta+ is framed as a multi-phase program. The initial phase targets about 15,000 hectares and 5 million credits, backed by roughly R$450 million (about US$77 million).

Over a longer horizon, the program states it can restore up to 50,000 hectares and sequester an estimated 15 million tonnes of CO₂. Organizers also expect thousands of local jobs in planting, maintenance, and monitoring.

Average CO₂ absorption rates help explain the numbers. Research on the Amazon biome shows that restoring native forests can remove 8 to 15 tonnes of CO₂ per hectare each year in early growth.

As the forests mature, they store even more CO₂ over the long term. Assisted natural regeneration can achieve similar rates in degraded lands that still have seed banks. These benchmarks support the program’s estimate of long-term removals.

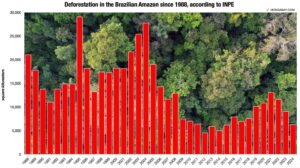

Amazon deforestation trends also show why the program is urgent. INPE satellite data recorded nearly 13,000 km² of deforestation in 2021, which fell to around 9,000 km² in 2023 after new enforcement measures.

Scientists estimate that over 54.2 million hectares of the Amazon have been lost in 20 years and need active or assisted restoration. The ProFloresta+ restoration area is small compared with this total, but it can test large-scale finance models.

Officials estimate the pilot will create about 4,500 jobs. It will also set clear rules and prices for restoration credits. Past restoration programs in Brazil and Latin America usually create 2–4 jobs per hectare during planting.

For long-term monitoring and maintenance, they generate 1–2 jobs per hectare. These figures help explain how large-scale planting can support rural employment.

Why This Tender Could Redefine Brazil’s Carbon Landscape

The program marks one of the largest public tenders for restoration credits in Brazil. It links a major corporate buyer (Petrobras) with a development bank to deliver scaled restoration. This structure can do three things:

- It provides price clarity.

- It reduces financing gaps for projects.

- It builds market confidence for high-integrity, nature-based credits.

Brazil is now a leading supplier of forest-related credits worldwide. REDD+, ARR, and agroforestry methods back this growth. But ARR supply has grown more slowly because restoration is expensive and long-term.

A project involving 3,000 hectares usually needs several million dollars in early investment. Public tenders like ProFloresta+ help bridge this gap.

Public tenders of this size are rare. Indonesia’s peatland and mangrove restoration programs have offered fewer large-volume restoration credit offtake tenders. In contrast, Congo Basin countries have emphasized REDD+ over ARR.

As such, ProFloresta+ is unique. It combines public procurement with development bank financing. It also includes long-term monitoring requirements.

Trust but Verify: How Brazil Will Track Every Tonne

The call requires robust verification and long monitoring periods. Projects must follow recognized restoration practices and provide measurable carbon removals.

BNDES and Petrobras require documentation, monitoring, and a 25-year contract to ensure credits are real, additional, and permanent.

Most Brazilian projects use international standards like Verra VCS or Gold Standard, alongside the national carbon registry, field audits, and remote sensing. Developers must follow restoration protocols, including native species, minimum density, and survival monitoring.

To ensure permanence, 10–20% of credits are often placed in a buffer pool, with some using insurance against fire, drought, or pests. Developers must submit baseline studies, restoration plans, and social-environmental safeguards, and undergo audits and reporting to qualify for credits and BNDES financing. Public tender results will be transparent.

Weighing ProFloresta+’s Impact

Proponents list several benefits of the program:

- It channels immediate demand and revenue to restoration projects.

- It uses public procurement to set market standards and prices.

- It couples purchases with concessional finance to lower project risks.

The program also aims to support social safeguards. Restoration in the Amazon often requires consent from local communities, Indigenous groups, and landholders. Many programs now include benefit-sharing rules, training, and local hiring. Monitoring includes checks on land use rights and social co-benefits.

But limits remain. Restoration takes time; carbon removals accrue over decades. Projects must manage risks such as fires, pests, land-use conflicts, and changing climate conditions.

Credit buyers and financiers need confidence that credits remain valid over long periods. Observers say the program will only prove effective if verification and long-term protection are strong.

A High-Stakes Test for Restoration at Scale

The public call opens the clock for proposals. Petrobras and BNDES will evaluate bids and award contracts. If the pilot goes as planned, the program can expand to more hectares and credits. This might also inspire other companies to start similar tenders. Many energy, aviation, and consumer goods companies in Brazil want to buy carbon credits. This shows that the market is growing.

The tender could strengthen Brazil’s restoration market by proving that public, transparent purchasing and concessional finance can bring large projects to scale. Success will depend on strong verification, durable finance, and effective on-the-ground management across the program’s long timeframe.

The post Petrobras and BNDES Launch a 5-Million Carbon Credit Push to Regrow Brazil’s Amazon appeared first on Carbon Credits.