See more visuals like this on the Voronoi app.

See more visuals like this on the Voronoi app.

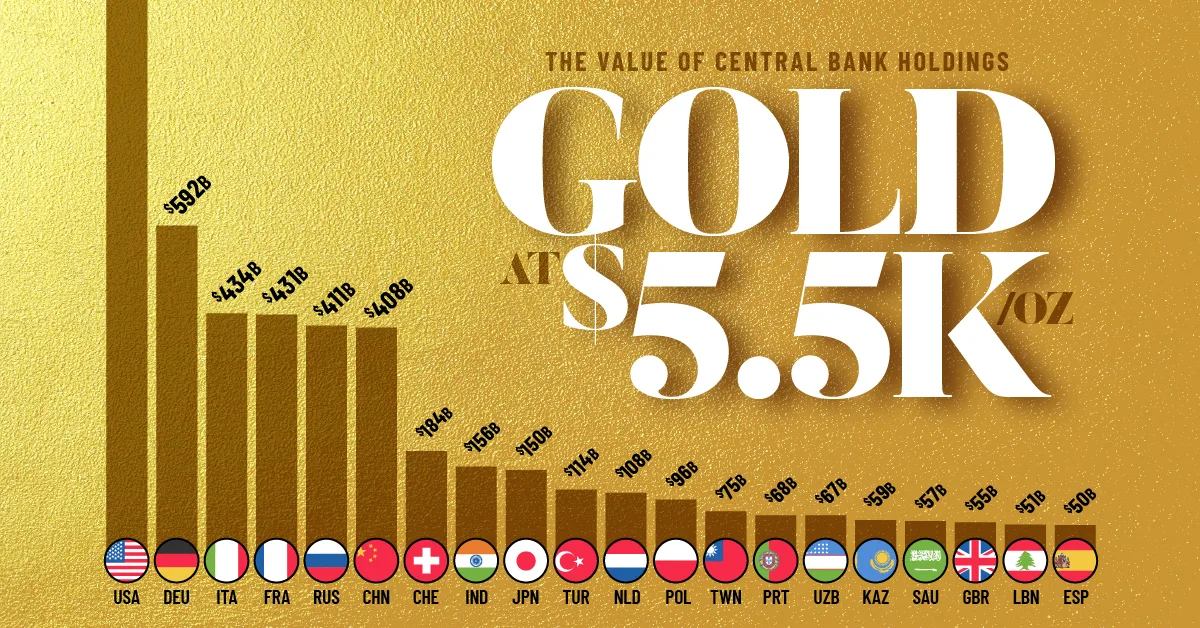

Ranked: Central Banks by the Value of Their Gold at $5,500 an Ounce

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- At a gold price of $5,500 per ounce, the U.S. holds gold worth more than $1.4 trillion, far ahead of any other country.

- Rising gold prices have dramatically increased the balance sheet value of central bank reserves worldwide.

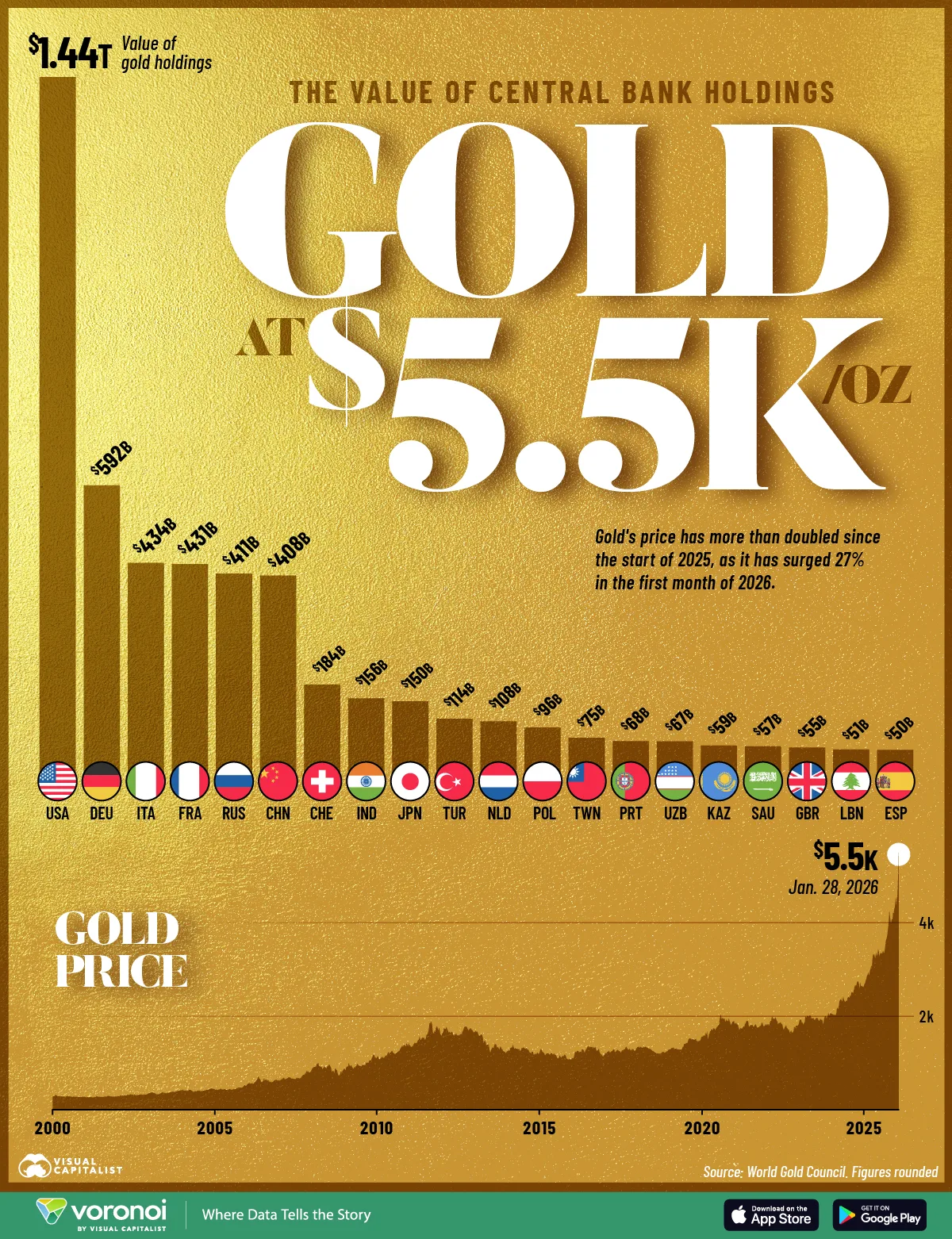

After more than doubling since the start of 2025, gold prices surged another 27% in the first month of 2026 alone.

With gold now trading above $5,500 per ounce, central bank gold reserves are worth far more than at any point in the past several decades.

This visualization highlights how much the world’s largest gold holders now control in dollar terms. The data for this visualization comes from the World Gold Council.

The United States Dominates in Absolute Value

The rally has been driven by strong safe-haven demand, as currency volatility and a wobbling U.S. dollar push investors and policymakers toward hard assets. For central banks, higher prices strengthen reserve positions without adding a single extra tonne of gold.

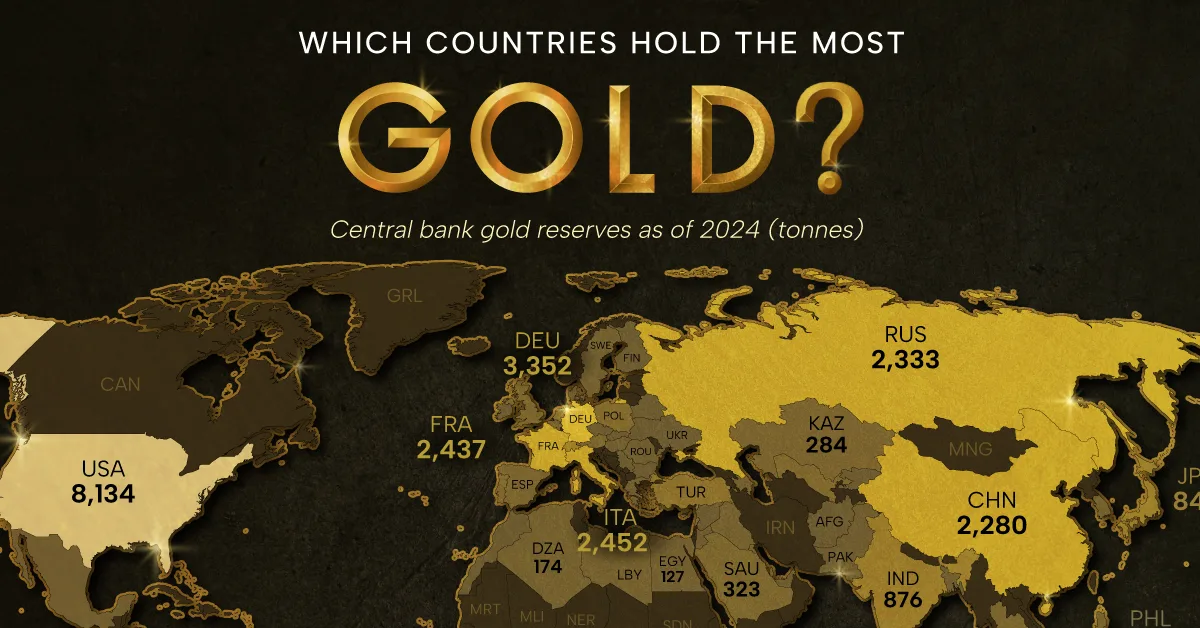

The United States remains the world’s largest official holder of gold, with 8,133.5 tonnes in reserves. At $5,500 per ounce, that stockpile is worth roughly $1.44 trillion. This puts the U.S. far ahead of Germany in second place, whose gold reserves are valued at just under $600 billion.

| Rank | Country | Value of gold holdings | Gold holdings (tonnes) |

|---|---|---|---|

| 1 |  United States United States |

$1.44T | 8,133.5 |

| 2 |  Germany Germany |

$592B | 3,350.3 |

| 3 |  Italy Italy |

$434B | 2,451.9 |

| 4 |  France France |

$431B | 2,437.0 |

| 5 |  Russia Russia |

$411B | 2,326.5 |

| 6 |  China China |

$408B | 2,305.4 |

| 7 |  Switzerland Switzerland |

$184B | 1,039.9 |

| 8 |  India India |

$156B | 880 |

| 9 |  Japan Japan |

$150B | 846 |

| 10 |  Türkiye Türkiye |

$114B | 644 |

| 11 |  Netherlands Netherlands |

$108B | 613 |

| 12 |  Poland Poland |

$96B | 543 |

| 13 |  Taiwan Taiwan |

$75B | 424 |

| 14 |  Portugal Portugal |

$68B | 383 |

| 15 |  Uzbekistan Uzbekistan |

$67B | 380 |

| 16 |  Kazakhstan Kazakhstan |

$59B | 333 |

| 17 |  Saudi Arabia Saudi Arabia |

$57B | 323 |

| 18 |  United Kingdom United Kingdom |

$55B | 310 |

| 19 |  Lebanon Lebanon |

$51B | 287 |

| 20 |  Spain Spain |

$50B | 282 |

America’s large gold position reflects decades of accumulation and its historical role at the center of the global monetary system.

Europe’s Big Four

Germany, Italy, and France all hold more than 2,400 tonnes of gold each. At current prices, each country’s reserves are valued between $430 billion and $590 billion.

Switzerland, while smaller, also stands out. Its gold reserves are worth around $184 billion, reinforcing its reputation for financial stability and conservative reserve management.

Rising Powers and Recent Buyers

Russia and China both hold over 2,300 tonnes of gold, with reserve values exceeding $400 billion each. In recent years, both countries have steadily increased gold purchases as a way to diversify away from U.S. dollar assets.

Emerging markets such as India, Türkiye, and Poland also feature prominently.

Learn More on the Voronoi App

If you enjoyed today’s post, check out The Rise of Major Currencies Against the USD in 2025 on Voronoi, the new app from Visual Capitalist.

- Source: https://www.visualcapitalist.com/ranked-central-banks-by-the-value-of-their-gold-at-5500-an-ounce/