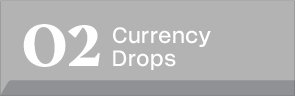

Countries With the Highest Remittance Costs

Key Takeaways

- Workers often pay high costs to send money across borders due to limited competition, poor price visibility, and, in some cases, underdeveloped payment systems.

- Tanzania has the highest average cost of $115 on a $200 remittance.

- Seven of the 15 most expensive countries for sending remittances are in Africa.

For workers sending money home to their family, every dollar counts. Unfortunately, the total cost they pay on a cross-border payment, also known as a remittance, can be high.

In part one of this digital dollar series, we partnered with Plasma to highlight countries with the highest costs for cross-border transfers.

Top Remittance Money Pits

Using data from the World Bank, we looked at the average cost to send $200 in major remittance corridors. The cost reflects the fee plus the exchange rate margin.

| Country | Average Cost to Send $200 Remittance |

|---|---|

| Tanzania | $115 |

| Türkiye | $53 |

| Senegal | $35 |

| Rwanda | $30 |

| Angola | $29 |

| Israel | $27 |

| Thailand | $26 |

| South Africa | $24 |

| Kenya | $22 |

| Ghana | $20 |

| Sweden | $16 |

| Switzerland | $16 |

| Brazil | $15 |

| Japan | $15 |

| Dominican Republic | $15 |

Data as of Q3 2024.

Tanzania has the highest average total cost of $115, adding up to over half of the total amount being transferred. A few large banks dominate the Tanzanian market, creating high transaction costs.

On top of limited competition, remittance costs can be high in various countries due to underdeveloped payment systems, a lack of access to the banking sector, and the difficulty in comparing prices between providers.

Even in more developed countries like Switzerland or Japan, the total cost can be over 7% of the transfer amount.

Remittances can also be slow. Globally, 32% of remittances take a day or more to reach their destination.

Stablecoins: A Low-Cost, Quick Way to Send Money

Stablecoins are a much faster and more cost-effective way to send money across borders. Linked to assets like the U.S. dollar for some price stability, stablecoins are a type of cryptocurrency that is transferred digitally.

Using Plasma, a blockchain built specifically for stablecoins, workers can send money across borders almost instantly at very low costs. This means more money can stay with families—and there’s a lot at stake.

In fact, the World Bank estimates that if costs were reduced by five percentage points relative to the value sent, people receiving money in developing countries would get $16 billion dollars more every year than they do now.

Learn more about how Plasma is redefining money movement with low-cost, 24/7, and borderless transfers.

-

Technology2 days ago

Technology2 days agoWhich Cities Are Investing Heavily into AI?

Beijing now leads the world in AI deal concentration, with 66% of its startup funding directed toward AI-native companies.

-

Technology4 days ago

Technology4 days agoRanked: Most Valuable Unicorns Created in 2025

Billion-dollar startups were once rare, but they’ve become increasingly common as venture capital funding and tech innovation has surged.

-

Energy1 week ago

Energy1 week agoCharted: The Energy Demand of U.S. Data Centers (2023-2030P)

Data center power needs are projected to triple by 2030.

-

Technology2 weeks ago

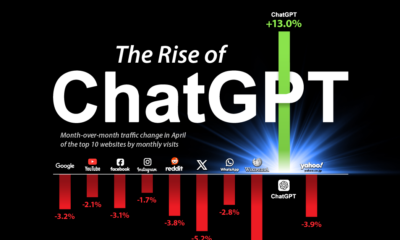

Technology2 weeks agoCharted: ChatGPT’s Rising Traffic vs. Other Top Websites

See how ChatGPT’s monthly traffic growth compares to other popular websites.

-

Technology2 weeks ago

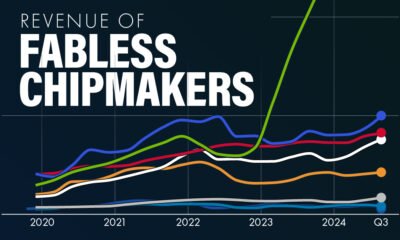

Technology2 weeks agoRanked: The Top Chip Designers by Revenue (2019-2024)

Compare the top chip designers by quarterly revenue since 2020, including Nvidia, AMD, Qualcomm, and Broadcom.

-

Technology2 weeks ago

Technology2 weeks agoCharted: A Decade of Smartphone Production, by Brand (2015-2024)

Samsung has remained the top vendor.

var disqus_shortname = “visualcapitalist.disqus.com”;

var disqus_title = “Ranked: Countries With the Highest Remittance Costs”;

var disqus_url = “https://www.visualcapitalist.com/sp/pla01-countries-with-the-highest-remittance-costs/”;

var disqus_identifier = “visualcapitalist.disqus.com-178451”;