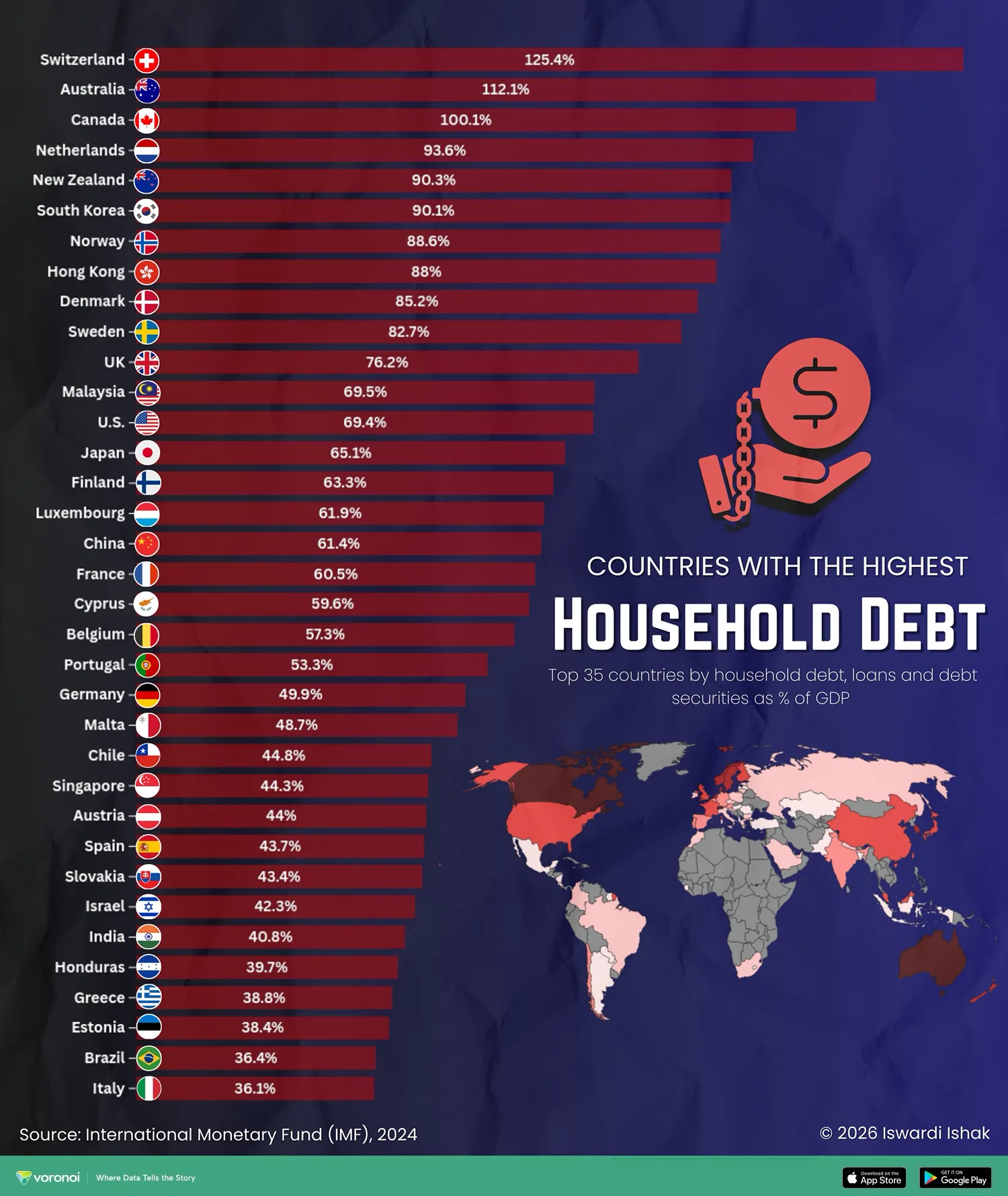

Charted: The 35 Countries with the Highest Household Debt

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- Switzerland tops the list with household debt totaling 125% of its GDP.

- Anglophone countries dominate the top ranks, including Australia (112%), Canada (100%), and New Zealand (90%).

- High household debt can make economies more vulnerable to interest rate hikes and economic shocks.

The International Monetary Fund (IMF) recently released data showing the countries with the highest levels of household debt, defined as loans and debt securities incurred by households, expressed as a percentage of GDP. The metric is often used as a barometer for financial risk and vulnerability at the household level.

Household debt typically includes mortgages, car loans, credit card debt, and personal loans. While some level of debt can stimulate economic growth through consumption and investment, excessive debt levels can lead to long-term financial instability, especially when interest rates rise or during economic downturns.

Today’s visualization breaks down the top 35 countries with the highest household debt levels, and was made by Iswardi Ishak using IMF data.

The Data: Countries With the Most Household Debt

Below is data for the 71 countries in the dataset:

| Rank | Country/Territory | Household debt (% of GDP) |

|---|---|---|

| 1 |  Switzerland Switzerland |

125.4 |

| 2 |  Australia Australia |

112.2 |

| 3 |  Canada Canada |

100.1 |

| 4 |  Netherlands Netherlands |

93.6 |

| 5 |  New Zealand New Zealand |

90.3 |

| 6 |  South Korea South Korea |

90.1 |

| 7 |  Norway Norway |

88.6 |

| 8 |  Hong Kong Hong Kong |

88.0 |

| 9 |  Denmark Denmark |

85.2 |

| 10 |  Sweden Sweden |

82.7 |

| 11 |  United Kingdom United Kingdom |

76.2 |

| 12 |  Malaysia Malaysia |

69.5 |

| 13 |  United States United States |

69.4 |

| 14 |  Japan Japan |

65.1 |

| 15 |  Finland Finland |

63.3 |

| 16 |  Luxembourg Luxembourg |

61.9 |

| 17 |  China China |

61.4 |

| 18 |  France France |

60.5 |

| 19 |  Cyprus Cyprus |

59.6 |

| 20 |  Belgium Belgium |

57.4 |

| 21 |  Portugal Portugal |

53.3 |

| 22 |  Germany Germany |

49.9 |

| 23 |  Malta Malta |

48.7 |

| 24 |  Chile Chile |

44.8 |

| 25 |  Singapore Singapore |

44.3 |

| 26 |  Austria Austria |

44.0 |

| 27 |  Spain Spain |

43.7 |

| 28 |  Slovakia Slovakia |

43.4 |

| 29 |  Israel Israel |

42.3 |

| 30 |  India India |

40.8 |

| 31 |  Honduras Honduras |

39.7 |

| 32 |  Greece Greece |

38.8 |

| 33 |  Estonia Estonia |

38.4 |

| 34 |  Brazil Brazil |

36.4 |

| 35 |  Italy Italy |

36.1 |

| 36 |  Saudi Arabia Saudi Arabia |

35.3 |

| 37 |  South Africa South Africa |

33.7 |

| 38 |  Nepal Nepal |

32.5 |

| 39 |  Czech Republic Czech Republic |

30.8 |

| 40 |  Vanuatu Vanuatu |

30.6 |

| 41 |  Croatia Croatia |

30.3 |

| 42 |  Ireland Ireland |

29.6 |

| 43 |  El Salvador El Salvador |

28.0 |

| 44 |  North Macedonia North Macedonia |

27.1 |

| 45 |  Costa Rica Costa Rica |

26.8 |

| 46 |  Bulgaria Bulgaria |

25.9 |

| 47 |  Colombia Colombia |

25.7 |

| 48 |  Morocco Morocco |

25.6 |

| 49 |  United Arab Emirates United Arab Emirates |

24.8 |

| 50 |  Slovenia Slovenia |

24.3 |

| 51 |  Poland Poland |

22.9 |

| 52 |  Russia Russia |

22.2 |

| 53 |  Lithuania Lithuania |

22.0 |

| 54 |  Samoa Samoa |

20.0 |

| 55 |  Latvia Latvia |

19.4 |

| 56 |  Lesotho Lesotho |

17.2 |

| 57 |  Kazakhstan Kazakhstan |

17.1 |

| 58 |  Hungary Hungary |

17.0 |

| 59 |  Mexico Mexico |

16.7 |

| 60 |  Nicaragua Nicaragua |

16.5 |

| 61 |  Indonesia Indonesia |

16.2 |

| 62 |  Albania Albania |

12.8 |

| 63 |  Romania Romania |

10.8 |

| 64 |  Türkiye Türkiye |

9.6 |

| 65 |  Solomon Islands Solomon Islands |

8.6 |

| 66 |  Paraguay Paraguay |

6.6 |

| 67 |  Bangladesh Bangladesh |

6.2 |

| 68 |  Suriname Suriname |

5.1 |

| 69 |  Argentina Argentina |

4.7 |

| 70 |  Pakistan Pakistan |

2.1 |

| 71 |  Sierra Leone Sierra Leone |

0.0 |

At the top of the chart is Switzerland, where household debt amounts to 125% of GDP. It’s followed by Australia (112%) and Canada (100%), two countries known for overheated housing markets.

On the other end of the list, countries like Brazil and Italy show far lower household debt burdens relative to their GDP, both below 37%.

Why High Household Debt Can Be Risky

While credit access enables household consumption and property ownership, it also creates exposure to economic shocks. High household debt can constrain economic growth when families divert income to servicing debt rather than spending or saving. It also increases sensitivity to interest rate hikes, which raise repayment costs.

In fact, research from the Leibniz Institute for Financial Research highlights how household debt, when misaligned with wage growth or asset prices, can trigger financial instability.

As the study notes: “In the event of economic shocks, high household debt levels result in non‑performing loans that weaken bank balance sheets and spread to other financial institutions through the contagion effect. This could result in an unstable financial sector that restricts lending to profitable investments and deserving households. Ultimately, household consumption and investment decrease, thereby lowering economic growth.”

In short, elevated household debt goes beyond being a macroeconomic statistic, and has the potential to amplify downturns and reduce resilience at both the household and national level.

Household Debt in Context

The distribution of household debt also ties into broader macroeconomic trends. Anglophone nations like the U.S., Canada, Australia, and the UK exhibit higher debt levels due to hot property markets, and cultural factors favoring homeownership and financial liberalization.

Meanwhile, in the United States, household finances vary drastically by state.

High household debt doesn’t always indicate looming trouble, but it does warrant careful monitoring, especially in environments of rising rates or slowing economic growth.

Learn More on the Voronoi App

Explore more data visuals like this on the Voronoi app. For example, see The World’s $111 Trillion in Government Debt.