Ranked: The Countries that Drink the Most Beer

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

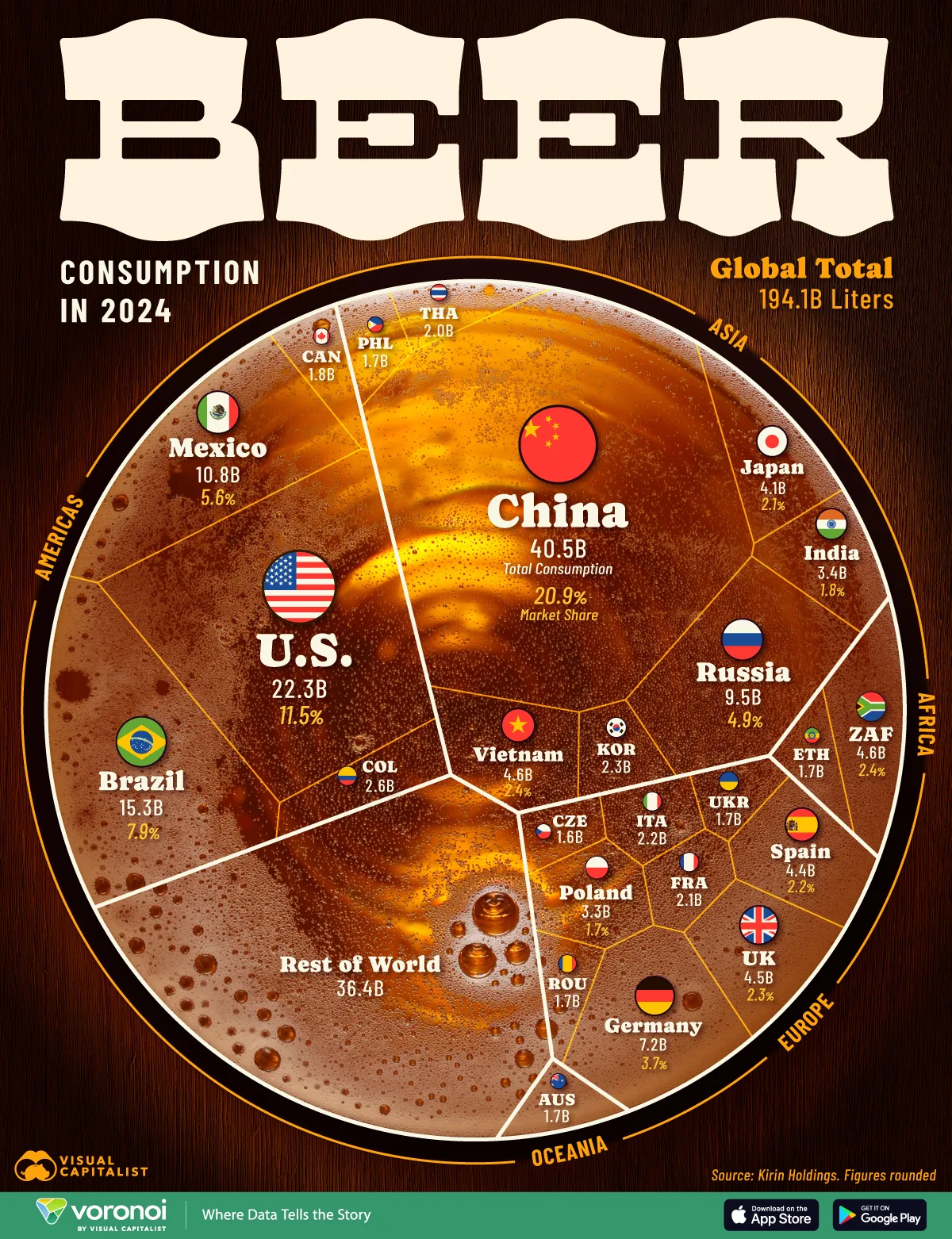

- Global beer consumption reached 194 billion liters in 2024, with China alone accounting for over one-fifth of the total.

- Emerging markets like India, Mexico, and Russia posted strong growth, even as consumption declined in several mature markets.

Beer remains one of the world’s most popular alcoholic beverages. While per-capita drinking often gets the spotlight, total consumption tells a different story, shaped by population size, economic growth, and shifting consumer habits.

This visualization ranks nations by the total volume of beer consumed in 2024. The data for this graphic comes from Kirin Holdings.

China and the U.S. Dominate Global Beer Consumption

China remains the world’s largest beer market by a wide margin, consuming 40.5 billion liters—nearly 21% of global demand.

Despite its size, China’s beer consumption fell by 3.7% year over year. The United States ranks second at 22.3 billion liters, accounting for 11.5% of the global market. Similar to China, U.S. beer consumption edged lower, continuing a long-term trend toward moderation and alternative beverages.

| Rank | Country | Billion liters | Global Market Share | Growth (2023-24) |

|---|---|---|---|---|

| 1 |  China China |

40.5 | 20.9% | -3.7% |

| 2 |  United States of America United States of America |

22.3 | 11.5% | -0.5% |

| 3 |  Brazil Brazil |

15.3 | 7.9% | 1.1% |

| 4 |  Mexico Mexico |

10.8 | 5.6% | 5.4% |

| 5 |  Russia Russia |

9.5 | 4.9% | 9.0% |

| 6 |  Germany Germany |

7.2 | 3.7% | -2.2% |

| 7 |  South Africa South Africa |

4.6 | 2.4% | 4.5% |

| 8 |  Vietnam Vietnam |

4.6 | 2.4% | 0.6% |

| 9 |  United Kingdom United Kingdom |

4.5 | 2.3% | 1.7% |

| 10 |  Spain Spain |

4.4 | 2.2% | -1.3% |

| 11 |  Japan Japan |

4.1 | 2.1% | -2.7% |

| 12 |  India India |

3.4 | 1.8% | 14.6% |

| 13 |  Poland Poland |

3.3 | 1.7% | -1.7% |

| 14 |  Colombia Colombia |

2.6 | 1.4% | 3.2% |

| 15 |  South Korea South Korea |

2.3 | 1.2% | 0.7% |

| 16 |  Italy Italy |

2.2 | 1.1% | 0.9% |

| 17 |  France France |

2.1 | 1.1% | -1.0% |

| 18 |  Thailand Thailand |

2.0 | 1.0% | 5.8% |

| 19 |  Canada Canada |

1.8 | 0.9% | -0.1% |

| 20 |  Australia Australia |

1.7 | 0.9% | -2.6% |

| 21 |  Ethiopia Ethiopia |

1.7 | 0.9% | 5.1% |

| 22 |  Romania Romania |

1.7 | 0.9% | 2.0% |

| 23 |  Philippines Philippines |

1.7 | 0.9% | 0.3% |

| 24 |  Ukraine Ukraine |

1.7 | 0.9% | 3.0% |

| 25 |  Czechia Czechia |

1.6 | 0.8% | -0.9% |

| — |  Rest of world Rest of world |

36.4 | 18.7% | — |

| — |  Global Total Global Total |

194.1 | 100.0% | 0.5% |

Growth Shifts Toward Emerging Markets

Several emerging markets posted notable gains in beer consumption. India recorded the fastest growth among major countries, with volumes rising 14.6% as incomes increase and beer becomes more popular among younger consumers.

Mexico and Russia also stood out, growing by 5.4% and 9.0% respectively.

Europe’s Mixed Picture

Europe remains a key beer-producing and consuming region, but trends vary widely by country.

Germany, the world’s sixth-largest beer market, saw consumption decline by 2.2%, while Czechia—famous for having the highest per-capita beer intake—also posted a modest drop.

In contrast, countries like the UK, Italy, and Romania experienced mild growth.

Learn More on the Voronoi App

If you enjoyed today’s post, check out The Most Popular Beer in Every U.S. State on Voronoi, the new app from Visual Capitalist.