Ranked: The Top 20 Exporters of Goods vs Digital Services

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

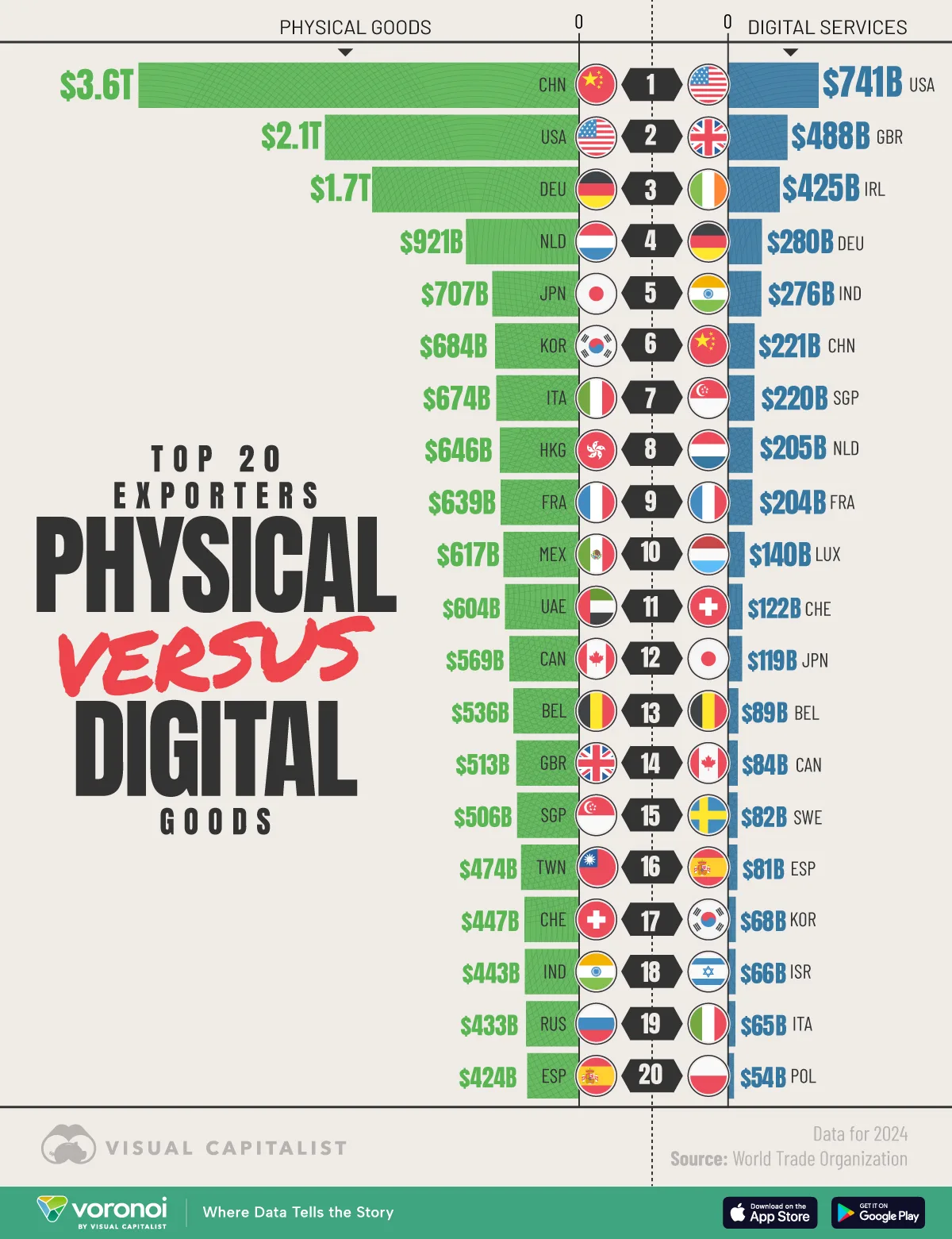

- Global goods exports totaled $23.8 trillion in 2024, far exceeding the $4.8 trillion in digital exports.

- China leads the world in goods exports, while the U.S. dominates digital services exports.

- Several smaller economies like Singapore, Switzerland, and Luxembourg rank much higher in digital exports than in goods trade.

Global trade today spans two very different categories: physical goods such as machinery, vehicles, and manufactured products, and digital services like software, cloud computing, and online platforms.

This infographic breaks down the world’s top 20 exporters of physical goods and digital services in 2024, based on data from the World Trade Organization.

The World’s 20 Largest Exporters of Goods

Goods trade remains the backbone of global commerce. In 2024, countries exported a combined $23.8 trillion worth of physical goods, driven largely by manufacturing powerhouses.

The table below ranks the top 20 exporters of physical goods worldwide:

| Rank | Country | Goods Exports in 2024 (USD, billions) |

|---|---|---|

| 1 |  China China |

$3,577 |

| 2 |  U.S. U.S. |

$2,065 |

| 3 |  Germany Germany |

$1,682 |

| 4 |  Netherlands Netherlands |

$921 |

| 5 |  Japan Japan |

$707 |

| 6 |  South Korea South Korea |

$684 |

| 7 |  Italy Italy |

$674 |

| 8 |  Hong Kong Hong Kong |

$646 |

| 9 |  France France |

$639 |

| 10 |  Mexico Mexico |

$617 |

| 11 |  UAE UAE |

$604 |

| 12 |  Canada Canada |

$569 |

| 13 |  Belgium Belgium |

$536 |

| 14 |  UK UK |

$513 |

| 15 |  Singapore Singapore |

$506 |

| 16 |  Taiwan Taiwan |

$474 |

| 17 |  Switzerland Switzerland |

$447 |

| 18 |  India India |

$443 |

| 19 |  Russia Russia |

$433 |

| 20 |  Spain Spain |

$424 |

China sits firmly at the top, exporting $3.38 trillion in goods—more than the United States and Germany combined. The U.S. follows with $2.02 trillion, while Germany ranks third at $1.69 trillion, reflecting its strong automotive and industrial base.

Other major goods exporters include the Netherlands, Japan, Italy, France, South Korea, and several European economies. Mexico and Canada also rank among the largest goods exporters globally, with the majority of their exports going to the United States.

The World’s 20 Largest Digital Services Exporters

While smaller in total value, digital exports are growing rapidly and reshaping global trade patterns. In 2024, digital services exports reached $4.8 trillion worldwide.

The table below shows the top 20 exporters of digital services:

| Rank | Country | Digital Exports in 2024 (USD, billions) |

|---|---|---|

| 1 |  U.S. U.S. |

$741 |

| 2 |  UK UK |

$488 |

| 3 |  Ireland Ireland |

$425 |

| 4 |  Germany Germany |

$280 |

| 5 |  India India |

$276 |

| 6 |  China China |

$221 |

| 7 |  Singapore Singapore |

$220 |

| 8 |  Netherlands Netherlands |

$205 |

| 9 |  France France |

$204 |

| 10 |  Luxembourg Luxembourg |

$140 |

| 11 |  Switzerland Switzerland |

$122 |

| 12 |  Japan Japan |

$119 |

| 13 |  Belgium Belgium |

$89 |

| 14 |  Canada Canada |

$84 |

| 15 |  Sweden Sweden |

$82 |

| 16 |  Spain Spain |

$81 |

| 17 |  South Korea South Korea |

$68 |

| 18 |  Israel Israel |

$66 |

| 19 |  Italy Italy |

$65 |

| 20 |  Poland Poland |

$54 |

The United States leads by a wide margin, exporting $741 billion in digital services, supported by its dominance in software, cloud infrastructure, and digital platforms. The U.S. is also the largest importer of digital services globally.

The U.K. comes second with $488 billion in digital exports, a significant jump from its 13th spot in goods exports. Ireland follows with $425 billion, up 24% from 2023 to 2024.

Similar to its standing in goods exports, Germany ranks highly in the digital category, with $280 billion worth of digital services exported in 2024. Meanwhile, India’s strong showing reflects its growing role as a global hub for IT and business services, with digital exports up 10% from 2023 levels.

Several smaller economies, including Switzerland, Singapore, and Luxembourg, rank disproportionately high in digital exports, benefiting from financial services and intellectual property flows.

Two Paths to Trade Leadership

Goods exporters tend to rely on scale, capital-intensive industries, and physical infrastructure. Digital exporters, by contrast, often benefit from human capital and intellectual property, allowing smaller countries to compete globally without massive manufacturing bases.

As the global economy continues to digitalize, the balance between goods and digital trade is likely to change, reshaping how countries generate export growth and economic influence.

Learn More on the Voronoi App

If you enjoyed today’s post, explore more global trade and economy insights on Voronoi, including The Global Export Power Shift.