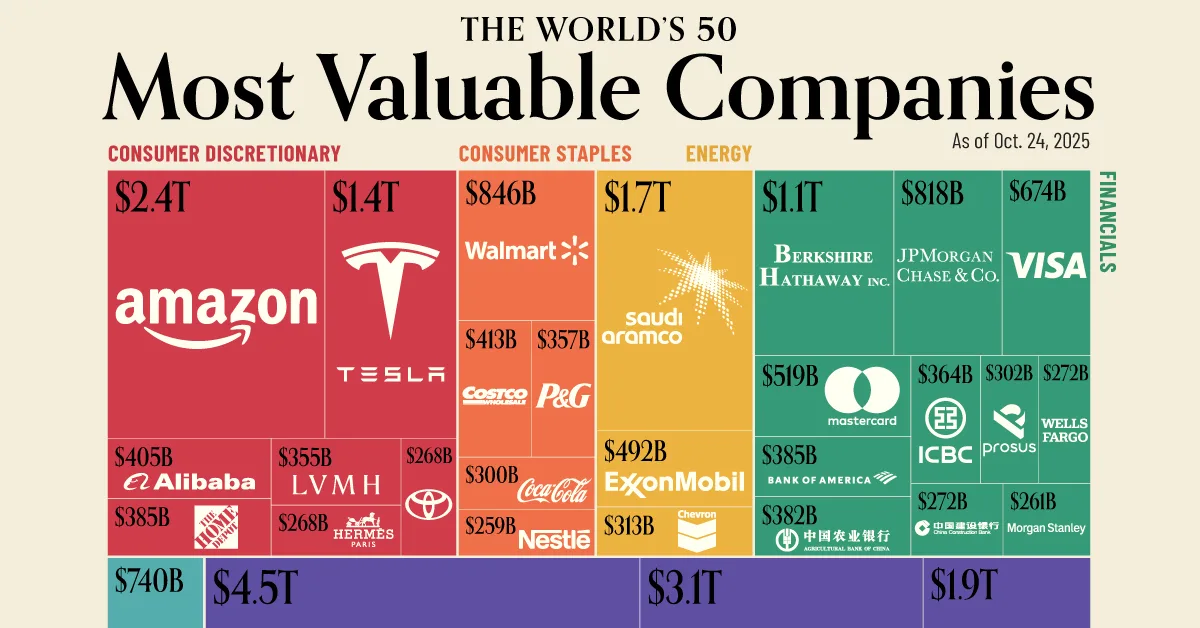

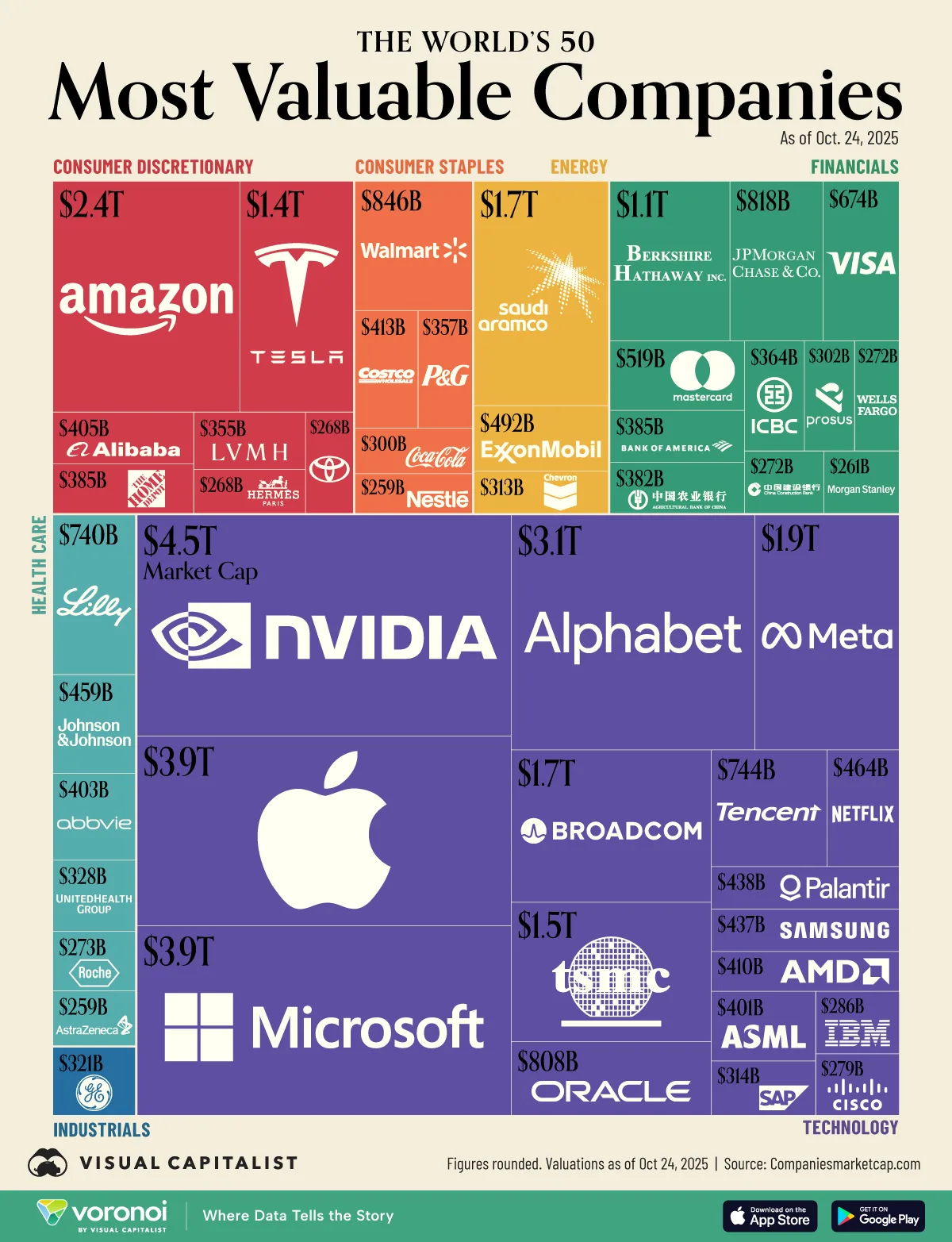

Ranked: The World’s 50 Most Valuable Companies in October 2025

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- Nvidia has pulled ahead of the rest of its Magnificent Seven peers, nearing an historic $5T valuation.

- Rival chipmaker AMD has surpassed $400B for the first time, riding off a series of catalysts including an OpenAI chip deal and a quantum computing deal with IBM.

The world’s most valuable companies have continued to grow larger in 2025, with the tech sector’s prevalence more profound than ever.

To see how things look as we approach the final two months of the year, we’ve ranked the top 50 companies by their market capitalization as of Oct. 24, sorted by industry.

Data & Discussion

The data for this visualization was sourced from CompaniesMarketCap, a simple and effective tool for tracking real-time market capitalization of publicly-traded firms.

| Name | Sector | Market Cap |

|---|---|---|

Amazon Amazon |

Consumer Discretionary | $2,391,180,000,000 |

Tesla Tesla |

Consumer Discretionary | $1,442,470,000,000 |

Alibaba Alibaba |

Consumer Discretionary | $405,129,000,000 |

Home Depot Home Depot |

Consumer Discretionary | $384,896,000,000 |

LVMH LVMH |

Consumer Discretionary | $355,009,000,000 |

Hermès Hermès |

Consumer Discretionary | $268,064,000,000 |

Toyota Toyota |

Consumer Discretionary | $267,678,000,000 |

Walmart Walmart |

Consumer Staples | $846,478,000,000 |

Costco Costco |

Consumer Staples | $413,105,000,000 |

Procter & Gamble Procter & Gamble |

Consumer Staples | $356,901,000,000 |

Coca-Cola Coca-Cola |

Consumer Staples | $299,892,000,000 |

Nestlé Nestlé |

Consumer Staples | $259,050,000,000 |

Saudi Aramco Saudi Aramco |

Energy | $1,667,830,000,000 |

Exxon Mobil Exxon Mobil |

Energy | $491,936,000,000 |

Chevron Chevron |

Energy | $313,426,000,000 |

Berkshire Hathaway Berkshire Hathaway |

Financials | $1,061,810,000,000 |

JPMorgan Chase JPMorgan Chase |

Financials | $817,858,000,000 |

Visa Visa |

Financials | $674,244,000,000 |

Mastercard Mastercard |

Financials | $518,604,000,000 |

Bank of America Bank of America |

Financials | $385,308,000,000 |

Agricultural Bank of China Agricultural Bank of China |

Financials | $381,791,000,000 |

ICBC ICBC |

Financials | $364,370,000,000 |

Prosus Prosus |

Financials | $302,205,000,000 |

Wells Fargo Wells Fargo |

Financials | $272,100,000,000 |

China Construction Bank China Construction Bank |

Financials | $271,816,000,000 |

Morgan Stanley Morgan Stanley |

Financials | $260,701,000,000 |

Eli Lilly Eli Lilly |

Health Care | $739,980,000,000 |

Johnson & Johnson Johnson & Johnson |

Health Care | $458,730,000,000 |

AbbVie AbbVie |

Health Care | $402,758,000,000 |

UnitedHealth UnitedHealth |

Health Care | $328,307,000,000 |

Roche Roche |

Health Care | $272,998,000,000 |

AstraZeneca AstraZeneca |

Health Care | $259,460,000,000 |

General Electric General Electric |

Industrials | $320,526,000,000 |

NVIDIA NVIDIA |

Technology | $4,534,870,000,000 |

Apple Apple |

Technology | $3,900,350,000,000 |

Microsoft Microsoft |

Technology | $3,892,040,000,000 |

Alphabet Alphabet |

Technology | $3,146,160,000,000 |

Meta Meta |

Technology | $1,854,860,000,000 |

Broadcom Broadcom |

Technology | $1,672,330,000,000 |

TSMC TSMC |

Technology | $1,529,820,000,000 |

Oracle Oracle |

Technology | $807,715,000,000 |

Tencent Tencent |

Technology | $744,318,000,000 |

Netflix Netflix |

Technology | $463,856,000,000 |

Palantir Palantir |

Technology | $438,006,000,000 |

Samsung Samsung |

Technology | $437,015,000,000 |

AMD AMD |

Technology | $410,450,000,000 |

ASML ASML |

Technology | $400,995,000,000 |

SAP SAP |

Technology | $313,919,000,000 |

IBM IBM |

Technology | $286,405,000,000 |

Cisco Cisco |

Technology | $279,214,000,000 |

Nvidia’s Rise to $4.5 Trillion

Nvidia leads the world with a staggering valuation of $4.53 trillion, surpassing both Apple ($3.9 trillion) and Microsoft ($3.89 trillion).

Nvidia GPUs remain the backbone of AI model training, with customers like OpenAI committing billions of dollars to buy its chips.

Nvidia has also committed to investing $100 billion in OpenAI to build more data centers, raising concerns about the circular nature of recent deals between major AI players.

OpenAI is currently the world’s most valuable private tech company, valued at $500 billion.

AI is Everywhere

The AI craze is creating many more winners than just Nvidia.

For example, in early October, AMD and OpenAI announced a strategic partnership to deploy 6 gigawatts of AMD GPUs. A week later, OpenAI followed up with a strategic collaboration with Broadcom to deploy 10 gigawatts of custom AI chips.

Broadcom shares are up 56% year to date, while AMD has rocketed 115% (its shares climbed 43% the week of the OpenAI announcement).

On the software side, Palantir has quickly risen to become the world’s 45th most valuable company, setting record-breaking P/E and P/S ratios along the way. The firms develops AI platforms that digest vast amounts of data to make predictive insights.

Palantir has been the best-performing S&P 500 stock since its addition to the index in September 2024, and has climbed 1,956% since its October 2020 IPO.

Learn More on the Voronoi App

If you enjoyed today’s post, check out Average S&P 500 Returns by Zodiac Year on Voronoi, the new app from Visual Capitalist.

- Source: https://www.visualcapitalist.com/ranked-the-worlds-50-most-valuable-companies-in-october-2025/