Top Performing Equity Markets as of May 2025

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

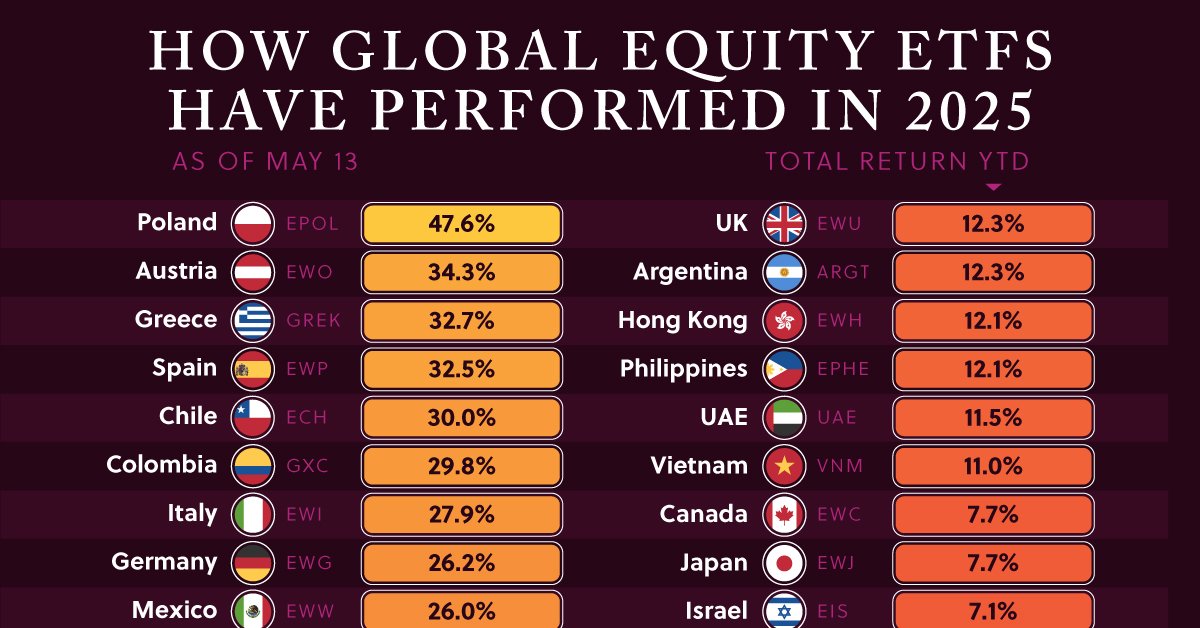

- U.S. equities (measured by the S&P 500) are among the world’s worst performers in 2025, as of May 13

- European markets like Poland, Austria, and Greece have greatly outperformed

Global equity markets have delivered mixed performance in 2025 so far, with U.S. stocks selling off sharply in April.

Meanwhile, European markets have surged due to easing monetary policy from the European Central Bank (ECB), as well as a rebound in industrial activity across the region.

In this graphic, we’ve visualized the top performing equity markets as of May 13, 2025, based on country-focused ETF returns. Tickers for each benchmark ETF are listed beside the flags.

Data & Discussion

The data we used to create this graphic comes from YCharts, accessed via Charlie Bilello’s weekly blog.

| Country | ETF Ticker | Total Return YTD |

|---|---|---|

Poland Poland |

EPOL | 47.6% |

Austria Austria |

EWO | 34.3% |

Greece Greece |

GREK | 32.7% |

Spain Spain |

EWP | 32.5% |

Chile Chile |

ECH | 30.0% |

Colombia Colombia |

GXC | 29.8% |

Italy Italy |

EWI | 27.9% |

Germany Germany |

EWG | 26.2% |

Mexico Mexico |

EWW | 26.0% |

Brazil Brazil |

EWZ | 25.9% |

Finland Finland |

EFNL | 22.6% |

Sweden Sweden |

EWD | 21.2% |

South Africa South Africa |

EZA | 20.9% |

France France |

EWQ | 17.3% |

Netherlands Netherlands |

EWN | 17.0% |

Norway Norway |

NORW | 16.9% |

China China |

MCHI | 16.7% |

Switzerland Switzerland |

EWL | 15.7% |

Singapore Singapore |

EWS | 15.4% |

Belgium Belgium |

EWK | 14.1% |

South Korea South Korea |

EWY | 13.5% |

Kuwait Kuwait |

KWT | 12.9% |

Peru Peru |

EPU | 12.8% |

UK UK |

EWU | 12.3% |

Argentina Argentina |

ARGT | 12.3% |

Hong Kong Hong Kong |

EWH | 12.1% |

Philippines Philippines |

EPHE | 12.1% |

UAE UAE |

UAE | 11.5% |

Vietnam Vietnam |

VNM | 11.0% |

Canada Canada |

EWC | 7.7% |

Japan Japan |

EWJ | 7.7% |

Israel Israel |

EIS | 7.1% |

Ireland Ireland |

EIRL | 6.7% |

Australia Australia |

EWA | 6.5% |

Qatar Qatar |

QAT | 6.1% |

Taiwan Taiwan |

EWT | 2.9% |

India India |

INDA | 2.1% |

Denmark Denmark |

EDEN | 1.9% |

Malaysia Malaysia |

EWM | 1.6% |

New Zealand New Zealand |

ENZL | 1.0% |

U.S. U.S. |

SPY | 0.4% |

Saudi Arabia Saudi Arabia |

KSA | -1.3% |

Indonesia Indonesia |

EIDO | -5.1% |

Thailand Thailand |

THD | -6.5% |

Turkey Turkey |

TUR | -9.5% |

Many of the world’s top performing equity markets are located in Europe.

One reason for this is the ECB’s recent rate cut decision, which reduced the three key ECB interest rates by 25 basis points in April.

Another reason is rising business activity across the eurozone, driven by German manufacturing.

European Defense Stocks Are Flying High

European defense stocks have performed particularly well in recent months due to ongoing Russian aggression and America’s wavering commitment to NATO.

As an example, shares of Rheinmetall AG, Germany’s largest defense company, have climbed nearly 200% since the beginning of the year.

Defense spending across Europe rose 17% to $693 million in 2024, according to data from the Stockholm International Peace Research Institute (SIPRI).

I do believe we will see further increases in the years ahead. Europe recognizes the need to stand on its own and not rely as heavily on the United States

Seth Krummrich, Vice President at Global Guardian

Learn More on the Voronoi App

NATO members have greatly increased their spending in recent years—see the data here.