The surfactants industry stands at a pivotal moment. Demand continues to rise but the feedstocks traditionally used to meet that demand, such as petrochemicals and oleochemicals (e.g. palm oil), are under increasing pressure as the world pushes toward using renewable carbon. The challenge isn’t just about using renewable feedstocks or reformulating existing products; it’s about doing so in a way that makes economic and logistical sense across a global, and often volatile, manufacturing landscape. Supply chains must evolve, too.

The urgent need for scalable, sustainable alternatives

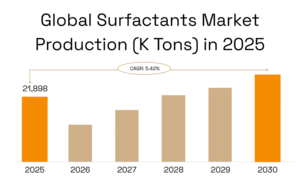

Global surfactant production is projected to reach 21,898 kT in 2025, comprised of approximately 12,433 kT petroleum‑based surfactants (56%), 8,830 kT bio‑based surfactants (40%), and 635 kT biosurfactants (3%). The market value stood at USD 45 billion in 2023 and is expected to grow to USD 6 billion by 2030. To meet this growth in demand, as well as goals for reducing dependence on fossil-based raw materials, the global surfactants industry urgently needs scalable, renewable carbon-based raw materials that reduce dependency on constrained resources and offer increased supply chain stability.

Supply chains that continue to rely fully on existing raw materials may struggle to remain competitive. They can also undermine corporate ESG commitments, leaving companies exposed to sudden price shifts, regulatory changes, resource constraints, and geopolitical disruptions such as oil price volatility and government action. For example, in 2022, Indonesia—the world’s largest palm oil exporter —temporarily banned palm oil exports to secure domestic supply, a move that sent global vegetable oil prices soaring and disrupted markets worldwide.

Replacing existing surfactant manufacturing infrastructure overnight isn’t realistic. Transitioning to new renewable carbon-based raw materials takes time and is most successful if companies can adapt their existing assets. This makes it even more important to find innovative solutions that can easily integrate with current infrastructure.

Source: Focend, Surfactants Market Production and Consumption (December 2024)

How localized supply chains support surfactant stability

Supply chain resilience is a strategic imperative, yet achieving resilience with sustainable raw materials for surfactants remains a rapidly evolving challenge. Palm-derived oleochemicals illustrate this tension. Palm oil producers face growing scrutiny under environmental regulations—such as the EU’s upcoming deforestation law going into effect in December 2025— demand continues to surge across surfactants, biodiesel, and food products. These overlapping environmental and demand pressures, paired with fluctuating palm prices, make stable sourcing difficult. As one industry report from Global Growth Insights notes, “The fluctuation in palm oil prices has historically led to disruption in the supply chain making it difficult for companies to maintain stable pricing and production schedules.”

Global trade dynamics continue to reshape sourcing strategies. For example, the Freightos Baltic Index (FBX) soared to many multiples of its historical norm during Covid, reflecting increased international goods shipment costs. In fact, a 2024 report in Manufacturing & Logistics Magazine found that nearly 60% of manufacturers have already started reshoring, and more than 80% plan to accelerate the pace over the next two years.

Supply chain localization isn’t just a current trend, it’s a proven strategy for building agility and resilience in today’s climate. PwC identifies six key drivers of supply chain performance that can be unlocked through strategic localization:

- improved resilience

- enhanced efficiency

- faster market responsiveness

- cost reduction

- sustainability benefits

- enhanced quality control

Aligning innovation with strategy

For surfactant producers, the challenge lies in aligning product innovation with operational, environmental, and commercial goals. As the industry works to reduce dependence on fossil feedstocks and navigate supply chain volatility, a variety of sustainable alternatives are emerging to meet performance and regulatory demands.

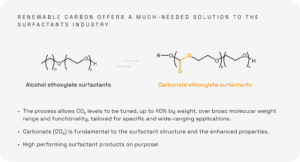

Among the newer solutions to supply chain resilience challenges, carbonate ethoxylates such as Econic’s Recreaire offer a pathway to help decarbonize ethoxylate production using CO₂ as a renewable carbon feedstock. As the Econic process is compatible with existing ethoxylation assets and local CO2 supplies, it provides an efficient route to reduce carbon footprint and reliance on petrochemical or food-based oleochemicals without requiring large-scale infrastructure changes. Crucially, Recreaire surfactants show strong performance in a number of applications.

offer a pathway to help decarbonize ethoxylate production using CO₂ as a renewable carbon feedstock. As the Econic process is compatible with existing ethoxylation assets and local CO2 supplies, it provides an efficient route to reduce carbon footprint and reliance on petrochemical or food-based oleochemicals without requiring large-scale infrastructure changes. Crucially, Recreaire surfactants show strong performance in a number of applications.

Other, more radical renewable carbon solutions to the supply chain problem exist, such as bio-surfactants, including sophorolipids and rhamnolipids. A review published by the National Institute of Health notes that these materials “have demonstrated the potential to offer a natural, sustainable, and skin-compatible alternative to synthetically derived surfactant compounds”. However, these bio-materials require significant formulation (e.g., managing foaming profiles and color) and investment in novel manufacturing processes. Many of these processes rely on food-grade feedstocks, such as glucose, and CO2 capture in order to substantiate renewable carbon claims.

The industry will ultimately require a broad palette of sustainable ingredients to meet rising surfactant demand and support modern formulation design. The ability to select the right combination based on performance needs, feedstock availability, and supply chain strategy, while meeting essential commercial needs, will be key to building a more resilient and climate-aligned future for the industry.

A future built on renewable carbon

The surfactants industry is at a turning point, and supply chains must evolve to keep pace with rising demand and mounting pressure on traditional feedstocks. At Econic, we believe renewable carbon carbonate ethoxylate technology offers a practical path forward by working with existing infrastructure, strengthening supply-chain resilience, and reducing reliance on constrained sources while delivering essential performance. This technology can redefine how and where core chemical ingredients are made, and that future is already taking shape.

This article was written by Simon Bennett, Econic’s Commercial Director for Surfactants. To learn more or contact Simon, click here.

The post Rethinking Supply Chain Strategy in the Age of Sustainable Surfactants appeared first on Econic Technologies.