Royal Caribbean Cruises Ltd. (NYSE: RCL) kicked off 2026 with strong financial results for 2025. The company’s success reflects a broader recovery and growth in the global cruise industry. Alongside financial gains, the industry faces growing scrutiny over environmental impact.

Cruise ships are highly carbon-intensive per passenger, prompting major lines—including Royal Caribbean, MSC, Carnival, and Norwegian Cruise Line—to invest in cleaner fuels, energy-efficient technologies, and shore power solutions.

This article looks at the cruise sector’s financial health, passenger growth, and environmental issues. It also discusses how companies are working to balance profits with sustainability.

Smooth Sailing: 2025 Profits and 2026 Outlook

Royal Caribbean Cruises had solid financial results in 2025 and a positive outlook for 2026. The company made nearly $18 billion in revenue in 2025, up from about $16.48 billion in 2024.

Net income also grew to about $4.27 billion, compared with roughly $2.88 billion the year before. Adjusted earnings per share (EPS) rose to $15.64, showing improved profitability.

The company also generated a strong operating cash flow of about $6.4–6.5 billion and returned around $2 billion to shareholders during the year. Record cruise bookings and higher ticket prices helped drive these results.

Royal Caribbean’s board expects double-digit revenue growth in 2026, along with higher capacity. Adjusted EPS is projected between $17.70 and $18.10. Around two-thirds of 2026 cruise capacity is already booked at strong pricing, supporting this forecast.

Jason Liberty, the company CEO, remarked:

“2025 was an outstanding year, and the momentum is further accelerating into 2026… and we continue to see strong and growing preference for our leading brands and differentiated vacation experiences. We expect another strong year of financial performance with both revenue and earnings growing double digits, and we remain on track to achieve our Perfecta goals by 2027.”

After the earnings call, the company’s stock climbed over 6%, mainly due to strong 2026 guidance.

These results show not only a recovery from pandemic lows but also sustained demand for cruises. Analysts expect this trend to continue as global travel and premium leisure spending grow.

Passenger Waves: Cruise Industry Expansion and Emissions

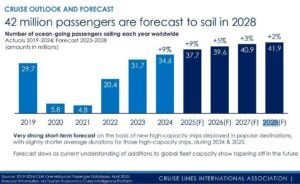

The global cruise industry is growing fast. Projections show over 38 million passengers by 2026, up from around 37.7 million in 2025. This growth follows strong momentum from 2024 and reflects overall travel trends.

Higher demand is encouraging cruise lines to add ships and expand routes. Royal Caribbean, for example, has ordered new Discovery Class vessels and is growing its river cruise segment with more ships planned through 2031. This shows long-term confidence in the market.

Carbon Wake: Cruise Emissions vs Other Travel

Cruising, however, has a higher environmental impact than many other types of travel. Cruise ships are among the most carbon-intensive forms of travel per passenger per distance traveled. This is because they need fuel not just to move but also to run cabins, restaurants, pools, and entertainment.

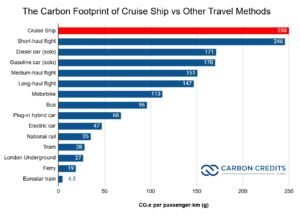

Even large, efficient cruise ships by Royal Caribbean emit around 250 grams of CO₂ per passenger-kilometer. That is higher than most long-haul flights or hotel stays. Onboard services and hotel-style energy use make cruises even more carbon-heavy.

For perspective:

- A five-night cruise of 1,200 miles produces about 1,100 pounds (≈500 kg) of CO₂ per passenger.

- A flight covering the same distance plus a hotel stay produces roughly 264 kg of CO₂ per person.

This means a cruise can generate about 2x the greenhouse gas emissions of an equivalent flight-and-hotel trip.

Trains and electric cars have much lower emissions per passenger. For example, traveling by national rail produces about 35 g CO₂ per kilometer, and international trains like Eurostar are even lower at 4.5 g CO₂ per kilometer.

Other comparison insights:

- Emissions per passenger-kilometer: Large cruise ships emit 0.43–0.65 kg CO₂, depending on occupancy and efficiency. Economy-class flights emit 0.15–0.20 kg, while high-speed rail is around 0.04 kg. Cruises can be 2–10x more carbon-intensive per passenger.

- Fuel and technology impact: Using LNG instead of heavy fuel oil reduces CO₂ by 20–25%, but methane slip and upstream emissions can reduce gains. Air lubrication and optimized routing can cut fuel use by 5–10% per voyage.

Ship engines burn huge amounts of fuel. Amenities like air conditioning, theaters, pools, and restaurants add to the energy demand. Cruises remain a luxurious experience, but travelers should know that they usually have a higher carbon footprint than flights, plus hotels or land-based travel. This shows that while cruises are luxurious and convenient, they have a much higher carbon footprint than most other ways of traveling.

Cruise ships also emit sulfur oxides (SOx), nitrogen oxides (NOx), and fine particles, which can harm air quality in port cities and marine ecosystems. Many passengers also fly to and from cruise ports, adding more carbon emissions that are often not included in cruise footprint estimates.

How Cruise Lines Are Addressing Environmental Impact

Cruise companies, including Royal Caribbean, are working to reduce their environmental impact. Many aim to reach net-zero greenhouse gas emissions by 2050 or earlier.

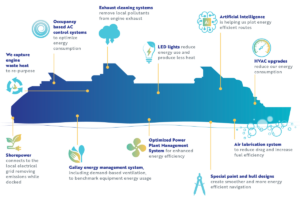

Royal Caribbean’s Destination Net Zero strategy focuses on:

- Alternative fuels: LNG-powered ships, biofuels, and fuel cell technology.

- New ship technologies: Advanced hulls, air lubrication systems, and shore power connections.

- Operational efficiency: Optimized routes and engine improvements to reduce fuel use per passenger.

Other cruise lines are also taking action to tackle their environmental footprint:

MSC Cruises used efficiency tools and smart itinerary planning to cut 50,000 tonnes of CO₂ in 2024. They are testing hybrid propulsion and shore power at multiple ports. Carnival Corporation is expanding LNG and biofuel use while increasing shore-side electrical connections. They are also researching carbon capture for ships.

Likewise, Norwegian Cruise Line (NCL) is adding LNG-powered ships, battery-assisted propulsion, and energy-efficient onboard systems. NCL is also expanding shore power at ports.

Disney Cruise Line uses hybrid exhaust gas cleaning, advanced wastewater treatment, and fuel-efficient hulls while eliminating single-use plastics onboard. Meanwhile, Princess Cruises applies energy-saving tech, waste reduction, and wastewater treatment, while testing LNG as a fuel alternative.

Overall, the cruise industry faces pressure to reduce carbon intensity. Cleaner fuels, new technologies, and operational efficiency are becoming standard. Environmental responsibility is now a key part of long-term business strategy.

Forecast Horizon: Growth, Finance, and Green Goals

Royal Caribbean and the cruise industry are financially strong. High bookings, growing revenue, and positive forecasts show that demand for cruises is rising. Investments in new ships and offerings aim to meet demand across different traveler groups.

Cruise forecasts show over 38 million passengers by 2026, highlighting ongoing interest. Electric and hybrid propulsion, shore power, biofuels, and fuel-saving technologies are slowly becoming standard.

Challenges remain. Reducing cruise carbon intensity to levels similar to other travel modes will require more alternative fuels, stricter rules, and continued innovation.

Still, many cruise lines have pledged net-zero targets, often aligned with global shipping goals. Passengers are also more aware of environmental impact, driving demand for greener cruises.

Balancing Growth and Emissions

Royal Caribbean’s strong earnings and positive outlook show a resilient and growing industry. Record bookings and strategic investments indicate financial health and long-term growth.

However, carbon emissions remain a major issue. Cruises generally produce more CO₂ per passenger than many other vacations. Cruising is also considered to emit the most emissions compared to other travel methods. Thus, the industry faces pressure to reduce this impact.

Understanding both the financial and environmental sides can help travelers make better choices. For cruise companies and policymakers, balancing growth with emissions reductions is key for the future of cruising.

The post Royal Caribbean’s (RCL) Record 2025 Profits Meet Carbon Challenges of the Cruise Industry appeared first on Carbon Credits.