Disseminated on behalf of Sierra Madre Gold & Silver Ltd.

Mexico has been a cornerstone of global silver and gold production for centuries, with historic mining regions such as Zacatecas, Durango, and the Sierra Madre belt supplying the world with these precious metals. Mining represents nearly 2.5% of Mexico’s GDP and produces significant export revenue.

However, decades of underinvestment and declining output from aging mines led to a slowdown in production growth. Today, a new wave of modern mining companies is reinvigorating Mexico’s silver and gold industry, bringing capital, modern technology, and strict environmental practices to historic mining regions.

Among these companies, Sierra Madre Gold & Silver Ltd. (TSXV: SM | OTCQX: SMDRF) is emerging as a standout player, spearheading the revival of Mexico’s rich Temascaltepec district with its La Guitarra Mine.

Mexico’s Silver and Gold Renaissance: Strategic Importance

Mexico remains the world’s largest silver producer, contributing roughly 23–25% of global output in 2024, with total production between 5,800 and 6,300 tonnes. The surge in industrial demand for silver is reshaping its role from primarily a jewelry and investment metal to an essential material in the clean energy transition.

- With silver prices stabilizing around US$28 per ounce in 2025 and climbing above $50 in October, mid-tier producers like Sierra Madre stand to increase shareholder value while supporting rural economies.

Each solar panel consumes about 20 grams of silver, while electric vehicles require up to 50 grams. Analysts predict that by 2030, global silver demand will exceed 1.2 billion ounces annually, highlighting the need for stable, modern supply sources.

Mexico’s combination of skilled workforce, supportive regulations, and modern infrastructure makes it an attractive destination for exploration and investment. Sierra Madre’s work at La Guitarra, along with exploration at Tepic, exemplifies how new companies are turning dormant assets into engines of growth for the next decade.

Reviving La Guitarra: History Meets Modern Mining

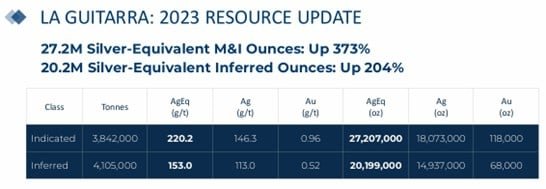

The La Guitarra Mine has a storied history dating back to colonial times, producing both gold and silver under different owners, most recently First Majestic Silver. After a period of care and maintenance, Sierra Madre acquired the mine in 2023 with a clear strategy: restart production (achieved January 2025) and expand output.

The mine comes equipped with a 500-tonnes-per-day processing plant, permitted underground workings, and nearby infrastructure including roads, water, and power. With C$19.5 million in fresh capital and a skilled technical team, it has achieved a full-scale restart, with commercial production announced in January 2025.

- By 2027, the company aims to up to triple production to 1,500 tonnes per day, leveraging smart mine design and local partnerships to keep costs low while ramping output efficiently.

Furthermore, their leadership blends local mining expertise with strong capital markets knowledge, enabling efficient project execution. La Guitarra’s high-grade veins, clear exploration targets, and straightforward permitting process make it one of Mexico’s most promising silver-gold projects.

Commitment to Responsible Mining

Sierra Madre embodies a new generation of environmentally and socially responsible miners. The company is upgrading waste and water systems to modern standards, reclaiming tailings efficiently, and minimizing water usage. Open communication with local communities, clear permitting, and strong ESG practices reinforce its credibility with stakeholders and investors.

Modernization at La Guitarra is as much about responsible operations as it is about increasing output. This focus on sustainability aligns with global investor expectations while strengthening its long-term partnerships.

Sierra Madre holds one other project in Mexico’s Sierra Madre mineral belt:

- Tepic Project (Nayarit): High-grade epithermal gold-silver deposit with near-surface mineralization and strong exploration upside.

By focusing on assets with existing infrastructure and clear development paths, Sierra Madre reduces operational risk compared with early-stage exploration projects.

Industrial Demand Drives Silver’s Strategic Role

Silver’s function has evolved beyond traditional uses. Its high conductivity and reflectivity make it essential in solar panels, EV batteries, 5G networks, and electronics. Industrial demand is rising sharply: in 2024, industrial silver consumption reached 680.5 million ounces, accounting for over 30% of total usage, and solar energy alone represents a growing share.

The EV market further drives demand, with each vehicle requiring up to 50 grams of silver. Rising industrial requirements, combined with structural supply deficits, position companies like Sierra Madre to benefit from near-term production growth.

Global silver production is struggling to keep pace. In 2024, total output was roughly 819.7 million ounces, barely a 1% increase over the previous year. A projected 117.6 million-ounce supply deficit in 2025 underscores the need for reliable producers in Mexico’s rich silver belt.

Leveraging Gold’s Enduring Value in a Record-Price Era

Gold remains a cornerstone of stability. Prices are expected to hold above US$3,000 per ounce, supported by investment demand, central bank buying, and geopolitical uncertainty. In Q2 2025, total gold demand rose 3% year-over-year, reaching 1,249 tonnes, while mine production matched this growth, reflecting a healthy market balance.

At La Guitarra, underground mining at the high-grade Coloso vein started in April 2025, increasing production potential and improving grades. The company is upgrading milling systems to improve recovery rates and lower costs, capitalizing on record-high gold prices.

Strong Operational and Financial Performance

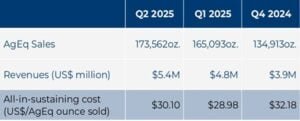

- In Q2 2025, Sierra Madre sold 173,562 silver-equivalent ounces: 66,011 ounces of silver and 1,048 ounces of gold, generating 168,535 AgEq ounces at an average price of US$30.10 per AgEq ounce.

The Coloso Mine is ramping up to 150 t/d by year-end, while underground development at the Nazareno Mine has already delivered over 700 tonnes of mineralized material to the Guitarra mill, with grades exceeding prior estimates.

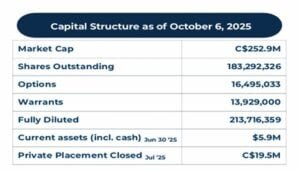

The company raised C$19.5 million in mid-2025 to expand throughput, launch a +20,000-meter exploration program across its mineralized belt, and target high-grade zones in the East District. Strong revenue, cash position, and working capital support ongoing operations and exploration, providing a solid financial foundation for growth.

Silver continues to show upside potential. With a gold-to-silver ratio of 70:1, silver is currently undervalued relative to gold. Combined with rising industrial demand and tight supply, this positions Sierra Madre’s dual-metal strategy to capitalize on both growth and stability. Analysts project that silver deficits will persist, reinforcing the value of near-term production assets like La Guitarra.

- ALSO READ: Gold’s Enduring Value: How Sierra Madre Is Advancing Mexico’s Next Generation of Gold Projects

Two Metals, One Growth Strategy

Sierra Madre’s dual-metal approach combines gold’s stability with silver’s growth potential. Gold anchors financial security, while silver leverages rising industrial demand. This strategy enables the company to maximize shareholder value while maintaining operational resilience.

Phased Expansion Plan

Sierra Madre is executing a two-phase expansion at La Guitarra:

- Phase 1 (Q2 2026): Increase capacity to 750–800 t/d with equipment upgrades, including a new cone crusher and ball mill.

- Phase 2 (Q3 2027): Ramp up to 1,200–1,500 t/d with additional crushing circuits, producing finer material and improving recovery rates.

No additional permits are required, and the expansion will be fully funded from existing cash flow, ensuring self-sustained growth.

Final Take: Why Sierra Madre Is Poised to Deliver Silver and Gold

Sierra Madre Gold & Silver is at the forefront of Mexico’s silver and gold revival. With a mix of production-ready assets, exploration upside, and strong financial backing, the company is well-positioned to benefit from rising demand, structural supply deficits, and supportive market dynamics.

La Guitarra combines history, infrastructure, and timing for near-term production, while Tepic offers significant exploration potential. Sierra Madre’s dual-metal strategy balances stability with growth, leveraging gold’s safe-haven value and silver’s industrial demand.

As global demand for clean energy technologies, electric vehicles, and industrial applications rises, Sierra Madre is uniquely equipped to deliver both silver and gold. Its operational asset, responsible mining practices, and strategic expansion plan position it as a leading junior miner in Mexico’s most productive silver-gold belt.

In short, Sierra Madre has not just restarted a mine—it is breathing new life into Mexico’s historic silver and gold heartland while positioning investors to benefit from a transformative decade in precious metals.

- MUST READ: Reviving Mexico’s Silver Belt: How Sierra Madre’s La Guitarra Mine Is Leading the Comeback

DISCLAIMER

New Era Publishing Inc. and/or CarbonCredits.com (“We” or “Us”) are not securities dealers or brokers, investment advisers, or financial advisers, and you should not rely on the information herein as investment advice. Sierra Madre Gold and Silver Ltd. (“Company”) made a one-time payment of $25,000 to provide marketing services for a term of one month. None of the owners, members, directors, or employees of New Era Publishing Inc. and/or CarbonCredits.com currently hold, or have any beneficial ownership in, any shares, stocks, or options of the companies mentioned.

This article is informational only and is solely for use by prospective investors in determining whether to seek additional information. It does not constitute an offer to sell or a solicitation of an offer to buy any securities. Examples that we provide of share price increases pertaining to a particular issuer from one referenced date to another represent arbitrarily chosen time periods and are no indication whatsoever of future stock prices for that issuer and are of no predictive value.

Our stock profiles are intended to highlight certain companies for your further investigation; they are not stock recommendations or an offer or sale of the referenced securities. The securities issued by the companies we profile should be considered high-risk; if you do invest despite these warnings, you may lose your entire investment. Please do your own research before investing, including reviewing the companies’ SEDAR+ and SEC filings, press releases, and risk disclosures.

It is our policy that information contained in this profile was provided by the company, extracted from SEDAR+ and SEC filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee them.

CAUTIONARY STATEMENT AND FORWARD-LOOKING INFORMATION

Certain statements contained in this news release may constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information generally can be identified by words such as “anticipate,” “expect,” “estimate,” “forecast,” “plan,” and similar expressions suggesting future outcomes or events. Forward-looking information is based on current expectations of management; however, it is subject to known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those anticipated.

These factors include, without limitation, statements relating to the Company’s exploration and development plans, the potential of its mineral projects, financing activities, regulatory approvals, market conditions, and future objectives. Forward-looking information involves numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking information. These risks and uncertainties include, among other things, market volatility, the state of financial markets for the Company’s securities, fluctuations in commodity prices, operational challenges, and changes in business plans.

Forward-looking information is based on several key expectations and assumptions, including, without limitation, that the Company will continue with its stated business objectives and will be able to raise additional capital as required. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, or intended.

There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially. Accordingly, readers should not place undue reliance on forward-looking information. Additional information about risks and uncertainties is contained in the Company’s management’s discussion and analysis and annual information form for the year ended December 31, 2024, copies of which are available on SEDAR+ at www.sedarplus.ca.

The forward-looking information contained herein is expressly qualified in its entirety by this cautionary statement. Forward-looking information reflects management’s current beliefs and is based on information currently available to the Company. The forward-looking information is made as of the date of this news release, and the Company assumes no obligation to update or revise such information to reflect new events or circumstances except as may be required by applicable law.

For more information on the Company, investors should review the Company’s continuous disclosure filings available on SEDAR+ at www.sedarplus.ca.

Disclosure: Owners, members, directors, and employees of carboncredits.com have/may have stock or option positions in any of the companies mentioned: None.

Carboncredits.com receives compensation for this publication and has a business relationship with any company whose stock(s) is/are mentioned in this article.

Additional disclosure: This communication serves the sole purpose of adding value to the research process and is for information only. Please do your own due diligence. Every investment in securities mentioned in publications of carboncredits.com involves risks that could lead to a total loss of the invested capital.

Please read our Full RISKS and DISCLOSURE here.

The post Sierra Madre: Breathing New Life into Mexico’s Silver and Gold Heartland appeared first on Carbon Credits.