Silver entered 2026 with strong momentum. Prices surged over the past year. Industrial users adjusted to rising costs. Investors returned to the market. At the same time, solar manufacturers began cutting silver use to save money.

Even with a higher supply, the global market stayed in deficit for the sixth straight year. In short, silver’s story in 2026 is one of tight supply, shifting demand, and rising importance.

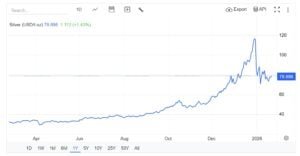

Silver Prices Rise as Investors Return

Silver prices recently stayed above $78 per ounce, helped by geopolitical tensions and light trading in Asia. After a volatile stretch, the metal was on track for its first weekly gain in four weeks.

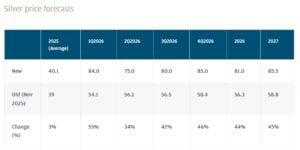

J.P. Morgan projects silver could average $81 per ounce in 2026, more than double its 2025 average. Yet the forecast depends on global demand and economic conditions. In 2025, silver jumped by over 130%. Industrial demand and tariff uncertainty fueled the rally. Later, U.S. Federal Reserve rate cuts boosted investor interest.

However, high prices bring challenges. Investors benefit, but industrial users face rising costs. Prolonged price pressure could reduce demand and cause more volatility.

Solar Manufacturers Cut Usage as Costs Climb

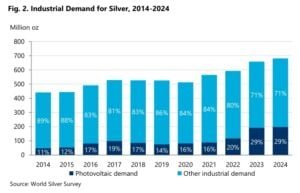

One of the most significant shifts in 2026 comes from the solar sector. According to BloombergNEF, solar manufacturers—the largest industrial consumers of silver—are accelerating efforts to reduce silver intensity in photovoltaic (PV) modules.

Silver demand from PV installations is expected to fall to roughly 194 million ounces, or about 6,028 metric tons, this year, marking a 7% year-on-year decline. This drop comes even as global solar capacity continues to expand by around 15%.

Simply put, as manufacturers are using less silver per cell, total silver demand from the sector is projected to decline.

Rising costs explain the shift. Silver now accounts for an estimated 17–29% of PV module costs per watt, up sharply from just 3% in 2023. As prices climbed toward and even above $80 per ounce, manufacturers intensified substitution efforts.

Chinese Solar Makers Lead the Silver Substitution Push

Chinese producers are leading the transition. Longi Green Energy Technology Co. announced plans to replace silver with base metals such as copper in its back-contact cells, with mass production expected in the second quarter of 2026. Similarly, Jinko Solar Co. signaled large-scale copper-based panel production, while Shanghai Aiko Solar Energy Co. has already launched silver-free solar cells.

However, substitution remains technically challenging. Copper can increase assembly costs and raise reliability concerns. Moreover, certain technologies, such as TOPCon cells, are less compatible with alternative metals due to high-temperature fabrication processes. As a result, silver continues to play a central role in high-efficiency solar designs, even as overall usage declines.

So, What’s Fueling Silver Demand in 2026?

Industrial Segments

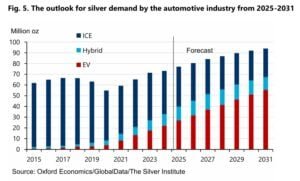

Although solar demand softens, other industrial segments continue to support silver consumption. The Silver Institute highlighted strong structural growth in data centers, artificial intelligence infrastructure, and the automotive sector. This is because it conducts electricity better than almost any other metal. As electrification and digital growth continue, these sectors help support steady industrial demand.

- Notably, the automotive industry will account for 59% of the share by 2031.

Investment Demand

On the other hand, investment demand is rising. Global physical investment is forecast to increase about 20% to 227 million ounces, reaching a three-year high. Western investors are returning after several weak years, supported by strong prices and economic uncertainty. At the same time, investment demand in India remains strong, helped by positive sentiment and recent gains.

Supply Growth Fails to Close the Gap

On the supply side, total global output is projected to increase 1.5% in 2026, reaching a decade high of 1.05 billion ounces. Mine production is expected to rise modestly to around 820 million ounces, supported by stronger output from existing operations and recently commissioned projects.

- Growth is anticipated in Mexico’s primary silver mines and at China Gold International’s Jiama polymetallic mine.

- In Canada, new and expanding projects such as Hecla’s Keno Hill and New Gold’s New Afton are contributing additional supply.

- By-product silver from gold mines is also expected to increase, with gains from operations including Barrick’s Pueblo Viejo in the Dominican Republic and Gold Fields’ Salares Norte in Chile.

Recycling is expected to climb 7%, surpassing 200 million ounces for the first time since 2012. High prices encourage consumers to sell scrap, especially silverware.

Even so, the market remains undersupplied. The Silver Institute forecasts a 67 million-ounce deficit in 2026. As a result, the market relies on stored silver reserves, adding pressure to an already tight supply.

BHP and Wheaton Strike a Record Silver Deal

Corporate activity reflects silver’s strength. BHP entered a long-term streaming agreement with Wheaton Precious Metals Corp. BHP received $4.3 billion upfront in exchange for silver linked to its share of production at the Antamina mine in Peru.

This deal, the largest streaming transaction by upfront payment, lets BHP monetize silver as a by-product while keeping full exposure to copper, zinc, and lead. It doesn’t affect BHP’s joint venture rights or customer contracts.

Strategically, the deal shows how miners turn non-core metals into cash to strengthen balance sheets and fund growth projects.

2030 Outlook: Silver Demand and Supply

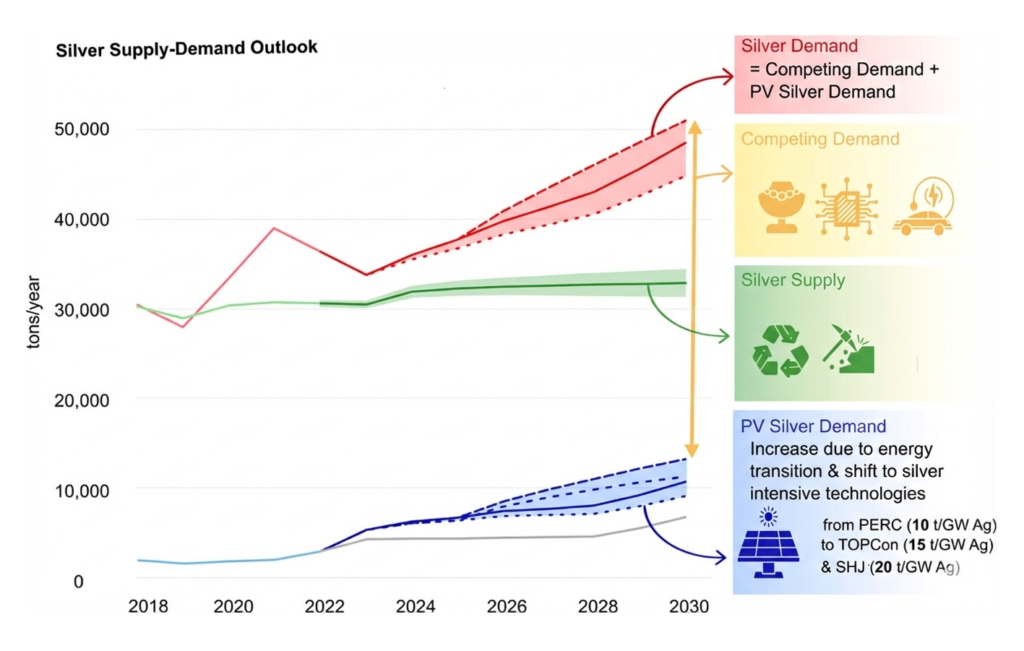

A research paper published recently looked at how much silver the solar industry may require by 2030. It also considered demand from other industries that use silver, such as electronics and automotive.

The findings raise concerns.

- By 2030, total silver demand could reach 48,000 to 54,000 tons per year. However, supply may only cover 62% to 70% of that need. In other words, the world could face a serious silver shortage.

Solar is expected to be the fastest-growing source of demand. The industry alone may require 10,000 to 14,000 tons per year, which could account for 29% to 41% of total supply. At the same time, other industries will continue to use large amounts of silver. Even with slower growth, demand from these sectors could still reach 38,000 to 40,000 tons per year by 2030.

In conclusion, the silver market continues to run in deficit. As long as supply lags total demand, prices may stay high. At the same time, higher prices could speed up substitution and increase volatility.

The post Silver in 2026 and Beyond: Rising Prices, Solar Substitution, and a Market Still in Deficit appeared first on Carbon Credits.