Standard Chartered has signed a five-year deal to sell up to five million carbon credits on behalf of the Brazilian state of Acre. The major bank and the state are working together to fund rainforest conservation using the carbon credit market.

Credits will be created within a REDD+ framework. This global system aims to cut emissions from deforestation and forest degradation.

Carbon credits will start being issued in 2026. They will be in the “avoided deforestation” category. This means they help prevent emissions by preserving current forests instead of creating new ones. The goal is to prevent deforestation and protect biodiversity and community livelihoods. It also helps reduce greenhouse gas emissions.

The deal could raise as much as $150 million in funding. Acre officials say that 72% of the proceeds will go to local and Indigenous communities. This will help them protect and conserve forests. The rest of the funds will support project management and monitoring systems. This will help ensure transparency and effectiveness.

Why Rainforest Protection Matters in Global Climate Goals

Forests—especially tropical rainforests like the Amazon—are among the most important carbon sinks on the planet. When they’re cut down or degraded, the carbon stored in trees and soil is released into the atmosphere.

The Amazon rainforest absorbs billions of tons of carbon dioxide each year. A NASA-led study found that, in a typical year, the Amazon rainforest absorbs about 2.2 billion metric tons (2 billion tons) of CO2. This is crucial for stabilizing the Earth’s climate.

Experts say that about 20% of global land-use emissions come from deforestation and forest degradation. This makes protecting rainforests one of the quickest and cheapest climate actions today.

Deals like Standard Chartered’s with Acre help banks and businesses support conservation. They can also meet their corporate net-zero goals.

The agreement combines solid financial support with environmental care. It shows how carbon credits can work with climate science and help communities grow.

Standard Chartered’s Chief Sustainability Officer, Marisa Drew, remarked:

“We’re leveraging our global network and carbon market expertise to address this challenge directly, offering a means to help preserve standing forests that act as vital carbon sinks, and in turn help the communities that depend on them continue to realise the economic and social returns they provide.”

High Integrity or Bust: Building Trust in Carbon Offsets

One of the biggest challenges in carbon markets today is credibility. Over the past few years, concerns have emerged about the quality and transparency of carbon offset projects. Some faced criticism for exaggerating emissions cuts. Others did not provide real environmental or social benefits.

To help address this, the Acre–Standard Chartered deal includes safeguards. First, there will be no forward selling of credits—this means credits will only be sold once they are officially issued and verified.

This reduces the risk of overpromising and underdelivering. The transaction also supports adherence to the Core Carbon Principles (CCPs) developed by the Integrity Council for the Voluntary Carbon Market (ICVCM). These principles define standards for top-quality carbon credits and include key factors like:

- permanence,

- additionality,

- leakage, and

- solid monitoring, reporting, and verification (MRV) systems.

The Acre project aims to create a real, measurable impact. Buyers and climate watchdogs want this more than ever.

Beyond the Trees: Inside the Bank’s Broader Climate Finance Strategy

This deal with Acre is part of a bigger move by Standard Chartered to increase its activity in sustainable finance and carbon markets. The bank has supported early-stage carbon removal firms like UNDO. UNDO uses enhanced weathering of rocks to take carbon out of the air.

The financing deal, supported by British Airways, had a unique structure. It included insurance and long-term offtake agreements.

Standard Chartered also partners with Puro.earth, a top carbon removal registry. This gives clients access to high-quality Carbon Dioxide Removal Certificates (CORCs). These types of credits are increasingly in demand from companies that want to go beyond carbon neutrality and achieve net-negative emissions.

The bank plans to achieve net-zero operations by 2025. It will use high-integrity carbon credits to offset emissions from energy use, air travel, and data centers. It also has a 2050 net-zero target for its financed emissions—those generated by the activities of companies it lends to or invests in.

The Carbon Market Is Growing Up – Fast

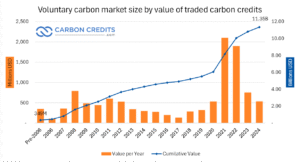

Standard Chartered’s deal also reflects broader trends in the voluntary carbon market (VCM). According to recent reports, the VCM was valued at around $2 billion in 2024, and could grow significantly in the coming years.

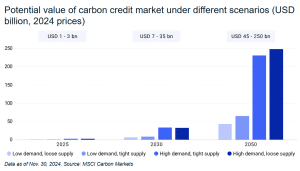

McKinsey & Company projects the VCM could reach over $50 billion by 2030 under favorable policy and corporate demand conditions. With strong market reform, the value could exceed $250 billion by 2050, driven by net-zero goals and increasing regulation.

One of the most important shifts is the rise of jurisdictional REDD+ credits—like those offered by Acre. Jurisdictional credits differ from small-scale projects because they cover whole regions or states.

This approach offers wider environmental protection. It also lowers the risk of “leakage.” This is when conservation in one area leads to deforestation moving elsewhere.

Jurisdictional programs are also more attractive to institutional investors and sovereign funds. Large buyers usually want scalability, accountability, and local community benefits. Traditional project-level carbon offsets often fail to meet these needs.

The carbon market is expanding beyond forest protection. It now includes carbon removal technologies like direct air capture, biochar, and mineralization. These solutions are still new, but they are vital for reaching global net-zero goals. This is especially true in tough sectors to decarbonize, like cement, aviation, and steel.

A New Standard for Carbon Finance and COP30

The Standard Chartered–Acre partnership stands out not just for its scale, but for its approach. It focuses on real climate outcomes, community benefits, and market integrity. In doing so, it may serve as a model for future deals between financial institutions, governments, and Indigenous groups.

This is especially important ahead of COP30, the global climate summit set to be hosted in Belém, Brazil, in 2025. As the world focuses on Amazon conservation and climate justice, projects like Acre’s are set to shine. They show how nature-based solutions can achieve financial, environmental, and social goals.

By treating forests not just as carbon stores but as living ecosystems supported by local people, this deal shows that climate action and development do not have to be at odds—they can move forward together.

The post Standard Chartered to Sell 5M Carbon Credits to Help Protect Amazon Rainforest appeared first on Carbon Credits.