Companies worldwide are under pressure to meet their 2030 net-zero targets, and high-quality carbon removal solutions are becoming scarce. Biochar offers a promising solution. It’s a carbon-rich material made by heating organic waste in low oxygen. This process is called pyrolysis.

Biochar lasts long and captures carbon. It also boosts soil health and helps crops grow better. However, new research from Supercritical shows that access to high-quality biochar carbon credits is getting tighter. Early adopters are securing their supply with long-term agreements.

Supercritical CEO, Michelle You, remarked:

“This isn’t just about buying carbon removal—it’s about securing future access in an increasingly competitive market. Companies signing offtakes today are gaining supply security and cost stability, while those waiting on the sidelines or relying on spot purchases will face shrinking availability and escalating prices.”

The Biochar Land Grab: Why Supply is Disappearing

Biochar turns agricultural waste into stable carbon. When buried in soil, it can stay there for centuries. This makes biochar one of the most effective carbon dioxide removal (CDR) methods available today.

Biochar is popular with 80% of CDR buyers as it is affordable and scalable. This makes it a smart choice for cutting emissions and boosting environmental health.

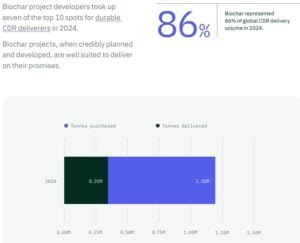

Despite these benefits, biochar production faces significant supply constraints. The latest Supercritical report, Locked in or Left Behind? Biochar Offtakes in 2025, highlights that 62% of the 2025 high-quality biochar supply is already locked into offtake agreements, with nearly 30% secured through 2026.

Companies must act now in this tight market. If they don’t, they risk missing out on affordable carbon removal credits.

Offtake Agreements: The Smartest Play in Carbon Removal

An offtake agreement is a long-term purchase contract that allows companies to secure future carbon removal credits before they are issued. These agreements help biochar suppliers feel secure financially. They can scale up production. Buyers benefit, too, as they get stable prices and a guaranteed supply.

Companies with multi-year offtake agreements save up to 31% compared to those buying credits on the spot market. People who depend on one-time purchases are seeing costs go up. They also face a shrinking supply of good-quality credits.

With biochar prices increasing 18% in 2024, securing long-term agreements has become the most strategic way to manage carbon removal costs.

Biochar Market Trends and Future Outlook

The demand for high-quality CDR solutions is expected to skyrocket in the coming years. According to Supercritical’s research:

- Global demand for durable carbon removal is expected to hit 40–200 MtCO₂ each year by 2030. However, the current supply falls far short of this need.

- Biochar accounted for 86% of all CDR deliveries in 2024, proving its reliability in the market.

- If just 10% of companies with Science Based Targets initiative (SBTi) commitments began buying carbon removal credits today, the market would need to grow 25 times its current size.

The biochar carbon credits market has experienced notable growth in recent years. This reflects an increasing corporate focus on sustainable practices and carbon removal strategies.

Pricing Trends

Biochar carbon credits command significantly higher prices compared to the broader voluntary carbon market.

In 2023, transaction prices ranged between $100 and $200 per metric ton of CO₂ equivalent, with an average price of around $150. This contrasts with the overall voluntary carbon market average of $5.80 per metric ton in the same year.

Future Outlook

Forecasts by MSCI Carbon Markets suggest that demand for biochar carbon credits could increase 20-fold over the next decade. However, this anticipated growth may lead to short-term price compression due to rising supply and competition, with prices potentially softening before strengthening again up to 2035.

As net-zero deadlines near, organizations that wait to get carbon credits will face tougher competition. Prices may rise, and they might not get any supply at all. This is very important. Updated SBTi guidelines will likely add interim carbon removal targets. This will increase demand even more.

Who is Leading the Biochar Offtake Movement?

Large corporations are already securing multi-year offtakes to future-proof their carbon removal strategies. Microsoft, Google, and Stripe have bought a lot of biochar credits. This ensures they get high-quality supplies at steady prices.

Other companies have followed suit, recognizing that offtakes are the key to maintaining cost-effective and reliable carbon removal solutions.

A few notable biochar offtake deals include:

- Google & Varaha (India): The largest biochar offtake agreement to date.

- Charm Industrial (USA): A 100,000-tonne multi-year biochar removal contract.

- Exomad Green (Bolivia): 70,000 tonnes secured over a seven-year contract.

These deals show that big buyers are eager to secure supply. They want to act before the market tightens further.

Waiting Could Cost Big: Spot Market vs. Offtakes

While some companies may prefer to buy carbon credits on the spot market, this approach comes with significant risks. The biochar market is splitting. Early movers are getting the best supply, but latecomers must fight for what’s left.

Key risks of relying on spot purchases include:

- Higher Prices: Biochar prices have increased at a 29.2% compound annual growth rate (CAGR) over the past four years, and price volatility is expected to continue.

- Limited Supply: As of 2025, more than 60% of available high-quality biochar is already locked into offtakes, leaving little room for new buyers.

- Lower-Quality Projects: Companies waiting to purchase on the spot market may be forced to accept lower-quality credits, which may not meet the highest standards for durability and effectiveness.

In contrast, companies with offtake agreements today are protecting their net-zero goals. They ensure a steady supply of high-quality biochar credits at clear prices.

The Urgency to Act Now

Biochar is becoming a top choice for large-scale carbon removal. However, its supply is quickly vanishing due to long-term contracts.

As prices rise and demand exceeds supply, companies must act now. If they don’t, they might be priced out or miss out on quality removals.

For organizations serious about meeting their net-zero commitments, securing biochar carbon credits via offtake agreements now is not just a smart move—it’s essential. As the market continues to evolve, those who take action today will shape the future of carbon removal, while those who hesitate risk being left behind.

The post The Biochar Gold Rush: Why Companies Are Scrambling to Lock in Carbon Credits appeared first on Carbon Credits.