Happy Monday!

In the Thanksgiving spirit, the energy transition gave us a lot to be grateful for this year. Check out our plate: the heavy hitters, the sides that keep the system moving, and the desserts that might change everything.

In deals, $1.6bn for data center development, $700m for advanced nuclear development, and $577m for sustainable mining solutions.

In other news, the Trump administration’s deregulation spree, the DOE re-org, and Australia’s successful residential solar battery scheme.

And don’t forget: take our 2026 Climate Tech Prediction Bets Survey to tell us what you think is in store for the year ahead, and the chance to win a $50 gift card!

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at hello@ctvc.co.

💼 Find or share roles on our job board here.

The energy transition’s holiday spread

We know you're probably recovering from your Thanksgiving meals, family debates, and out-of-office triage. But after a weekend of reflections (and Open Circuit’s Feast of Hot Takes still ringing in our ears), we came back with our own post-holiday audit.

The global energy transition, as it turns out, looks a lot like the table you just left: a heavy centerpiece, a few sides doing the quiet hard work, and a dessert spread full of risky ideas with outsized upside. It also reminds us what we are grateful for in climate tech this year: cost drops, policy wins, and real steel in the ground.

🦃 The turkey: Big, loud wins. The things going well and grabbing headlines.

- Real steel in the ground > slide decks, lab experiments, etc. Direct lithium extraction pilots launched in the UK, France, Germany, and Canada. Thermal energy storage reached commercial scale. Advanced nuclear company Kairos poured concrete as it started construction. Long-duration energy storage projects moved ahead in the US and Europe. Cement and CCS projects at Brevik hit key milestones. These are shovels, rigs, and money, especially in Europe and emerging markets, which can offer faster permitting, cheaper feedstocks, and massive scale.

- Solar at record scale continues to rise faster than expected, even after a turbulent year for manufacturers. Deployment momentum has carried the sector through policy swings and supply chain resets.

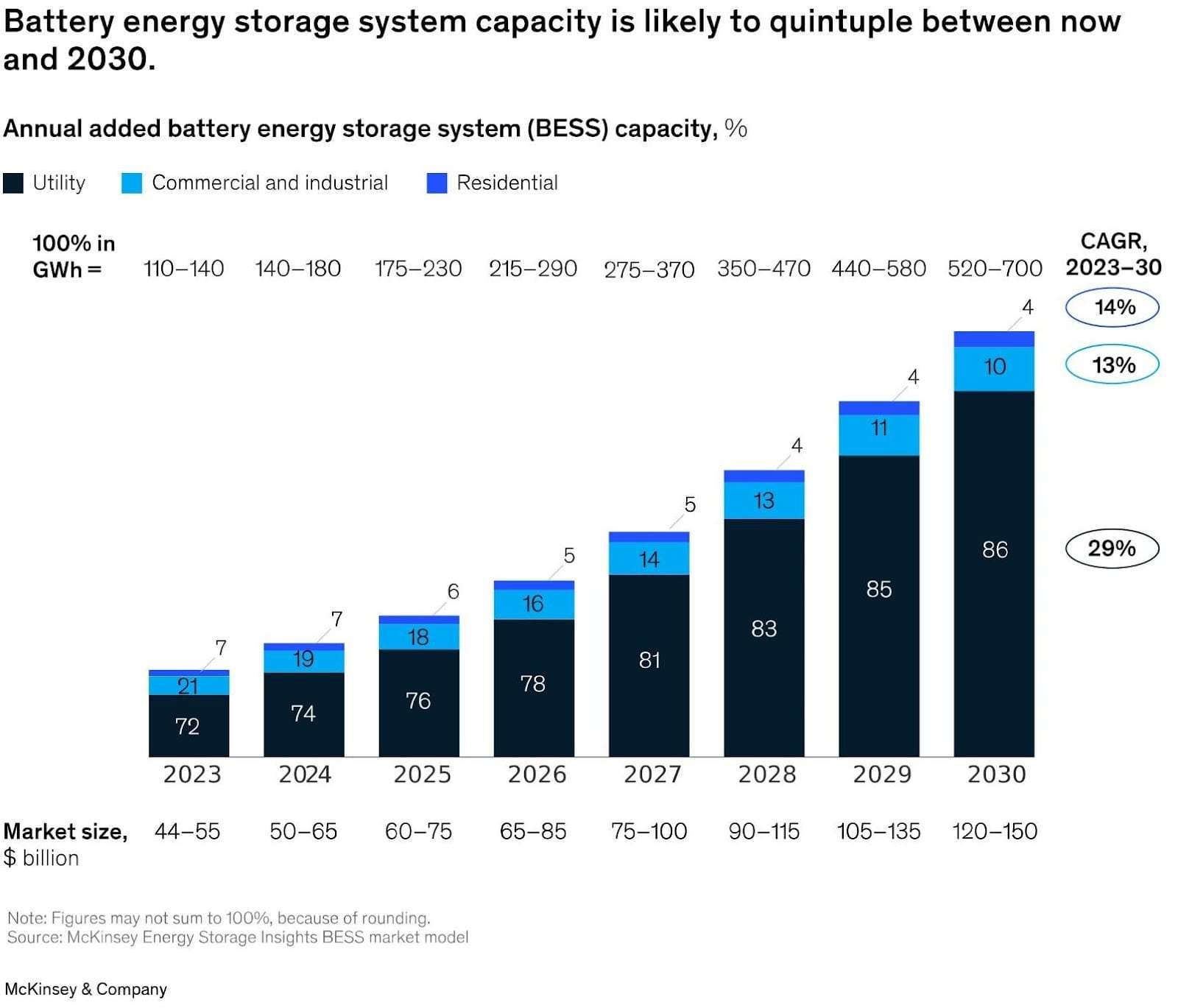

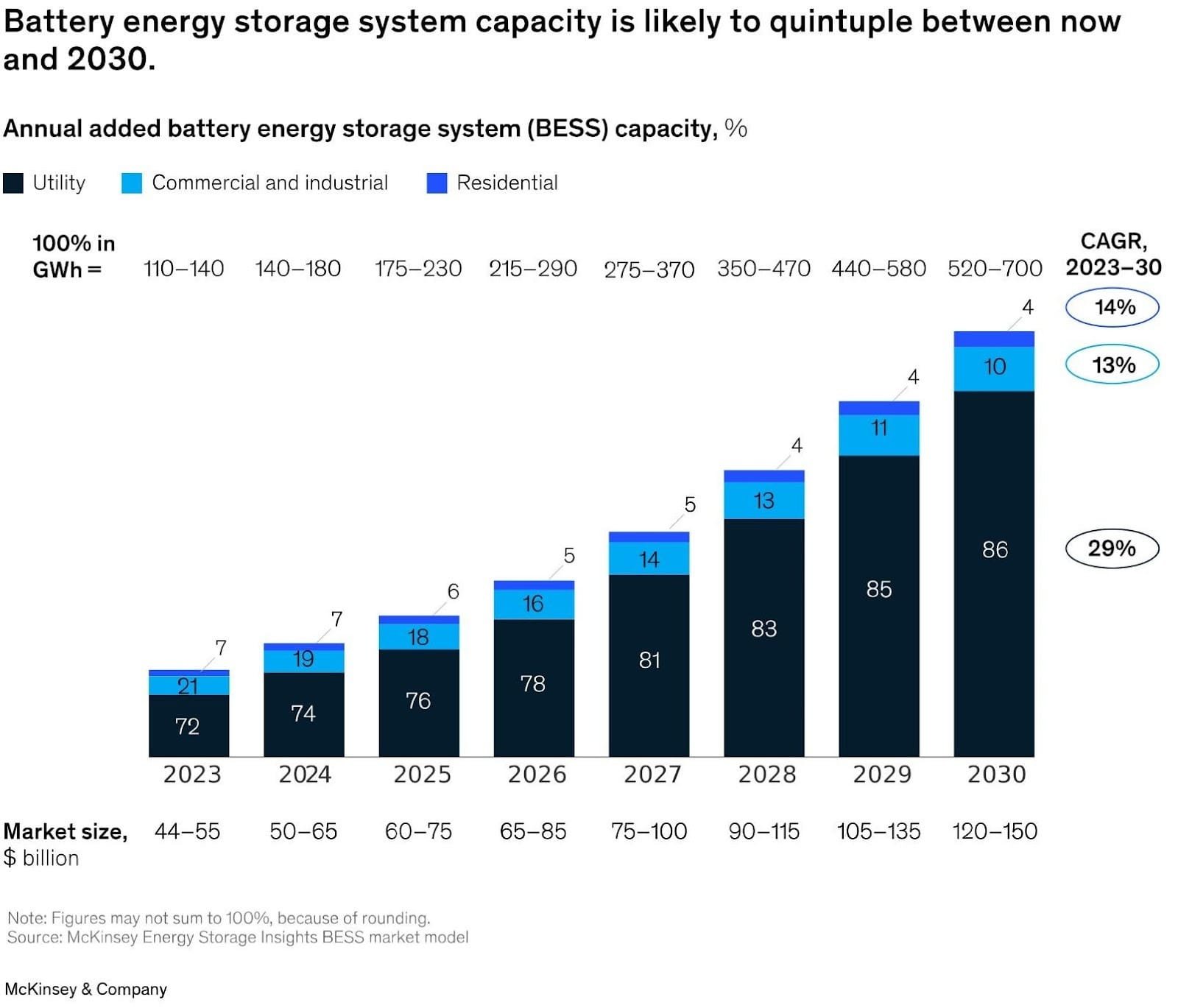

- China’s battery juggernaut keeps pushing BESS prices down YoY. The cuts show up across global procurement and are reshaping utility planning in real time.

- A nuclear sentiment shift is underway, as countries like Japan move to restart reactors and others open new policy lanes. The majority of development is currently in Asia, but the US and countries across Europe are also opening the door to more development.

- Global EV adoption keeps climbing, especially in fleets that now see a clear economic payoff. The fleet shift is pushing charging networks and battery supply chains to scale faster.

- Data center demand is pulling utilities back into the spotlight. Rising load is triggering the fastest wave of grid investment in years, making flexible assets a reality (finally) and changing how developers model supply and interconnection.

🥗 The sides: Crucial, a little overlooked, but steadily carrying the meal.

- India’s IPOs. Between 2024-2025, India saw more climate tech IPOs than the US and Europe combined. Years of funding for micromobility and renewable energy startups is paying off, as high-profile players like Ola Electric and Ather Energy go public.

- US state-level fuels policy advanced in Oregon, Wisconsin, and California. These rules shape project economics faster than federal action and give developers a clearer lane to build.

- LDES policy signals in New York, Massachusetts, and California are starting to shape bankability. These programs are setting energy storage goals and pushing demand for the still emerging tech.

- Dynamic line rating is moving from pilot to practice. Utilities are adopting it to unlock headroom on existing wires and delay expensive upgrades.

- The 45Q credit survived a volatile policy year. Its stability keeps carbon capture and storage projects in motion while developers search for offtake.

- Sodium-ion is no longer a rumor. Early commercial activity is happening, even if scaling remains uncertain and production costs still need to fall.

- DERS are in demand, thanks to falling technology costs, rising power prices, and massive load growth. VPP projects are taking off across the US, the UK, and Europe.

🥧 The desserts: Sweet, risky, with a possibly brilliant payoff.

- Fusion funding keeps building, with national programs and private investment accelerating, even as timelines remain uncertain.

- Next-gen geothermal momentum is back. The Cape Station project will deliver 100MW toward a planned 500MW in 2026, with more next-gen drilling and stimulation tech coming behind it.

- Solid-state transformers promise smaller, safer, more flexible grid hardware. They could relieve substation bottlenecks and support higher-variance loads from data centers.

- Space-based solar returned to serious discussion. New studies on transmission efficiency and launch costs reopened a concept once seen as pure science fiction.

- Adaptation funding is rising after another year of fires, floods, and heat waves. Cities and states are now shifting budgets toward heat resilience, water management, and wildfire prevention.

And of course, as always, we’re thankful for you, our lovely CTVC readers!

We’d be extra grateful if you could take our Prediction bets survey for the year ahead. We’re also working diligently on our end-of-year report, so watch out for that in your inbox soon!

Deals of the Week (11/24-12/01)

Late-Stage / Growth

🏠 Vantage Data Centers, a Denver, CO-based data center service provider, raised $1.6b in Growth funding from GIC and Abu Dhabi Investment Authority.

⚡ X-energy, a Rockville, MD-based nuclear SMR and fuel developer, raised $700m in Series D funding from Jane Street, Emerson Collective, Galvanize Climate Solutions, NGP Capital, Point72 Ventures, and other investors.

⚡ Overstory, a Somerville, MA-based vegetation wildfire risk monitoring platform, raised $43m in Series B funding from Blume Equity, B Capital Group, Convective Capital, Energy Impact Partners, MCJ, and other investors.

🌾 AgroStar, a Pune, India-based smallholder agricultural solutions provider, raised $30m in Growth funding from Just Climate.

☀️ NexWafe, a Freiburg, Germany-based photovoltaic wafer producer, raised $25m in Growth funding from European Innovation Council.

⚡ EcoG, a Munich, Germany-based EV charging infrastructure software provider, raised $19m in Series B funding from GET Fund, Bayern Kapital, and Extantia.

🚢 Flux Marine, a Bristol, RI-based electric marine propulsion system developer, raised $15m in Growth funding from Collide Capital.

Early-Stage

⚡ PowerUp, a Tallinn, Estonia-based hydrogen fuel cell developer, raised $12m in Series A funding from Mercaton, ScaleWolf, and SmartCap.

🐄 Ruminant Biotech, an Auckland, New Zealand-based livestock methane mitigation device developer, raised $10m in Series A funding from Cultivate Ventures, AgriZeroNZ, and Marex.

⚡ Maritime Fusion, a San Francisco, CA-based marine fusion reactor developer, raised $5m in Seed funding from Trucks Venture Capital, Aera VC, Alumni Ventures, Paul Graham, and Y Combinator.

👕 Ponda, a Bristol, England-based regenerative biomaterial textiles developer, raised $2m in Seed funding from Counteract, Faber, Evenlode Investment, PDS Ventures, and Royal College of Art.

Other

🏭 Sandvik, a Stockholm, Sweden-based sustainable mining and manufacturing equipment manufacturer, raised $577m in Debt funding from European Investment Bank.

🔋 Eos Energy Enterprises, an Edison, NJ-based battery energy storage developer, raised $458m in Post-IPO Debt funding.

🏠 CoreWeave, a New York City, NY-based AI cloud services provider, raised $250m in PF Tax Equity funding from the New Jersey Economic Development Authority.

⚡ Waga Energy, a Meylan, France-based RNG project developer, raised $180m in Debt funding from Crédit Agricole CIB and HSBC Asset Management.

🏭 Stegra, a Stockholm, Sweden-based green steel producer, raised $41m in Grant funding from Swedish Energy Agency.

Exits

⚡ Ambia Solar, a Lindon, UT-based residential solar installer, was acquired by SunPower for $38m.

⚡ SEFE Mobility, a Berlin, Germany-based renewable biofuel station operator, was acquired by biogeen for an undisclosed amount.

⚡ Shawton Energy, a Warrington, England-based commercial solar project developer, was acquired by AMPYR Distributed Energy for an undisclosed amount.

🍎 PhenoFarm, a Scandriglia, Italy-based botanical extracts producer, was acquired by Solina for an undisclosed amount.

🔋 PotisEdge, a Burnaby, Canada-based advanced energy storage system developer, was acquired by LONGi for an undisclosed amount.

⚡ PosiGen, a Metairie, LA-based national residential solar installer, filed for Bankruptcy.

🏠 Bitzero, a Vancouver, Canada-based renewable-powered data center builder and cryptominer, announced an IPO funding.

🐄 Sea Forest, a Hobart, Australia-based seaweed producer for livestock methane reduction, announced anIPO at an implied valuation of $73m.

Funds

💰 Future Energy Ventures, a Berlin, Germany-based VC firm, closed $224m for Fund II from E.ON SE, European Investment Fund, KFW Capital, ABN AMRO, and other investors, focusing on software-centric energy technologies across Europe.

This is a sample of deals available for Sightline Clients. Can’t get enough deals?

In the News

The Trump administration is on a deregulation spree, with rollbacks of the Clean Water Act, the Endangered Species Act, and offshore drilling regulations. These changes remove federal protections from up to 55m acres of wetlands, allow economic factors to influence endangered species listings, and permit oil and gas leasing across 1.3bn acres of federal coastal waters. The EPA also delayed a requirement for oil and gas firms to cut methane emissions, considering repealing the measure altogether.

In more DOE news, the agency’s re-org is here: climate and renewable energy offices are gone from the org chart, including OCED, OFEC, GDA, and OEERE. The organizations are expected to be absorbed into the Office of Critical Minerals and Energy Innovation, plus Fusion gets a new department. Meanwhile, the DOE also launched the Genesis Mission, allowing private sector partners to train AI on decades of federal scientific breakthroughs in fusion, fission, and critical-mineral research, with partners like Anthropic, NVIDIA, OpenAI for Government, IBM, Microsoft, AMD, AWS, and Google.

Demand for household solar batteries in Australia has surged, with installations of 25MWh/day, leading the national rebate program at risk of exhausting its $2.3bn budget by July 2026. Since the program began, Australians have installed more than 136,000 batteries, representing 2GWh of storage capacity, beginning to flatten electricity demand during solar peak hours. The widespread adoption of batteries positions it as an ideal location for VPPs.

In the UK, the North Sea energy strategy was introduced that maintains its pledge of “no new licences” while still allowing limited new drilling through tiebacks to existing fields. New discoveries near current sites hold about 25m barrels of oil and 20m barrels of oil-equivalent gas. The autumn budget also introduced a tax on electric vehicles, shifted $2.7bn in green levies to general taxation, and confirmed that the energy profits levy will continue until 2030, expected to raise $3.1bn in the next year.

Korea joined the Powering Past Coal Alliance at COP30. It operates the world’s 7th-largest coal fleet, cut coal generation from 42.5% in 2015 to 30.5% in 2024, and now committed to end new unabated coal plants while phasing out 40 of 61 existing units by 2040.

Pop-up

The future of the American electric grid is in FERC’s hands.

Permitting / NEPA reform bill SPEED gets fast-tracked.

In California, solar is reaching new peaks as natural gas generation falls.

Passport, please – US national park fees for foreign visitors are about to triple.

From Qatar to Canada: new report on global CO2 subsurface storage (and Sightline clients can read our analysis here).

Elon’s mini solar farm won’t make a dent in his data center’s energy appetite.

Food companies are serving up ‘resilience’ rather than net-zero in new climate plans.

Stegra got €37m for green steel — but there’s still a gap before it can really forge ahead.

Opportunities & Events

💡 Norrsken Fixathon: Join 200+ change-makers coming together to build AI-powered solutions from December 5-6 at Norrsken House in Stockholm, Sweden.

📅 Mobilising capital for climate and development: Join British International Investment in London, UK for a conversation on capital mobilization post-COP30 with investors and climate experts on December 8 from 2:30-6pm.

📅 Beyond COP30: Tune into the International Institute for Environment and Development’s Zoom webinar on December 9 from 2-3:15 PM GMT for a discussion on climate finance and action in 2026, considering NDCs and developments on the Just Transition Mechanism.

💡 NEB Catalyse: Become part of the 2026 cohort of the EIT Community New European Bauhaus (NEB) Catalyse programme, a start-up accelerator for ventures working to implement NEB values across Europe. Apply by January 19, 2026.

💡 Tech Nation Climate 2026 Growth Programme: Apply by January 31, 2026 to participate in a program for Seed to Series A climate tech startups in Europe. Benefits include curated events, investor access, policy engagement, tailored mentoring, and a lifelong founder network.

Jobs

Software Engineer, Full-stack @Eagle

Associate @Carbon Business Council

Senior Manager of Partnerships @Carbon Business Council

Analyst @DBL Partners

Sales Associate @Voltus, inc

Director, Project Development @Brightcore

Accounting Manager @Brightcore

Finance Lead @Frontier Climate

Head of Trading @Restoration Climate

Graduate Project Manager @Tokamak Energy

Renewable Energy Analyst @Advantage Capital

📩 Feel free to send us deals, announcements, or anything else at hello@ctvc.co. Have a great week ahead!