Carbon capture has entered a decisive phase. What once looked like an experimental climate solution now stands at the center of global decarbonization strategies. By 2026, governments, corporations, and investors increasingly rely on carbon capture to deal with emissions that cannot be eliminated.

Three companies now dominate this space: Climeworks, Carbon Engineering, and SLB Capturi. Each addresses a different part of the problem. Some remove carbon dioxide directly from the air. Others stop emissions at factories before they escape. Together, they shape how the world manages residual emissions in a tightening net-zero era.

Market Overview: Why Carbon Capture Matters Now

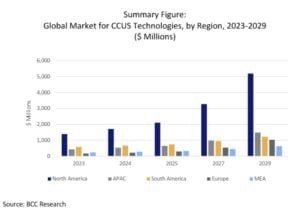

BCC Research highlighted that the global market for carbon capture, utilization, and storage (CCUS) technologies was at $3.4 billion in 2024. It is projected to reach $9.6 billion by the end of 2029, at a compound annual growth rate (CAGR) of 23.1% during the forecast period of 2024 to 2029.

Governments expanded incentives, while companies faced growing pressure to meet climate commitments with real, measurable outcomes.

In the United States, tax credits under the Inflation Reduction Act made large-scale capture projects financially attractive. In Europe, the expanded EU Emissions Trading System increased compliance costs, pushing industries toward capture solutions. Meanwhile, corporate buyers signed long-term contracts to secure high-quality carbon removal credits.

At the same time, technology advanced quickly. Capture costs fell, monitoring systems improved, and long-term storage options expanded. Leading projects now capture carbon for less than $300 per ton, a sharp drop from early pilot costs.

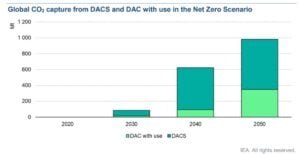

By 2026, more than 20 direct air capture facilities operate worldwide. Still, most captured carbon comes from point-source projects in cement, steel, waste-to-energy, and hydrogen production. Permanence, transparency, and verification now define success in the carbon market.

Climeworks: From DAC Pioneer to Carbon Removal Platform

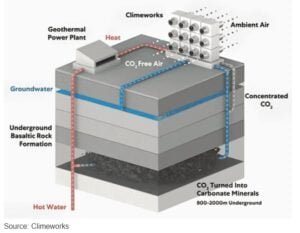

Climeworks remains the most visible name in direct air capture. Based in Switzerland, the company developed modular systems that pull carbon dioxide directly from the air using fans and solid filters.

Its Iceland operations set early benchmarks. The Orca plant captures 4,000 tons of CO₂ per year. The newer Mammoth facility scales capacity to 36,000 tons annually. Generation 3 technology sharply cuts energy use, making DAC more efficient and easier to expand.

However, it has evolved beyond hardware alone.

Building Diversified Carbon Removal Portfolios

Climeworks now offers blended carbon removal portfolios designed for corporate buyers. These portfolios combine direct air capture with other engineered and nature-based removal methods. The strategy spreads risk while meeting different climate and budget needs.

The portfolio includes:

- Direct Air Capture with geological storage

- Bioenergy with carbon capture and storage (BECCS)

- Biochar

- Enhanced rock weathering (ERW)

- Afforestation and reforestation

- Mangrove restoration

Each method provides a different storage lifespan. DAC and BECCS store carbon for over 10,000 years. ERW lasts about 1,000 years. Biochar offers century-scale storage. Nature-based projects provide shorter-term storage but deliver strong co-benefits for ecosystems and communities.

By 2026, Climeworks will deliver over 50,000 tons of verified carbon removal credits per year. Buyers include Stripe, Schneider Electric, and shipping giant NYK. Credit prices range from $600 to $800 per ton, reflecting strong demand for durable removals.

This portfolio model positions Climeworks as a full-service carbon removal provider, especially for companies tackling Scope 3 residual emissions.

Carbon Engineering: Scaling Direct Air Capture to Megatons

Carbon Engineering takes a bold, industrial approach to carbon removal. Instead of small modular units, it builds large-scale DAC plants designed to capture hundreds of thousands of tons of CO₂ each year.

The Canada-founded company uses a liquid solvent process. Air flows through large contactors, where potassium hydroxide captures CO₂. The system regenerates the solvent in a closed loop, producing a pure CO₂ stream ready for storage or fuel production.

Occidental Petroleum acquired Carbon Engineering in 2023, accelerating its scale-up through access to capital, storage sites, and energy infrastructure.

The Stratos Project Sets a New Standard

By 2026, Carbon Engineering’s Stratos facility in Texas will capture between 500,000 and 1 million tons of CO₂ annually, making it the world’s largest DAC plant.

The company relies on proven industrial equipment and standardized designs. This “design one, build many” approach lowers costs and speeds up deployment across regions.

Capture costs now fall between $250 and $600 per ton, supported by U.S. tax credits and long-term offtake agreements with buyers like Frontier, Amazon, and Airbus.

Linking Capture to Clean Fuels

Carbon Engineering also uses captured CO₂ to produce synthetic fuels. Its Air-to-Fuels technology combines CO₂ with green hydrogen to create low-carbon aviation fuel. This helps reduce emissions in aviation, a sector responsible for about 2–3% of global emissions.

By combining storage and fuel production, Carbon Engineering bridges voluntary carbon markets with compliance systems. Its large pipeline—running into tens of millions of tons—makes it a cornerstone of future gigaton-scale removal.

SLB Capturi: Decarbonizing Heavy Industry at the Source

While DAC removes carbon after it mixes into the air, SLB Capturi focuses on prevention. The joint venture between SLB and Aker Carbon Capture specializes in point-source carbon capture for industrial emitters.

Its amine-based technology captures more than 95% of CO₂ emissions from facilities such as cement plants, waste-to-energy sites, gas processing units, and bioenergy operations.

Designed for Fast Deployment

SLB Capturi’s Just Catch™ units are modular and compact. Operators can retrofit them into existing plants with minimal downtime. This makes them ideal for industries under immediate pressure to cut Scope 1 emissions.

Ørsted Kalundborg CO₂ Hub

By 2026, the company can support over 5 million tons of annual capture capacity across Europe and North America. Many projects connect directly to permanent storage sites, including offshore saline aquifers.

Role in Carbon Markets

BECCS projects using SLB Capturi technology qualify as durable carbon removals. These credits typically trade between $80 and $150 per ton, making them more affordable than DAC while still meeting high integrity standards.

SLB’s strength lies in integration. The company combines capture, transport, and storage into a single value chain. This end-to-end capability appeals to oil majors, utilities, and governments seeking reliable decarbonization pathways.

What This Means for Carbon Capture in 2026

Together, Climeworks, Carbon Engineering, and SLB Capturi define the carbon capture landscape in 2026. The market now rewards permanence, transparency, and verified impact. Buyers no longer chase cheap offsets. They invest in long-term solutions that stand up to scrutiny.

As net-zero deadlines draw closer, carbon capture shifts from optional to essential. These three companies show how removal and abatement can work together—turning climate ambition into real-world action.

The post Top 3 Carbon Capture Leaders to Drive the Net-Zero Race in 2026 appeared first on Carbon Credits.