TotalEnergies has committed about US$167 million to study offshore carbon capture and storage (CCS) in Brazil. The funding will support mapping and analyzing deep-sea geological formations along the Brazilian coast.

Scientists will look at deep saline reservoirs below the seabed. They seek to find out which ones can safely store carbon dioxide (CO₂) for a long time. If suitable, these reservoirs could host large-scale offshore CO₂ storage projects in the future.

This investment comes as Brazil works on developing regulations for CCS. Scientific studies will help regulators, investors, and companies identify safe storage sites and reduce project risks. TotalEnergies shows trust in Brazil’s ability to be a carbon storage hub. This may draw more investment to the country.

TotalEnergies’ Global CCS Initiatives

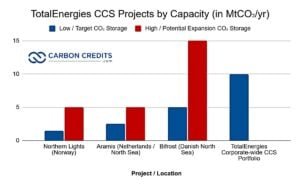

TotalEnergies is also active in CCS projects worldwide, using international experience to support its work in Brazil. Key examples include:

-

Northern Lights (Norway): Phase 1 operations started summer of 2025 with a capacity of 1.5 million tons of CO₂ per year, aiming to expand to 5 million tons by 2028.

-

Aramis (Netherlands): Planned to store CO₂ captured from industrial sources under the North Sea, building experience in transport and injection technologies.

-

North Sea Projects (Europe): TotalEnergies plans to repurpose depleted oil and gas fields for CO₂ storage. This could help hard-to-decarbonize industries reduce emissions.

By 2030, TotalEnergies aims to offer more than 10 million tons of CO₂ storage per year globally. The knowledge from these projects—on capture, transport, injection, monitoring, and safety—can help speed up Brazil’s CCS development.

Why Offshore Storage Makes Sense for Brazil

Brazil has deep offshore basins with geology well-suited for CO₂ injection. These deep saline reservoirs lie beneath thick rock layers that act as natural seals, trapping CO₂ for centuries. Offshore storage offers advantages over building new land-based facilities, including:

-

Existing oil and gas infrastructure, such as wells and pipelines, can be adapted for CO₂ injection.

-

Deployment can be quicker and cheaper. New land-based storage sites need a lot of construction.

-

Offshore storage reduces competition for land and avoids densely populated areas.

For a country with big offshore oil operations, using current offshore geology makes sense both technically and economically. It also provides a pathway to reduce emissions from energy and industrial production.

Moreover, CCS can earn carbon credits by reliably removing or stopping CO₂ emissions from getting into the atmosphere. Each tonne of CO₂ stored in geological formations or offshore reservoirs can be measured and certified.

This allows companies or governments to earn tradable carbon credits. These credits can be sold or used to offset emissions. This creates a financial incentive to boost carbon storage projects. It also helps with wider climate change efforts.

Brazil’s CCS Market Potential and Economic Impact

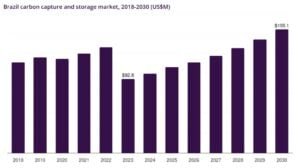

Currently, Brazil’s CCS market is small but growing. In 2024, the market value was estimated at roughly US$99.6 million. By 2030, it could rise to around US$155.1 million, with an average growth rate of 7.5% per year, per market research.

Brazil could capture and store hundreds of millions of tons of CO₂ each year. This is possible if industries use CCS and create suitable storage sites.

Blending offshore and onshore storage with industrial emissions capture, plus bioenergy with carbon capture, could form a complete CCS industry. This could create billions in yearly economic value. It includes infrastructure development, monitoring services, and new jobs.

CCS Already Operating in Brazil

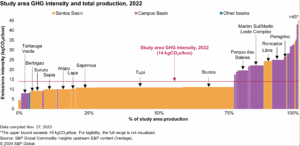

Brazil is not starting from scratch. Petrobras, the state-owned oil and gas company, operates one of the world’s largest offshore carbon storage programs. From 2008 to 2024, Petrobras injected about 67.9 million tons of CO₂ into deep-sea pre-salt reservoirs. In 2024 alone, the company reinjected 14.2 million tons, setting a new annual record.

Petrobras separates CO₂ from extracted gas using floating production, storage, and offloading vessels in ultra-deepwater. CO₂ is then reinjected into offshore reservoirs. This process boosts oil recovery and cuts emissions from production.

Some pre-salt oil fields now produce oil with lower emissions per barrel than the global offshore average, according to an S&P Global study. This existing track record shows that offshore CCS in Brazil is operational at a large scale.

Industries like cement and steel are looking into CCS technologies. These could cut greenhouse gas emissions by up to 57% in heavy industry.

What TotalEnergies’ Investment Brings

TotalEnergies’ funding plays several key roles:

First is scientific research. Mapping geology and testing reservoirs reduces uncertainty and risks for large-scale CCS projects.

Second is market confidence. Investment by a major energy company signals that Brazil could become a CCS hub, attracting more companies and investors.

Third is industry development. If offshore and onshore CCS grow together, Brazil can create a strong carbon-management industry. This would mix industrial capture, bioenergy, and storage.

Last is climate impact. CCS helps sectors that find it hard to cut emissions, such as heavy industry and fossil fuel extraction, reduce their CO₂ output.

TotalEnergies’ investment can boost Brazil’s climate strategy. It supports scientific research and industrial adoption that could lead to safe, scalable CCS capacity.

Challenges for Scaling CCS in Brazil

Despite its potential, scaling CCS in Brazil faces several hurdles, such as:

-

Cost: Building offshore infrastructure, drilling injection wells, and installing CO₂-handling systems require large investments.

-

Regulation: Clear laws and oversight are essential. CCS operations need rules for site approval, environmental safety, monitoring CO₂ over decades, and liability if leaks occur.

-

Demand: CCS depends on enough CO₂ emitters—such as factories, refineries, and power plants—willing to pay for capture and storage. Without sufficient demand, storage sites and pipelines may remain underused.

-

Public Trust: Communities need assurance that CO₂ storage is safe over the long term. Transparency, monitoring, and clear liability are critical.

-

Scope Limits: CCS reduces emissions at the point of capture but does not prevent CO₂ released when fossil fuels are later burned. CCS complements, but does not replace, the need for cleaner energy and reduced fossil-fuel use.

Addressing these challenges will determine whether Brazil can achieve large-scale CCS adoption and unlock its full potential.

What to Watch: Future CCS Growth and Policy Developments

In the next few years, several key changes will shape how carbon capture and storage grow in Brazil. First, TotalEnergies’ geological studies will identify safe offshore locations for burying CO₂. This will help find the best storage sites.

Clear government rules will be important. They will guide how to approve sites, monitor stored CO₂, and certify carbon credits. This will help build trust with investors and protect the environment. More industries, like power plants, oil refineries, cement factories, and bioenergy plants, will begin using CCS. This will increase the demand for new setups.

Brazil will expand its infrastructure to keep up with rising demand. This includes building more pipelines, injection wells, storage centers, and monitoring tools. These steps, backed by companies like Petrobras investing billions, position Brazil as a leader in Latin American CCS.

If these factors align, Brazil could establish a major carbon storage industry. This would reduce national greenhouse gas emissions and create a new economic sector, while using existing expertise from Petrobras and global CCS developments.

The post TotalEnergies Bets $167M on Brazil’s Carbon Capture Potential appeared first on Carbon Credits.