TotalEnergies spent a record $73 million on carbon credits in 2025. This was up 49% compared with 2024. The figure was disclosed alongside the company’s full-year financial results.

Carbon credits allow companies to offset emissions by funding projects that reduce or remove carbon dioxide. These projects include forest protection, reforestation, and other verified climate initiatives.

The higher spending shows that TotalEnergies is expanding its carbon portfolio. The company uses carbon credits to manage emissions that are hard to cut quickly. This includes emissions from oil and gas production and from the use of its products.

The $73 million figure marks the company’s highest annual carbon credit spend to date.

Strong Profits Hold Firm in a Softer Oil Market

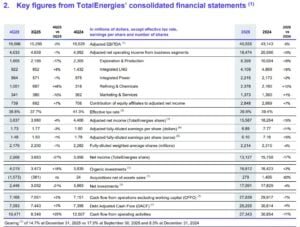

TotalEnergies reported strong 2025 financial results even as oil prices softened. For the full year 2025:

- Adjusted net income reached $15.6 billion, down about 15% from 2024.

- IFRS net income totaled $13.1 billion, down around 17% year-on-year.

- The company generated nearly $28 billion in cash flow from operations, about 7% lower than 2024.

- Return on average capital employed stood at 12.6%, among the highest for major energy companies.

- Net debt remained low, with a gearing ratio of around 15% at year-end.

These results show that TotalEnergies maintained strong profitability and balance sheet discipline. Upstream oil and gas production rose by about 4% in 2025, helping offset weaker oil prices. LNG sales also supported earnings.

The company continued to reward shareholders while investing in future growth.

Billions Flow Into Renewables and Power Growth

TotalEnergies invested $17.1 billion in capital expenditures in 2025. About 37% went to new oil and gas projects while around $3.5 billion went to low-carbon energies. Of that, nearly $3 billion was directed to electricity and renewables.

The company added 8 gigawatts (GW) of renewable capacity in 2025. This matches its goal of adding about 8 GW per year through 2030.

Electricity production continues to grow as part of the company’s strategy. In 2024, TotalEnergies reported a 23% rise in net electricity generation compared with the previous year.

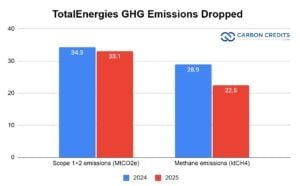

Methane reduction also advanced. In 2025, TotalEnergies reported a 65% cut in methane emissions compared with 2020 levels. The company aims for near-zero methane by 2030.

These steps support its broader climate strategy while keeping traditional energy operations active.

Offsets as a Bridge in the Net-Zero Plan

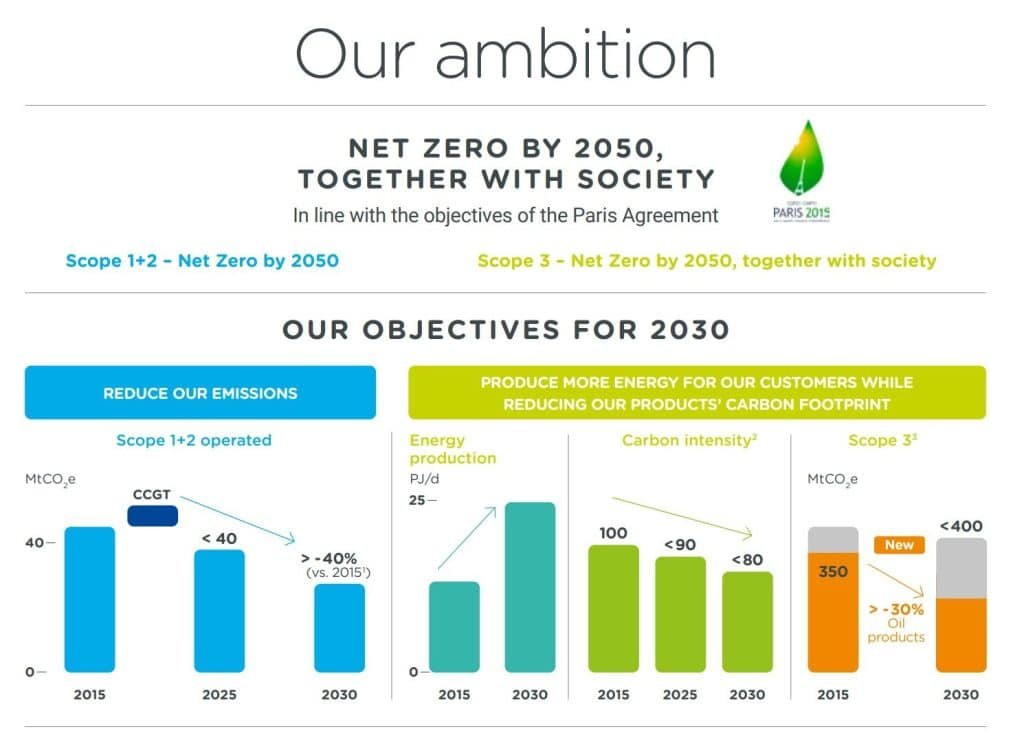

Carbon credits play a defined role in TotalEnergies’ climate plan. The company has stated that it plans to invest about $100 million per year in carbon projects over time. These projects aim to build a large portfolio of credits to offset residual emissions by 2030.

Carbon credits help cover emissions that cannot yet be eliminated through technology or operational changes. For oil and gas companies, this often includes emissions from product use, also known as Scope 3 emissions.

TotalEnergies aims to reach net-zero emissions by 2050 across its operations and energy products. This includes reducing direct emissions and lowering the carbon intensity of the energy it sells.

In 2024, the energy company reported a 16.5% reduction in lifecycle carbon intensity compared with 2015, exceeding its initial 14% target.

Carbon credits serve as a bridge. They support climate projects while the company expands renewables and reduces operational emissions. The oil major reduced its Scope 1 and 2 GHG emissions from 34.3 Mt CO₂e in 2024 to 33.1 Mt CO₂e in 2025, a drop of 1.2 Mt or ~3.5%.

How Big Oil Is Leveraging the Carbon Credit Market

TotalEnergies is not alone in using carbon credits. Many large oil and gas companies use credits as part of their climate plans. For example:

- Shell has invested in nature-based carbon projects and operates a large carbon credit portfolio to offset customer emissions.

- BP has also used carbon credits in voluntary carbon markets as part of its net-zero ambition.

- Equinor invests in carbon capture and storage and has supported carbon market mechanisms.

Oil majors face unique challenges. Their products release emissions when burned. Cutting these emissions fully will take decades and large-scale changes in global energy systems. This is where carbon credits come in. It allows companies to support emission reductions elsewhere while they shift their energy mix.

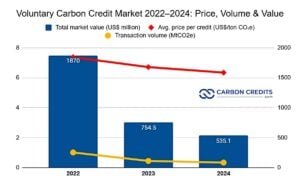

The voluntary carbon market has grown in recent years. Companies across sectors use credits to meet climate commitments. However, the market has also faced scrutiny over credit quality and verification standards, and thus, the declining transaction volume.

As a result, many large companies now focus on high-quality, verified projects. These include forest conservation, reforestation, and technology-based carbon removal.

For oil majors, carbon credits are often a small share of total spending. But they signal engagement with climate tools and frameworks. TotalEnergies’ record $73 million spend in 2025 reflects both climate strategy and market conditions.

Balancing Cash Flow and Climate Goals

TotalEnergies continues to operate as a diversified energy company. Oil and gas remain core revenue drivers. At the same time, renewables, electricity, and low-carbon investments are growing.

The oil major also plans to keep expanding renewable capacity while maintaining upstream strength.

In 2025, TotalEnergies signed and advanced major electricity projects totaling more than 14 GW of capacity in Europe. It also recycled capital through asset sales to fund further clean energy investments. This dual strategy allows the company to generate cash from traditional energy while investing in transition pathways.

The record carbon credit spending fits into this broader balance. It complements operational emission cuts and renewable expansion.

For instance, TotalEnergies has partnered with Google on large renewable energy deals. The company has signed two 15-year solar PPAs in Texas. These agreements will provide 1 GW of solar capacity. That’s about 28 TWh for Google’s data centers in Texas over the contract period.

These deals reflect TotalEnergies’ expanding role in corporate renewable supply and its growing electricity portfolio across the United States.

2026 Outlook: Profitability Meets Transition Pressure

The French multinational integrated energy company enters 2026 with strong finances and a defined climate path. The company plans to continue investing in oil and gas projects that generate stable returns. At the same time, it aims to grow electricity production and low-carbon assets. Carbon credits will likely remain part of its strategy, especially as voluntary carbon markets mature and standards improve.

The $73 million record in 2025 shows increased use of carbon market tools. It also highlights how energy companies are combining financial performance with climate commitments.

TotalEnergies’ results suggest that profitability and climate investment can move in parallel, even in a changing energy landscape.

- READ MORE: TotalEnergies and Google’s 1 GW Solar Deal Signals a New Phase in the Data Center Energy Race

The post TotalEnergies Hits Record $73 Million Carbon Credit Spend as 2025 Profits Stay Strong appeared first on Carbon Credits.