Toyota Motor Corporation reported a sharp drop in earnings for the quarter ending June 30, 2025. Net profit fell 37% to ¥841 billion ($5.7 billion), down from ¥1.33 trillion a year earlier. This marked one of the steepest quarterly declines in recent years. Revenue, however, rose 3% year-over-year to ¥12 trillion ($82 billion), supported by strong demand in North America and Asia.

The primary drag came from new U.S. tariffs of 15% on Japanese car imports, which reduced profit by an estimated ¥450 billion. Higher costs for raw materials and a stronger yen hurt overseas earnings. Global inflation also impacted the results.

Toyota has revised its full-year operating profit forecast downward to ¥2.66 trillion ($18 billion). This speaks of a more cautious outlook for 2025. Analysts say the biggest automaker is keeping strong sales. However, profit margins face pressure from outside economic factors.

Amid the financial hiccup, the company reaffirmed its commitment to climate leadership. It aims for carbon neutrality with strong emissions targets, green manufacturing projects, and renewable energy investments. This effort is part of its Environmental Challenge 2050 framework.

Hybrids Take the Wheel as Sales Defy the Downturn

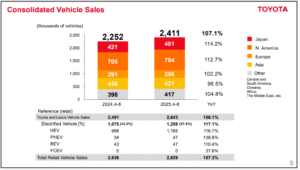

Global vehicle sales for the quarter reached 2.4 million units, up from 2.2 million a year ago. Toyota’s sales in North America rose nearly 20% in July. This boost came from its hybrid models, like the RAV4 Hybrid and Camry Hybrid, which both showed double-digit growth.

Hybrid and plug-in hybrid models make up over one-third of Toyota’s total sales. This shows how important electrified powertrains are becoming in the company’s lineup.

Battery electric vehicle (BEV) sales, while still a smaller portion, increased steadily in markets with expanding charging infrastructure.

Toyota stayed on top in Japan and Southeast Asia. This was thanks to its compact cars and commercial vehicles. However, European sales dipped a bit due to tougher emissions rules and strong competition from local EV brands.

Toyota’s share price fell about 1.6% following the earnings announcement, as tariff concerns weighed on investor sentiment. Even with this dip, the stock still looks good. Its forward price-to-earnings (P/E) ratio is 6.9. That’s lower than the industry average of 8.0 and Toyota’s five-year average of 9.3.

Driving Toward 2050: Toyota’s Net Zero Roadmap

Toyota has set a long-term target to achieve carbon neutrality across the entire life cycle of its vehicles by 2050. This goal covers emissions from all stages: vehicle design, production, use, and recycling. It also includes emissions from suppliers and logistics partners.

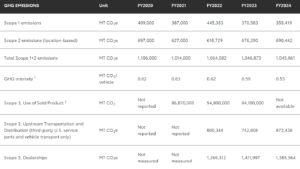

In its latest sustainability report, Toyota reported its Scope 1 and Scope 2 greenhouse gas emissions. These emissions, from direct operations and purchased electricity, reached around 2.05 million metric tons of CO₂e in FY 2024. This shows a 15% drop from FY 2019 levels. The company aims to cut these emissions by 68% by 2035, using 2019 as the baseline year.

For Scope 3 emissions, which account for most of Toyota’s footprint, targets are set. By 2030, Toyota aims for a 30% reduction from suppliers, logistics, and dealerships. They also seek a 35% cut in average vehicle-use emissions. These goals account for the fact that tailpipe emissions from vehicles remain the single largest part of the company’s climate impact.

Globally, Toyota is investing in solar, wind, hydrogen, and renewable natural gas to power its factories. It has also joined multiple international coalitions to accelerate low-carbon manufacturing and logistics.

The largest carmaker is investing a lot in renewable energy. They plan to use 45% renewable electricity in North America by 2026. By 2035, they aim for 100% renewable energy at all global plants.

Projects include:

- Large-scale solar panel installations at assembly plants

- Hydrogen-powered forklifts

- Renewable natural gas systems at engine facilities.

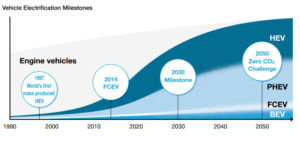

The company’s approach combines electrification with manufacturing decarbonization. This includes hybrids, battery electric vehicles (BEVs), and hydrogen fuel cell vehicles.

Toyota’s leaders think this multi-pathway strategy will reduce emissions quickly. This is especially true in areas where full BEV infrastructure is still growing. It also helps ensure steady progress toward the company’s 2050 carbon neutrality goal.

In summary, the company’s near-term reduction targets are:

- 68% reduction in Scope 1 and 2 emissions by 2035 (compared to 2019 levels).

- 30% cut in Scope 3 emissions from suppliers, logistics, and dealerships by 2030.

- Matching 45% of electricity use with renewables in North America by 2026.

Environmental Challenge 2050: Six Pillars of Action

Toyota’s Environmental Challenge 2050, launched in 2015, remains its guiding framework for sustainability. The initiative is built on six core challenges:

- Zero CO₂ emissions from new vehicles through hybrid, BEV, and hydrogen fuel cell adoption.

- Zero CO₂ emissions in manufacturing by shifting to renewable energy and low-carbon processes.

- Life cycle zero CO₂ emissions, including recycling and parts reuse.

- Minimizing water usage and improving water discharge quality.

- Protecting biodiversity around manufacturing sites and supply chains.

- Advancing a circular economy by extending product lifecycles and reducing waste.

Toyota aims to sell 1.5 million BEVs annually by 2026 and 3.5 million by 2030, alongside continuing hybrid and fuel cell development. This multi-path approach allows the company to meet varying customer needs and infrastructure readiness levels worldwide.

Green Manufacturing: Major Investments in Low-Carbon Plants and ESG

Toyota’s largest new sustainability investment is a ¥140 billion ($922 million) advanced paint facility in Georgetown, Kentucky. Set to open in 2027, the plant will reduce paint shop carbon emissions by 30% and cut water use by 1.5 million gallons annually.

In Japan, Toyota is piloting hydrogen-powered forklifts and solar-powered assembly lines. The company will use 100% renewable electricity for its manufacturing in Europe by 2030.

These projects reduce environmental impact and boost operational efficiency. They support Toyota’s goals of sustainability and profitability.

Beyond emissions, Toyota is strengthening its broader ESG performance. The company has strict human rights rules for suppliers. These rules include labor conditions, conflict minerals, and environmental compliance. By 2030, Toyota aims for 90% of its top suppliers to set their own science-based emissions targets.

In 2024, Toyota diverted 94% of waste from landfills globally and recycled over 99% of scrap metal from manufacturing. It also invested in reforestation projects in Asia and Africa as part of its carbon offset strategy.

Balancing Short-Term Pressures With Long-Term Goals

The April–June quarter highlighted Toyota’s resilience in the face of macroeconomic challenges. Tariffs and currency changes have hurt short-term profits. However, strong vehicle sales, especially in hybrids, keep the company competitive.

At the same time, Toyota is moving ahead with one of the most thorough sustainability programs in the auto industry. Its carbon neutrality goals and the Environmental Challenge 2050 framework guide its actions. Also, large-scale green manufacturing investments help meet the growing demands for cleaner mobility from regulators and consumers.

As Toyota navigates market volatility, its ability to deliver both financial and environmental strategies will be key to maintaining global leadership in the shift toward sustainable transportation.

The post Toyota’s (TM Stock) Q1 Twist: Why Profits Dip But Hybrids Surge, and Net Zero Goals Accelerate appeared first on Carbon Credits.